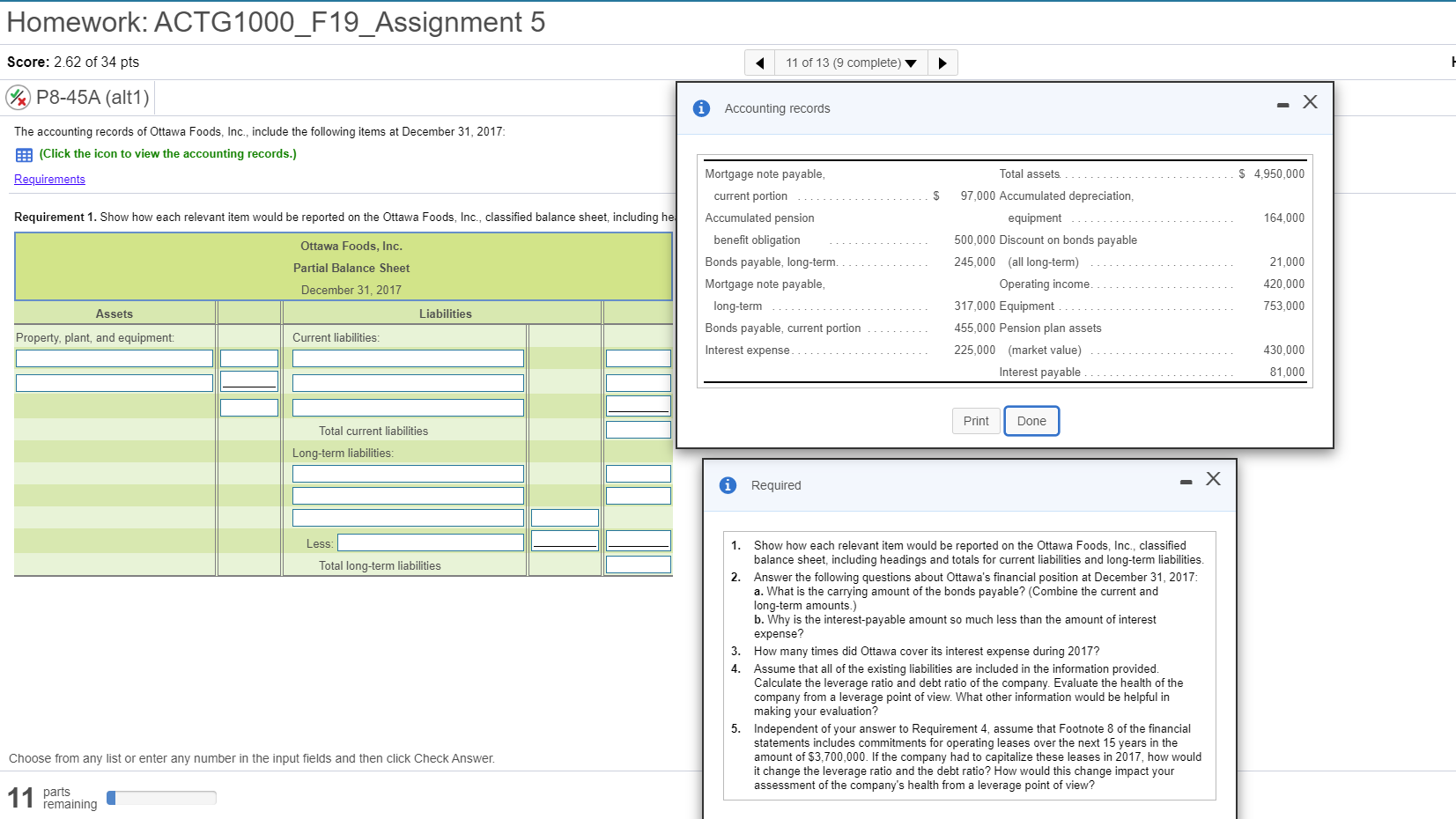

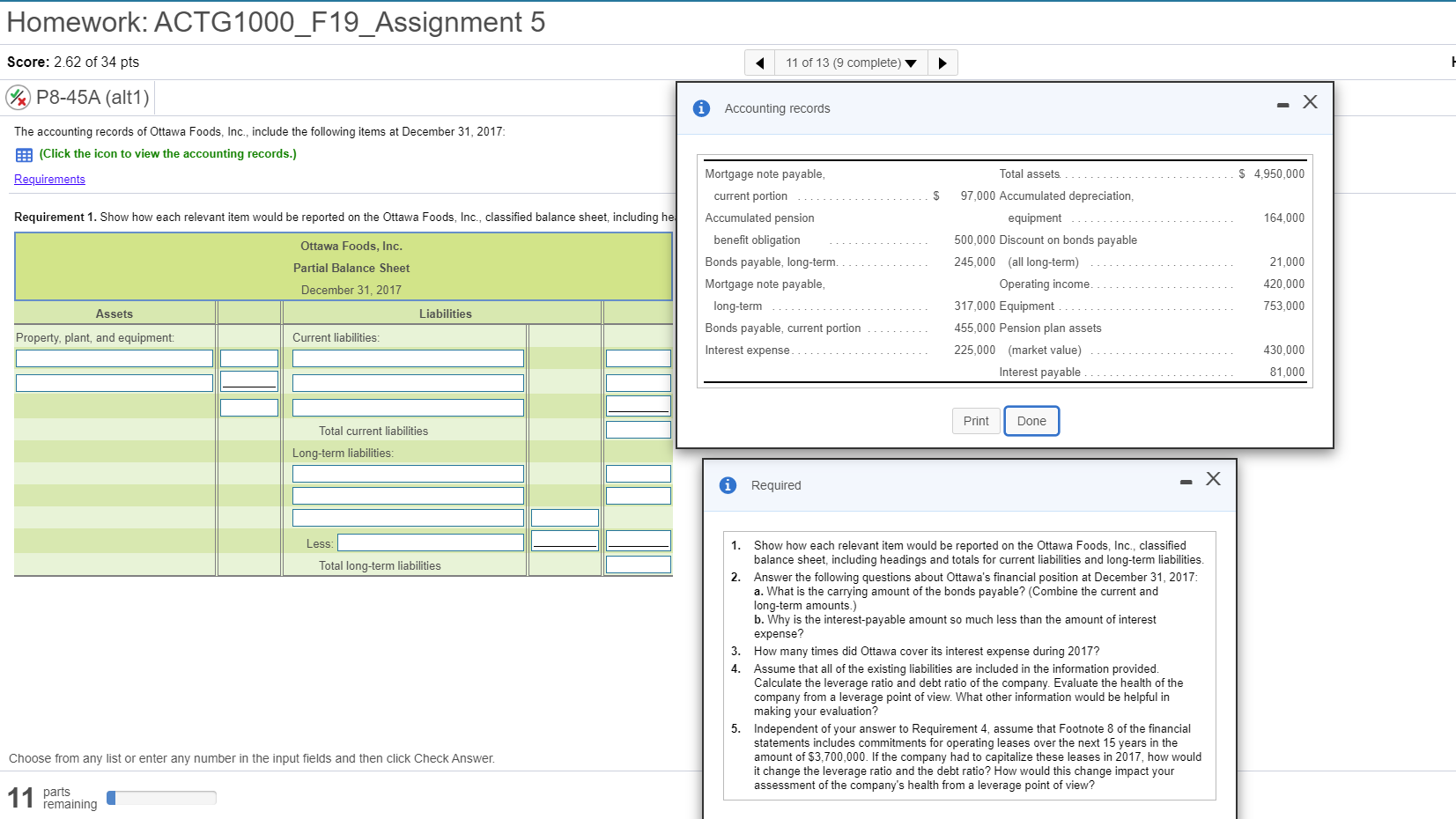

Homework: ACTG1000_F19_Assignment 5 Score: 2.62 of 34 pts 11 of 13 (9 complete) %x P8-45A (alt1) 0 Accounting records The accounting records of Ottawa Foods, Inc., include the following items at December 31, 2017: E: (Click the icon to view the accounting records.) Requirements $ 4,950,000 Requirement 1. Show how each relevant item would be reported on the Ottawa Foods, Inc., classified balance sheet, including he 164,000 Ottawa Foods, Inc. Partial Balance Sheet December 31, 2017 Mortgage note payable, current portion .........$ Accumulated pension benefit obligation Bonds payable, long-term. ...... Mortgage note payable, long-term Bonds payable, current portion ..... Interest expense. Total assets. 97,000 Accumulated depreciation, equipment 500,000 Discount on bonds payable 245,000 (all long-term) Operating income.......... 317,000 Equipment ... 455,000 Pension plan assets 225,000 (market value) Interest payable 21,000 420,000 753,000 Assets Liabilities Property, plant, and equipment: Current liabilities: 430,000 81,000 Print Done Total current liabilities Long-term liabilities: Required Less: Total long-term liabilities 1. Show how each relevant item would be reported on the Ottawa Foods, Inc., classified balance sheet, including headings and totals for current liabilities and long-term liabilities. Answer the following questions about Ottawa's financial position at December 31, 2017: a. What is the carrying amount of the bonds payable? (Combine the current and long-term amounts.) b. Why is the interest-payable amount so much less than the amount of interest expense? 3. How many times did Ottawa cover its interest expense during 2017? 4. Assume that all of the existing liabilities are included in the information provided. Calculate the leverage ratio and debt ratio of the company. Evaluate the health of the company from a leverage point of view. What other information would be helpful in making your evaluation? Independent of your answer to Requirement 4, assume that Footnote 8 of the financial statements includes commitments for operating leases over the next 15 years in the amount of $3,700,000. If the company had to capitalize these leases in 2017, how would it change the leverage ratio and the debt ratio? How would this change impact your assessment of the company's health from a leverage point of view? Choose from any list or enter any number in the input fields and then click Check Answer. 11 parts remaining