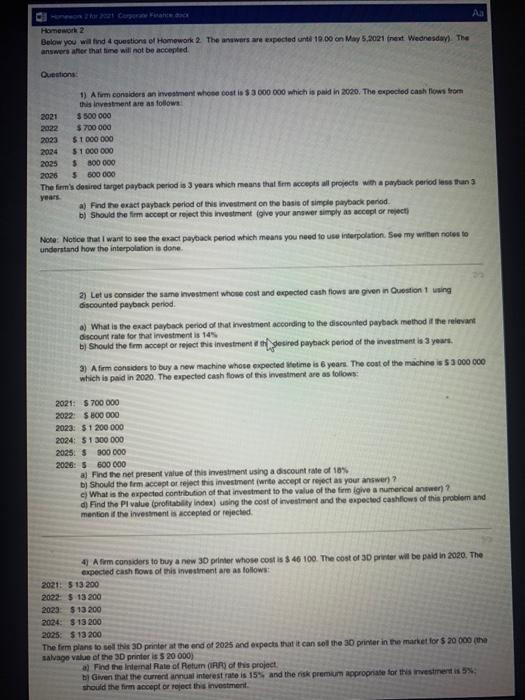

Homework 2 Below you will find 4 questions of Homework 2. The answers are expected unt 10.00 on May 5,2021 next Wednesday). The answers after that time will not be accepted Questions 1) Afum considers an investment who costis 3 000 000 which is paid in 2020. The expected cash flow from this investment are as follows 2021 $ 500 000 $700 000 2023 $ 1 000 000 5 1 000 000 2025 $ 800 000 2026 5 000 000 The firm's desired target payback period is 3 years which means that moet al projects with a payback period less than 3 years a) Find the exact payback period of this investment on the basis of simple payback period b) Should the firm accept or reject this investment (give your answer simply as accept of reject) Note: Notice that I want to see the exact payback period which means you need to use interpolation See my written notes to understand how the interpolation is done 2) Let us consider the same investment whose cost and expected cash flows are given in Question 1 wing discounted payback period a) What is the exact payback period of that investment according to the discounted payback method it the relevant discount rate for that investment is 145 by Should the firm accept or reject this investment Sesred payback period of the investment is 3 yewe. 3) Afirm considers to buy a new machine whose expected time is 6 years. The cost of the machine is $ 3 000 000 which is paid in 2020. The expected cash flows of this investment are as follows: 2021: $ 700 000 2022: S 800 000 2023: $1 200 000 2024: 51 300 000 2025: 5 300 000 2020: S 600 000 a) Find the ner present value of this investment using a discount rate of 10% Dj Should the firm accept or reject this investment write accept or reject as your answer)? c) What is the expected contribution of that investment to the value of the firm igive a numerical answer)? d) Find the Pl value (profitability Index) using the cost of investment and the expected cashflows of this problem and mention of the investment is accepted or rejected 4 Afum considers to buy a new 3D printer whose cost is $ 46 100. The cost of 3D printer will be paid in 2020. The expected cash flows of this investment are as follows: 2021: 5 13 200 2022: $ 13200 2023 S 13 200 2024: $ 13 200 2025S13 200 The tem plans to set the 3D printer at the end of 2025 and expects that it can tell the 30 printer in the market for 20 000 salvage value of the 3D printer is 5 20 000) a Find the Internal Rate of Return of this project Given that the current annual interest rate is 15% and the risk premium appropriate for this investments should the firm accept or reject the investment