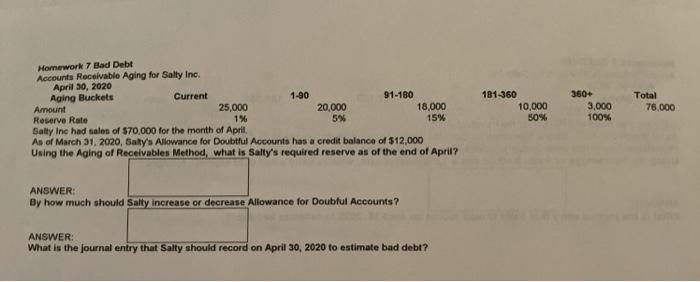

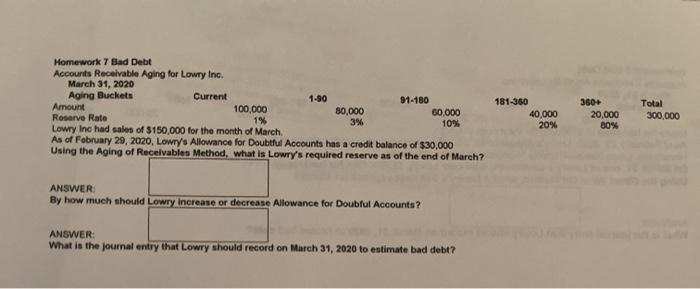

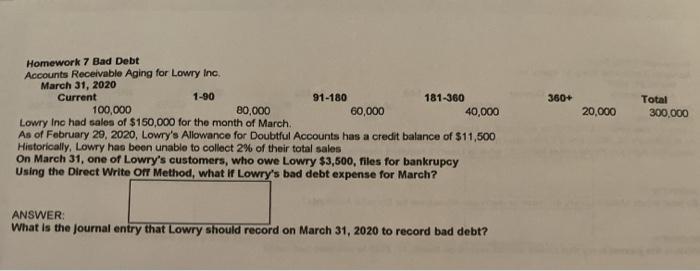

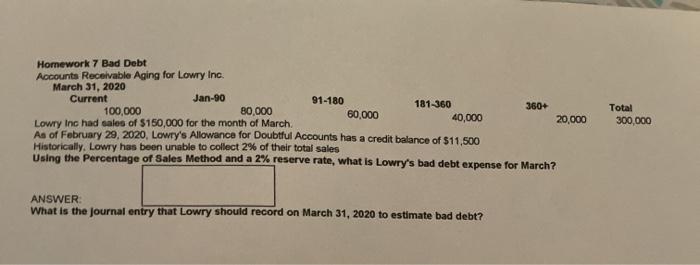

Homework 7 Bad Debt Accounts Receivable Aging for Salty Inc. April 30, 2020 Aging Buckets Current 1-90 91-180 Amount 25,000 20,000 18,000 Reserve Rate 1% 5% 15% Salty Inc had sales of $70,000 for the month of April As of March 31, 2020, Sally's Allowance for Doubtful Accounts has a credit balance of $12,000 Using the Aging of Receivables Method, what is Salty's required reserve as of the end of April? 181-360 10,000 50% 350+ 3,000 100% Total 76,000 ANSWER: By how much should Salty increase or decrease Allowance for Doubtul Accounts? ANSWER: What is the journal entry that Salty should record on April 30, 2020 to estimate bad debt? Homework 7 Bad Debt Accounts Receivable Aging for Lowry Inc. March 31, 2020 Aging Buckets Current 1-90 01-180 Amount 100,000 80,000 60,000 Rosarve Rato 1% 3% 10% Lowry Inc had sales of $150,000 for the month of March As of February 29, 2020, Lowry's Allowance for Doubtful Accounts has a credit balance of $30,000 Using the Aging of Receivables Method, what is Lowry's required reserve as of the end of March? 181-350 40.000 20% 360+ 20,000 B0% Total 300,000 ANSWER By how much should Lowry increase or decrease Allowance for Doublul Accounts ? ANSWER: What is the journal entry that Lowry should record on March 31, 2020 to estimate bad debt? 360+ 20,000 Total 300,000 Homework 7 Bad Debt Accounts Receivable Aging for Lowry Inc. March 31, 2020 Current 1-90 91-180 181-360 100,000 80,000 60,000 40,000 Lowry Inc had sales of $150,000 for the month of March As of February 20, 2020, Lowry's Allowance for Doubtful Accounts has a credit balance of $11,500 Historically. Lowry has been unable to collect 2% of their total sales On March 31, one of Lowry's customers, who owe Lowry $3,500, files for bankrupcy Using the Direct Write Off Method, what It Lowry's bad debt expense for March? ANSWER: What is the Journal entry that Lowry should record on March 31, 2020 to record bad debt? Homework 7 Bad Debt Accounts Receivable Aging for Lowry Inc. March 31, 2020 Current Jan-90 91-180 181-360 360+ 100,000 80,000 60,000 40,000 20,000 Lowry Inc had sales of $150,000 for the month of March As of February 29, 2020, Lowry's Allowance for Doubtful Accounts has a credit balance of $11,500 Historically. Lowry has been unable to collect 2% of their total sales Using the Percentage of Sales Method and a 2% reserve rate, what is Lowry's bad debt expense for March? Total 300,000 ANSWER What is the journal entry that Lowry should record on March 31, 2020 to estimate bad debt