Answered step by step

Verified Expert Solution

Question

1 Approved Answer

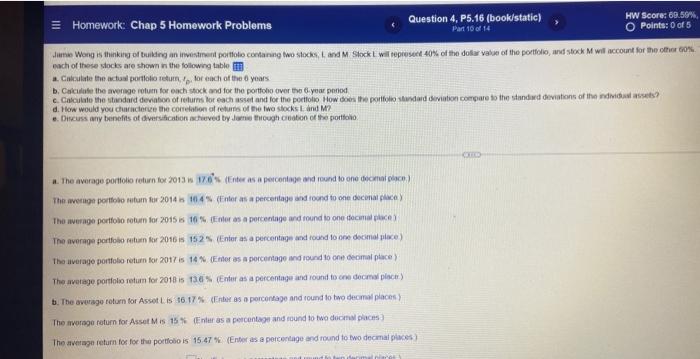

Homework: Chap 5 Homework Problems Question 4, P5.16 (book/static) Part 10 of 14 HW Score: 69.59% O Points: 0 of 5 Jamie Wong is

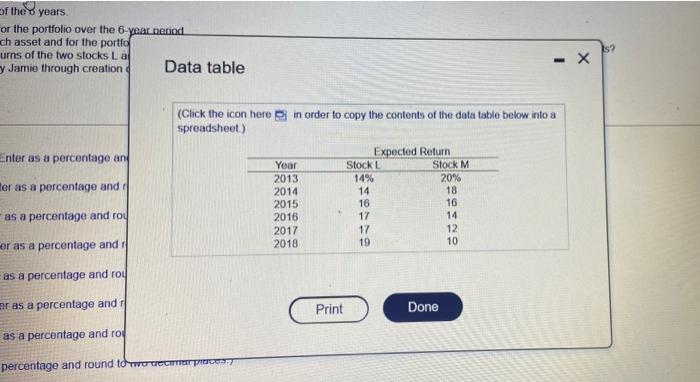

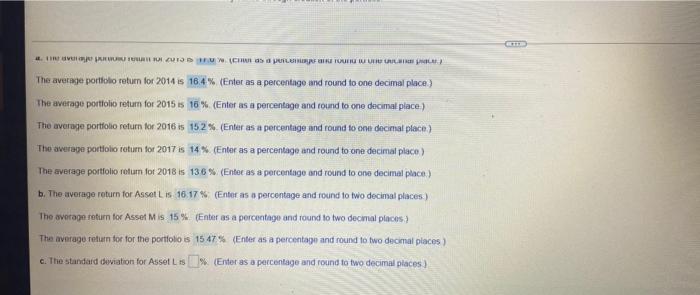

Homework: Chap 5 Homework Problems Question 4, P5.16 (book/static) Part 10 of 14 HW Score: 69.59% O Points: 0 of 5 Jamie Wong is thinking of building an investment portfolio containing two stocks, I, and M. Stock L will represent 40% of the dollar value of the portfolio, and stock M will account for the other 60% each of these stocks are shown in the following table a. Calculate the actual portfolio return, f. for each of the 6 years b. Calculate the average retum for each stock and for the portfolio over the 6-year penod c. Calculate the standard deviation of returns for each asset and for the portfolio How does the portfolio standard deviation compare to the standard deviations of the individual assets? d. How would you characterize the correlation of returns of the two stocks L and M e. Discuss any benefits of diversification achieved by Jamie through creation of the portfolio a. The average portfolio return for 2013 is 17.6% (Enter as a percentage and round to one decimal place) The average portfolio return for 2014 is 10.4% (Enter as a percentage and round to one decimal place) The average portfolio return for 2015 is 16 % (Enter as a percentage and round to one decimal place) The average portfolio return for 2016 is 152 % (Enter as a percentage and round to one decimal place) The average portfolio return for 2017 is 14 % (Enter as a percentage and round to one decimal place) The average portfolio return for 2018 is 13.6 % (Enter as a percentage and round to one decimal place) b. The average return for Asset L is 36.17% (Enter as a percentage and round to two decimal places) The average return for Asset M is 15 % (Enter as a percentage and round to two decimal places) The average return for for the portfolio is 15.47 % (Enter as a percentage and round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started