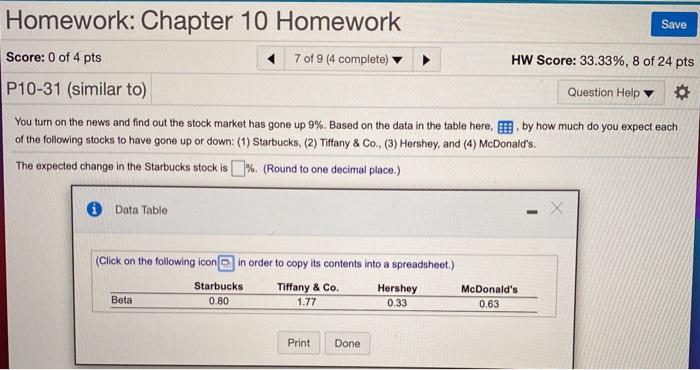

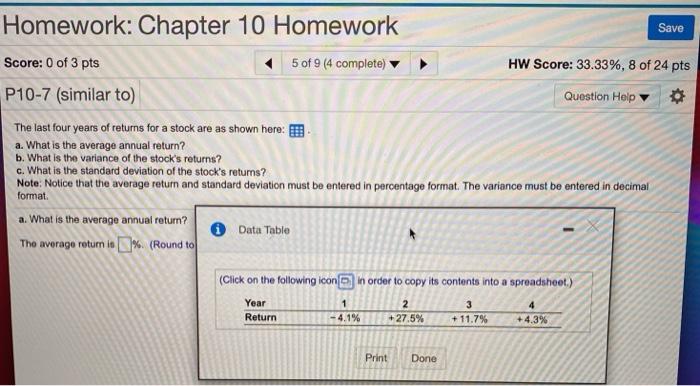

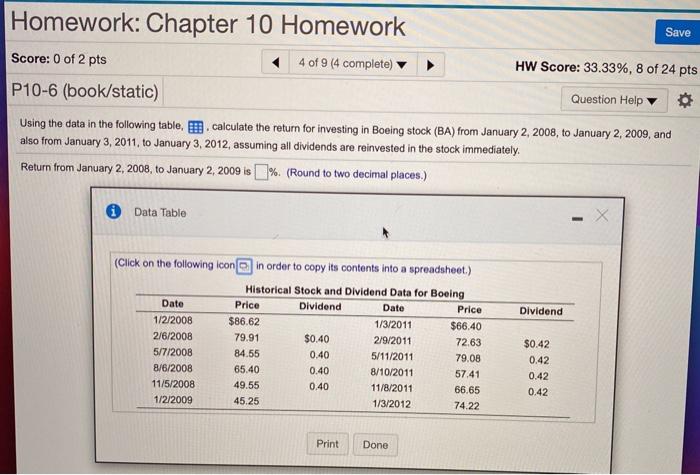

Homework: Chapter 10 Homework Save Score: 0 of 4 pts 7 of 9 (4 complete) HW Score: 33.33%, 8 of 24 pts P10-31 (similar to) Question Help You turn on the news and find out the stock market has gone up 9%. Based on the data in the table here, by how much do you expect each of the following stocks to have gone up or down: (1) Starbucks, (2) Tiffany & Co. (3) Hershey, and (4) McDonald's The expected change in the Starbucks stock is % (Round to one decimal place.) i Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Starbucks Tiffany & Co. Hershey Beta 0.80 1.77 0.33 McDonald's 0.63 Print Done Save Homework: Chapter 10 Homework Score: 0 of 3 pts 5 of 9 (4 complete) HW Score: 33.33%, 8 of 24 pts P10-7 (similar to) Question Help The last four years of returns for a stock are as shown here: a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's retums? Note: Notice that the average return and standard deviation must be entered in percentage format. The variance must be entered in decimal format a. What is the average annual return? 1 Data Table The average return in % (Round to (Click on the following icon in order to copy its contents into a spreadsheet.) Year 2 3 4 Return -4.1% +27.5% + 11.7% +4.3% 1 Print Done Homework: Chapter 10 Homework Save Score: 0 of 2 pts 4 of 9 (4 complete) HW Score: 33.33%, 8 of 24 pts P10-6 (book/static) Question Help Using the data in the following table, calculate the return for investing in Boeing stock (BA) from January 2, 2008, to January 2, 2009, and also from January 3, 2011, to January 3, 2012, assuming all dividends are reinvested in the stock immediately. Return from January 2, 2008, to January 2, 2009 is % (Round to two decimal places.) Data Table Dividend (Click on the following icon in order to copy its contents into a spreadsheet.) Historical Stock and Dividend Data for Boeing Date Price Dividend Date Price 1/2/2008 $86.62 1/3/2011 $66.40 2/6/2008 79.91 $0.40 2/9/2011 72.63 5/7/2008 84.55 5/11/2011 79.08 8/6/2008 65.40 0.40 8/10/2011 57.41 11/5/2008 49.55 0.40 11/8/2011 66.65 1/2/2009 45.25 1/3/2012 74.22 0.40 $0.42 0.42 0.42 0.42 Print Done