Answered step by step

Verified Expert Solution

Question

1 Approved Answer

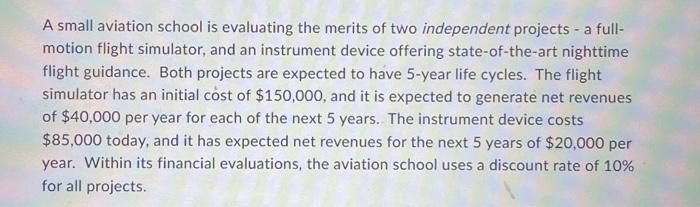

Homework A small aviation school is evaluating the merits of two independent projects - a fullmotion flight simulator, and an instrument device offering state-of-the-art nighttime

Homework

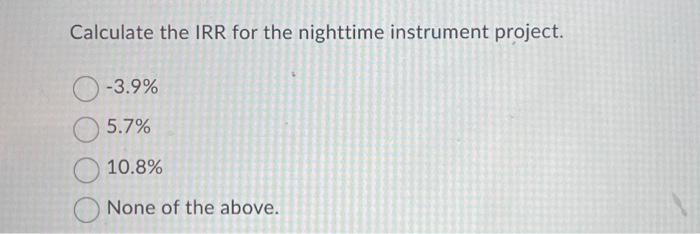

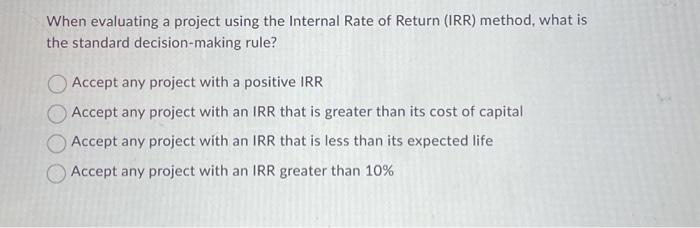

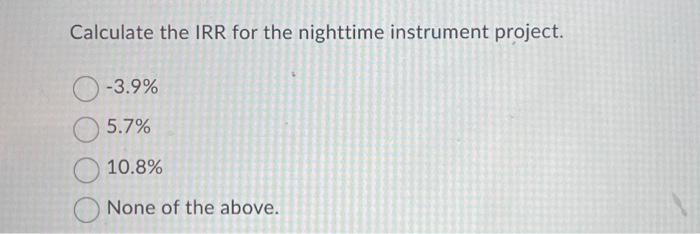

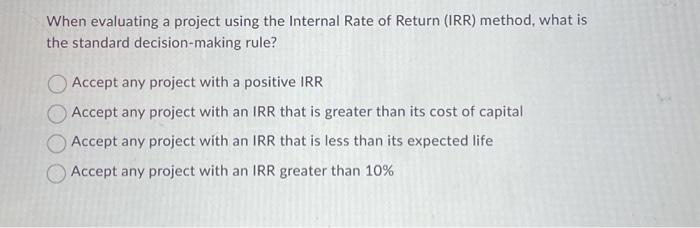

A small aviation school is evaluating the merits of two independent projects - a fullmotion flight simulator, and an instrument device offering state-of-the-art nighttime flight guidance. Both projects are expected to have 5-year life cycles. The flight simulator has an initial cost of $150,000, and it is expected to generate net revenues of $40,000 per year for each of the next 5 years. The instrument device costs $85,000 today, and it has expected net revenues for the next 5 years of $20,000 per year. Within its financial evaluations, the aviation school uses a discount rate of 10% for all projects. When evaluating a project using the Internal Rate of Return (IRR) method, what is the standard decision-making rule? Accept any project with a positive IRR Accept any project with an IRR that is greater than its cost of capital Accept any project with an IRR that is less than its expected life Accept any project with an IRR greater than 10% Calculate the IRR for the nighttime instrument project. 3.9% 5.7% 10.8% None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started