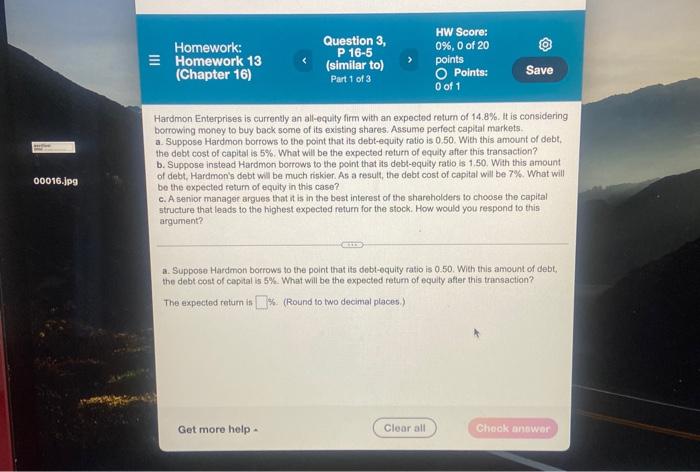

Homework Homework 13 (Chapter 16) Question 3, P 16-S (similar to HW Score N. 020 point Save Point 1 Harmon mari consult was erected of 4 is considering in on the singer Suppose Harmons to the pondus 0.50 motoros Water Supponevated on to a ponta do conto waste water wat will be the only Amnior manager wat is in the best frientes con esat sa se agreed How would you down pewne tout dettet ose we are White Teed future for at The expected tun Mon ) Homework: Homework 13 (Chapter 16) Question 3, P 16-5 (similar to) Part 1 of 3 HW Score: 0%, 0 of 20 points Points: 0 of 1 Save Hardmon Enterprises is currently an all-equity firm with an expected return of 14.8%. It is considering borrowing money to buy back some of its existing shares. Assume perfect capital markets a. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 5% What will be the expected return of equity after this transaction? b. Suppose instead Hardmon borrows to the point that its debt-equity ratio is 1.50. With this amount of debt, Hardmon's debt will be much riskier. As a result, the debt cost of capital will be 7%. What will be the expected return of equity in this caso? C. A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected return for the stock. How would you respond to this argument? 00016.jpg a. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 5% What will be the expected retum of equity after this transaction? The expected return is 1% (Round to two decimal places.) Get more help Cloor all Check answer Homework Homework 13 (Chapter 16) Question 3, P 16-S (similar to HW Score N. 020 point Save Point 1 Harmon mari consult was erected of 4 is considering in on the singer Suppose Harmons to the pondus 0.50 motoros Water Supponevated on to a ponta do conto waste water wat will be the only Amnior manager wat is in the best frientes con esat sa se agreed How would you down pewne tout dettet ose we are White Teed future for at The expected tun Mon ) Homework: Homework 13 (Chapter 16) Question 3, P 16-5 (similar to) Part 1 of 3 HW Score: 0%, 0 of 20 points Points: 0 of 1 Save Hardmon Enterprises is currently an all-equity firm with an expected return of 14.8%. It is considering borrowing money to buy back some of its existing shares. Assume perfect capital markets a. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 5% What will be the expected return of equity after this transaction? b. Suppose instead Hardmon borrows to the point that its debt-equity ratio is 1.50. With this amount of debt, Hardmon's debt will be much riskier. As a result, the debt cost of capital will be 7%. What will be the expected return of equity in this caso? C. A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected return for the stock. How would you respond to this argument? 00016.jpg a. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 5% What will be the expected retum of equity after this transaction? The expected return is 1% (Round to two decimal places.) Get more help Cloor all Check