Homework 10

Instruction

Comprehensive Problem 10-1

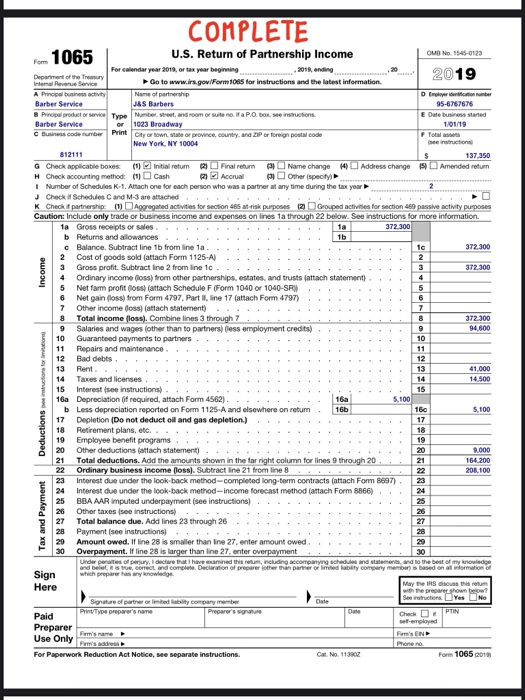

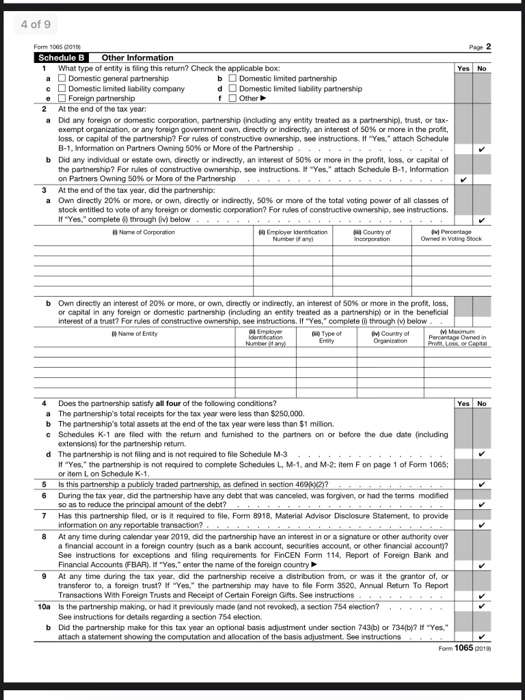

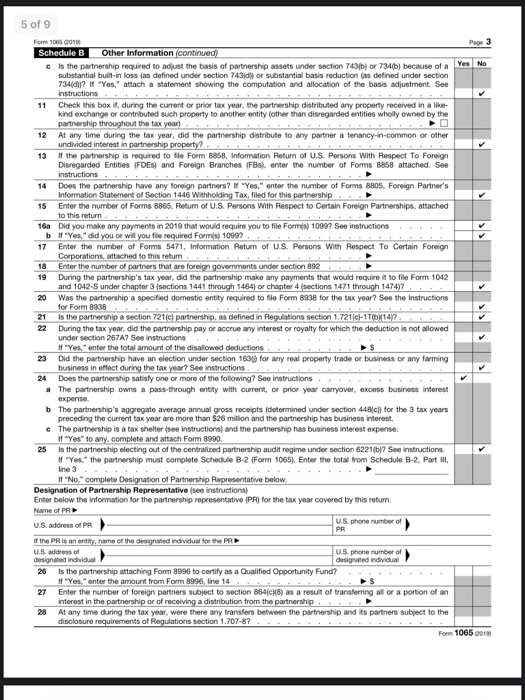

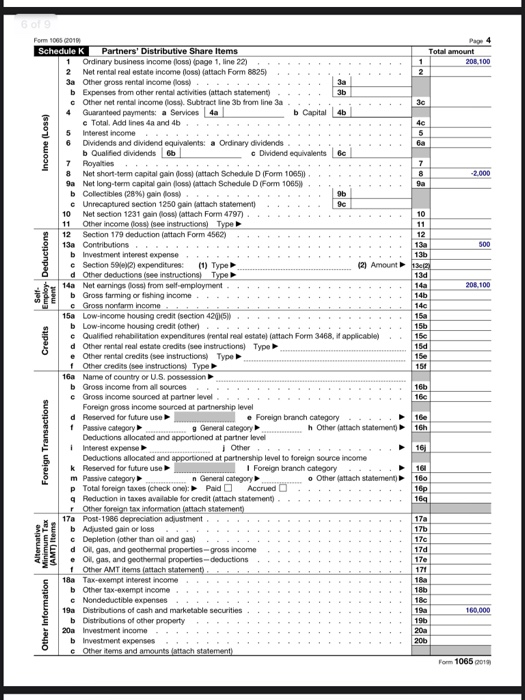

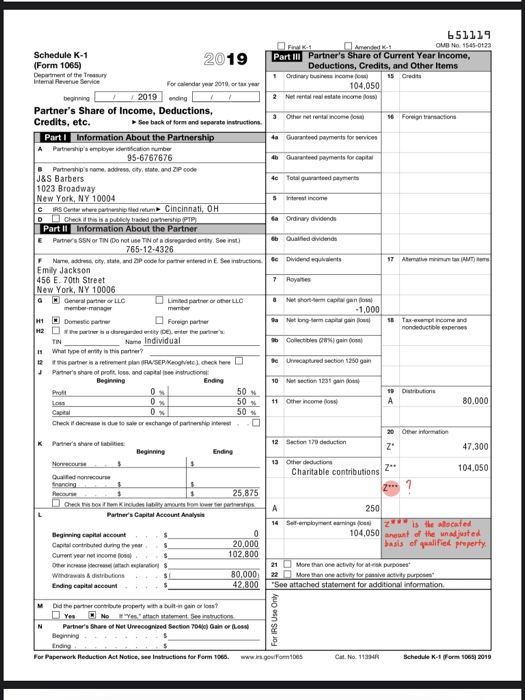

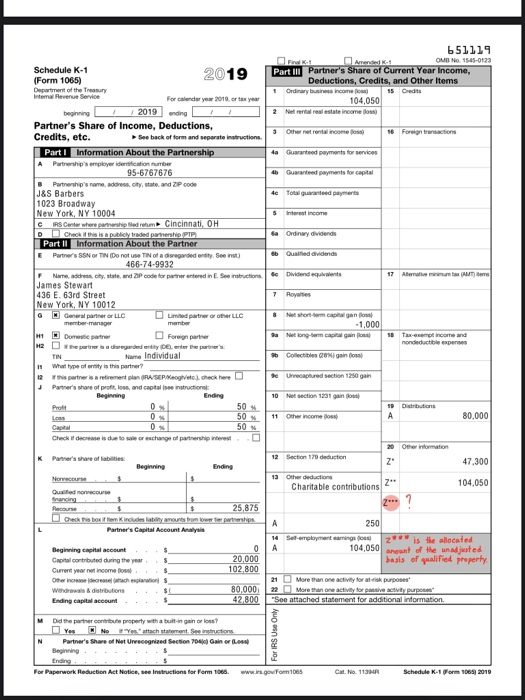

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership's first year of operation is 2019. Emily and James divide income and expenses equally. The partnership name is J&S Barbers, it is located at 1023 Broadway, New York, NY 10004, and its Federal ID number is 95-6767676. The 2019 financial statements for the partnership are presented below.

| J&S Barbers Income Statement for the Year Ending December 31, 2019 | | Gross income from operations | $372,300 | | Deductions: | | | Salaries to employees | 94,600 | | Payroll taxes | 14,500 | | Supplies | 9,000 | | Rent | 41,000 | | Depreciation | 5,100 | | Short-term capital loss | 2,000 | | Charitable contributions | 500 | | Net income | $205,600 | | Partners' withdrawals (each partner) | $80,000 | | J&S Barbers Balance Sheet as of December 31, 2019 | | Assets: | | Cash | $100,450 | | Accounts receivable | 10,000 | | Equipment | $32,000 | | | | Accum. depreciation | (5,100) | | 26,900 | | | $137,350 | | Liabilities and Capital: | | | Accounts payable | $29,750 | | Notes payable | 22,000 | | Partners' capital ($20,000 contributed by each partner) | 85,600 | | | $137,350 | |

Emily lives at 456 E. 70th Street, New York, NY 10006, and James lives at 436 E. 63rd Street, New York, NY 10012.

Required: Complete the Form 1065 and the accompanying K-1 forms. Do not complete Schedule D for the capital loss, Form 4562 for depreciation, or Schedule B-1 related to ownership of the partnership.

- Make realistic assumptions about any missing data.

- If an amount box does not require an entry or the answer is zero, enter "0".

- If required, round your answers to nearest dollar.

- Enter amounts as positive numbers, except for a "loss". If required, enter a "loss" as a negative number on the tax form.

- Assume all debt is recourse debt.

Complete the Form 1065 and the accompanying K-1 forms. Do not complete Schedule D for the capital loss, Form 4562 for depreciation, or Schedule B-1 related to ownership of the partnership

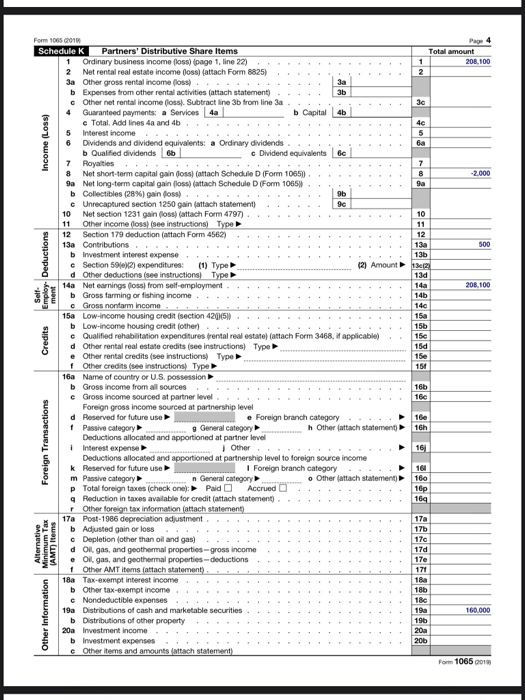

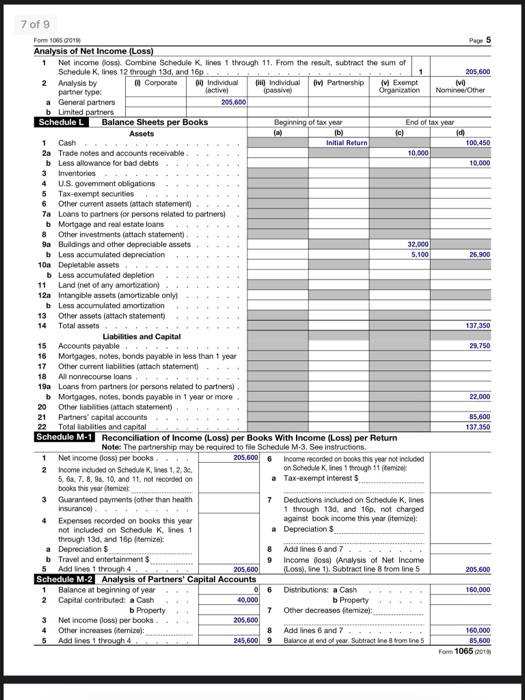

COMPLETE U.S. Return of Partnership Income 1065 2018 ending pow. Form1065 for instructions and the 2019 Go to www. main H 95-6767676 P roduct Type N a ndroom or see TaPO Box Sections 1019 Barber Service or 1023 Broadway Chyrowo roccountry and Perforen p ode New York, NY 10004 812111 137350 o Check applicationes intrum Finalrum Name change Address charge Amended our Check accounting method to Cash or Other specity Number of Schedules 1 Altach one for each person who was a partner at any time during the tax year Check Schedules and M areached - K Checkpartnership Aggregated activities for section is purposes Grouped activities for section 49 passive activity purposes Caution include only trade or business income and expenses on line 1a through 22 below. See instructions for more information 1a Gross receipts or sales. . . . . . . . . . b urns and lowances Balance. Subtract line 1b from line 1a. . 372,300 Cost of goods sold attach Form 1125-A) . . . . . . . . . . . . . 3 Gross profit. Subtract line 2 from line 1c.. . 372.300 . Ordinary income loss) from other partnerships.estates, and trusts attach statement) 5 Netfarm profit loss attach Schedule F Form 1040 1040-SRW Net gain floss) from Form 4797. Part II line 17 (attach Form 4797) . . 7 Other income foss) attach statement) . . . . . . . . . . . . 8 Total income foss). Combine lines 3 through 7. 9 Salaries and wages other than to partners Oess employment credits)........ 10 Guaranteed payments to partners . . . . . . . . . . . . . . 11 Repairs and maintenance. . . . . . . . . . . Income = = = 14 15 16a b 17 = = Deductions 19 20 8 Taxes and licenses. . . Interestisce instructions . . . . . . . . . . . . . . . . . Depreciation of required, attach Form 4562)... . . . Less depreciation reported on Form 1125-A and elsewhere on return . 16b Depletion (Do not deduct oil and gas depletion.) . . Retirement plans, etc.. Employee benefit programs. . . . . . . . . . . . . Other deductions atlach statement) . . . . . . Total deductions. Add the amounts shown in the far right column for lines 9 through 20. Ordinary business income oss). Subtract line 21 from line 8 Interest due under the look back methodcompleted long-term contracts attach Form 8897) Interest due under the look back method-income forecast method attach Form 8866) BBA AAR imputed underpayment see instructions - Other taxes e instructions Total balance due. Add lines 23 through 26 . - . - . . - .- Payment is instructions) Amount owed. If line 28 is smaller than line 27. enter amount owed. . Overpayment. line 28 is larger than line 27.anter overpayment EIN 2 and Payment SBR 30 Sign Here same Perre Paid The Preparer Use Only For Paperwork Reduction Act Notice, se separate instructions 1065 4 of 9 Foto Schedule B Other Information 1 What type of entity is in this return? Check the applicable box a Domestic general partnership b Domestic limited partnership Domesticited abity company d Domestic limited liability partnership Foreign partnership Other 2 At the end of the tax year a Did any foreign or domestic corporation, partnership including any entity treated as a partnership trust or to exempt organization, or any foreign government own directly or indirectly, an interest of 50% or more in the profit loss, or capital of the partnership? For rules of constructive ownership instructions. Yesattach Schedule B-1 Information on Partners Owning 50% Or More of the Partnership Did any individual or estate own, directly or indirectly, an interest of 50% or more in the profit loss, or capital of the partnership? For rules of constructive ownership instructions. "Yesattach Schedule B-1. Information on Partners Owning 50% or More of the Partnership . . . 3 At the end of the tax year, did the partnership a Own directly 20% or more, or own, directly or indirectly, 50 or more of the total voting power of all classes of stock entitled to vote of any foreign or domestic corporation? For rules of constructive ownership See instructions "Yes" complete through below . . . . . . Name of Corporation Employer identification Country Meta Number of Om Vong b Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If "Yes, complete through below Namen Type of M County MM 4 Does the partnership satisfy all four of the following conditions? a The partnership's total receipts for the tax year were less than $250,000 The partnership's total assets at the end of the tax year were less than $1 million c Schedules K-1 are filed with the return and furnished to the partners on or before the due date including extensions for the partnership retur. d The partnership is not filing and is not required to file Schedule M-3 If "Yes," the partnership is not required to complete Schedules L. M-1, and M-2: item F on page 1 of Form 1065; or item Lon Schedule K-1 5 is this partnership a publicly traded partnership, as defined in section 4692 2 6 During the tax year, did the partnership have any debt that was canceled, was forgiven, or had the terms modified so as to reduce the principal amount of the debt? . . . . . 7 Has this partnership filed, or is it required to file. Form 8918. Material Advisor Disclosure Statement to provide 9 At any time during calendar year 2019, did the partnership have an interest in or a signature or other authority over a financial account in a foreign country such as a bank account, securities account, or other financial account? See instructions for exceptions and fling requirements for FCEN Form 114. Report of Foreign Bank and Financial Accounts FBAR "Yes" enter the name of the foreign country At any time during the tax year, did the partnership receive a distribution from or was the grantor of, or transferorto a foreign trust? Yes. The partnership may have to file Form 3520. Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign G . See instructions is the partnership making, or had previously made and not revoked, a section 754 lection? See instructions for de regarding a section 754 lection Did the partnership make for this tax year an optional basis adjustment under section 743 or 7346 "Yes." ch a statement showing the comutation and allocation of the basis adjustment. See Instructions 10 a 1065 2018 5 of 9 Foto 2018 Schedule B O ther Information continued c is the partnership required to adjust the basis of partnership s under section or 73 ec o fa substantial built-in loss as defined under section 743 or substantial basis reduction las defined under section 734/ "Yes, attach a statement showing the computation and allocation of the basis adjustment See instructions 11 Check this box during the current or prior tax year, the partnership distributed any property received in a kind exchange or contributed such property to another entity other than disregarded entities wholly owned by the partnership throughout the tax year. . . . . . 12 At any time during the tax year, did the partnership distribute to any partner a tenancy-in-common or other undvided interest in partnership property? . . . 13 the partnership is required to file Form 3858, Information Return of U.S. Persons with Respect To Foreign Disregarded Entities FDES) and Foreign Branches FB, enter the number of Forms BSB attached. See instructions 14 Does the partnership have any foreign partners? Yes." enter the number of Forms 8805, Foreign Partner's Information Statement of Section 1446 Withholding Tax, filed for this partnership 15 Enter the number of Forms 8865. Return of U.S. Persons with Respect to certain Foreign Partnerships attached to this retum. 168 Did you make any payments in 2019 that would require you to file Forms 10997 See instructions "Yes," did you or will you file required Formis) 10997. . . . 17 Enter the number of Forms 5471, Information Return of US. Persons with Respect To Certain Foreign Corporations, attached to this retum . . . 18 Enter the number of partners that are foreign governments under section 892 19 During the partnership's tax year, did the partnership make any payments that would required to file Form 1042 and 1042-S under chapter 3 sections 1441 through 1464) or chapter 4 sections 1471 through 1474)? 20 Was the partnership a specified domestic entity required to file Form 8938 for the tax year? See the Instructions for Form 8938 21 is the partnership a section 721cl partnership, as defined in Regulations section 1.721c)-1 TK1477 22 During the tax year, did the partnership pay or accrue any interest or royalty for which the deduction is not allowed under section 267A? See instructions If "Yes,"enter the total amount of the disallowed deductions 23 Did the partnership have an election under section 1630 for any real property trade or business or any farming business in effect during the tax year? See instructions 24 Does the partnership satisfy one or more of the following? See instructions .. . . . . . . . . . . . a The partnership owns a pass through antity with current, or prior year carryover, excess business interest expense. b The partnership's aggregate average annual gross receipts determined under section 448 cl for the 3 tax years preceding the current tax year are more than $20 million and the partnership has business interest. The partnership is a tax shelter (see instructions and the partnership has business interest expense If "Yes" to my complete and attach Form 1990 25 is the partnership electing out of the centralized partnership audit regime under section 622112 See instructions If "Yes. the partnership must complete Schedule 3-2 Form 1065). Enter the total from Schedule B-2 Part II "No," complete Designation of Partnership Representative below. Designation of Partnership Representatives instructions Enter below the information for the partnership representative (PR) for the tax year covered by this return Name of US as of PR US phone I PR is an entity name of the wated individus for the PR US US gone umber of designed individu 20 is the partnership attaching Form 1996 to certify as a Qualified Opportunity Fund? - - Yes enter the amount from Form 8996. line 14 27 Enter the number of foreign partners subject to section 864 ) as a result of transferring all or a portion of an interest in the partnership or of receiving a distribution from the partnership. ... 28 At any time during the tax yeu were there any transfers between the partnership and its partners subject to the disclosure requirements of Regulations section 1.707-8? . . . For 1065 Foro Schedule K 1 2 3a Partners' Distributive Share Items Ordinary business income foss) page 1. line 22) Net rental real estate income foss) attach Form 8825) . Other gross rental income . . . Expenses from other rental activities attach statement . . . . Othernet income oss. Subtract line 3b from line 3a. . . Guaranteed payments a Services 4a b Capital Total Add lines and . . . . . . . 4 4 Income (Loss 13b 102 130 145 150 6 Dividends and dividend equivalents a Ordinary dividends. b Qualified dividends 6b Dividend equivalents 6c 7 Royalties - - 8 Net short-term capital gain oss attach Schedule D Form 10651. .. . sa Netlong-term capital gains attach Schedule D Form 1065). b Collectibles (28%) gain foss). . . . . . . . . Unrecaptured section 1250 gain ach statement . . . . 9 10 Net section 1231 anos) attach Form 4797) . . 11 Other income oss) see instructions) Type 12 Section 179 deduction (attach Form 4562) 13a Contributions Investment interest expense . . . . . . . . . c Section 592) expenditures: (1) Type (2) Amount d Other deductions (see instructions) Type 14a Net earnings from self-employment... . . . Gross farming or fishing income. . . . . . . c Gross nontam Income .. . . . . . . . . . . . . . . . . . . . 15a Low-income housing credit section 42005) . . . . . . . Low-income housing credit fother) ... . . . . . . . . . . . . . . c Qualified rehabilitation expenditures frontal real estate attach Form 3468,applicable d Other rental real estate credits (see instructions) Type Other rental credits (e instructions) Type Other credit instructions Type 16a Name of country or U.S. Possession b Gross income from all sources Gross income sourced at partner level . . . . . . . . . Foreign gross income sourced at partnership level d Reserved for future use e Foreign branch category . . . Passive category ....... General category Other attach statement Deductions allocated and apportioned at partner level i interest expense Other Deductions allocated and apportioned at partnership level to foreign source income Reserved for future use Foreign branch category- m Passive category General category Other Gach statement Total foreign taxes (check one: Paid Accrued .. Reduction in taxes available for credit attach statement. . Other foreign tax information attach statement 170 Post-1086 depreciation adjustment.... . Adjusted gain or loss Depletion other than oil and gas) - - - - d Oilgas, and geothermal properties-gross income - - - - - - - - - - Oil gas, and geothermal properties-deductions - - - - - - 1 Other AMT tems attach statement 180 Tax-exemptinterest income Other -exempt income.. . - - - - Nondeductible expenses - - - - - - 19 Distributions of cash and marketable securities ... . . . . Distributions of other property - - - - 20a v estment income. - - - - investment expenses . . . Other items and amounts lach statement 16h Foreign Transactions 16 16 169 170 170 170 Alternative Marimum Other Information For 1065 00 Foro Schedule K 1 2 3a Partners' Distributive Share Items Ordinary business income foss) page 1. line 22) Net rental real estate income foss) attach Form 8825) . Other gross rental income . . . Expenses from other rental activities attach statement . . . . Othernet income oss. Subtract line 3b from line 3a. . . Guaranteed payments a Services 4a b Capital Total Add lines and . . . . . . . 4 4 Income (Loss 13b 102 130 145 150 6 Dividends and dividend equivalents a Ordinary dividends. b Qualified dividends 6b Dividend equivalents 6c 7 Royalties - - 8 Net short-term capital gain oss attach Schedule D Form 10651. .. . sa Netlong-term capital gains attach Schedule D Form 1065). b Collectibles (28%) gain foss). . . . . . . . . Unrecaptured section 1250 gain ach statement . . . . 9 10 Net section 1231 anos) attach Form 4797) . . 11 Other income oss) see instructions) Type 12 Section 179 deduction (attach Form 4562) 13a Contributions Investment interest expense . . . . . . . . . c Section 592) expenditures: (1) Type (2) Amount d Other deductions (see instructions) Type 14a Net earnings from self-employment... . . . Gross farming or fishing income. . . . . . . c Gross nontam Income .. . . . . . . . . . . . . . . . . . . . 15a Low-income housing credit section 42005) . . . . . . . Low-income housing credit fother) ... . . . . . . . . . . . . . . c Qualified rehabilitation expenditures frontal real estate attach Form 3468,applicable d Other rental real estate credits (see instructions) Type Other rental credits (e instructions) Type Other credit instructions Type 16a Name of country or U.S. Possession b Gross income from all sources Gross income sourced at partner level . . . . . . . . . Foreign gross income sourced at partnership level d Reserved for future use e Foreign branch category . . . Passive category ....... General category Other attach statement Deductions allocated and apportioned at partner level i interest expense Other Deductions allocated and apportioned at partnership level to foreign source income Reserved for future use Foreign branch category- m Passive category General category Other attach statement Total foreign taxes (check one: Paid Accrued .. Reduction in taxes available for credit attach statement. . Other foreign tax information attach statement 170 Post-1086 depreciation adjustment.... . Adjusted gain or loss Depletion other than oil and gas) - - - - d Oilgas, and geothermal properties-gross income - - - - - - - - - - Oil gas, and geothermal properties-deductions - - - - - - 1 Other AMT tems attach statement 180 Tax-exemptinterest income Other -exempt income.. . - - - - Nondeductible expenses - - - - - - 19 Distributions of cash and marketable securities . . . . Distributions of other property - - - - - - 20a investment income -- - - - - - - - - - - - - - investment expenses . . Other items and amounts lach statement 16h Foreign Transactions 16 16 169 170 170 170 Alternative Marimum Other Information For 1065 00 7 of 9 From 2018 Analysis of Net Income Loss) 1 income fos Combine Schedule Kines 1 through 11. From the result, subtract the sum of Schedule Kines 12 through 13d. and 160 2 Analysis by Corporate Sual M Partnership Exempt ave partner type Organization a General partners Limited partners Schedule Balance Sheets per Books inning of tax year Assets 1 Cash In Return 2a Tradenotes and accounts receivable. . . Less towance for bad debts . . . . . . . . 3 Inventories - - - - - - - - 4 US government obligations- 5 Tax-exempt securities 6 Other current assets attach statement Ta Loans to partners for persons related to partners Mortgage and real estate loans 8 Other investments attach statement sa Buildings and other depreciable assets. b Less accumulated depreciation . 100 Depletable assets . . . Less accumulated depletion 11 Land inet of any amortization. . . . 12a intangible assets (amortizable only . . . b Less accumulated amortization 13 Other assets attach statement . . . . . . 14 Total assets. Liabilities and Capital 15 Accounts payable. . . . . . . . 16 Mortgages, notes, bonds payable in less than 1 year 17 Other current liabilities attach statement) . . . . 18 All norecourse loans. . . . . 10a Loans from partners for persons related to partners). b Mortgages, notes, bonds payable in 1 year or more 20 Other abilities attach statement) 21 Partners' capital accounts . . . . . . . . 22 Total abilities and capital Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note: The partnership may be required to file Schedule M-3 See instructions 1 Net income foss) per books. 205,600 6 6 income recorded on books this year not included Income included on Schedule Kline 1. 2. 3. on Schedule Kines through 11 tamil 5. 6. 7. 8. 9. 10 and 11. not recorded on a Tax-exempt interests booksis year 3 Guaranteed payments other than health 7 Deductions included on Schedule Kines insurance - 1 through 13d, and 16. not charged Expenses recorded on books this year against book income this year m 4 e not included on Schedule Kines 1 a Depreciations through 13 and 16ptomize a Depreciations 8 Addins 6 and 7 Travel and entertainment 9 income oss Analysis of Net Income 5 Addines 1 through 4. 205 500 Lossline 1. Subtract line fromines Schedule M-2 Analysis of Partners' Capital Accounts 1 Balance beginning of year Distributions a Cash 2 Capital contributed a Cash Property Property 7 Other decreases ternicze 3 Net income foss) per books. 4 Other increases termice 8 Add lines 6 and 7. 5 Addlines 1 though 16 106501 Schedule K-1 Form 1065 2019 Part 1 652119 OM Partner's Share of Current Year Income, Deductions, Credits, and other items 104,050 2019 Partner's Share of Income, Deductions, Credits, etc. Part 1 Information About the Partnership 5 Ohrome Forum C 95-6767676 Parth 's mes sa and ZIP code JBS Barbers 4 Tod ay 1023 Broadway New York, NY 10004 income e we Cincinnati, OH D B Chat is a publicaded partes PIP a Ordinary dividends Part II Information About the Partner EPSON TI D o dd y See ) Que dividende 765-12-4326 F N y e forwardin Sections Dividendes Emily Jackson 456 E. 70th Street 7 Royalties New York, NY 10006 e neral partner or LLC Limited partner or other LLC # Net short-term capilgan membrana 1.000 1 Dome Foreign Netlogom Ha w w w . the TIN Name Individual * Collectibles gain ons 11 Way is this partner? partneris reven g e . check here te Unrecaptured section 1250 gain Partner's share of prot loss, and capital s tructions: Beginning 10 Net section 1231 an 0 O 11 Other income O Check deciderechange of persones G 10 Taneca come and 80,000 Paroles 12 Section 17dection 47.300 13 Other deductions Charitable contributions 104.050 25,875 Partner's Capital Account Anal 250 teamge 104,050 Beginning s tecated ut of the wated basis of qualified properly 20.000 102.800 80.000 42000 "See attached statement for additional information De rry aban? For Production Action for Form 1088 wwwgoufom Schedule K-1 (Form 1065) 2019 Part II b51119 ON Partner's Share of Current Year Income, Deductions, Credits, and Other Items 104,050 2019 din Partner's Share of Income, Deductions, Credits, etc. Part 1 Information About the Partnership 4 Total payment C D & Quid dividende s e Owend wers 7 Royalties 95-6767676 Pur w and ZIP code JBS Barbers 1023 Broadway New York, NY 10004 e we Cincinnati, OH B Check this is a publicly traded partnership PTP Part II Information About the Partner Partners SSN TN Do d ged Seest) 466-74-9932 F Num a r Pode for parentered in Es James Stewart 436 E. 63rd Street New York, NY 10012 e neral partner or LLC LLC memberger member Foreign parte Ha Whi te Name Individual 11 W ype of writy is this partner? 12 sterren Segel cheche Partner's w o rto, and captainstruction Beginning 0 50 50 % 50 Check case is due to change of partnership G . Net Wortm a n - 1,000 Da Nang man cartone and nonductie per * Collectio n te Unrecaptured section 12:50 gain 10 Net section 1231 gain 11 Other income 80,000 Pataware of its 12 Section 179 deduction 47.300 Beginning 13 Other deductions 104.050 Charitable contributions 25,875 Partners Capital Account m 250 is docted 104,050 Sount of the adjusted basis of qualified property Beginning 20 000 102 800 80.000 42.800 Ending t o See attached statement for additional information M otywano For IRS USB Ca. 110 Schedule 1 Form10, 2012 COMPLETE U.S. Return of Partnership Income 1065 2018 ending pow. Form1065 for instructions and the 2019 Go to www. main H 95-6767676 P roduct Type N a ndroom or see TaPO Box Sections 1019 Barber Service or 1023 Broadway Chyrowo roccountry and Perforen p ode New York, NY 10004 812111 137350 o Check applicationes intrum Finalrum Name change Address charge Amended our Check accounting method to Cash or Other specity Number of Schedules 1 Altach one for each person who was a partner at any time during the tax year Check Schedules and M areached - K Checkpartnership Aggregated activities for section is purposes Grouped activities for section 49 passive activity purposes Caution include only trade or business income and expenses on line 1a through 22 below. See instructions for more information 1a Gross receipts or sales. . . . . . . . . . b urns and lowances Balance. Subtract line 1b from line 1a. . 372,300 Cost of goods sold attach Form 1125-A) . . . . . . . . . . . . . 3 Gross profit. Subtract line 2 from line 1c.. . 372.300 . Ordinary income loss) from other partnerships.estates, and trusts attach statement) 5 Netfarm profit loss attach Schedule F Form 1040 1040-SRW Net gain floss) from Form 4797. Part II line 17 (attach Form 4797) . . 7 Other income foss) attach statement) . . . . . . . . . . . . 8 Total income foss). Combine lines 3 through 7. 9 Salaries and wages other than to partners Oess employment credits)........ 10 Guaranteed payments to partners . . . . . . . . . . . . . . 11 Repairs and maintenance. . . . . . . . . . . Income = = = 14 15 16a b 17 = = Deductions 19 20 8 Taxes and licenses. . . Interestisce instructions . . . . . . . . . . . . . . . . . Depreciation of required, attach Form 4562)... . . . Less depreciation reported on Form 1125-A and elsewhere on return . 16b Depletion (Do not deduct oil and gas depletion.) . . Retirement plans, etc.. Employee benefit programs. . . . . . . . . . . . . Other deductions atlach statement) . . . . . . Total deductions. Add the amounts shown in the far right column for lines 9 through 20. Ordinary business income oss). Subtract line 21 from line 8 Interest due under the look back methodcompleted long-term contracts attach Form 8897) Interest due under the look back method-income forecast method attach Form 8866) BBA AAR imputed underpayment see instructions - Other taxes e instructions Total balance due. Add lines 23 through 26 . - . - . . - .- Payment is instructions) Amount owed. If line 28 is smaller than line 27. enter amount owed. . Overpayment. line 28 is larger than line 27.anter overpayment EIN 2 and Payment SBR 30 Sign Here same Perre Paid The Preparer Use Only For Paperwork Reduction Act Notice, se separate instructions 1065 4 of 9 Foto Schedule B Other Information 1 What type of entity is in this return? Check the applicable box a Domestic general partnership b Domestic limited partnership Domesticited abity company d Domestic limited liability partnership Foreign partnership Other 2 At the end of the tax year a Did any foreign or domestic corporation, partnership including any entity treated as a partnership trust or to exempt organization, or any foreign government own directly or indirectly, an interest of 50% or more in the profit loss, or capital of the partnership? For rules of constructive ownership instructions. Yesattach Schedule B-1 Information on Partners Owning 50% Or More of the Partnership Did any individual or estate own, directly or indirectly, an interest of 50% or more in the profit loss, or capital of the partnership? For rules of constructive ownership instructions. "Yesattach Schedule B-1. Information on Partners Owning 50% or More of the Partnership . . . 3 At the end of the tax year, did the partnership a Own directly 20% or more, or own, directly or indirectly, 50 or more of the total voting power of all classes of stock entitled to vote of any foreign or domestic corporation? For rules of constructive ownership See instructions "Yes" complete through below . . . . . . Name of Corporation Employer identification Country Meta Number of Om Vong b Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If "Yes, complete through below Namen Type of M County MM 4 Does the partnership satisfy all four of the following conditions? a The partnership's total receipts for the tax year were less than $250,000 The partnership's total assets at the end of the tax year were less than $1 million c Schedules K-1 are filed with the return and furnished to the partners on or before the due date including extensions for the partnership retur. d The partnership is not filing and is not required to file Schedule M-3 If "Yes," the partnership is not required to complete Schedules L. M-1, and M-2: item F on page 1 of Form 1065; or item Lon Schedule K-1 5 is this partnership a publicly traded partnership, as defined in section 4692 2 6 During the tax year, did the partnership have any debt that was canceled, was forgiven, or had the terms modified so as to reduce the principal amount of the debt? . . . . . 7 Has this partnership filed, or is it required to file. Form 8918. Material Advisor Disclosure Statement to provide 9 At any time during calendar year 2019, did the partnership have an interest in or a signature or other authority over a financial account in a foreign country such as a bank account, securities account, or other financial account? See instructions for exceptions and fling requirements for FCEN Form 114. Report of Foreign Bank and Financial Accounts FBAR "Yes" enter the name of the foreign country At any time during the tax year, did the partnership receive a distribution from or was the grantor of, or transferorto a foreign trust? Yes. The partnership may have to file Form 3520. Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign G . See instructions is the partnership making, or had previously made and not revoked, a section 754 lection? See instructions for de regarding a section 754 lection Did the partnership make for this tax year an optional basis adjustment under section 743 or 7346 "Yes." ch a statement showing the comutation and allocation of the basis adjustment. See Instructions 10 a 1065 2018 5 of 9 Foto 2018 Schedule B O ther Information continued c is the partnership required to adjust the basis of partnership s under section or 73 ec o fa substantial built-in loss as defined under section 743 or substantial basis reduction las defined under section 734/ "Yes, attach a statement showing the computation and allocation of the basis adjustment See instructions 11 Check this box during the current or prior tax year, the partnership distributed any property received in a kind exchange or contributed such property to another entity other than disregarded entities wholly owned by the partnership throughout the tax year. . . . . . 12 At any time during the tax year, did the partnership distribute to any partner a tenancy-in-common or other undvided interest in partnership property? . . . 13 the partnership is required to file Form 3858, Information Return of U.S. Persons with Respect To Foreign Disregarded Entities FDES) and Foreign Branches FB, enter the number of Forms BSB attached. See instructions 14 Does the partnership have any foreign partners? Yes." enter the number of Forms 8805, Foreign Partner's Information Statement of Section 1446 Withholding Tax, filed for this partnership 15 Enter the number of Forms 8865. Return of U.S. Persons with Respect to certain Foreign Partnerships attached to this retum. 168 Did you make any payments in 2019 that would require you to file Forms 10997 See instructions "Yes," did you or will you file required Formis) 10997. . . . 17 Enter the number of Forms 5471, Information Return of US. Persons with Respect To Certain Foreign Corporations, attached to this retum . . . 18 Enter the number of partners that are foreign governments under section 892 19 During the partnership's tax year, did the partnership make any payments that would required to file Form 1042 and 1042-S under chapter 3 sections 1441 through 1464) or chapter 4 sections 1471 through 1474)? 20 Was the partnership a specified domestic entity required to file Form 8938 for the tax year? See the Instructions for Form 8938 21 is the partnership a section 721cl partnership, as defined in Regulations section 1.721c)-1 TK1477 22 During the tax year, did the partnership pay or accrue any interest or royalty for which the deduction is not allowed under section 267A? See instructions If "Yes,"enter the total amount of the disallowed deductions 23 Did the partnership have an election under section 1630 for any real property trade or business or any farming business in effect during the tax year? See instructions 24 Does the partnership satisfy one or more of the following? See instructions .. . . . . . . . . . . . a The partnership owns a pass through antity with current, or prior year carryover, excess business interest expense. b The partnership's aggregate average annual gross receipts determined under section 448 cl for the 3 tax years preceding the current tax year are more than $20 million and the partnership has business interest. The partnership is a tax shelter (see instructions and the partnership has business interest expense If "Yes" to my complete and attach Form 1990 25 is the partnership electing out of the centralized partnership audit regime under section 622112 See instructions If "Yes. the partnership must complete Schedule 3-2 Form 1065). Enter the total from Schedule B-2 Part II "No," complete Designation of Partnership Representative below. Designation of Partnership Representatives instructions Enter below the information for the partnership representative (PR) for the tax year covered by this return Name of US as of PR US phone I PR is an entity name of the wated individus for the PR US US gone umber of designed individu 20 is the partnership attaching Form 1996 to certify as a Qualified Opportunity Fund? - - Yes enter the amount from Form 8996. line 14 27 Enter the number of foreign partners subject to section 864 ) as a result of transferring all or a portion of an interest in the partnership or of receiving a distribution from the partnership. ... 28 At any time during the tax yeu were there any transfers between the partnership and its partners subject to the disclosure requirements of Regulations section 1.707-8? . . . For 1065 Foro Schedule K 1 2 3a Partners' Distributive Share Items Ordinary business income foss) page 1. line 22) Net rental real estate income foss) attach Form 8825) . Other gross rental income . . . Expenses from other rental activities attach statement . . . . Othernet income oss. Subtract line 3b from line 3a. . . Guaranteed payments a Services 4a b Capital Total Add lines and . . . . . . . 4 4 Income (Loss 13b 102 130 145 150 6 Dividends and dividend equivalents a Ordinary dividends. b Qualified dividends 6b Dividend equivalents 6c 7 Royalties - - 8 Net short-term capital gain oss attach Schedule D Form 10651. .. . sa Netlong-term capital gains attach Schedule D Form 1065). b Collectibles (28%) gain foss). . . . . . . . . Unrecaptured section 1250 gain ach statement . . . . 9 10 Net section 1231 anos) attach Form 4797) . . 11 Other income oss) see instructions) Type 12 Section 179 deduction (attach Form 4562) 13a Contributions Investment interest expense . . . . . . . . . c Section 592) expenditures: (1) Type (2) Amount d Other deductions (see instructions) Type 14a Net earnings from self-employment... . . . Gross farming or fishing income. . . . . . . c Gross nontam Income .. . . . . . . . . . . . . . . . . . . . 15a Low-income housing credit section 42005) . . . . . . . Low-income housing credit fother) ... . . . . . . . . . . . . . . c Qualified rehabilitation expenditures frontal real estate attach Form 3468,applicable d Other rental real estate credits (see instructions) Type Other rental credits (e instructions) Type Other credit instructions Type 16a Name of country or U.S. Possession b Gross income from all sources Gross income sourced at partner level . . . . . . . . . Foreign gross income sourced at partnership level d Reserved for future use e Foreign branch category . . . Passive category ....... General category Other attach statement Deductions allocated and apportioned at partner level i interest expense Other Deductions allocated and apportioned at partnership level to foreign source income Reserved for future use Foreign branch category- m Passive category General category Other Gach statement Total foreign taxes (check one: Paid Accrued .. Reduction in taxes available for credit attach statement. . Other foreign tax information attach statement 170 Post-1086 depreciation adjustment.... . Adjusted gain or loss Depletion other than oil and gas) - - - - d Oilgas, and geothermal properties-gross income - - - - - - - - - - Oil gas, and geothermal properties-deductions - - - - - - 1 Other AMT tems attach statement 180 Tax-exemptinterest income Other -exempt income.. . - - - - Nondeductible expenses - - - - - - 19 Distributions of cash and marketable securities ... . . . . Distributions of other property - - - - 20a v estment income. - - - - investment expenses . . . Other items and amounts lach statement 16h Foreign Transactions 16 16 169 170 170 170 Alternative Marimum Other Information For 1065 00 Foro Schedule K 1 2 3a Partners' Distributive Share Items Ordinary business income foss) page 1. line 22) Net rental real estate income foss) attach Form 8825) . Other gross rental income . . . Expenses from other rental activities attach statement . . . . Othernet income oss. Subtract line 3b from line 3a. . . Guaranteed payments a Services 4a b Capital Total Add lines and . . . . . . . 4 4 Income (Loss 13b 102 130 145 150 6 Dividends and dividend equivalents a Ordinary dividends. b Qualified dividends 6b Dividend equivalents 6c 7 Royalties - - 8 Net short-term capital gain oss attach Schedule D Form 10651. .. . sa Netlong-term capital gains attach Schedule D Form 1065). b Collectibles (28%) gain foss). . . . . . . . . Unrecaptured section 1250 gain ach statement . . . . 9 10 Net section 1231 anos) attach Form 4797) . . 11 Other income oss) see instructions) Type 12 Section 179 deduction (attach Form 4562) 13a Contributions Investment interest expense . . . . . . . . . c Section 592) expenditures: (1) Type (2) Amount d Other deductions (see instructions) Type 14a Net earnings from self-employment... . . . Gross farming or fishing income. . . . . . . c Gross nontam Income .. . . . . . . . . . . . . . . . . . . . 15a Low-income housing credit section 42005) . . . . . . . Low-income housing credit fother) ... . . . . . . . . . . . . . . c Qualified rehabilitation expenditures frontal real estate attach Form 3468,applicable d Other rental real estate credits (see instructions) Type Other rental credits (e instructions) Type Other credit instructions Type 16a Name of country or U.S. Possession b Gross income from all sources Gross income sourced at partner level . . . . . . . . . Foreign gross income sourced at partnership level d Reserved for future use e Foreign branch category . . . Passive category ....... General category Other attach statement Deductions allocated and apportioned at partner level i interest expense Other Deductions allocated and apportioned at partnership level to foreign source income Reserved for future use Foreign branch category- m Passive category General category Other attach statement Total foreign taxes (check one: Paid Accrued .. Reduction in taxes available for credit attach statement. . Other foreign tax information attach statement 170 Post-1086 depreciation adjustment.... . Adjusted gain or loss Depletion other than oil and gas) - - - - d Oilgas, and geothermal properties-gross income - - - - - - - - - - Oil gas, and geothermal properties-deductions - - - - - - 1 Other AMT tems attach statement 180 Tax-exemptinterest income Other -exempt income.. . - - - - Nondeductible expenses - - - - - - 19 Distributions of cash and marketable securities . . . . Distributions of other property - - - - - - 20a investment income -- - - - - - - - - - - - - - investment expenses . . Other items and amounts lach statement 16h Foreign Transactions 16 16 169 170 170 170 Alternative Marimum Other Information For 1065 00 7 of 9 From 2018 Analysis of Net Income Loss) 1 income fos Combine Schedule Kines 1 through 11. From the result, subtract the sum of Schedule Kines 12 through 13d. and 160 2 Analysis by Corporate Sual M Partnership Exempt ave partner type Organization a General partners Limited partners Schedule Balance Sheets per Books inning of tax year Assets 1 Cash In Return 2a Tradenotes and accounts receivable. . . Less towance for bad debts . . . . . . . . 3 Inventories - - - - - - - - 4 US government obligations- 5 Tax-exempt securities 6 Other current assets attach statement Ta Loans to partners for persons related to partners Mortgage and real estate loans 8 Other investments attach statement sa Buildings and other depreciable assets. b Less accumulated depreciation . 100 Depletable assets . . . Less accumulated depletion 11 Land inet of any amortization. . . . 12a intangible assets (amortizable only . . . b Less accumulated amortization 13 Other assets attach statement . . . . . . 14 Total assets. Liabilities and Capital 15 Accounts payable. . . . . . . . 16 Mortgages, notes, bonds payable in less than 1 year 17 Other current liabilities attach statement) . . . . 18 All norecourse loans. . . . . 10a Loans from partners for persons related to partners). b Mortgages, notes, bonds payable in 1 year or more 20 Other abilities attach statement) 21 Partners' capital accounts . . . . . . . . 22 Total abilities and capital Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return Note: The partnership may be required to file Schedule M-3 See instructions 1 Net income foss) per books. 205,600 6 6 income recorded on books this year not included Income included on Schedule Kline 1. 2. 3. on Schedule Kines through 11 tamil 5. 6. 7. 8. 9. 10 and 11. not recorded on a Tax-exempt interests booksis year 3 Guaranteed payments other than health 7 Deductions included on Schedule Kines insurance - 1 through 13d, and 16. not charged Expenses recorded on books this year against book income this year m 4 e not included on Schedule Kines 1 a Depreciations through 13 and 16ptomize a Depreciations 8 Addins 6 and 7 Travel and entertainment 9 income oss Analysis of Net Income 5 Addines 1 through 4. 205 500 Lossline 1. Subtract line fromines Schedule M-2 Analysis of Partners' Capital Accounts 1 Balance beginning of year Distributions a Cash 2 Capital contributed a Cash Property Property 7 Other decreases ternicze 3 Net income foss) per books. 4 Other increases termice 8 Add lines 6 and 7. 5 Addlines 1 though 16 106501 Schedule K-1 Form 1065 2019 Part 1 652119 OM Partner's Share of Current Year Income, Deductions, Credits, and other items 104,050 2019 Partner's Share of Income, Deductions, Credits, etc. Part 1 Information About the Partnership 5 Ohrome Forum C 95-6767676 Parth 's mes sa and ZIP code JBS Barbers 4 Tod ay 1023 Broadway New York, NY 10004 income e we Cincinnati, OH D B Chat is a publicaded partes PIP a Ordinary dividends Part II Information About the Partner EPSON TI D o dd y See ) Que dividende 765-12-4326 F N y e forwardin Sections Dividendes Emily Jackson 456 E. 70th Street 7 Royalties New York, NY 10006 e neral partner or LLC Limited partner or other LLC # Net short-term capilgan membrana 1.000 1 Dome Foreign Netlogom Ha w w w . the TIN Name Individual * Collectibles gain ons 11 Way is this partner? partneris reven g e . check here te Unrecaptured section 1250 gain Partner's share of prot loss, and capital s tructions: Beginning 10 Net section 1231 an 0 O 11 Other income O Check deciderechange of persones G 10 Taneca come and 80,000 Paroles 12 Section 17dection 47.300 13 Other deductions Charitable contributions 104.050 25,875 Partner's Capital Account Anal 250 teamge 104,050 Beginning s tecated ut of the wated basis of qualified properly 20.000 102.800 80.000 42000 "See attached statement for additional information De rry aban? For Production Action for Form 1088 wwwgoufom Schedule K-1 (Form 1065) 2019 Part II b51119 ON Partner's Share of Current Year Income, Deductions, Credits, and Other Items 104,050 2019 din Partner's Share of Income, Deductions, Credits, etc. Part 1 Information About the Partnership 4 Total payment C D & Quid dividende s e Owend wers 7 Royalties 95-6767676 Pur w and ZIP code JBS Barbers 1023 Broadway New York, NY 10004 e we Cincinnati, OH B Check this is a publicly traded partnership PTP Part II Information About the Partner Partners SSN TN Do d ged Seest) 466-74-9932 F Num a r Pode for parentered in Es James Stewart 436 E. 63rd Street New York, NY 10012 e neral partner or LLC LLC memberger member Foreign parte Ha Whi te Name Individual 11 W ype of writy is this partner? 12 sterren Segel cheche Partner's w o rto, and captainstruction Beginning 0 50 50 % 50 Check case is due to change of partnership G . Net Wortm a n - 1,000 Da Nang man cartone and nonductie per * Collectio n te Unrecaptured section 12:50 gain 10 Net section 1231 gain 11 Other income 80,000 Pataware of its 12 Section 179 deduction 47.300 Beginning 13 Other deductions 104.050 Charitable contributions 25,875 Partners Capital Account m 250 is docted 104,050 Sount of the adjusted basis of qualified property Beginning 20 000 102 800 80.000 42.800 Ending t o See attached statement for additional information M otywano For IRS USB Ca. 110 Schedule 1 Form10, 2012