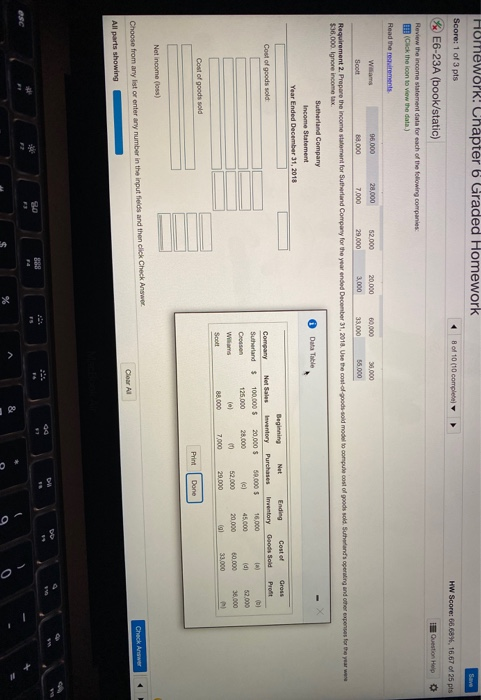

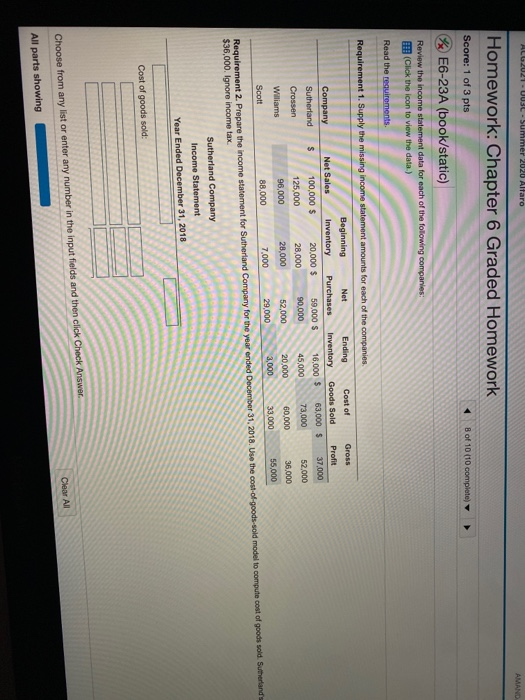

Homework! Chapter 6 Graded Homework Save Score: 1 of 3 pts 8 of 10 (10 complete HW Score: 66,68%, 16.67 of 25 pts Question Help %E6-23A (book/static) Review the income statement data for each of the following companies (Click the loon to view the data) Read the regirements Williams 95.000 28,000 52.000 20.000 60,000 30.000 Scott 88.000 7,000 29,000 3.000 33.000 55.000 Requirement 2. Prepare the income statement for Sutherland Company for the year ended December 31, 2018. Use the cond-goods-sold model to compute cost of goods sold Sutherlands operating and her expenses for the year were $36,000. Ignore income tax Sutherland Company Income Statement Data Table Year Ended December 31, 2018 Gross Pro Cost of goods sold Company Sutherland Beginning Net Ending Cost of Net as Inventory Purchases Inventory Goods Sold $ 100.000 $ 20,000 $ 50.000 $ 16 000 125.000 28.000 (c) 45.000 id (0) 00 52.000 20 000 80 000 88,000 7.000 29.000 al 33,000 Crossen 00) 52 000 36.000 Williams Scott Cost of goods sold Print Done Net income (los) Check Answer Choose from any list or enter any number in the input fields and then click Check Answer All parts showing Clear All go OC % ALG 2021 - UUSL - Summer 2020 Alfaro AMAND Homework: Chapter 6 Graded Homework Score: 1 of 3 pts 8 of 10 (10 complete) E6-23A (book/static) Review the income statement data for each of the following companies (Click the icon to view the data) Read the requirements Gross Profit 37,000 Requirement 1. Supply the missing income statement amounts for each of the companies Beginning Net Ending Cost of Company Net Sales Inventory Purchases Inventory Goods Sold Sutherland $ 100,000 $ 20,000 $ 59,000 $ 16,000 $ 63,000 $ Crossen 125,000 28,000 90.000 45.000 73,000 Williams 96,000 28,000 52,000 20.000 60,000 88,000 Scott 7.000 29,000 3,000 33,000 52.000 36.000 55,000 Requirement 2. Prepare the income statement for Sutherland Company for the year ended December 31, 2018. Use the cost of goods sold model to compute cost of goods sold Sutherlands $36,000. Ignore income tax. Sutherland Company Income Statement Year Ended December 31, 2018 Cost of goods sold Clear All Choose from any list or enter any number in the input fields and then click Check Answer All parts showing