Homework #16 is taken from the class Capital Budgeting handout (attached), as follows:

page 1, example #1

Using the information given, calculate the following: capital proportions, cost of debt, cost of preferred stock, cost of common equity. Then, combine those (along with the tax rate) to calculate the company's weighted average cost of capital (WACC).

page 3, example #3

Calculate the components of the cost of capital (proportions, cost of debt, cost of preferred stock, cost of common equity). Using these components, calculate the company's WACC.

Show your work!!

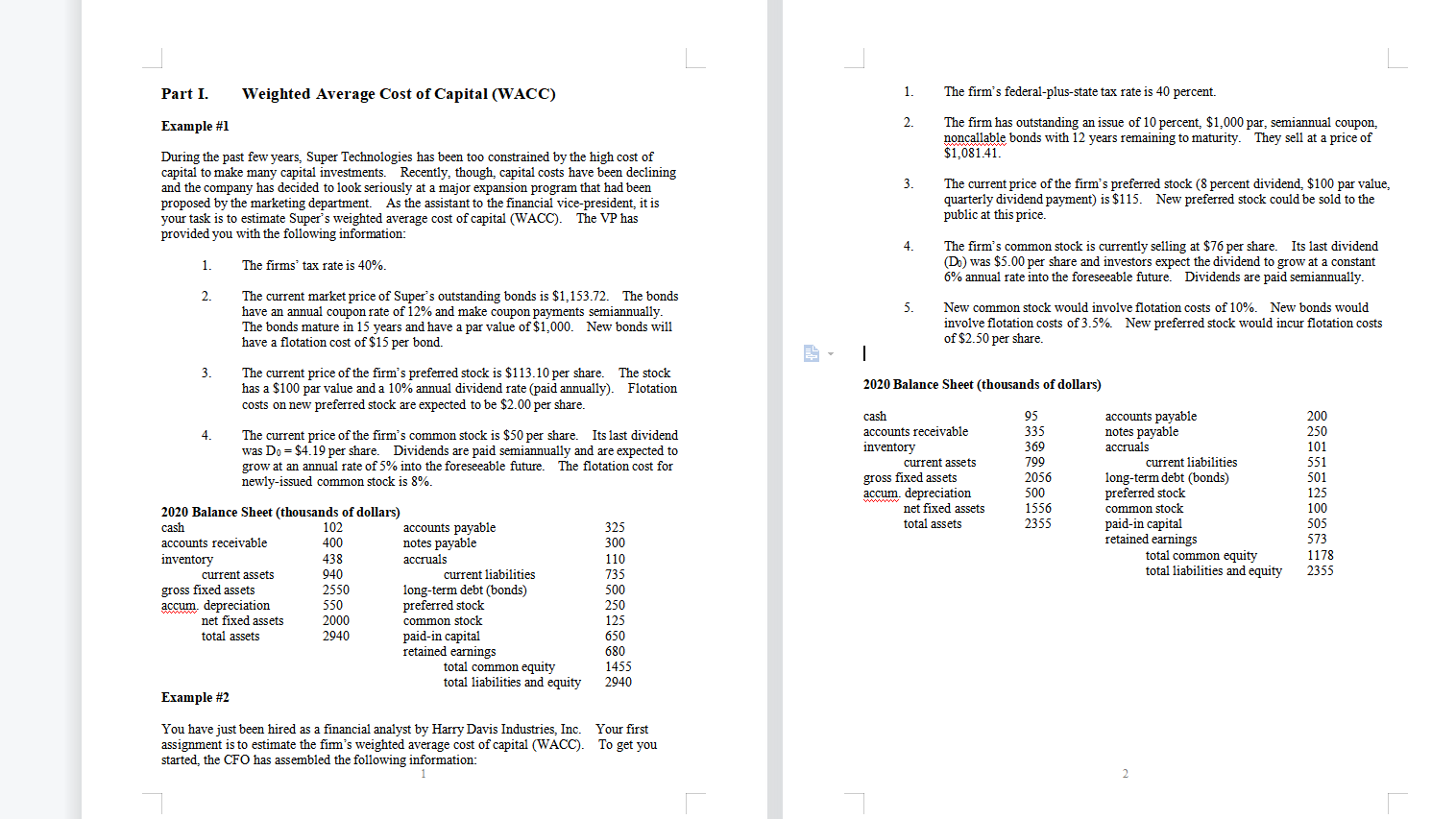

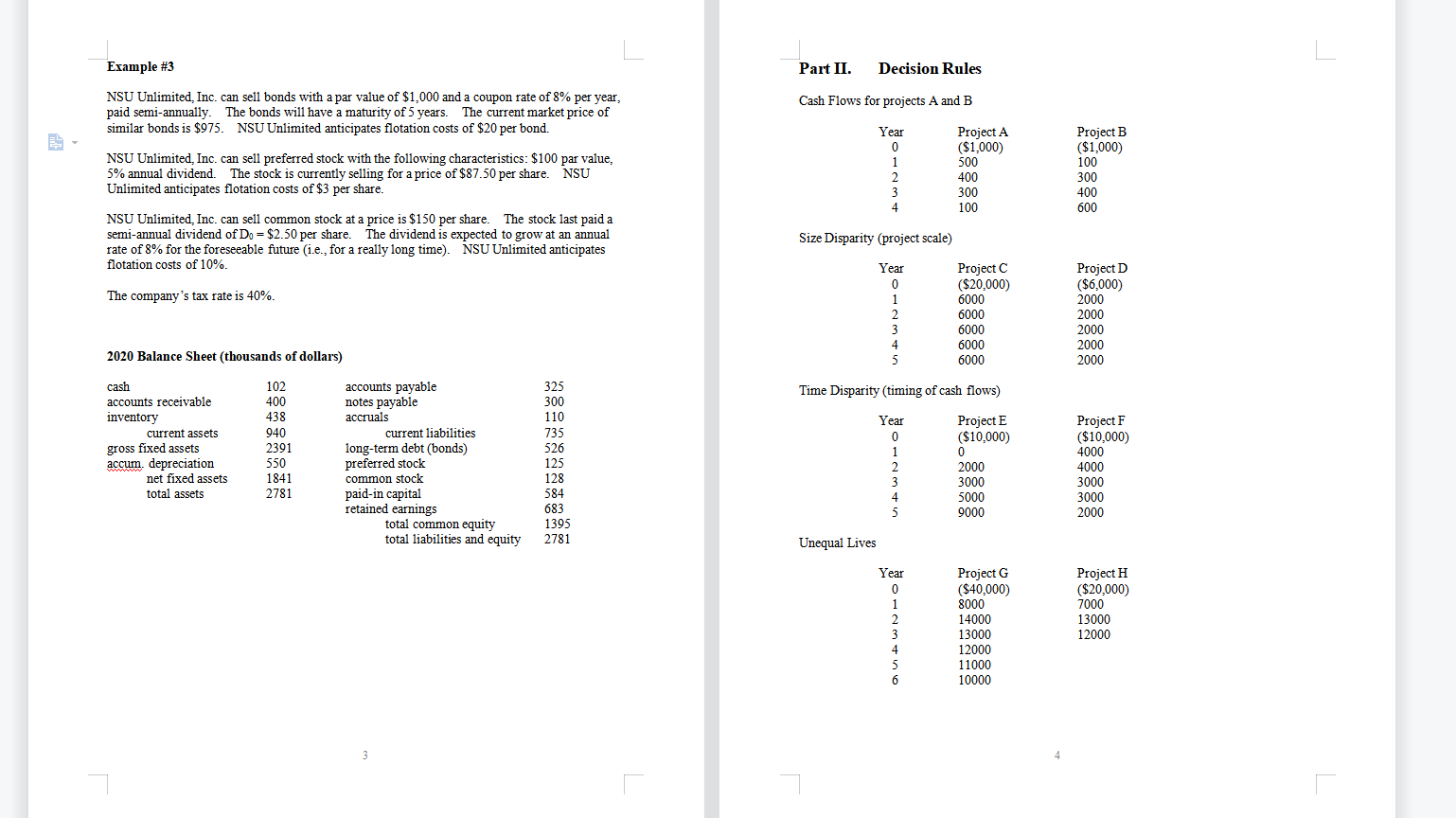

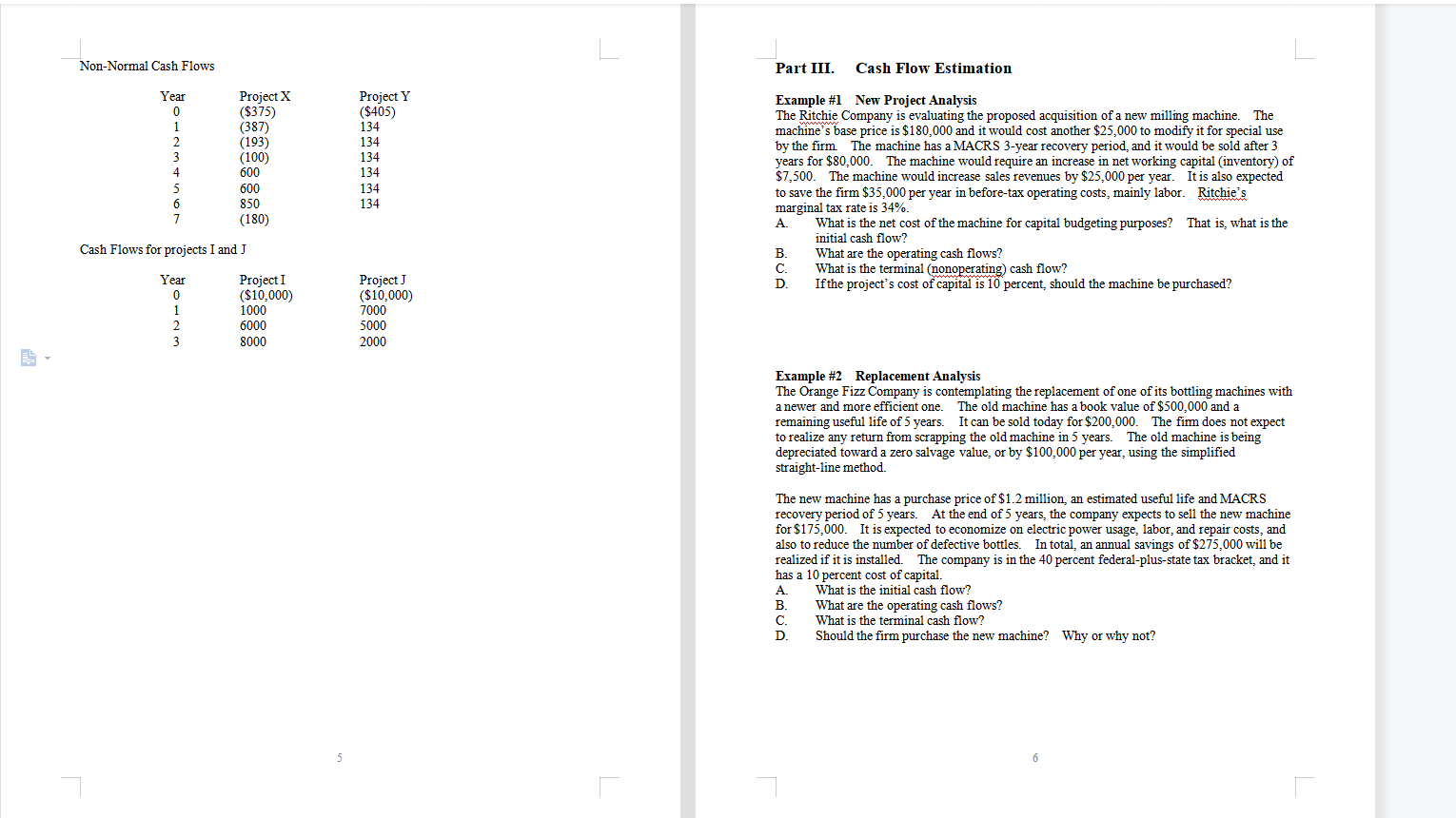

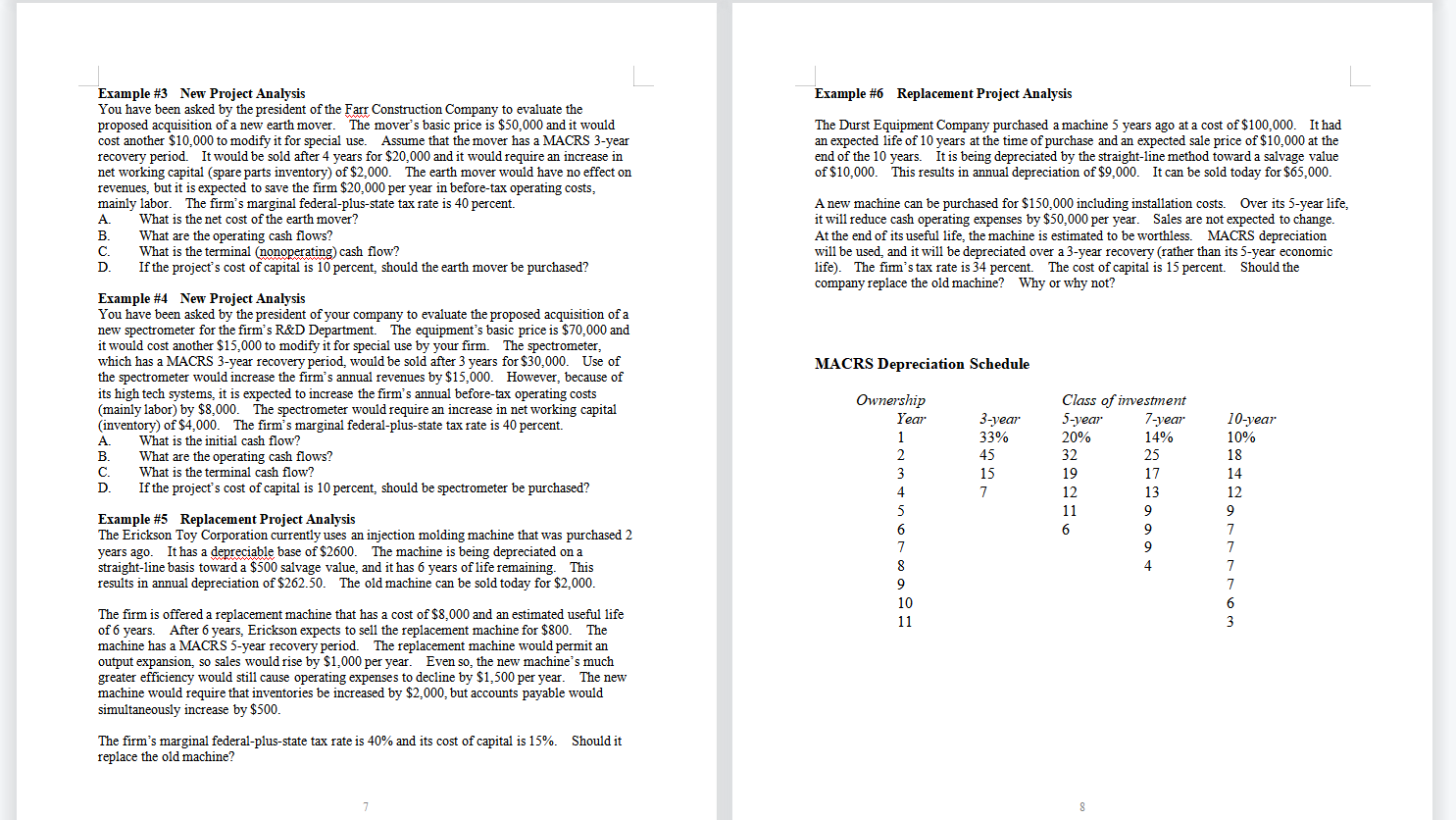

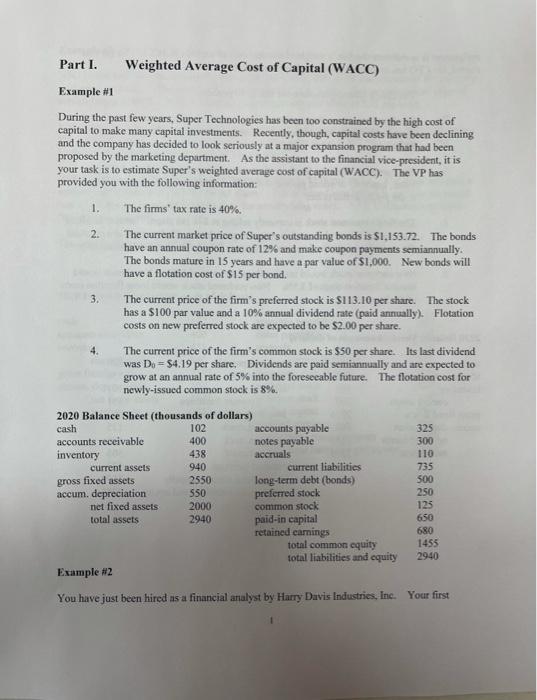

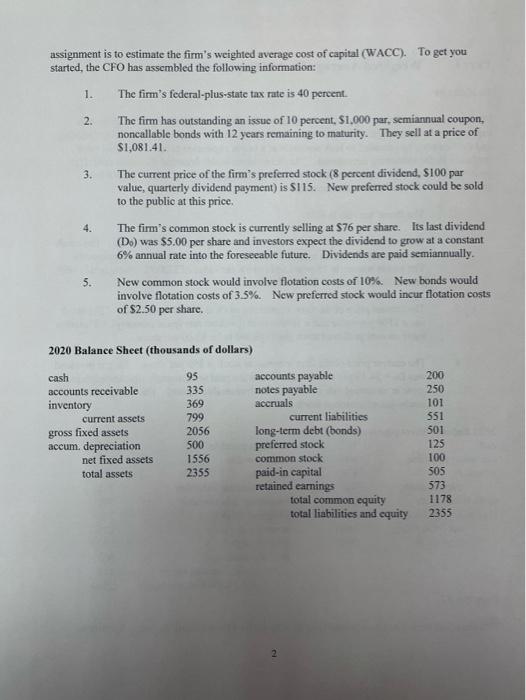

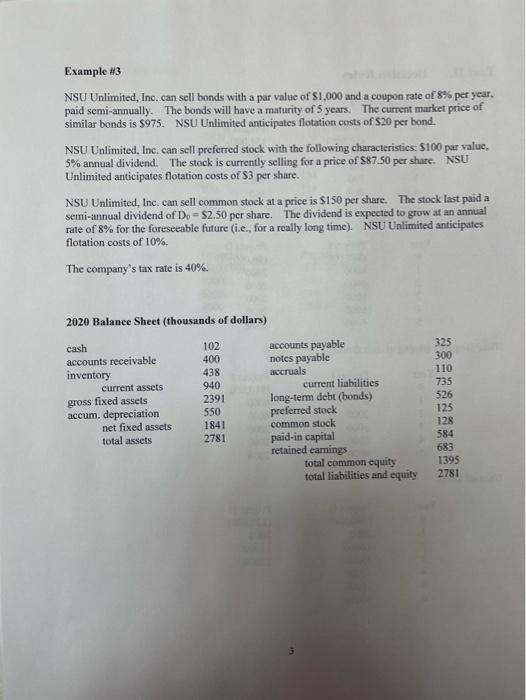

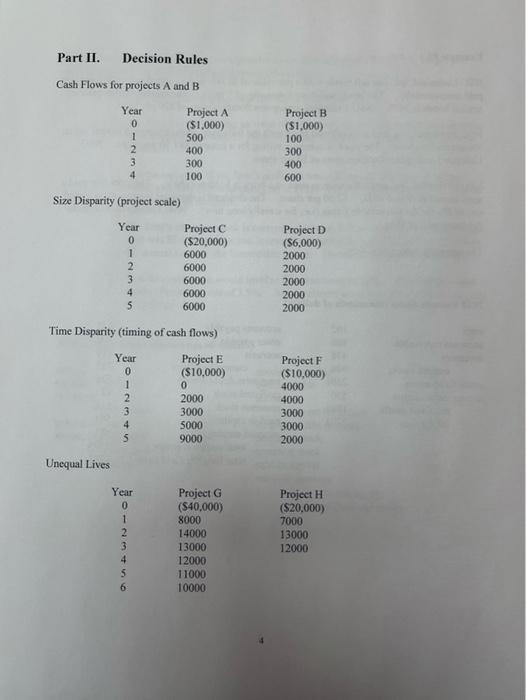

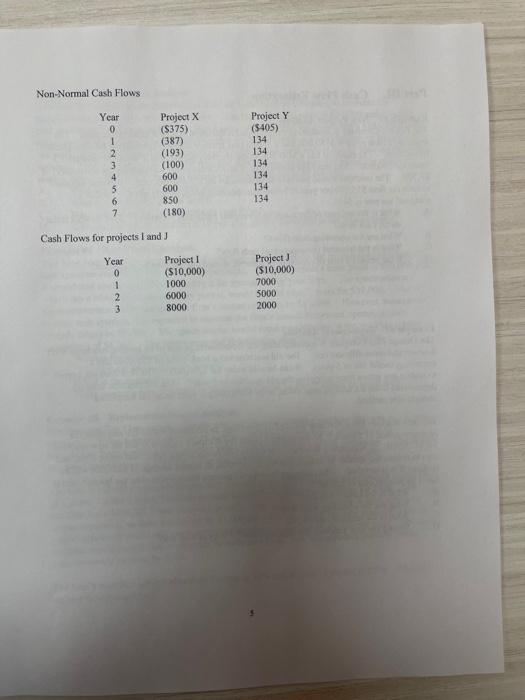

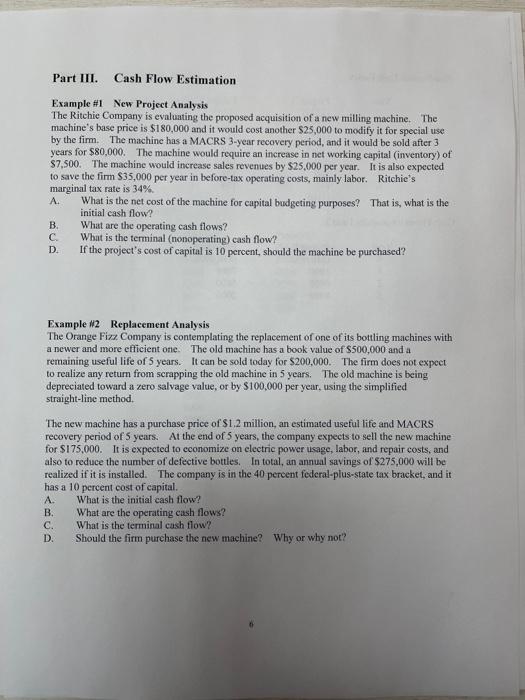

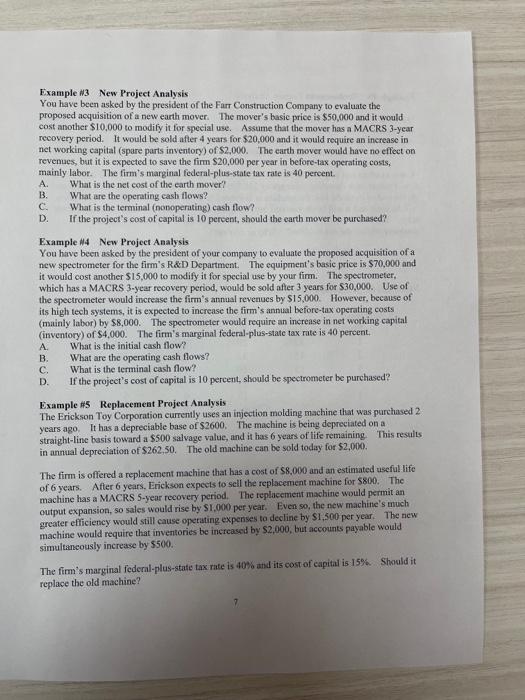

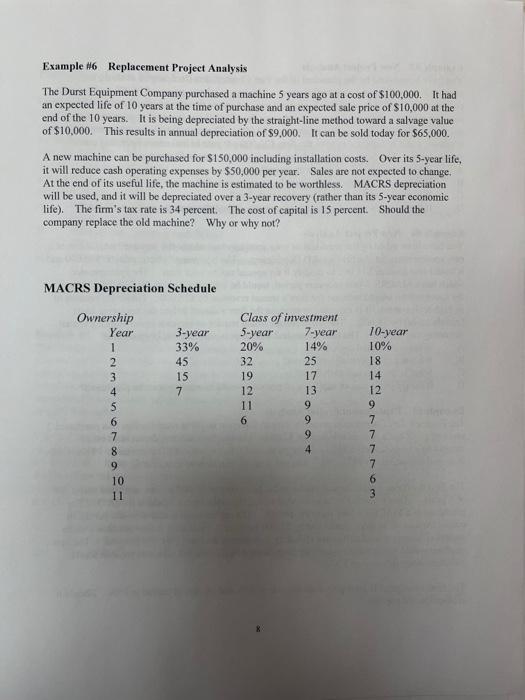

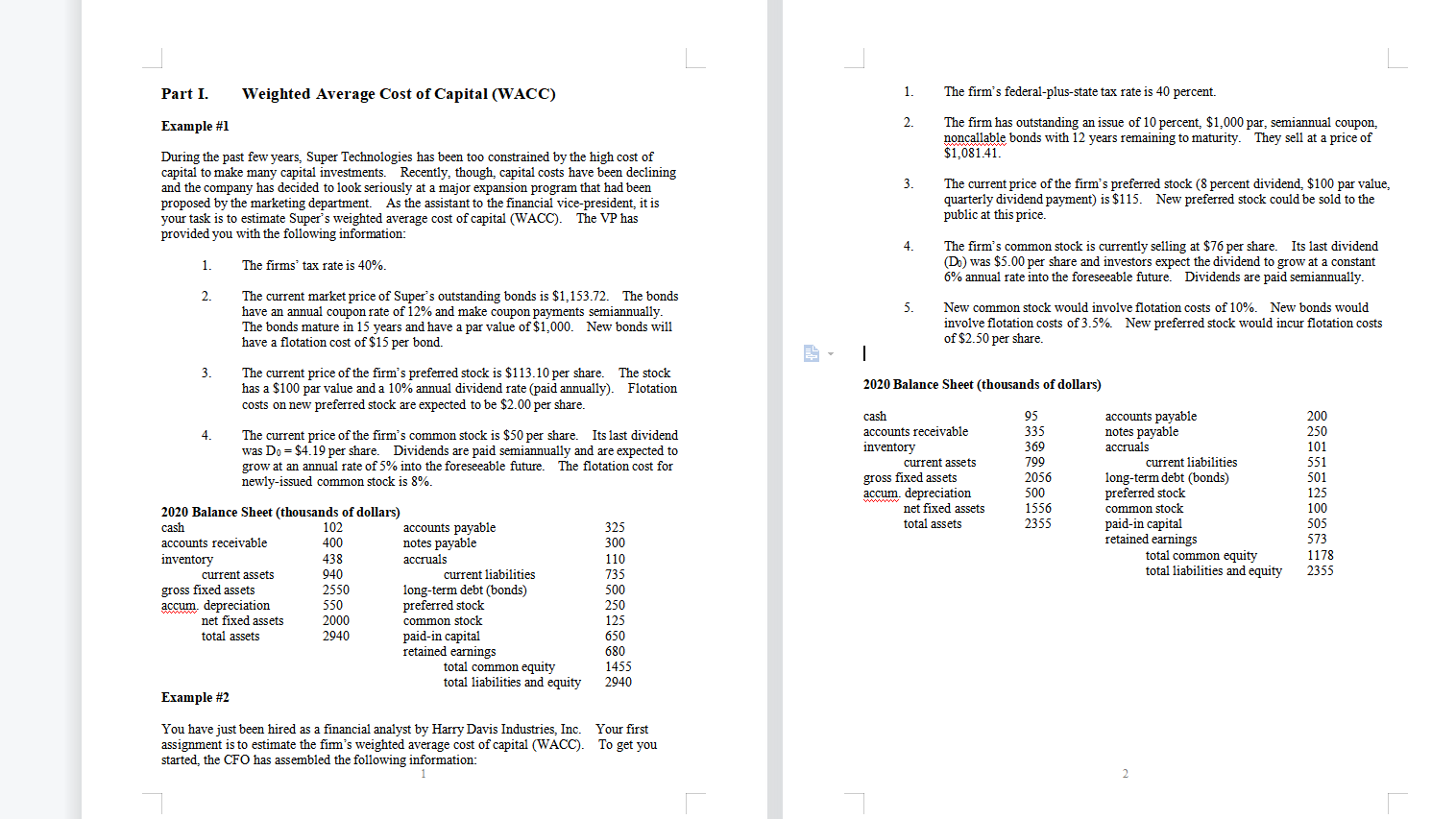

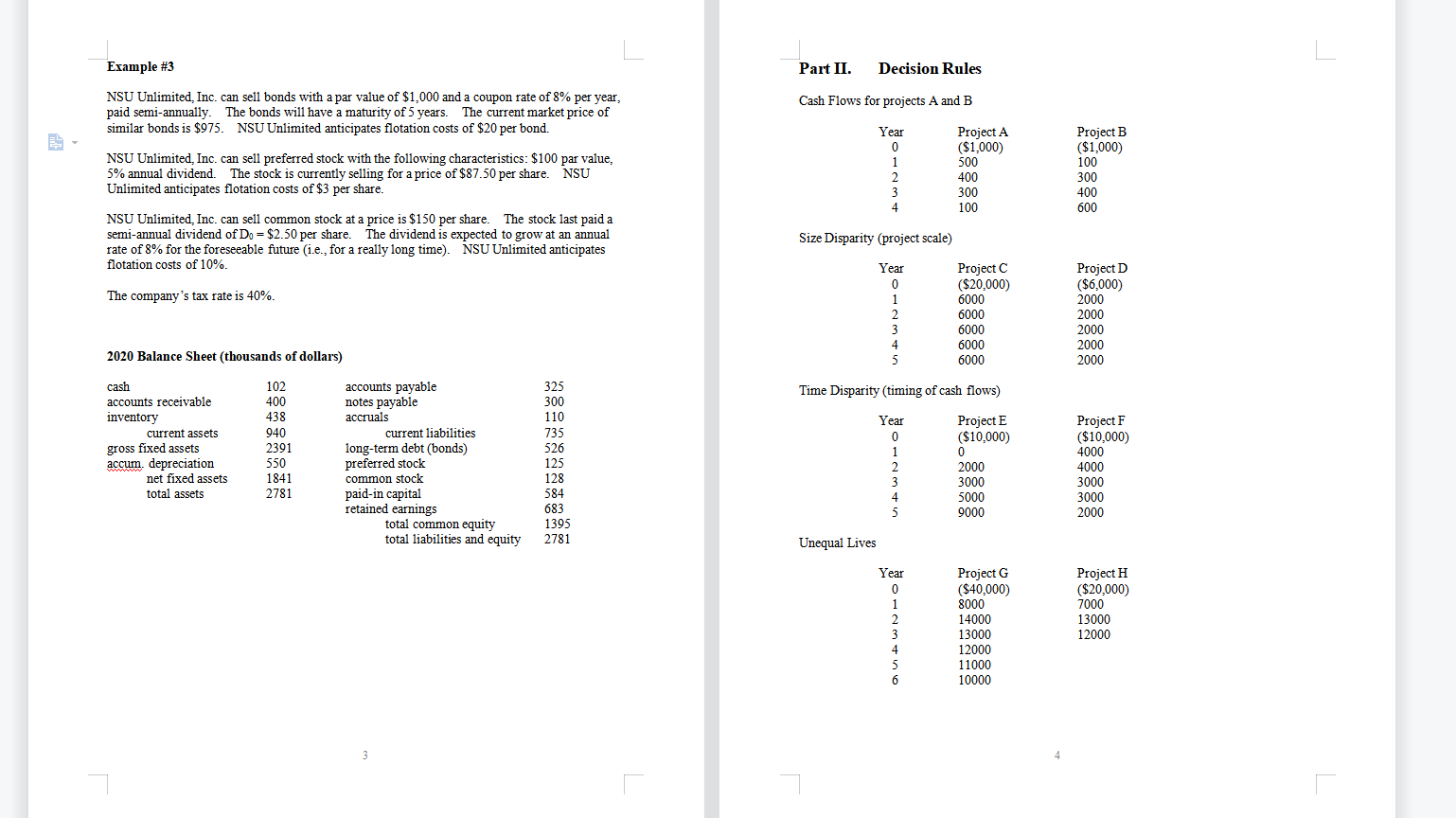

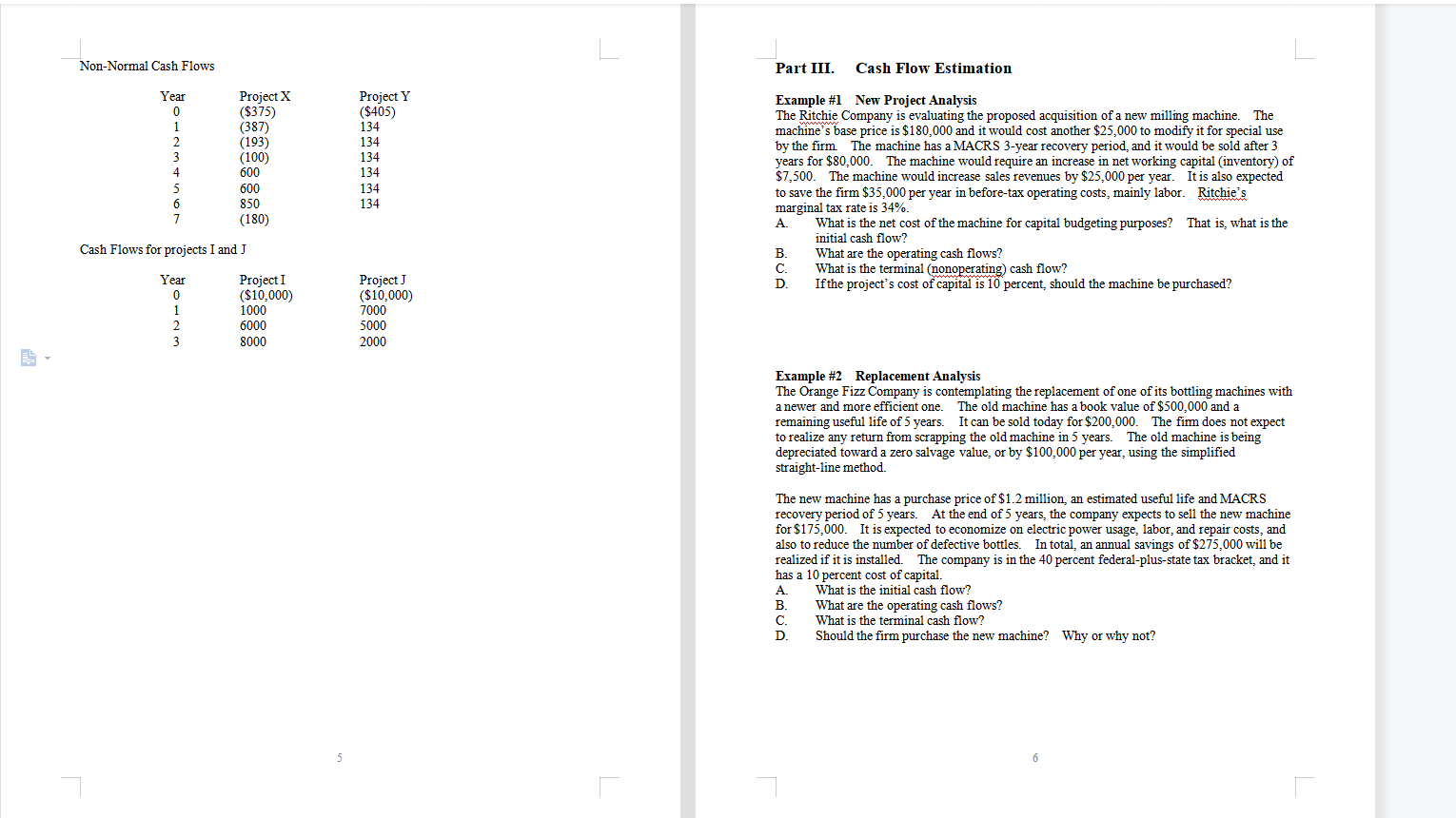

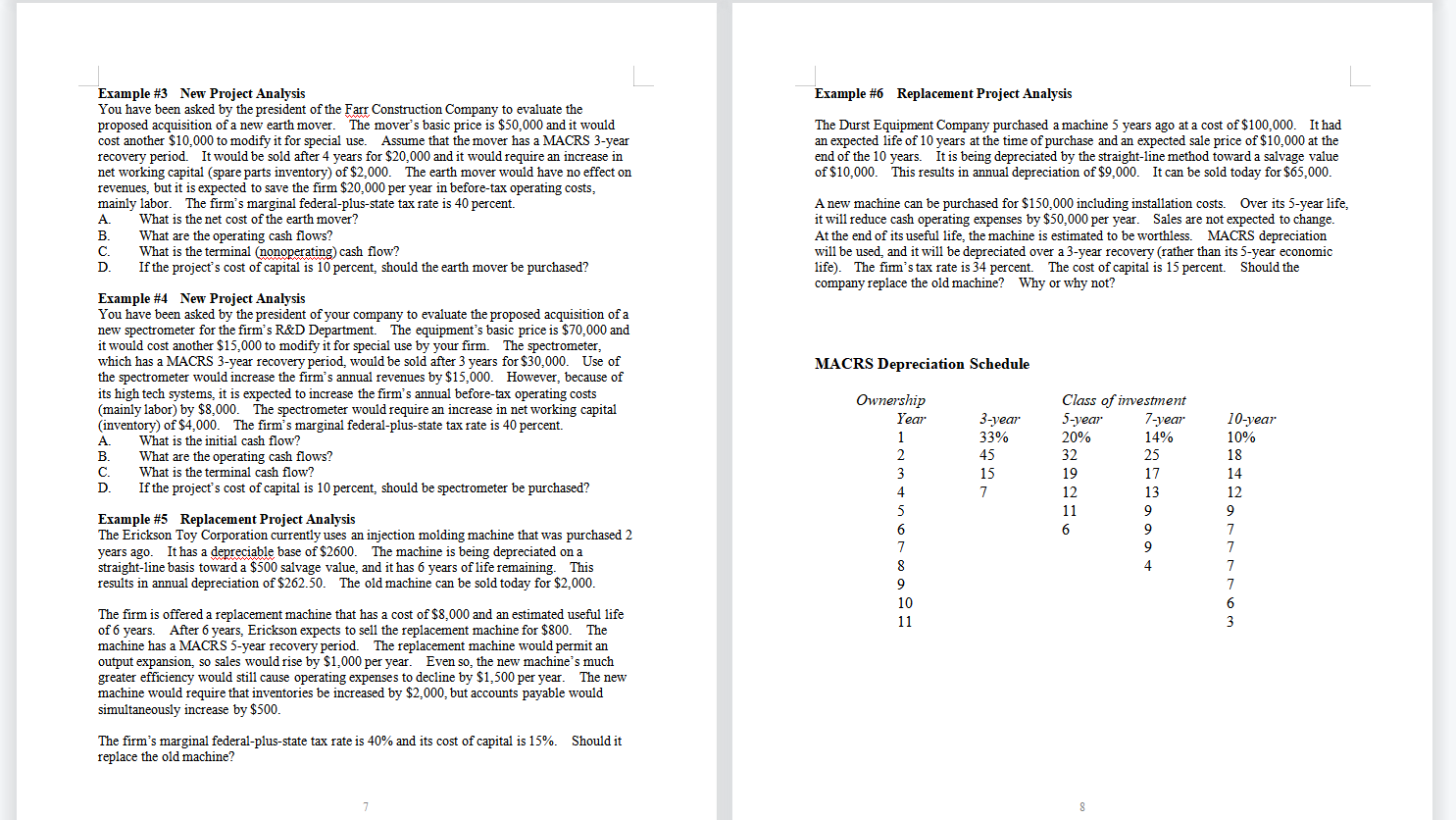

Part I. Weighted Average Cost of Capital (WACC) 1. The firm's federal-plus-state tax rate is 40 percent. 2. Example #1 The firm has outstanding an issue of 10 percent, $1,000 par, semiannual coupon, noncallable bonds with 12 years remaining to maturity. They sell at a price of $1,081.41. 3. During the past few years, Super Technologies has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining and the company has decided to look seriously at a major expansion program that had been proposed by the marketing department. As the assistant to the financial vice-president, it is your task is to estimate Super's weighted average cost of capital (WACC). The VP has provided you with the following information: The current price of the firm's preferred stock (8 percent dividend, $100 par value, quarterly dividend payment) is $115. New preferred stock could be sold to the public at this price. 4. 1. The firms tax rate is 40%. The firm's common stock is currently selling at $76 per share. Its last dividend (D) was $5.00 per share and investors expect the dividend to grow at a constant 6% annual rate into the foreseeable future. Dividends are paid semiannually. 2. 5. The current market price of Super's outstanding bonds is $1,153.72. The bonds have an annual coupon rate of 12% and make coupon payments semiannually. The bonds mature in 15 years and have a par value of $1,000. New bonds will have a flotation cost of $15 per bond. New common stock would involve flotation costs of 10%. New bonds would involve flotation costs of 3.5%. New preferred stock would incur flotation costs of $2.50 per share. 3. 2020 Balance Sheet (thousands of dollars) The current price of the firm's preferred stock is $113.10 per share. The stock has a $100 par value and a 10% annual dividend rate (paid annually). Flotation costs on new preferred stock are expected to be $2.00 per share. The current price of the firm's common stock is $50 per share. Its last dividend was Do = $4.19 per share. Dividends are paid semiannually and are expected to grow at an annual rate of 5% into the foreseeable future. The flotation cost for newly-issued common stock is 8%. 4. cash accounts receivable inventory current assets gross fixed assets accum. depreciation net fixed assets total assets , 95 335 369 799 2056 500 1556 2355 accounts payable notes payable accruals current liabilities long-term debt (bonds) preferred stock common stock paid-in capital retained earnings total common equity total liabilities and equity 200 250 101 551 501 125 100 505 573 1178 2355 2020 Balance Sheet (thousands of dollars) cash 102 accounts payable accounts receivable 400 notes payable inventory 438 accruals current assets 940 current liabilities gross fixed assets 2550 long-term debt (bonds) accum. depreciation 550 preferred stock net fixed assets 2000 common stock total assets paid-in capital retained earnings total common equity total liabilities and equity Example #2 325 300 110 735 500 250 250 125 650 650 680 1455 2940 2940 You have just been hired as a financial analyst by Harry Davis Industries, Inc. Your first assignment is to estimate the fim's weighted average cost of capital (WACC). To get you started, the CFO has assembled the following information: Example #3 Part II. Decision Rules Cash Flows for projects A and B Year 0 NSU Unlimited, Inc. can sell bonds with a par value of $1,000 and a coupon rate of 8% per year, paid semi-annually. The bonds will have a maturity of 5 years. The current market price of similar bonds is $975. NSU Unlimited anticipates flotation costs of $20 per bond. NSU Unlimited, Inc. can sell preferred stock with the following characteristics: $100 par value, 5% annual dividend. The stock is currently selling for a price of $87.50 per share. NSU Unlimited anticipates flotation costs of $3 per share. NSU Unlimited, Inc. can sell common stock at a price is $150 per share. The stock last paid a semi-annual dividend of Do = $2.50 per share. The dividend is expected to grow at an annual rate of 8% for the foreseeable future (i.e., for a really long time). NSU Unlimited anticipates flotation costs of 10%. Project A ($1,000) 500 400 300 100 Project B ($1,000) 100 300 400 600 4 Size Disparity (project scale) Year 0 The company's tax rate is 40%. Project C ($20,000) 6000 6000 6000 6000 6000 Project D ($6,000) 2000 2000 2000 2000 2000 2020 Balance Sheet (thousands of dollars) Time Disparity (timing of cash flows) cash accounts receivable inventory current assets gross fixed assets accum. depreciation net fixed assets total assets 102 400 438 940 2391 550 1841 2781 Year 0 Project E ($10,000) accounts payable notes payable accruals current liabilities long-term debt (bonds) preferred stock common stock paid-in capital retained total common equity total liabilities and equity 325 300 110 735 526 125 128 584 683 1395 2781 2000 3000 5000 9000 Project F ($10,000) 4000 4000 3000 3000 2000 4 earnings Unequal Lives Year Awno Project G ($40,000) 8000 14000 13000 12000 11000 10000 Project H ($20,000) 7000 13000 12000 6 L Non-Normal Cash Flows Part III. Cash Flow Estimation Year Project X ($375) (387) (193) (100) 600 600 850 (180) Project Y ($405) 134 134 134 134 134 134 Example #1 New Project Analysis The Ritchie Company is evaluating the proposed acquisition of a new milling machine. The machines base price is $180,000 and it would cost another $25,000 to modify it for special use by the firm The machine has a MACRS 3-year recovery period, and it would be sold after 3 years for $80,000. The machine would require an increase in net working capital inventory) of $7,500. The machine would increase sales revenues by $25,000 per year. It is also expected to save the firm $35,000 per year in before-tax operating costs, mainly labor. Ritchie's marginal tax rate is 34% 1 A. What is the net cost of the machine for capital budgeting purposes? That is what is the initial cash flow? What are the operating cash flows? What is the terminal (nonoperating) cash flow? D. If the project's cost of capital is 10 percent, should the machine be purchased? 6 Cash Flows for projects I and J MUA Year 0 1 2 3 Project I ($10,000) 1000 6000 8000 Project ($10,000) 7000 5000 2000 Example #2 Replacement Analysis The Orange Fizz Company is contemplating the replacement of one of its bottling machines with a newer and more efficient one. The old machine has a book value of $500,000 and a remaining useful life of 5 years. It can be sold today for $200,000. The fim does not expect to realize any return from scrapping the old machine in 5 years. The old machine is being depreciated toward a zero salvage value, or by $100,000 per year, using the simplified straight-line method The new machine has a purchase price of $1.2 million, an estimated useful life and MACRS recovery period of 5 years. At the end of 5 years, the company expects to sell the new machine for $175,000. It is expected to economize on electric power usage, labor, and repair costs, and also to reduce the number of defective bottles. In total, an annual savings of $275,000 will be realized if it is installed. The company is i the 40 percent federal-plus-state tax bracket, and it has a 10 percent cost of capital. A is the initial cash flow? B. What are the operating cash flows? C. What is the terminal cash flow? D. Should the firm purchase the new machine? Why or why not? What i 6 Example #6 Replacement Project Analysis The Durst Equipment Company purchased a machine 5 years ago at a cost of $100,000. It had an expected life of 10 years at the time of purchase and an expected sale price of $10,000 at the end of the 10 years. It is being depreciated by the straight-line method toward a salvage value of $10,000. This results in annual depreciation of $9,000. It can be sold today for $65,000. Example #3 New Project Analysis You have been asked by the president of the Farr Construction Company to evaluate the proposed acquisition of a new earth mover. The mover's basic price is $50,000 and it would cost another $10,000 to modify it for special use. Assume that the mover has a MACRS 3-year recovery period. It would be sold after 4 years for $20,000 and it would require an increase in net working capital (spare parts inventory) of $2,000. The earth mover would have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal federal-plus-state tax rate is 40 percent. What is the net cost of the earth mover? B. What are the operating cash flows? What is the terminal (nonoperating) cash flow? D If the project's cost of capital is 10 percent, should the earth mover be purchased? Example #4 New Project Analysis You have been asked by the president of your company to evaluate the proposed acquisition of a new spectrometer for the firm's R&D Department. The equipment's basic price is $70,000 and it would cost another $15,000 to modify it for special use by your firm. The spectrometer, which has a MACRS 3-year recovery period, would be sold after 3 years for $30,000. Use of the spectrometer would i increase the firm's annual revenues by $15,000. However, because of its high tech systems, it is expected to increase the firm's annual before-tax operating costs (mainly labor) by $8,000. The spectrometer would require an increase in net working capital (inventory) of $4,000 The firm's marginal federal-plus-state tax rate is 40 percent. What is the initial cash flow? B. What are the operating cash flows? What is the terminal cash flow? If the project's cost of capital is 10 percent, should be spectrometer be purchased? A new machine can be purchased for $150,000 including installation costs. Over its 5-year life, it will reduce cash operating expenses by $50,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. MACRS depreciation will be used, and it will be depreciated over a 3-year recovery (rather than its 5-year economic life). The fim's tax rate is 34 percent. The cost of capital is 15 percent. Should the company replace the old machine? Why or why not? a MACRS Depreciation Schedule Class of investment 5-year 7-year 20% 14% 10-year 10% A 3-year 33% 45 15 7 Ownership Year 1 2 3 4 5 6 7 8 9 10 11 ss= linssonar **www.0*3* 3 Example #5 Replacement Project Analysis The Erickson Toy Corporation currently uses an injection molding machine that was purchased 2 years ago. It has a depreciable base of $2600. The machine is being depreciated on a straight-line basis toward a $500 salvage value, and it has 6 years of life remaining. This results in annual depreciation of $262.50. The old machine can be sold today for $2,000. The firm is offered a i a replacement machine that has a cost of $8,000 and an estimated useful life of 6 After 6 years, Erickson expects to sell the replacement machine for $800. The machine has a MACRS 5-year recovery period. The replacement machine would permit an output expansion, so sales would rise by $1,000 per year. Even so, the new machine's much greater efficiency would still cause operating expenses to decline by $1,500 per year. The new machine would require that inventories be increased by $2,000, but accounts payable would simultaneously increase by $500. The firm's marginal federal-plus-state tax rate is 40% and its cost of capital is 15%. Should it replace the old machine? years. Part I. Weighted Average Cost of Capital (WACC) Example #1 During the past few years, Super Technologies has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining and the company has decided to look seriously at a major expansion program that had been proposed by the marketing department. As the assistant to the financial vice-president, it is your task is to estimate Super's weighted average cost of capital (WACC). The VP has provided you with the following information: 1. The fimms' tax rate is 40%. 2. The current market price of Super's outstanding bonds is $1,153.72. The bonds have an annual coupon rate of 12% and make coupon payments semiannually. The bonds mature in 15 years and have a par value of $1,000. New bonds will have a flotation cost of $15 per bond. 3. The current price of the firm's preferred stock is $113.10 per share. The stock has a $100 par value and a 10% annual dividend rate (paid annually). Flotation costs on new preferred stock are expected to be $2.00 per share. The current price of the firm's common stock is $50 per share. Its last dividend was Do = 54.19 per share. Dividends are paid semiannually and are expected to grow at an annual rate of 5% into the foreseeable future. The flotation cost for newly-issued common stock is 8%. 2020 Balance Sheet (thousands of dollars) cash 102 accounts payable 325 accounts receivable 400 notes payable 300 inventory 438 accruals current assets 940 current liabilities 735 gross fixed assets 2550 long-term debt (bonds) 500 accum. depreciation 550 preferred stock 250 net fixed assets 2000 common stock 125 total assets 2940 paid-in capital retained earnings 680 total common equity 1455 total liabilities and equity 2940 Example #2 You have just been hired as a financial analyst by Harry Davis Industries, Inc. Your first 110 650 assignment is to estimate the firm's weighted average cost of capital (WACC). To get you started, the CFO has assembled the following information: 1. The firm's federal-plus-state tax rate is 40 percent. 2. The firm has outstanding an issue of 10 percent. $1.000 par, semiannual coupon. noncallable bonds with 12 years remaining to maturity. They sell at a price of $1,081.41. 3. The current price of the firm's preferred stock (8 percent dividend, S100 par value, quarterly dividend payment) is $115. New preferred stock could be sold to the public at this price The firm's common stock is currently selling at $76 per share. Its last dividend (Do) was $5.00 per share and investors expect the dividend to grow at a constant 6% annual rate into the foreseeable future. Dividends are paid semiannually. 5. New common stock would involve flotation costs of 10%. New bonds would involve flotation costs of 3.5%. New preferred stock would incur flotation costs of $2.50 per share 4. 2020 Balance Sheet (thousands of dollars) cash accounts receivable inventory current assets gross fixed assets accum. depreciation net fixed assets total assets 95 335 369 799 2056 500 1556 2355 accounts payable notes payable accruals current liabilities long-term debt (bonds) preferred stock common stock paid-in capital retained earnings total common equity total liabilities and equity 200 250 101 551 501 125 100 505 573 1178 2355 Example #3 NSU Unlimited, Inc. can sell bonds with a par value of $1,000 and a coupon rate of 8% per year, paid semi-annually. The bonds will have a maturity of 5 years. The current market price of similar bonds is $975. NSU Unlimited anticipates flotation costs of $20 per bond. NSU Unlimited, Inc. can sell preferred stock with the following characteristics: $100 par value, 5% annual dividend. The stock is currently selling for a price of $87.50 per share. NSU Unlimited anticipates flotation costs of S3 per share. NSU Unlimited, Inc. can sell common stock at a price is $150 per share. The stock last paid a semi-annual dividend of Do-$2.50 per share. The dividend is expected to grow at an annual rate of 8% for the foreseeable future (ie., for a really long time). NSU Unlimited anticipates flotation costs of 10%. The company's tax rate is 40%. 2020 Balance Sheet (thousands of dollars) cash accounts receivable inventory current assets gross fixed assets accum. depreciation net fixed assets total assets 102 400 438 940 2391 550 1841 2781 accounts payable notes payable accruals current liabilities long-term debt (bonds) preferred stock common stock paid-in capital retained earnings total common equity total liabilities and equity 325 300 110 735 526 125 128 584 683 1395 2781 Part II. Decision Rules Cash Flows for projects A and B Year Project A 0 ($1,000) 1 500 2 400 3 300 4 100 Project B ($1,000) 100 300 400 600 Size Disparity (project scale) Year 0 1 2 3 4 5 Project C ($20,000) 6000 6000 6000 6000 6000 Project D ($6,000) 2000 2000 2000 2000 2000 Time Disparity (timing of cash flows) Year NO 2 Project E ($10,000) 0 2000 3000 5000 9000 Project F ($10,000) 4000 4000 3000 3000 2000 4 Unequal Lives Year 0 1 2 3 4 5 6 Project G (540,000) 8000 14000 13000 12000 11000 10000 Project H ($20,000) 7000 13000 12000 Non-Normal Cash Flows Year 0 1 2 3 4 5 6 7 Project X (5375) (387) (193) (100) 600 600 850 (180) Project Y (5405) 134 134 134 134 134 134 Cash Flows for projects I and J Year 0 1 2 3 Project 1 ($10,000) 1000 6000 8000 Project ($10,000) 7000 5000 2000 Part III. Cash Flow Estimation Example 1 New Project Analysis The Ritchie Company is evaluating the proposed acquisition of a new milling machine. The machine's base price is $180,000 and it would cost another $25,000 to modify it for special use by the firm. The machine has a MACRS 3-year recovery period, and it would be sold after 3 years for $80,000. The machine would require an increase in net working capital inventory) of $7,500. The machine would increase sales revenues by $25,000 per year. It is also expected to save the firm $35,000 per year in before tax operating costs, mainly labor. Ritchie's marginal tax rate is 34% A. What is the net cost of the machine for capital budgeting purposes? That is what is the initial cash flow? B. What are the operating cash flows? C What is the terminal (nonoperating) cash flow? D. If the project's cost of capital is 10 percent, should the machine be purchased? Example 2 Replacement Analysis The Orange Fizz Company is contemplating the replacement of one of its bottling machines with a newer and more efficient one. The old machine has a book value of $500,000 and a remaining useful life of 5 years. It can be sold today for $200,000. The firm does not expect to realize any return from scrapping the old machine in 5 years. The old machine is being depreciated toward a zero salvage value, or by $100.000 per year, using the simplified straight-line method. The new machine has a purchase price of $1.2 million, an estimated useful life and MACRS recovery period of 5 years. At the end of 5 years, the company expects to sell the new machine for $175,000. It is expected to economize on electric power usage, labor, and repair costs, and also to reduce the number of defective bottles. In total, an annual savings of $275,000 will be realized if it is installed. The company is in the 40 percent federal-plus-state tax bracket, and it has a 10 percent cost of capital. A What is the initial cash flow? B. What are the operating cash flows? c. What is the terminal cash flow? D. Should the firm purchase the new machine? Why or why not? Example N3 New Project Analysis You have been asked by the president of the Farr Construction Company to evaluate the proposed acquisition of a new earth mover. The mover's basic price is $50,000 and it would cost another $10,000 to modify it for special use. Assume that the mover has a MACRS 3-year recovery period. It would be sold after 4 years for $20,000 and it would require an increase in net working capital (spare parts inventory) of $2,000. The earth mover would have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal federal-plus-state tax rate is 40 percent. A. What is the net cost of the earth mover? B. What are the operating cash flows? C. What is the terminal (nonoperating) cash flow? D. If the project's cost of capital is 10 percent, should the earth mover be purchased? Example 4 New Project Analysis You have been asked by the president of your company to evaluate the proposed acquisition of a new spectrometer for the firm's R&D Department. The equipment's basic price is $70,000 and it would cost another $15,000 to modify it for special use by your fimm. The spectrometer, which has a MACRS 3-year recovery period, would be sold after 3 years for $30,000. Use of the spectrometer would increase the firm's annual revenues by $15,000. However, because of its high tech systems, it is expected to increase the firm's annual before-tax operating costs (mainly labor) by $8,000. The spectrometer would require an increase in net working capital (inventory) of $4,000. The firm's marginal federal-plus-state tax rate is 40 percent. A What is the initial cash flow? B. What are the operating cash flows? C. What is the terminal cash flow? D If the project's cost of capital is 10 percent, should be spectrometer be purchased? Example #5 Replacement Project Analysis The Erickson Toy Corporation currently uses an injection molding machine that was purchased 2 years ago. It has a depreciable base of $2600. The machine is being depreciated on a straight-line basis toward a $500 salvage value, and it has 6 years of life remaining. This results in annual depreciation of S262,50. The old machine can be sold today for $2.000. The firm is offered a replacement machine that has a cost of $8,000 and an estimated useful life of 6 years. After 6 years, Erickson expects to sell the replacement machine for $800. The machine has a MACRS 5-year recovery period. The replacement machine would permit an output expansion, so sales would rise by S1,000 per year. Even so, the new machine's much greater efficiency would still cause operating expenses to decline by $1,500 per year. The new machine would require that inventories be increased by $2,000, but accounts payable would simultaneously increase by $500. The firm's marginal federal-plus-state tax rate is 40% and its cost of capital is 15% Should it replace the old machine? Example 6 Replacement Project Analysis The Durst Equipment Company purchased a machine 5 years ago at a cost of $100,000. It had an expected life of 10 years at the time of purchase and an expected sale price of $10,000 at the end of the 10 years. It is being depreciated by the straight-line method toward a salvage value of $10,000. This results in annual depreciation of $9,000. It can be sold today for $65,000. A new machine can be purchased for $150,000 including installation costs. Over its S-year life, it will reduce cash operating expenses by $50,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. MACRS depreciation will be used, and it will be depreciated over a 3-year recovery (rather than its 5-year economic life). The firm's tax rate is 34 percent. The cost of capital is 15 percent. Should the company replace the old machine? Why or why not? MACRS Depreciation Schedule 3-year 33% 45 15 7 Ownership Year 1 2 3 4 5 6 7 8 9 10 11 Class of investment 5-year 7-year 20% 14% 32 25 19 17 12 13 11 9 6 9 9 10-year 10% 18 14 12 9 7 6 Part I. Weighted Average Cost of Capital (WACC) 1. The firm's federal-plus-state tax rate is 40 percent. 2. Example #1 The firm has outstanding an issue of 10 percent, $1,000 par, semiannual coupon, noncallable bonds with 12 years remaining to maturity. They sell at a price of $1,081.41. 3. During the past few years, Super Technologies has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining and the company has decided to look seriously at a major expansion program that had been proposed by the marketing department. As the assistant to the financial vice-president, it is your task is to estimate Super's weighted average cost of capital (WACC). The VP has provided you with the following information: The current price of the firm's preferred stock (8 percent dividend, $100 par value, quarterly dividend payment) is $115. New preferred stock could be sold to the public at this price. 4. 1. The firms tax rate is 40%. The firm's common stock is currently selling at $76 per share. Its last dividend (D) was $5.00 per share and investors expect the dividend to grow at a constant 6% annual rate into the foreseeable future. Dividends are paid semiannually. 2. 5. The current market price of Super's outstanding bonds is $1,153.72. The bonds have an annual coupon rate of 12% and make coupon payments semiannually. The bonds mature in 15 years and have a par value of $1,000. New bonds will have a flotation cost of $15 per bond. New common stock would involve flotation costs of 10%. New bonds would involve flotation costs of 3.5%. New preferred stock would incur flotation costs of $2.50 per share. 3. 2020 Balance Sheet (thousands of dollars) The current price of the firm's preferred stock is $113.10 per share. The stock has a $100 par value and a 10% annual dividend rate (paid annually). Flotation costs on new preferred stock are expected to be $2.00 per share. The current price of the firm's common stock is $50 per share. Its last dividend was Do = $4.19 per share. Dividends are paid semiannually and are expected to grow at an annual rate of 5% into the foreseeable future. The flotation cost for newly-issued common stock is 8%. 4. cash accounts receivable inventory current assets gross fixed assets accum. depreciation net fixed assets total assets , 95 335 369 799 2056 500 1556 2355 accounts payable notes payable accruals current liabilities long-term debt (bonds) preferred stock common stock paid-in capital retained earnings total common equity total liabilities and equity 200 250 101 551 501 125 100 505 573 1178 2355 2020 Balance Sheet (thousands of dollars) cash 102 accounts payable accounts receivable 400 notes payable inventory 438 accruals current assets 940 current liabilities gross fixed assets 2550 long-term debt (bonds) accum. depreciation 550 preferred stock net fixed assets 2000 common stock total assets paid-in capital retained earnings total common equity total liabilities and equity Example #2 325 300 110 735 500 250 250 125 650 650 680 1455 2940 2940 You have just been hired as a financial analyst by Harry Davis Industries, Inc. Your first assignment is to estimate the fim's weighted average cost of capital (WACC). To get you started, the CFO has assembled the following information: Example #3 Part II. Decision Rules Cash Flows for projects A and B Year 0 NSU Unlimited, Inc. can sell bonds with a par value of $1,000 and a coupon rate of 8% per year, paid semi-annually. The bonds will have a maturity of 5 years. The current market price of similar bonds is $975. NSU Unlimited anticipates flotation costs of $20 per bond. NSU Unlimited, Inc. can sell preferred stock with the following characteristics: $100 par value, 5% annual dividend. The stock is currently selling for a price of $87.50 per share. NSU Unlimited anticipates flotation costs of $3 per share. NSU Unlimited, Inc. can sell common stock at a price is $150 per share. The stock last paid a semi-annual dividend of Do = $2.50 per share. The dividend is expected to grow at an annual rate of 8% for the foreseeable future (i.e., for a really long time). NSU Unlimited anticipates flotation costs of 10%. Project A ($1,000) 500 400 300 100 Project B ($1,000) 100 300 400 600 4 Size Disparity (project scale) Year 0 The company's tax rate is 40%. Project C ($20,000) 6000 6000 6000 6000 6000 Project D ($6,000) 2000 2000 2000 2000 2000 2020 Balance Sheet (thousands of dollars) Time Disparity (timing of cash flows) cash accounts receivable inventory current assets gross fixed assets accum. depreciation net fixed assets total assets 102 400 438 940 2391 550 1841 2781 Year 0 Project E ($10,000) accounts payable notes payable accruals current liabilities long-term debt (bonds) preferred stock common stock paid-in capital retained total common equity total liabilities and equity 325 300 110 735 526 125 128 584 683 1395 2781 2000 3000 5000 9000 Project F ($10,000) 4000 4000 3000 3000 2000 4 earnings Unequal Lives Year Awno Project G ($40,000) 8000 14000 13000 12000 11000 10000 Project H ($20,000) 7000 13000 12000 6 L Non-Normal Cash Flows Part III. Cash Flow Estimation Year Project X ($375) (387) (193) (100) 600 600 850 (180) Project Y ($405) 134 134 134 134 134 134 Example #1 New Project Analysis The Ritchie Company is evaluating the proposed acquisition of a new milling machine. The machines base price is $180,000 and it would cost another $25,000 to modify it for special use by the firm The machine has a MACRS 3-year recovery period, and it would be sold after 3 years for $80,000. The machine would require an increase in net working capital inventory) of $7,500. The machine would increase sales revenues by $25,000 per year. It is also expected to save the firm $35,000 per year in before-tax operating costs, mainly labor. Ritchie's marginal tax rate is 34% 1 A. What is the net cost of the machine for capital budgeting purposes? That is what is the initial cash flow? What are the operating cash flows? What is the terminal (nonoperating) cash flow? D. If the project's cost of capital is 10 percent, should the machine be purchased? 6 Cash Flows for projects I and J MUA Year 0 1 2 3 Project I ($10,000) 1000 6000 8000 Project ($10,000) 7000 5000 2000 Example #2 Replacement Analysis The Orange Fizz Company is contemplating the replacement of one of its bottling machines with a newer and more efficient one. The old machine has a book value of $500,000 and a remaining useful life of 5 years. It can be sold today for $200,000. The fim does not expect to realize any return from scrapping the old machine in 5 years. The old machine is being depreciated toward a zero salvage value, or by $100,000 per year, using the simplified straight-line method The new machine has a purchase price of $1.2 million, an estimated useful life and MACRS recovery period of 5 years. At the end of 5 years, the company expects to sell the new machine for $175,000. It is expected to economize on electric power usage, labor, and repair costs, and also to reduce the number of defective bottles. In total, an annual savings of $275,000 will be realized if it is installed. The company is i the 40 percent federal-plus-state tax bracket, and it has a 10 percent cost of capital. A is the initial cash flow? B. What are the operating cash flows? C. What is the terminal cash flow? D. Should the firm purchase the new machine? Why or why not? What i 6 Example #6 Replacement Project Analysis The Durst Equipment Company purchased a machine 5 years ago at a cost of $100,000. It had an expected life of 10 years at the time of purchase and an expected sale price of $10,000 at the end of the 10 years. It is being depreciated by the straight-line method toward a salvage value of $10,000. This results in annual depreciation of $9,000. It can be sold today for $65,000. Example #3 New Project Analysis You have been asked by the president of the Farr Construction Company to evaluate the proposed acquisition of a new earth mover. The mover's basic price is $50,000 and it would cost another $10,000 to modify it for special use. Assume that the mover has a MACRS 3-year recovery period. It would be sold after 4 years for $20,000 and it would require an increase in net working capital (spare parts inventory) of $2,000. The earth mover would have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal federal-plus-state tax rate is 40 percent. What is the net cost of the earth mover? B. What are the operating cash flows? What is the terminal (nonoperating) cash flow? D If the project's cost of capital is 10 percent, should the earth mover be purchased? Example #4 New Project Analysis You have been asked by the president of your company to evaluate the proposed acquisition of a new spectrometer for the firm's R&D Department. The equipment's basic price is $70,000 and it would cost another $15,000 to modify it for special use by your firm. The spectrometer, which has a MACRS 3-year recovery period, would be sold after 3 years for $30,000. Use of the spectrometer would i increase the firm's annual revenues by $15,000. However, because of its high tech systems, it is expected to increase the firm's annual before-tax operating costs (mainly labor) by $8,000. The spectrometer would require an increase in net working capital (inventory) of $4,000 The firm's marginal federal-plus-state tax rate is 40 percent. What is the initial cash flow? B. What are the operating cash flows? What is the terminal cash flow? If the project's cost of capital is 10 percent, should be spectrometer be purchased? A new machine can be purchased for $150,000 including installation costs. Over its 5-year life, it will reduce cash operating expenses by $50,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. MACRS depreciation will be used, and it will be depreciated over a 3-year recovery (rather than its 5-year economic life). The fim's tax rate is 34 percent. The cost of capital is 15 percent. Should the company replace the old machine? Why or why not? a MACRS Depreciation Schedule Class of investment 5-year 7-year 20% 14% 10-year 10% A 3-year 33% 45 15 7 Ownership Year 1 2 3 4 5 6 7 8 9 10 11 ss= linssonar **www.0*3* 3 Example #5 Replacement Project Analysis The Erickson Toy Corporation currently uses an injection molding machine that was purchased 2 years ago. It has a depreciable base of $2600. The machine is being depreciated on a straight-line basis toward a $500 salvage value, and it has 6 years of life remaining. This results in annual depreciation of $262.50. The old machine can be sold today for $2,000. The firm is offered a i a replacement machine that has a cost of $8,000 and an estimated useful life of 6 After 6 years, Erickson expects to sell the replacement machine for $800. The machine has a MACRS 5-year recovery period. The replacement machine would permit an output expansion, so sales would rise by $1,000 per year. Even so, the new machine's much greater efficiency would still cause operating expenses to decline by $1,500 per year. The new machine would require that inventories be increased by $2,000, but accounts payable would simultaneously increase by $500. The firm's marginal federal-plus-state tax rate is 40% and its cost of capital is 15%. Should it replace the old machine? years. Part I. Weighted Average Cost of Capital (WACC) Example #1 During the past few years, Super Technologies has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining and the company has decided to look seriously at a major expansion program that had been proposed by the marketing department. As the assistant to the financial vice-president, it is your task is to estimate Super's weighted average cost of capital (WACC). The VP has provided you with the following information: 1. The fimms' tax rate is 40%. 2. The current market price of Super's outstanding bonds is $1,153.72. The bonds have an annual coupon rate of 12% and make coupon payments semiannually. The bonds mature in 15 years and have a par value of $1,000. New bonds will have a flotation cost of $15 per bond. 3. The current price of the firm's preferred stock is $113.10 per share. The stock has a $100 par value and a 10% annual dividend rate (paid annually). Flotation costs on new preferred stock are expected to be $2.00 per share. The current price of the firm's common stock is $50 per share. Its last dividend was Do = 54.19 per share. Dividends are paid semiannually and are expected to grow at an annual rate of 5% into the foreseeable future. The flotation cost for newly-issued common stock is 8%. 2020 Balance Sheet (thousands of dollars) cash 102 accounts payable 325 accounts receivable 400 notes payable 300 inventory 438 accruals current assets 940 current liabilities 735 gross fixed assets 2550 long-term debt (bonds) 500 accum. depreciation 550 preferred stock 250 net fixed assets 2000 common stock 125 total assets 2940 paid-in capital retained earnings 680 total common equity 1455 total liabilities and equity 2940 Example #2 You have just been hired as a financial analyst by Harry Davis Industries, Inc. Your first 110 650 assignment is to estimate the firm's weighted average cost of capital (WACC). To get you started, the CFO has assembled the following information: 1. The firm's federal-plus-state tax rate is 40 percent. 2. The firm has outstanding an issue of 10 percent. $1.000 par, semiannual coupon. noncallable bonds with 12 years remaining to maturity. They sell at a price of $1,081.41. 3. The current price of the firm's preferred stock (8 percent dividend, S100 par value, quarterly dividend payment) is $115. New preferred stock could be sold to the public at this price The firm's common stock is currently selling at $76 per share. Its last dividend (Do) was $5.00 per share and investors expect the dividend to grow at a constant 6% annual rate into the foreseeable future. Dividends are paid semiannually. 5. New common stock would involve flotation costs of 10%. New bonds would involve flotation costs of 3.5%. New preferred stock would incur flotation costs of $2.50 per share 4. 2020 Balance Sheet (thousands of dollars) cash accounts receivable inventory current assets gross fixed assets accum. depreciation net fixed assets total assets 95 335 369 799 2056 500 1556 2355 accounts payable notes payable accruals current liabilities long-term debt (bonds) preferred stock common stock paid-in capital retained earnings total common equity total liabilities and equity 200 250 101 551 501 125 100 505 573 1178 2355 Example #3 NSU Unlimited, Inc. can sell bonds with a par value of $1,000 and a coupon rate of 8% per year, paid semi-annually. The bonds will have a maturity of 5 years. The current market price of similar bonds is $975. NSU Unlimited anticipates flotation costs of $20 per bond. NSU Unlimited, Inc. can sell preferred stock with the following characteristics: $100 par value, 5% annual dividend. The stock is currently selling for a price of $87.50 per share. NSU Unlimited anticipates flotation costs of S3 per share. NSU Unlimited, Inc. can sell common stock at a price is $150 per share. The stock last paid a semi-annual dividend of Do-$2.50 per share. The dividend is expected to grow at an annual rate of 8% for the foreseeable future (ie., for a really long time). NSU Unlimited anticipates flotation costs of 10%. The company's tax rate is 40%. 2020 Balance Sheet (thousands of dollars) cash accounts receivable inventory current assets gross fixed assets accum. depreciation net fixed assets total assets 102 400 438 940 2391 550 1841 2781 accounts payable notes payable accruals current liabilities long-term debt (bonds) preferred stock common stock paid-in capital retained earnings total common equity total liabilities and equity 325 300 110 735 526 125 128 584 683 1395 2781 Part II. Decision Rules Cash Flows for projects A and B Year Project A 0 ($1,000) 1 500 2 400 3 300 4 100 Project B ($1,000) 100 300 400 600 Size Disparity (project scale) Year 0 1 2 3 4 5 Project C ($20,000) 6000 6000 6000 6000 6000 Project D ($6,000) 2000 2000 2000 2000 2000 Time Disparity (timing of cash flows) Year NO 2 Project E ($10,000) 0 2000 3000 5000 9000 Project F ($10,000) 4000 4000 3000 3000 2000 4 Unequal Lives Year 0 1 2 3 4 5 6 Project G (540,000) 8000 14000 13000 12000 11000 10000 Project H ($20,000) 7000 13000 12000 Non-Normal Cash Flows Year 0 1 2 3 4 5 6 7 Project X (5375) (387) (193) (100) 600 600 850 (180) Project Y (5405) 134 134 134 134 134 134 Cash Flows for projects I and J Year 0 1 2 3 Project 1 ($10,000) 1000 6000 8000 Project ($10,000) 7000 5000 2000 Part III. Cash Flow Estimation Example 1 New Project Analysis The Ritchie Company is evaluating the proposed acquisition of a new milling machine. The machine's base price is $180,000 and it would cost another $25,000 to modify it for special use by the firm. The machine has a MACRS 3-year recovery period, and it would be sold after 3 years for $80,000. The machine would require an increase in net working capital inventory) of $7,500. The machine would increase sales revenues by $25,000 per year. It is also expected to save the firm $35,000 per year in before tax operating costs, mainly labor. Ritchie's marginal tax rate is 34% A. What is the net cost of the machine for capital budgeting purposes? That is what is the initial cash flow? B. What are the operating cash flows? C What is the terminal (nonoperating) cash flow? D. If the project's cost of capital is 10 percent, should the machine be purchased? Example 2 Replacement Analysis The Orange Fizz Company is contemplating the replacement of one of its bottling machines with a newer and more efficient one. The old machine has a book value of $500,000 and a remaining useful life of 5 years. It can be sold today for $200,000. The firm does not expect to realize any return from scrapping the old machine in 5 years. The old machine is being depreciated toward a zero salvage value, or by $100.000 per year, using the simplified straight-line method. The new machine has a purchase price of $1.2 million, an estimated useful life and MACRS recovery period of 5 years. At the end of 5 years, the company expects to sell the new machine for $175,000. It is expected to economize on electric power usage, labor, and repair costs, and also to reduce the number of defective bottles. In total, an annual savings of $275,000 will be realized if it is installed. The company is in the 40 percent federal-plus-state tax bracket, and it has a 10 percent cost of capital. A What is the initial cash flow? B. What are the operating cash flows? c. What is the terminal cash flow? D. Should the firm purchase the new machine? Why or why not? Example N3 New Project Analysis You have been asked by the president of the Farr Construction Company to evaluate the proposed acquisition of a new earth mover. The mover's basic price is $50,000 and it would cost another $10,000 to modify it for special use. Assume that the mover has a MACRS 3-year recovery period. It would be sold after 4 years for $20,000 and it would require an increase in net working capital (spare parts inventory) of $2,000. The earth mover would have no effect on revenues, but it is expected to save the firm $20,000 per year in before-tax operating costs, mainly labor. The firm's marginal federal-plus-state tax rate is 40 percent. A. What is the net cost of the earth mover? B. What are the operating cash flows? C. What is the terminal (nonoperating) cash flow? D. If the project's cost of capital is 10 percent, should the earth mover be purchased? Example 4 New Project Analysis You have been asked by the president of your company to evaluate the proposed acquisition of a new spectrometer for the firm's R&D Department. The equipment's basic price is $70,000 and it would cost another $15,000 to modify it for special use by your fimm. The spectrometer, which has a MACRS 3-year recovery period, would be sold after 3 years for $30,000. Use of the spectrometer would increase the firm's annual revenues by $15,000. However, because of its high tech systems, it is expected to increase the firm's annual before-tax operating costs (mainly labor) by $8,000. The spectrometer would require an increase in net working capital (inventory) of $4,000. The firm's marginal federal-plus-state tax rate is 40 percent. A What is the initial cash flow? B. What are the operating cash flows? C. What is the terminal cash flow? D If the project's cost of capital is 10 percent, should be spectrometer be purchased? Example #5 Replacement Project Analysis The Erickson Toy Corporation currently uses an injection molding machine that was purchased 2 years ago. It has a depreciable base of $2600. The machine is being depreciated on a straight-line basis toward a $500 salvage value, and it has 6 years of life remaining. This results in annual depreciation of S262,50. The old machine can be sold today for $2.000. The firm is offered a replacement machine that has a cost of $8,000 and an estimated useful life of 6 years. After 6 years, Erickson expects to sell the replacement machine for $800. The machine has a MACRS 5-year recovery period. The replacement machine would permit an output expansion, so sales would rise by S1,000 per year. Even so, the new machine's much greater efficiency would still cause operating expenses to decline by $1,500 per year. The new machine would require that inventories be increased by $2,000, but accounts payable would simultaneously increase by $500. The firm's marginal federal-plus-state tax rate is 40% and its cost of capital is 15% Should it replace the old machine? Example 6 Replacement Project Analysis The Durst Equipment Company purchased a machine 5 years ago at a cost of $100,000. It had an expected life of 10 years at the time of purchase and an expected sale price of $10,000 at the end of the 10 years. It is being depreciated by the straight-line method toward a salvage value of $10,000. This results in annual depreciation of $9,000. It can be sold today for $65,000. A new machine can be purchased for $150,000 including installation costs. Over its S-year life, it will reduce cash operating expenses by $50,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. MACRS depreciation will be used, and it will be depreciated over a 3-year recovery (rather than its 5-year economic life). The firm's tax rate is 34 percent. The cost of capital is 15 percent. Should the company replace the old machine? Why or why not? MACRS Depreciation Schedule 3-year 33% 45 15 7 Ownership Year 1 2 3 4 5 6 7 8 9 10 11 Class of investment 5-year 7-year 20% 14% 32 25 19 17 12 13 11 9 6 9 9 10-year 10% 18 14 12 9 7 6