Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Homework: Ch . 1 HW Question 7 , Qi: 1 - 1 9 ( similar to ) HW Score: 4 6 . 1 5 %

Homework: Ch HW

Question Qi:similar to

HW Score: of points

Part of

Points: of

The Bunting Corporation, a C corporation, is owned by Dave Brown and had taxable income in of $ Dave is also an employee of the corporation. In December the corporation has decided to distribute $ to Dave and has asked you whether it would be better to distribute the money as a dividend or salary. Dave, a single taxpayer, is in the marginal tax bracket. How would you respond to Bunting Corporation? Consider only income taxes for this problem, and ignore the net investment income tax. Daves taxable income exceeds $

Vew the capital gain rates for

Calculate the taxes for Bunting and Dave under each option. For the purpose of this analysis, we will only consider the marginal and capital gain rates for Dave. Ignore the net investment income tax.

tableDistributed as dividend,Distributed as salaryTaxes for Bunting,,Taxes for Dave,,Total tax liability,,

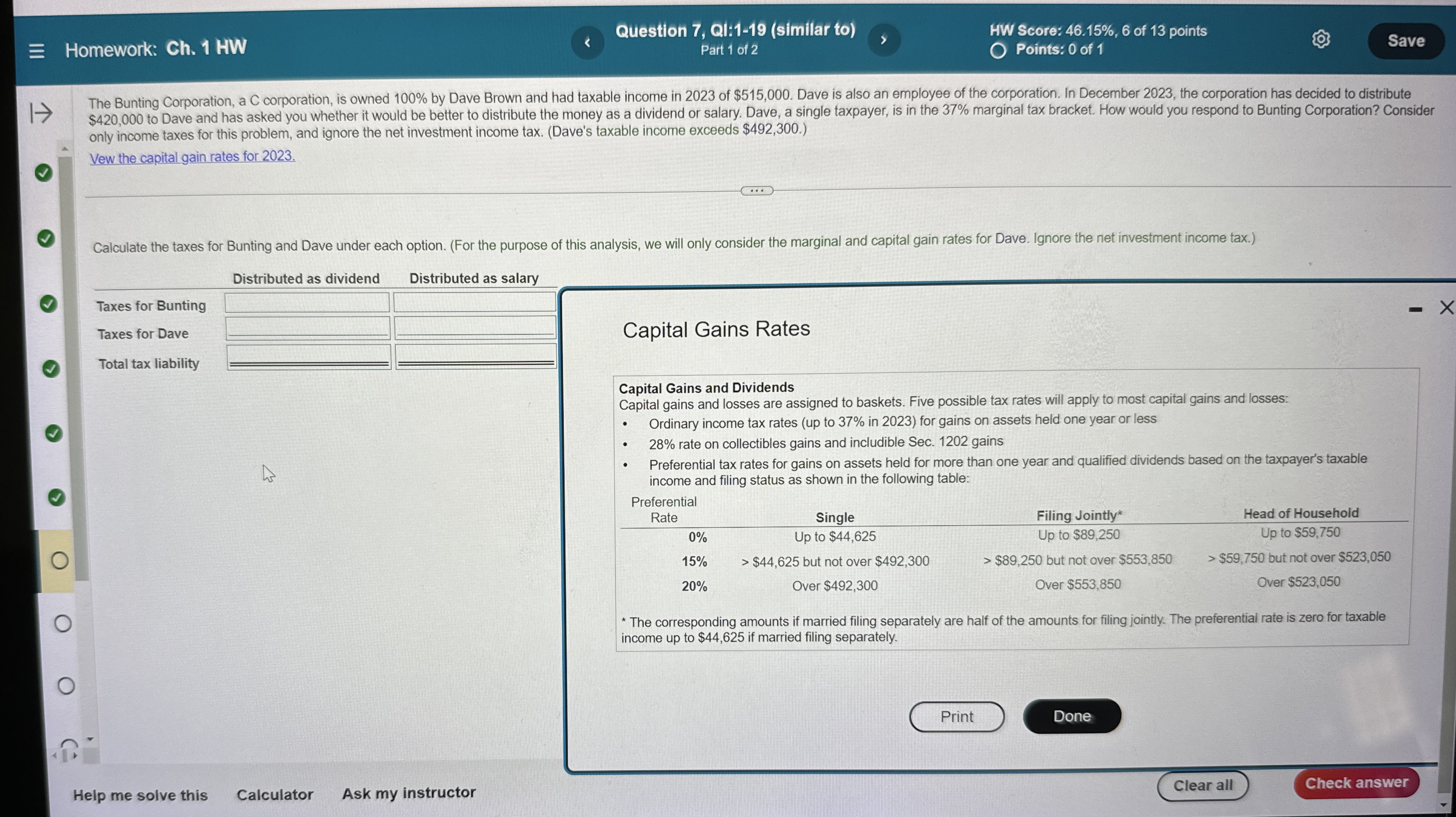

Capital Gains Rates

Capital Gains and Dividends

Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses:

Ordinary income tax rates up to in for gains on assets held one year or less

rate on collectibles gains and includible Sec. gains

Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table:

tabletablePreferentialRateSingle,Filing JointlyHead of HouseholdUp to $Up to $Up to $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started