Answered step by step

Verified Expert Solution

Question

1 Approved Answer

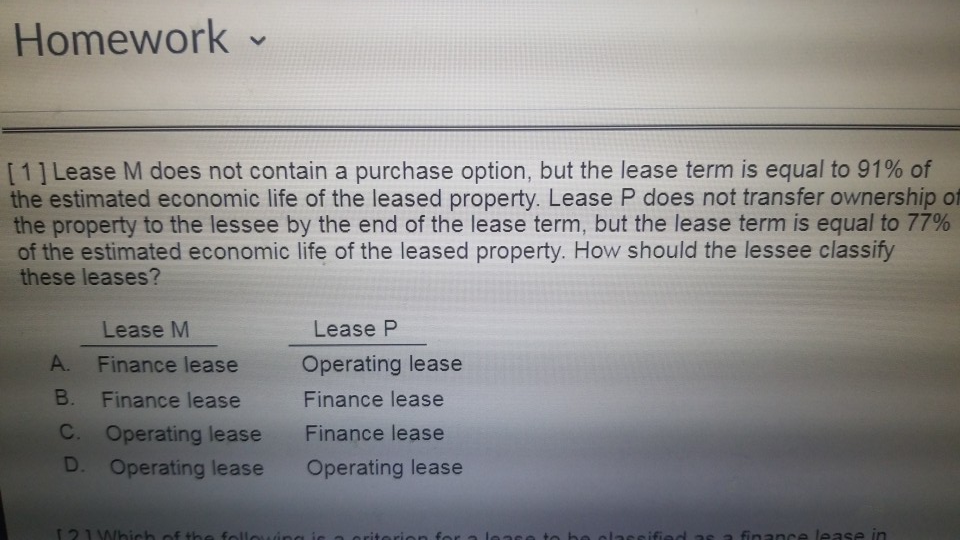

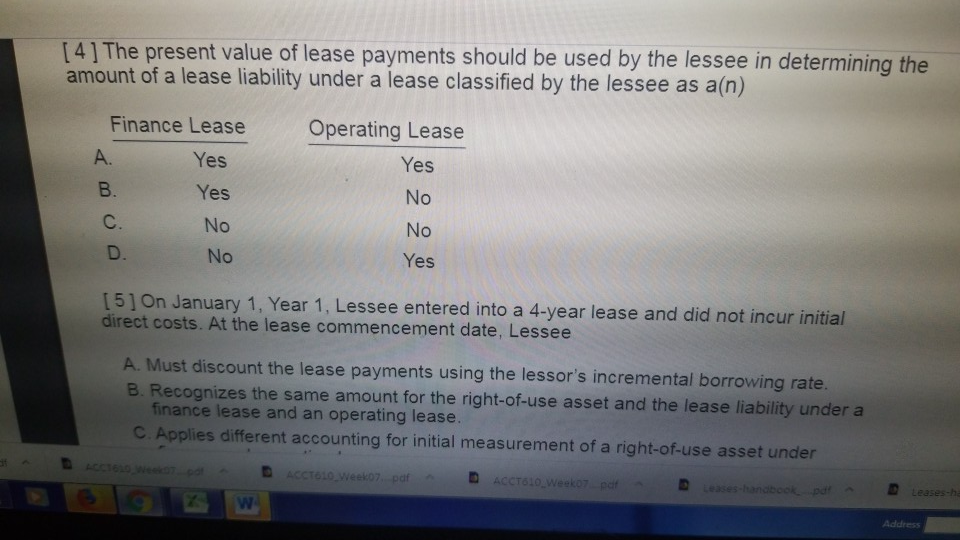

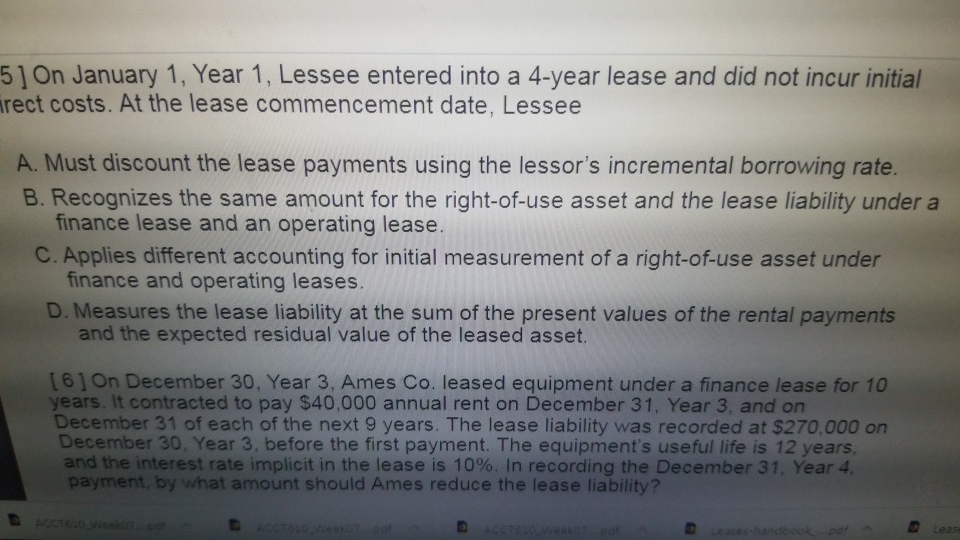

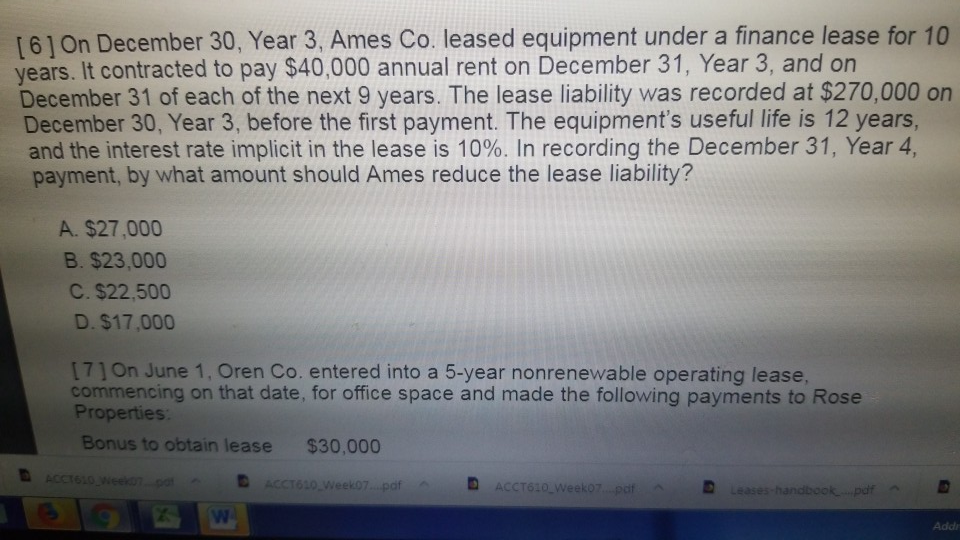

Homework [1 ] Lease M does not contain a purchase option, but the lease term is equal to 91% of the estimated economic life of

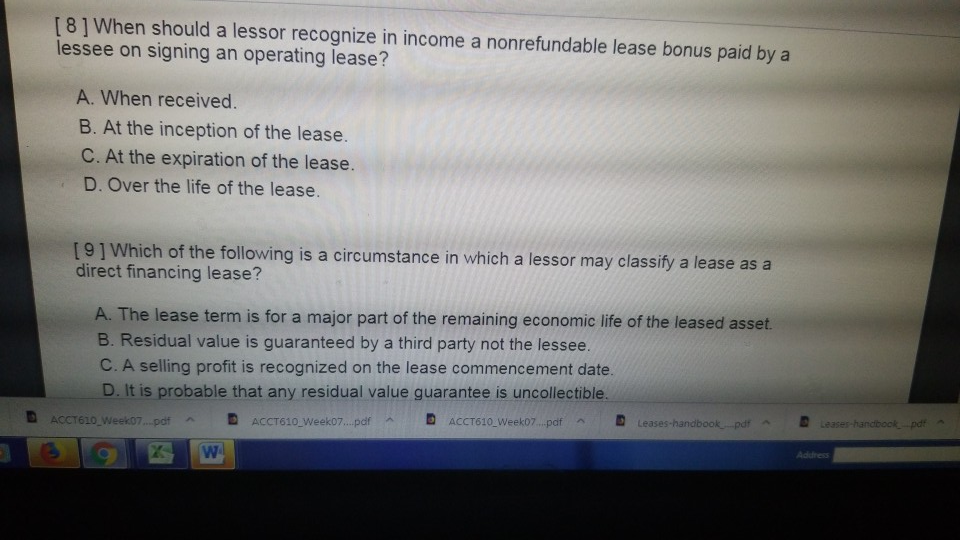

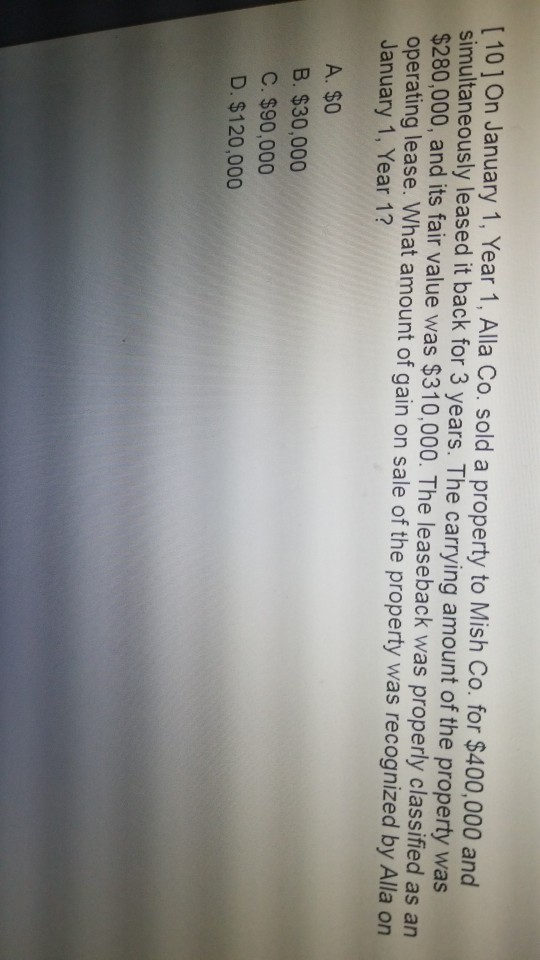

Homework [1 ] Lease M does not contain a purchase option, but the lease term is equal to 91% of the estimated economic life of the leased property. Lease P does not transfer ownership of the property to the lessee by the end of the lease term, but the lease term is equal to 77% of the estimated economic life of the leased property. How should the lessee classify these leases? Lease MM Lease P A. Finance lease Operating lease B. Finance lease C. Operating lease Finance lease D. Operating lease Operating lease Finance lease 2 1 M/hich of th [4] The present value of lease payments should be used by the lessee in determining the amount of a lease liability under a lease classified by the lessee as a(n) Finance Lease Operating Lease A. Yes Yes No No Yes B. Yes C. No [51 On January 1, Year 1, Lessee entered into a 4-year lease and did not incur initial direct costs. At the lease commencement date, Lessee A. Must discount the lease payments using the lessor's incremental borrowing rate. B. Recognizes the same amount for the right-of-use asset and the lease liability under a finance lease and an operating lease. C. Applies different accounting for initial measurement of a right-of-use asset under D Leases-ha 51 On January 1, Year 1, Lessee entered into a 4-year lease and did not incur initial rect costs. At the lease commencement date, Lessee A. Must discount the lease payments using the lessor's incremental borrowing rate. B. Recognizes the same amount for the right-of-use asset and the lease liability under a finance lease and an operating lease. C. Applies different accounting for initial measurement of a right-of-use asset under finance and operating leases D. Measures the lease liability at the sum of the present values of the rental payments and the expected residual value of the leased asset. L61 On December 30, Year 3, Ames Co. leased equipment under a finance lease for 10 years. It contracted to pay $40,000 annual rent on December 31, Year 3, and on December 31 of each of the next 9 years. The lease liability was recorded at $270,000 on December 30, Year 3, before the first payment. The equipment's useful life is 12 years and the interest rate implicit in the lease is 10%. In recording the December 31, Year 4, payment, by what amount should Ames reduce the lease liability? [61 On December 30, Year 3, Ames Co. leased equipment under a finance lease for 10 years. It contracted to pay $40,000 annual rent on December 31, Year 3, and on December 31 of each of the next 9 years. The lease liability was recorded at $270,000 on December 30, Year 3, before the first payment. The equipment's useful life is 12 years and the interest rate implicit in the lease is 10%. In recording the December 31, Year 4, payment, by what amount should Ames reduce the lease liability? A. $27,000 B. $23,000 C. $22,500 D. $17,000 I71 On June 1, Oren Co. entered into a 5-year nonrenewable operating lease, commencing on that date, for office space and made the following payments to Rose Properties Bonus to obtain lease $30,000 Add 8] When should a lessor recognize in income a nonrefundable lease bonus paid by a lessee on signing an operating lease? A. When received B. At the inception of the lease C. At the expiration of the lease. D. Over the life of the lease. llowing is a circumstance in which a lessor may classify a lease as a direct financing lease? A. The lease term is for a major part of the remaining economic life of the leased asset B. Residual value is guaranteed by a third party not the lessee C. A selling profit is recognized on the lease commencement date. D. It is probable that any residual value guarantee is uncollectible Leases-handbook-, par . ^ ACCT610-Week07 pdf ^ t) ACCT610-week07 pdf ^ ACCT610-Week07-.pdf

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started