Answered step by step

Verified Expert Solution

Question

1 Approved Answer

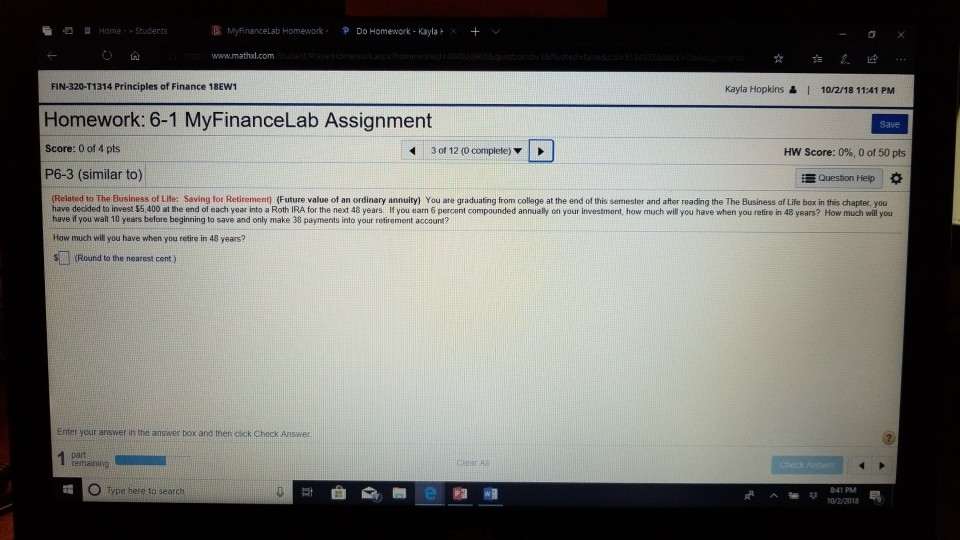

Home-Students B Myfinancelab Homework.PDo Homework - Kayla + FIN-320-T1314 Principles of Finance 18EW1 Kayla Hopkins&I 10/2/18 11:41 PM Homework: 6-1 MyFinanceLab Assignment Save Score: 0

Home-Students B Myfinancelab Homework.PDo Homework - Kayla + FIN-320-T1314 Principles of Finance 18EW1 Kayla Hopkins&I 10/2/18 11:41 PM Homework: 6-1 MyFinanceLab Assignment Save Score: 0 of 4 pts 3 of 12 (0 complete) HW Score: 0%, 0 of 50 pts P6-3 (similar to) Queston Help to The Business of Life: Saving for Retirement) (Future value of an ordinary annuity) You are graduating from college at the end of this semester and after reading the The Business of Life box in this chapter have decided to invest $5,400 at the end of each year into a Roth IRA for the next 48 years If you earn 6 percent compounded annually on your investment, how much will you have when you retire in 48 years? How much will you have if you wait 10 years before beginning to save and only make 38 payments into your retirement account? How much will you have when you retire in 48 years? SRound to the nearest cent ) Enter your answer in the answer box and then cick Check Answer O type here to search 841 PM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started