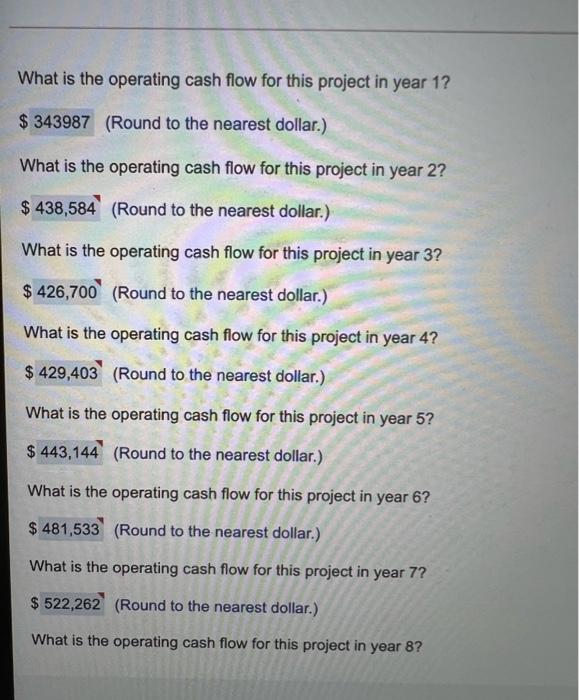

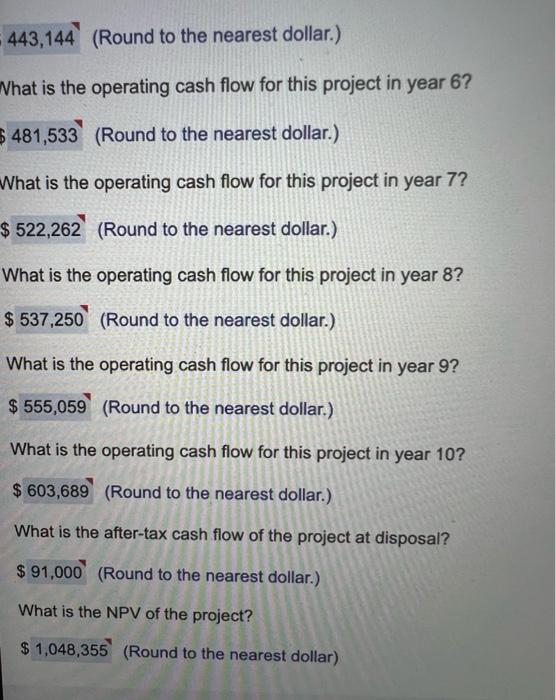

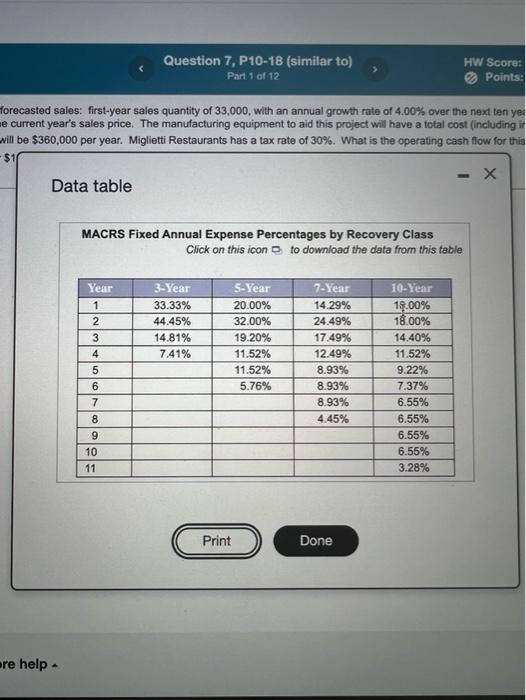

Homework: Chapter 10 Homework Question 7P10-18 (similar to) HW Score 76.04%, 6.08 of sports Part 1 of 12 Points: 0,08 of 1 Save NPV Miles Restaurants is looking at a project with the following forced first year any of 33.000, with an uw growth rate of 400s over the rest ten years. The properties and we 2.00 per year. The production costs are expected to be 55% of the current year's price. The manufacturing out to this project war avea tot nouding installation of 2.500.000 will be red MACRE mundsso MACRS teation Facts will be $360,000 per year Mestranhostate of 30%What is the operating cath fow for the project over het voor Mint Restaurante during equipment can be sold for $150.000 at the end of the son year project and the cost of capital for this projects 8% What is the operating with flow for this project in your 12 What is the operating cash flow for this project in year 1? $ 343987 (Round to the nearest dollar.) What is the operating cash flow for this project in year 2? $ 438,584 (Round to the nearest dollar.) What is the operating cash flow for this project in year 3? $426,700 (Round to the nearest dollar.) What is the operating cash flow for this project in year 4? $ 429,403 (Round to the nearest dollar.) What is the operating cash flow for this project in year 5? $ 443,144 (Round to the nearest dollar.) What is the operating cash flow for this project in year 6? $ 481,533 (Round to the nearest dollar.) What is the operating cash flow for this project in year 7? $ 522,262 (Round to the nearest dollar.) What is the operating cash flow for this project in year 8? 443,144 (Round to the nearest dollar.) What is the operating cash flow for this project in year 6? $ 481,533 (Round to the nearest dollar.) What is the operating cash flow for this project in year 7? $ 522,262 (Round to the nearest dollar.) What is the operating cash flow for this project in year 8? $ 537,250 (Round to the nearest dollar.) What is the operating cash flow for this project in year 9? $ 555,059 (Round to the nearest dollar.) What is the operating cash flow for this project in year 10? $ 603,689 (Round to the nearest dollar.) What is the after-tax cash flow of the project at disposal? $ 91,000 (Round to the nearest dollar.) What is the NPV of the project? $ 1,048,355 (Round to the nearest dollar) Question 7, P10-18 (similar to) Part 1 of 12 HW Score: Points: Horecasted sales: first-year sales quantity of 33,000, with an annual growth rate of 4.00% over the next ten yer e current year's sales price. The manufacturing equipment to aid this project will have a total cost (including in will be $360,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this $1 -X Data table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table Year 1 2 3 3-Year 33.33% 44,45% 14.81% 7.41% 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% who Emes 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 19.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% 10 11 Print Done are help