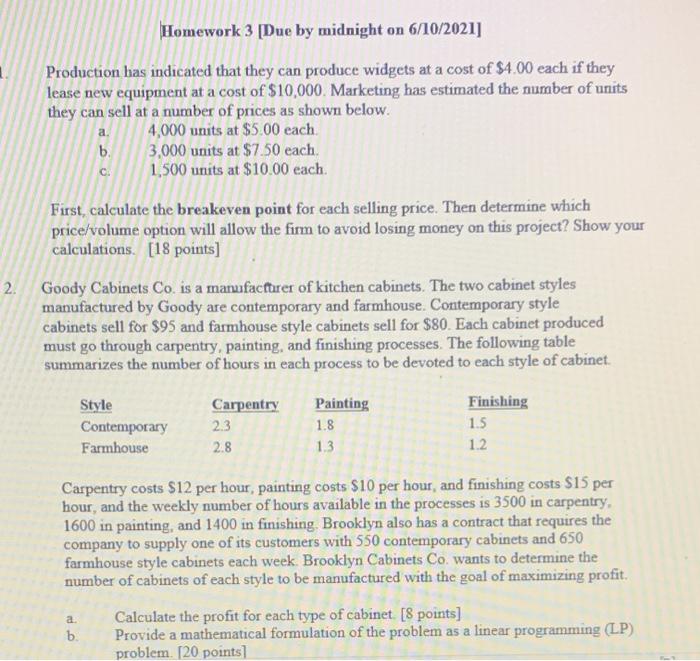

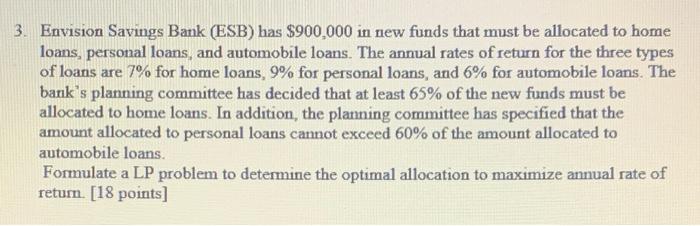

Homework 3 [Due by midnight on 6/10/2021] Production has indicated that they can produce widgets at a cost of $4.00 each if they lease new equipment at a cost of $10,000. Marketing has estimated the number of units they can sell at a number of prices as shown below. 4,000 units at $5.00 each b. 3,000 units at $7.50 each 1,500 units at $10.00 each. a C. First, calculate the breakeven point for each selling price. Then determine which price/volume option will allow the firm to avoid losing money on this project? Show your calculations. [18 points] 2. Goody Cabinets Co. is a manufacturer of kitchen cabinets. The two cabinet styles manufactured by Goody are contemporary and farmhouse. Contemporary style cabinets sell for $95 and farmhouse style cabinets sell for $80. Each cabinet produced must go through carpentry, painting, and finishing processes. The following table summarizes the number of hours in each process to be devoted to each style of cabinet Painting Style Contemporary Farmhouse Carpentry 2.3 Finishing 1.5 1.8 2.8 1.3 1.2 Carpentry costs $12 per hour, painting costs $10 per hour and finishing costs $15 per hour, and the weekly number of hours available in the processes is 3500 in carpentry. 1600 in painting, and 1400 in finishing. Brooklyn also has a contract that requires the company to supply one of its customers with 550 contemporary cabinets and 650 farmhouse style cabinets each week. Brooklyn Cabinets Co wants to determine the number of cabinets of each style to be manufactured with the goal of maximizing profit. a b. Calculate the profit for each type of cabinet. [8 points) Provide a mathematical formulation of the problem as a linear programming (LP) problem. [20 points 3. Envision Savings Bank (ESB) has $900,000 in new funds that must be allocated to home loans, personal loans, and automobile loans. The annual rates of return for the three types of loans are 7% for home loans, 9% for personal loans, and 6% for automobile loans. The bank's planning committee has decided that at least 65% of the new funds must be allocated to home loans. In addition, the planning committee has specified that the amount allocated to personal loans cannot exceed 60% of the amount allocated to automobile loans. Formulate a LP problem to determine the optimal allocation to maximize annual rate of retum. [18 points) Homework 3 [Due by midnight on 6/10/2021] Production has indicated that they can produce widgets at a cost of $4.00 each if they lease new equipment at a cost of $10,000. Marketing has estimated the number of units they can sell at a number of prices as shown below. 4,000 units at $5.00 each b. 3,000 units at $7.50 each 1,500 units at $10.00 each. a C. First, calculate the breakeven point for each selling price. Then determine which price/volume option will allow the firm to avoid losing money on this project? Show your calculations. [18 points] 2. Goody Cabinets Co. is a manufacturer of kitchen cabinets. The two cabinet styles manufactured by Goody are contemporary and farmhouse. Contemporary style cabinets sell for $95 and farmhouse style cabinets sell for $80. Each cabinet produced must go through carpentry, painting, and finishing processes. The following table summarizes the number of hours in each process to be devoted to each style of cabinet Painting Style Contemporary Farmhouse Carpentry 2.3 Finishing 1.5 1.8 2.8 1.3 1.2 Carpentry costs $12 per hour, painting costs $10 per hour and finishing costs $15 per hour, and the weekly number of hours available in the processes is 3500 in carpentry. 1600 in painting, and 1400 in finishing. Brooklyn also has a contract that requires the company to supply one of its customers with 550 contemporary cabinets and 650 farmhouse style cabinets each week. Brooklyn Cabinets Co wants to determine the number of cabinets of each style to be manufactured with the goal of maximizing profit. a b. Calculate the profit for each type of cabinet. [8 points) Provide a mathematical formulation of the problem as a linear programming (LP) problem. [20 points 3. Envision Savings Bank (ESB) has $900,000 in new funds that must be allocated to home loans, personal loans, and automobile loans. The annual rates of return for the three types of loans are 7% for home loans, 9% for personal loans, and 6% for automobile loans. The bank's planning committee has decided that at least 65% of the new funds must be allocated to home loans. In addition, the planning committee has specified that the amount allocated to personal loans cannot exceed 60% of the amount allocated to automobile loans. Formulate a LP problem to determine the optimal allocation to maximize annual rate of retum. [18 points)