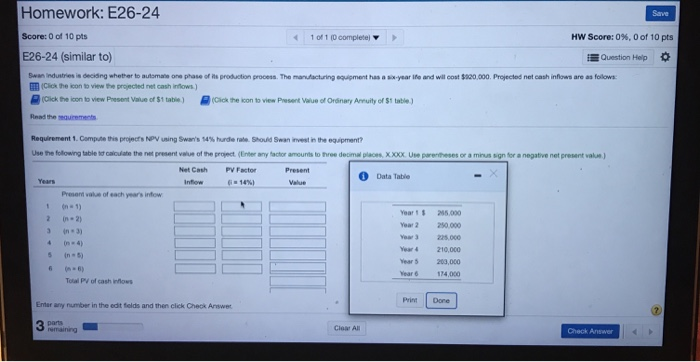

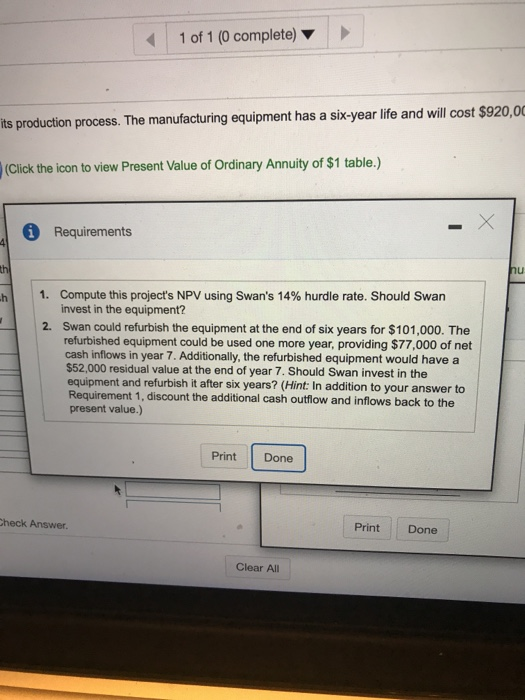

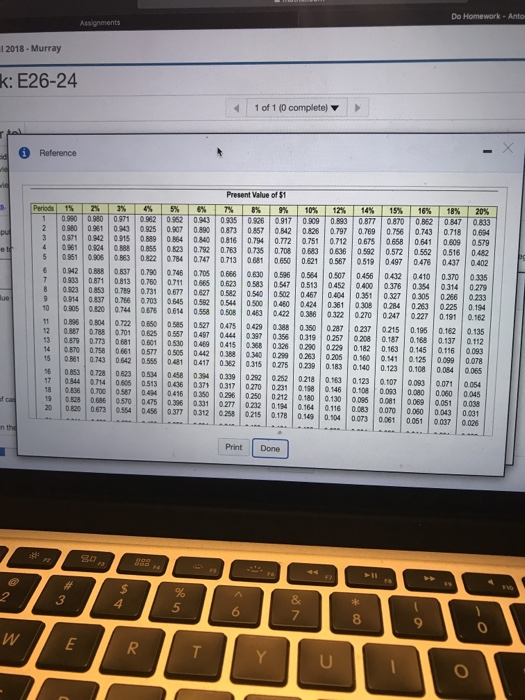

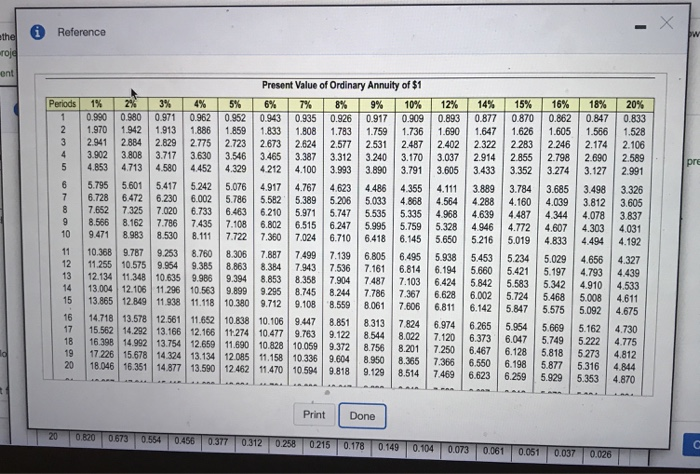

Homework: E26-24 Score: 0 of 10 pts E26-24 (similar to) Save 1of1(Doornplete) Hw Score: 0%, 0 of 10 pts Question Hosp * Swan industries is decising whether to autsmate one phase of ts production prooess. The manufacturing equipment has a six-year Ife and will cost $020,000. Projectod net cash inflows are as follows (cickthe contowew Present Value of $1 tatie ) Ock on to view Present wue eordnary Amuity of $1 table) mad the eaurements Requirement 1. Compae this prones MV uung Swan's 4% hrde ral. Should Swan r-rno equpment? Use the following table it caloulate the net present value of the project (Enter any tactor amounts to three deomal places, XXX Use parentheses or a minus sign for a negative net present value ) Net Cash PY Factor Present Data Table Years --(in 14%) Intow Present vah ot each year's irtew 1 in- 1) 3 in 3) s (n s Year1s 245.000 Year 2 250.000 Year 3225,000 Year 210,000 Year 5 203,000 Year 6 174,000 Total PV of cash inflows Print Dore Ernar any runter in the folds and then clckeck Amwm 2. Clear All Check Answer 1 of 1 (0 complete) ts production process. The manufacturing equipment has a six-year life and will cost $920,0 (Click the icon to view Present Value of Ordinary Annuity of $1 table.) 6 Requirements hl 1, compute this project's NPV using Swan's 14% hurdle rate. Should Swan invest in the equipment? Swan could refurbish the equipment at the end of six years for $101,000. The refurbished equipment could be used one more year, providing $77,000 of net cash inflows in year 7. Additionally, the refurbished equipment would have a $52,000 residual value at the end of year 7. Should Swan invest in the equipment and refurbish it after six years? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the 2. present value.) Print Done heck Answer Print Done Clear All Do Homework- Anto 1 2018- Murray k: E26-24 10f 1,0 complete) Present Value of $1 0.90 0 980 0.971 0.962 062 0943 0935 0.826 0.917 0.909 0.893 0.877 0870 0.852 0847 0833 20980 0961 043 925. 0.890 0873 0.857 0.842 08260797 0769 0.756 0743 0.718 0.694 3 0.971 0942 0.915 0889 0.84 0840 0816 0940.772 0751 0.712 0675 0658 0641 0.809 0579 4 0.961 | 0, O 888 | 0855 | 0823 | 0792 | 0763 | 0735 | 0.708 | 0683 | oss | 0592 | 0.572 | 0552 | 0.516 | 0482 5 | 0951 | OSO6 | 0863 | 0822 | 0784 | 0.747 | 0713 | 0681 | 0650 | 0621 | 0.567 | 0.519 | 0497 0.476 | 0437 | 0.402 6 0942 088 0837 0790 746 0705 0666 0630 56 054 0456 0432 010 0.370 0335 0547 0.513 0452 0400 03760.34 03140.27 0923 0.853 0.789 0.731 0677 0627 0582 00502 0467 0404 0351 0.327 0305 0266 0233 914 0837 0.76 0.703 645 052 0544 0500 0450 024 0.361 30 0284 0263 0225 .194 0933 0871 0813 0.760 0711 0665 0623 0583 11 | 0| 0804 | 0722 | 0650 | 0ses | 0527 | 0475 | 0429 | 0.388 | 0350 | 0.287 237 | 0215 | O 195 0162 1 0135 12 0.87 0788 0.701 625 055 049 0444 037 0.356 0319 0257 28 0.187 0.168 0.137 0.112 | 0415 | 0 8 | 0326 | 0290 | 0229 | 0.182 | 0163 | 014s l at16 l aces 14 0870 0.758 0661 0577 005 0442 088 0340 0290263 0205 0.160 0.141 .125 0099 0.078 15 | 0861 | 0743 | 0642 | 0555 | 0 8 | 0417 | 0362 | 0315 0275 | 0239 | 0.183 0140 0.123 0.108 0.084 0.065 6 0.853 0728 0823 0.34 0458 34 339 22 022 0218 0163 0123 0107 00830071 0054 17 0844 0.714 0805 0513 0436 037 0317 0270 0231 01 0146 0108 0.03 0.080 0.060 0.045 13 0879 | 0773 | 0681 | 0601 | 0530 | 0469 19 0828 0666 0570 0475 36 0331 027 0232 0.94 0.164 0.116 0.083 0.070 0.060 0.043 0.031 20820 0573 4 0458 0377 0312 0258 0215 0178 0.49 0104 00730061 0051 0037 0.026 Print Done 7 8 6 9 he Reference Present Value of Ordinary Annuity of $1 10.990 0.980 0971 0.962 0.952 0943 0.935 0.926 0.917 0.909 0.893 0.877 0870 0.862 0.847 0.833 2 1.970 1942 1.913 1886 859 1.833 1.808 1783 1759 1.736 690 1.647 1.626 1.605 1.566 1.528 3 2941 2884 2829 2775 2723 2.673 2.624 2.577 2531 2487 2.402 2.322 2283 2.246 2.174 2.106 4 3902 3.808 3.717 3,630 3.546 3.465 3.387 3.312 3240 3.170 3.037 2.914 2855 2.798 2.690 2.589 5 4853 4713 80 4452 4329 4212 4.100 3.93 3.890 3791 3,605 3433 3,32 3,274 3,127 2.991 6 | 5.795 | 5601 | 5417 | 5242 | 5.076 | 4.917 | 4767 | 4623 | 4486 | 4.355 | 4.111 | 3.889 | 3.784 | 3.685 | 3498 | 3326 7 6.728 6472 6230 6002 5786 552 5.389 5206 5033 4.868 4564 4.288 4.60 4.039 3.812 3605 8 7.652 7.325 7.020 6733 6.636210 5.971 5.747 5535 5.335 4.968 4639 4487 4.344 4.078 3837 9 8.566 8.162 7.786 7435 7.08 68 6515 6247 5995 5.759 5.328 4946 4772 4607 4.303 4.031 10 | 9471 8.983 | 8530 | 8.111 | 7722 | 7.360 | 7.024 | 6.710 | 6.418 | 6.145 | 5.650 | 5216 | 5.019 | 4833 | 4494 | 4.192 11 10.368 9787 9.253 8.760 8306 7.887 7,499 7139 6.805 6495 5.938 5453 5234 5029 4.656 4.327 12 11.255 10.575 9.64 9.385 8.863 8.384 7943 7536 7.161 6.814 6.194 5.660 5.4215.97 4793 4439 13 12.134 11.348 10635 9.986 9.34 8853 8358 7.904 7.487 7.103 6.424 5.842 5.583 5.342 4.910 4.533 14 13.004 12.106 11.296 10.563 9.899 9.295 8745 15 13.865 12.849 11.938 1.118 10.380 9.712 108 85 8061 7.606 6811 6142 5.847 5.575 16 14718 13.578 12561 1652 10. 8.244 7.786 7.367 668 6002 5.724 5.468 5008 4.611 5.092 4675 838 10.106 9447 8.851 8313 7824 6974 6.265 5954 5.669 5.162 4730 10477 9.763 9 18 16398 14.992 13.754 12.65 11,9 10.828 10.059 9.372 8756 8.201 7250 6467 6.128 5818 5273 4.812 19 17 226 15.678 14.324 13.134 12.085 11.158 10.336 20 18.046 16.351 14 877 13.590 12462 11.470 10 9.604 8.950 8.365 73666550 6.198 5877 5316 4.844 94 9818 9.129 8.514 7469 6623 6259 529 .33 4.870 Print Done 573-554T 456 0377 0312 0258 0215 0.178 0149 0.104 0073 0061 0.051 0.037 0026