Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Homework help!! You bought a stock one year ago for $49.97 per share and sold it today for $58.39 per share. It paid a $1.27

Homework help!!

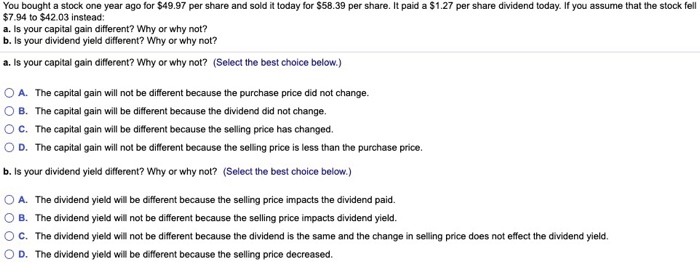

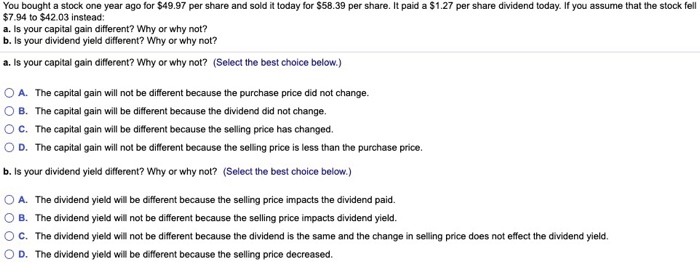

You bought a stock one year ago for $49.97 per share and sold it today for $58.39 per share. It paid a $1.27 per share dividend today. If you assume that the stock fell $7.94 to $42.03 instead: a. Is your capital gain different? Why or why not? b. Is your dividend yield different? Why or why not? a. Is your capital gain different? Why or why not? (Select the best choice below.) O A. The capital gain will not be different because the purchase price did not change. OB. The capital gain will be different because the dividend did not change. O C. The capital gain will be different because the selling price has changed OD. The capital gain will not be different because the selling price is less than the purchase price. b. Is your dividend yield different? Why or why not? (Select the best choice below.) O A. The dividend yield will be different because the selling price impacts the dividend paid. O B. The dividend yield will not be different because the selling price impacts dividend yield. O C. The dividend yield will not be different because the dividend is the same and the change in selling price does not effect the dividend yield. OD. The dividend yield will be different because the selling price decreased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started