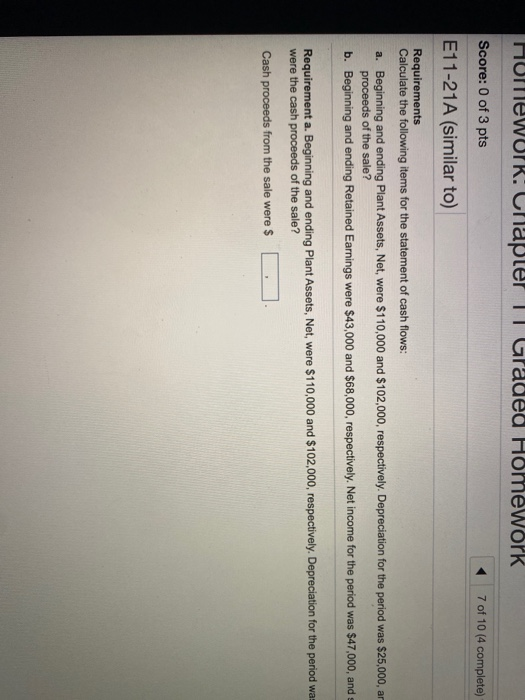

Homework: Chapter 11 Graded Homework Score: 0 of 3 pts 7 of 10 (4 completely HW Score: 36%, 9 of 25 E11-21A (similar to) Question Help Requirements Calculate the following terms for the statement of cash flows Beginning and ending Plant Assets, Net, were $110,000 and $102.000, respectively. Depreciation for the period was $25.000, and purchases of new plants were $29.000. Plants were sold at again of S8,00 What were the cash proceeds of the sale . Beginning and ending Retained Earnings were 543,000 and $68,000, respectively. Net income for the period was 547000, and stock dividends were $4.000. How much were the cash dividends? Requirements. Beginning and ending Plantes, Net, were $110,000 and $102.000, respectively. Depreciation for the period was $25.000, and purchases of new plant assets were $29,000. Plant assets were sold at again of $8,000. What were the cash proceeds of these? Cash proceeds from the sale were $ Enterary number in the edit fields and then click Check Answer. Clear All Check Answer part remaining & 7 3 5 6 8 homeWUIR: Chapter 11 Gradea Homework Score: 0 of 3 pts 7 of 10 (4 complete) E11-21A (similar to) Requirements Calculate the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, were $110,000 and $102,000, respectively. Depreciation for the period was $25,000, ar proceeds of the sale? b. Beginning and ending Retained Earnings were $43,000 and $68,000, respectively. Net income for the period was $47,000, and = Requirement a. Beginning and ending Plant Assets, Net, were $110,000 and $102,000, respectively. Depreciation for the period was were the cash proceeds of the sale? Cash proceeds from the sale were $ Save 7 of 10 (4 complete) HW Score: 36%, 9 of 25 pts Question Help wely. Depreciation for the period was $25,000, and purchases of new plant assets were $29,000. Plant assets were sold at a gain of $8,000. What were the cash ly. Net income for the period was $47,000, and stock dividends were $4,000. How much were the cash dividends? 000, respectively. Depreciation for the period was $25,000, and purchases of new plant assets were $29,000. Plant assets were sold at a gain of $8,000. What