Homers wife Marge Simple is 68. Her only source of income is interest of $1,000. Marges father Abe, is 92. Abe and his wife Mona

Homer’s wife Marge Simple is 68. Her only source of income is interest of $1,000.

Marge’s father Abe, is 92. Abe and his wife Mona (see below) live with and are supported by Homer.

Abe has Pension income of $16,200.

Marge’s parents are divorced and Abe remarried a few years ago. Abe’s wife, Mona, is physically inform and has net rental income of $6,000. Abe and Mona, who lived outside of Canada for many decades in their youth, do not qualify for OAS or GIS.

Homer’s Income Information:

• Employment income: $100,000

o CPP contribution: Nil

o EI contribution: $856.36

o Taxes withheld: $21,000

• Pension income: $20,000

• Old Age Security: 7,200

• Home office Costs:

o Electricity $3,250

o House insurance 2,890

o Mortgage interest 10,000

o Property taxes 15,000

o Repairs 5,000

o Lawn service 2,000

o Total $38,140

• Personal automobile used at work

o 27% usage

o Total operating cost (100%) $4,500

o You can ignore Capital Cost Allowance.Homer’s Income Information (cont’d):

• Other benefits received

o Group accident and sickness insurance: employer costs $300 a month

o Life insurance: employer costs $125 a month

o RPP: employer costs $15,500

o Gold watch on 35th year anniversary: $1,800

o Christmas gifts: $100 Safeway certificate and food hamper worth $75

Medical expenditures:

o Homer - $1,000 prescription drugs, $600 physiotherapy, acupuncture $401, Chinese herbal medicine $399.

o Marge – prescription sunglasses $250, routine teeth cleaning $300. During the year, Marge flew to Thailand to obtain medically necessary procedures that would have costed more in Canada. She spent $2,000 on the medical procedure, $1,800 for travel costs and $280 to purchase insurance for out-of-country medical coverage.

o Abe – doctor-prescribed vitamins $200 and hearing aid $500.

o Mona – wheelchair $2,000.

1. Calculate Homer’s NIFTP, Taxable income, federal tax payable, showing all work. You do not need to prepare tax forms or compute provincial taxes.

2. What does Homer need to do to support the deductions, if any, he takes for the home office costs and personal automobile costs?

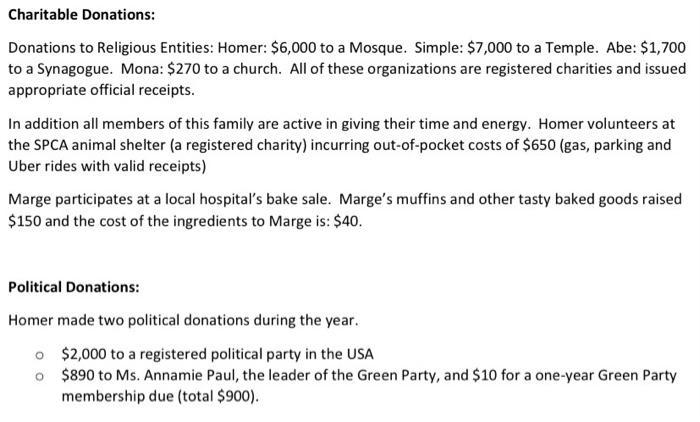

Charitable Donations: Donations to Religious Entities: Homer: $6,000 to a Mosque. Simple: $7,000 to a Temple. Abe: $1,700 to a Synagogue. Mona: $270 to a church. All of these organizations are registered charities and issued appropriate official receipts. In addition all members of this family are active in giving their time and energy. Homer volunteers at the SPCA animal shelter (a registered charity) incurring out-of-pocket costs of $650 (gas, parking and Uber rides with valid receipts) Marge participates at a local hospital's bake sale. Marge's muffins and other tasty baked goods raised $150 and the cost of the ingredients to Marge is: $40. Political Donations: Homer made two political donations during the year. o $2,000 to a registered political party in the USA o $890 to Ms. Annamie Paul, the leader of the Green Party, and $10 for a one-year Green Party membership due (total $900).

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A To compute for Homers Net income for tax purposes Employment income 100000 CPP contribution Nil El ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started