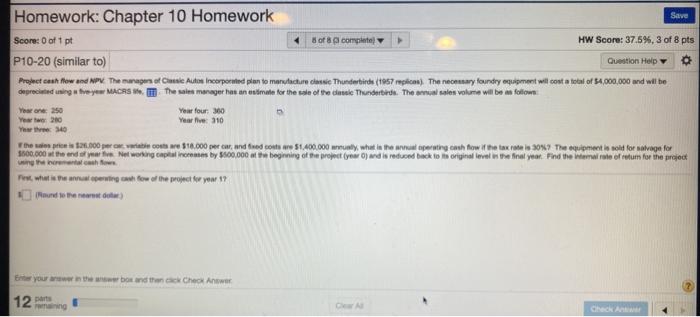

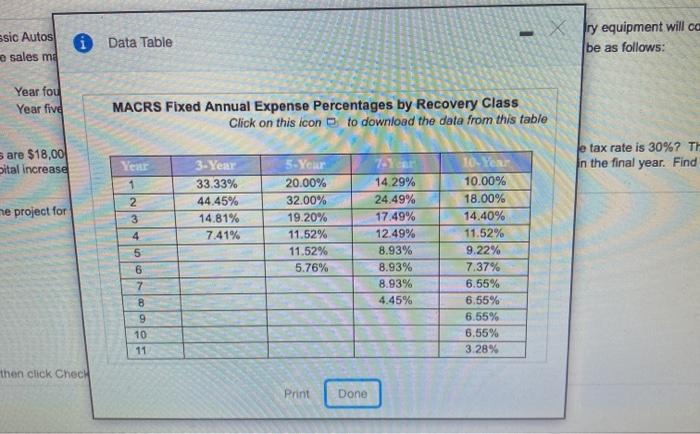

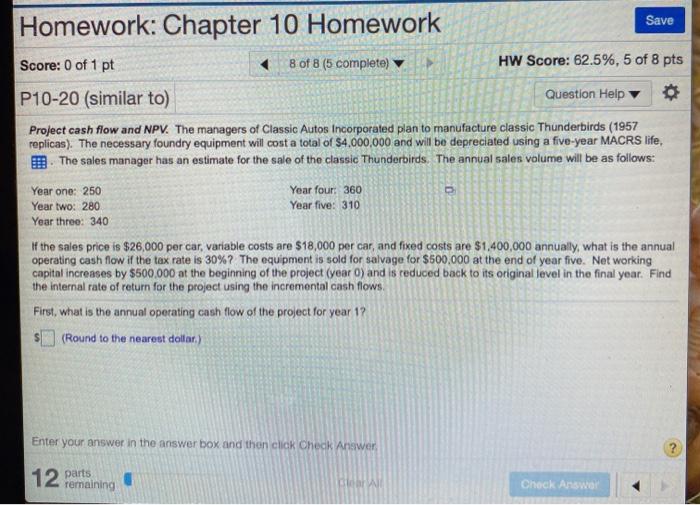

Homework: Chapter 10 Homework Save Score0 of 1 pt B of complete HW Score: 37.5%, 3 of 8 pts P10-20 (similar to) Question Help Product cash flow and Now The manager of Cansie Autot Incorporated plan to mortuus clause Thunderbirds (1857 replica). The neonatary foundry equipment will cost a total of 4,000,000 and will be deprocited using the ye MACRS I. II the sales manager has an estimate for the sale of the coule Thunderbirds. The sales volume will be us foliowa Your on 250 Your four 360 Year: 200 Yearfe 310 Yhte 40 thew 26.000 per os e 118.000 per car and fred core 1.400.000 ly, what is the perting cash flow of the taxei 3047 The equipment is not for salvage for 1600.000 the end of Networking capital incremes by $800.000 af he beginning of the proyeur ) and is reduced back to the original level in the final year. Find the Wemal rate of return for the project the release Test , what is the annual pertogenow the project for your 17 Into The Go) your own the box and thank Check Answer 12 wang ssic Autos! e sales me i Data Table ry equipment will ca be as follows: Year fou Year five MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table s are $18,00 Sital increase e tax rate is 30%? TH In the final year. Find 3-Year 33.33% 44.45% 14.81% 7.41% me project for Yen 1 2 3 4 5 6 7 8 9 10 11 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% then click Check Print Done Homework: Chapter 10 Homework Save Score: 0 of 1 pt 8 of 8 (5 complete) HW Score: 62.5%, 5 of 8 pts P10-20 (similar to) Question Help Project cash flow and NPV. The managers of Classic Autos incorporated plan to manufacture classic Thunderbirds (1957 replicas). The necessary foundry equipment will cost a total of $4,000,000 and will be depreciated using a five-year MACRS life, 5. The sales manager has an estimate for the sale of the classic Thunderbirds. The annual sales volume will be as follows: Year one: 250 Year four: 360 Year two: 280 Year five: 310 Year three: 340 If the sales price is $26,000 per car, variable costs are $18,000 per car, and fixed costs are $1,400,000 annually, what is the annual operating cash flow if the tax rate is 30%? The equipment is sold for salvage for $500,000 at the end of year five. Net working capital increases by $500.000 at the beginning of the project (year and is reduced back to its original level in the final year. Find the internal rate of return for the project using the incremental cash flows. First, what is the annual operating cash flow of the project for year 1? (Round to the nearest dollar) Enter your answer in the answer box and then click Check Answer 12 parts remaining BA Check