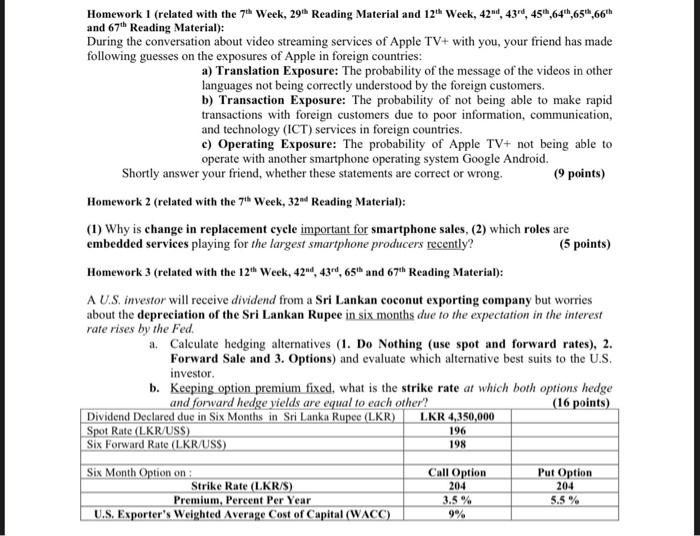

Homework 1 (related with the 7 Week, 29 Reading Material and 12 Week, 42, 43, 45,64,65*,66 and 67h Reading Material): During the conversation about video streaming services of Apple TV+ with you, your friend has made following guesses on the exposures of Apple in foreign countries: a) Translation Exposure: The probability of the message of the videos in other languages not being correctly understood by the foreign customers. b) Transaction Exposure: The probability of not being able to make rapid transactions with foreign customers due to poor information, communication, and technology (ICT) services in foreign countries. c) Operating Exposure: The probability of Apple TV+ not being able to operate with another smartphone operating system Google Android. Shortly answer your friend, whether these statements are correct or wrong. (9 points) Homework 2 (related with the 7h Week, 32Reading Material): (1) Why is change in replacement cycle important for smartphone sales, (2) which roles are embedded services playing for the largest smartphone producers recently? (5 points) Homework 3 (related with the 12th Week, 42, 43, 65 and 67" Reading Material): A U.S. investor will receive dividend from a Sri Lankan coconut exporting company but worries about the depreciation of the Sri Lankan Rupee in six months due to the expectation in the interest rate rises by the Fed. a. Calculate hedging alternatives (1. Do Nothing (use spot and forward rates), 2. Forward Sale and 3. Options) and evaluate which alternative best suits to the U.S. investor b. Keeping option premium fixed, what is the strike rate at which both options hedge and forward hedge yields are equal to each other? (16 points) Dividend Declared duc in Six Months in Sri Lanka Rupee (LKR) LKR 4,350,000 Spot Rate (LKR/USS) 196 Six Forward Rate (LKR/USS) 198 Six Month Option on Call Option Put Option Strike Rate (LKR/S) Premium, Percent Per Year 3.5 % 5.5% U.S. Exporter's Weighted Average Cost of Capital (WACC) 9% 204 204 Homework 1 (related with the 7 Week, 29 Reading Material and 12 Week, 42, 43, 45,64,65*,66 and 67h Reading Material): During the conversation about video streaming services of Apple TV+ with you, your friend has made following guesses on the exposures of Apple in foreign countries: a) Translation Exposure: The probability of the message of the videos in other languages not being correctly understood by the foreign customers. b) Transaction Exposure: The probability of not being able to make rapid transactions with foreign customers due to poor information, communication, and technology (ICT) services in foreign countries. c) Operating Exposure: The probability of Apple TV+ not being able to operate with another smartphone operating system Google Android. Shortly answer your friend, whether these statements are correct or wrong. (9 points) Homework 2 (related with the 7h Week, 32Reading Material): (1) Why is change in replacement cycle important for smartphone sales, (2) which roles are embedded services playing for the largest smartphone producers recently? (5 points) Homework 3 (related with the 12th Week, 42, 43, 65 and 67" Reading Material): A U.S. investor will receive dividend from a Sri Lankan coconut exporting company but worries about the depreciation of the Sri Lankan Rupee in six months due to the expectation in the interest rate rises by the Fed. a. Calculate hedging alternatives (1. Do Nothing (use spot and forward rates), 2. Forward Sale and 3. Options) and evaluate which alternative best suits to the U.S. investor b. Keeping option premium fixed, what is the strike rate at which both options hedge and forward hedge yields are equal to each other? (16 points) Dividend Declared duc in Six Months in Sri Lanka Rupee (LKR) LKR 4,350,000 Spot Rate (LKR/USS) 196 Six Forward Rate (LKR/USS) 198 Six Month Option on Call Option Put Option Strike Rate (LKR/S) Premium, Percent Per Year 3.5 % 5.5% U.S. Exporter's Weighted Average Cost of Capital (WACC) 9% 204 204