Answered step by step

Verified Expert Solution

Question

1 Approved Answer

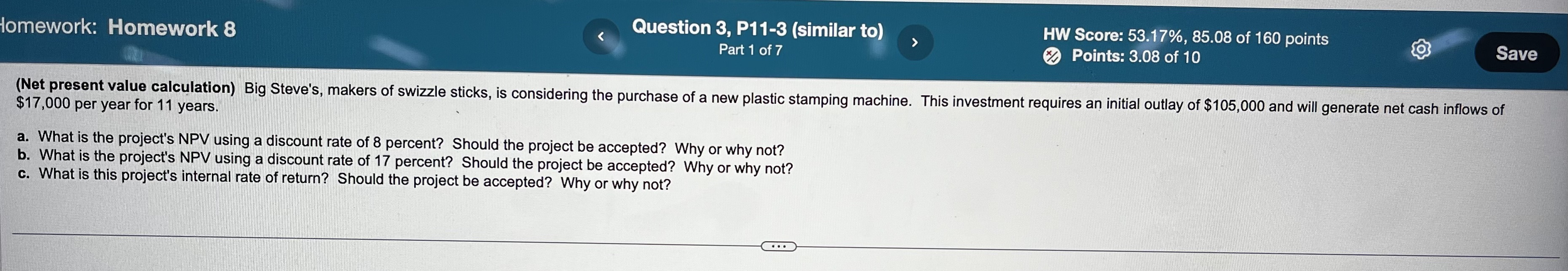

Homework: Homework 8 Question 3, P11-3 (similar to) Part 1 of 7 HW Score: 53.17%, 85.08 of 160 points Points: 3.08 of 10 Save

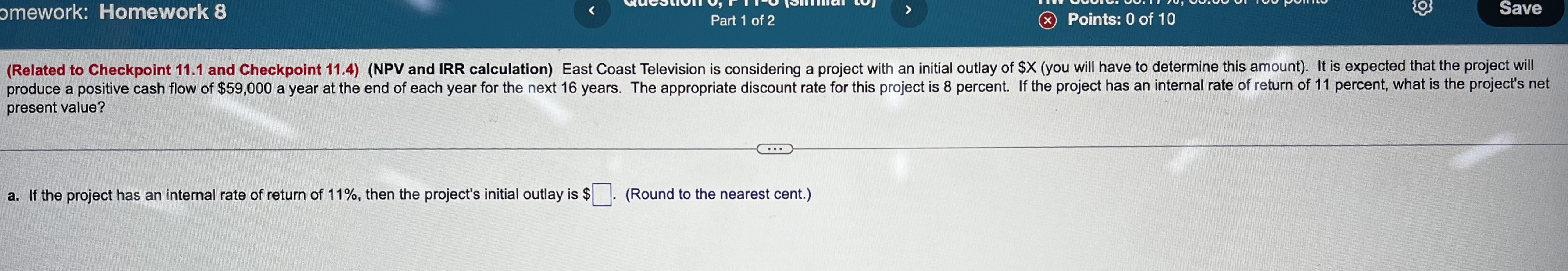

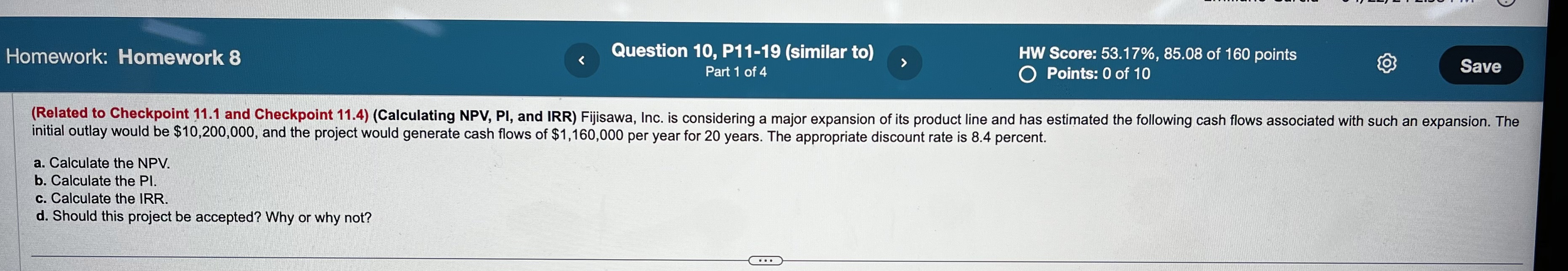

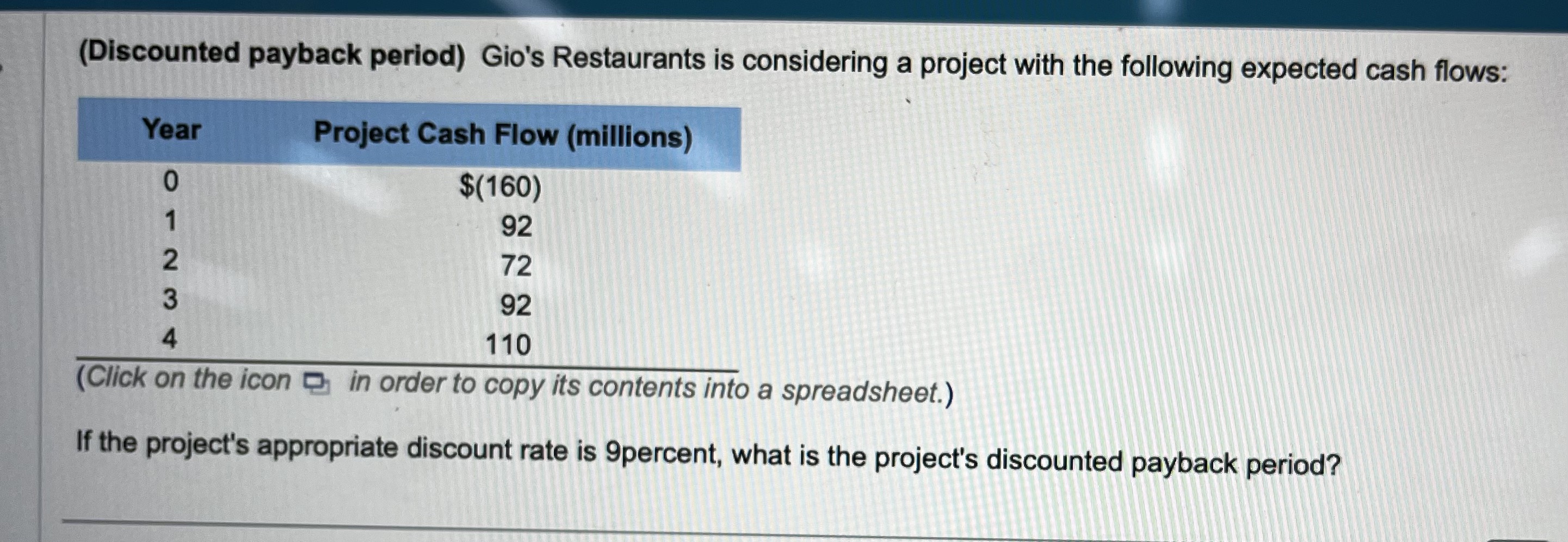

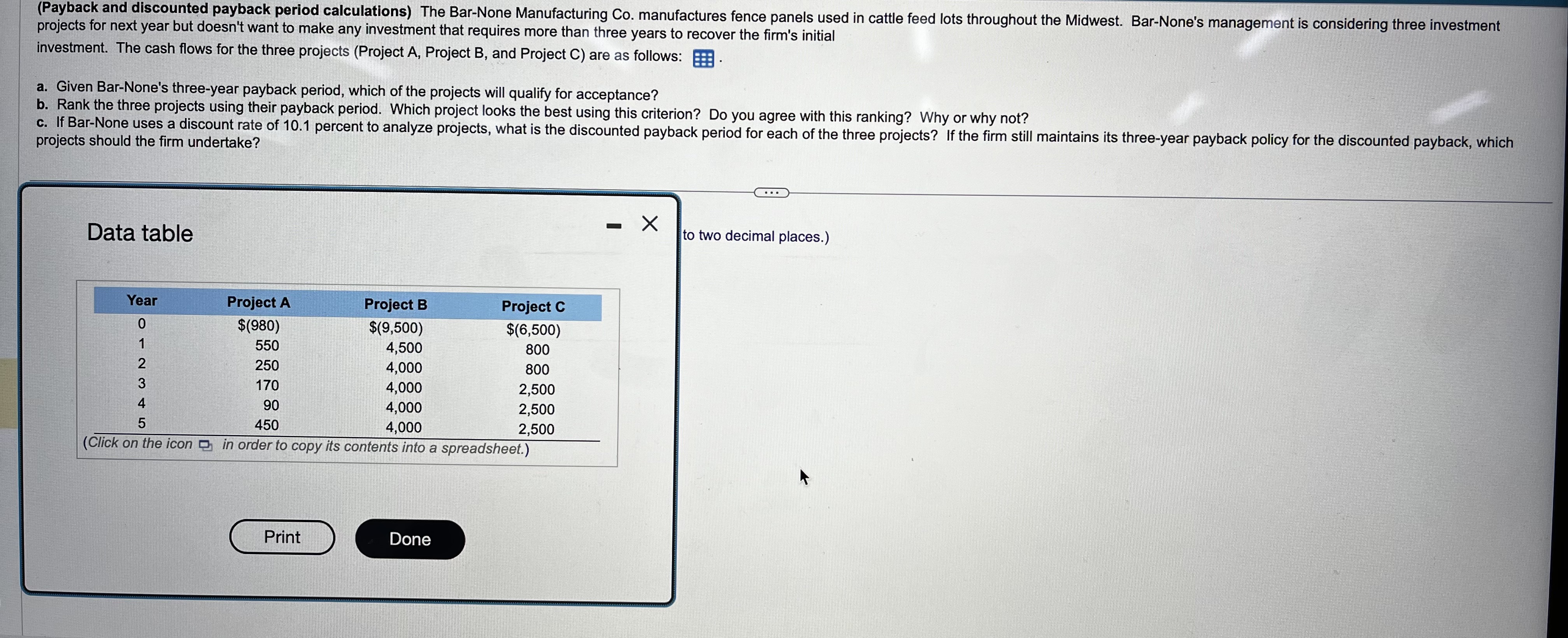

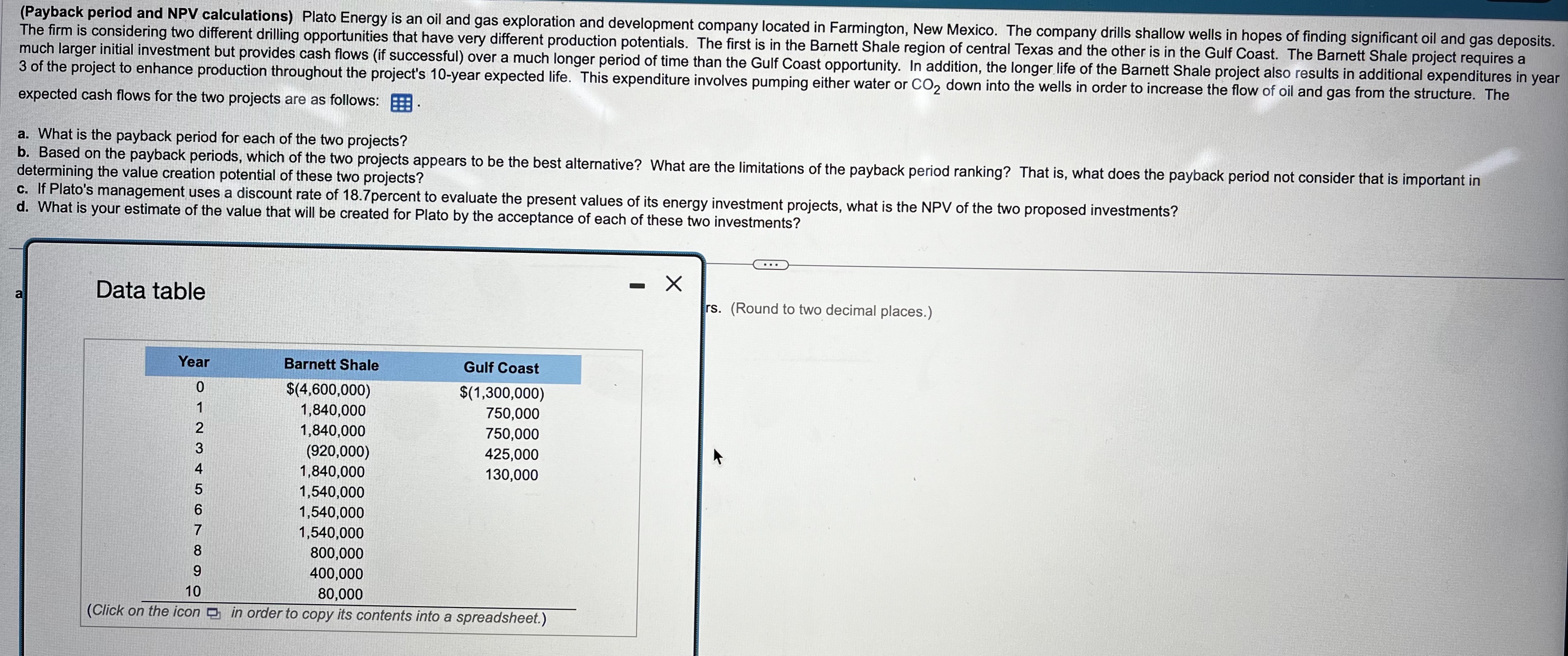

Homework: Homework 8 Question 3, P11-3 (similar to) Part 1 of 7 HW Score: 53.17%, 85.08 of 160 points Points: 3.08 of 10 Save (Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $105,000 and will generate net cash inflows of $17,000 per year for 11 years. a. What is the project's NPV using a discount rate of 8 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 17 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not? omework: Homework 8 Part 1 of 2 Points: 0 of 10 Save (Related to Checkpoint 11.1 and Checkpoint 11.4) (NPV and IRR calculation) East Coast Television is considering a project with an initial outlay of $X (you will have to determine this amount). It is expected that the project will produce a positive cash flow of $59,000 a year at the end of each year for the next 16 years. The appropriate discount rate for this project is 8 percent. If the project has an internal rate of return of 11 percent, what is the project's net present value? a. If the project has an internal rate of return of 11%, then the project's initial outlay is $ (Round to the nearest cent.) Homework: Homework 8 Question 10, P11-19 (similar to) Part 1 of 4 HW Score: 53.17%, 85.08 of 160 points O Points: 0 of 10 Save (Related to Checkpoint 11.1 and Checkpoint 11.4) (Calculating NPV, PI, and IRR) Fijisawa, Inc. is considering a major expansion of its product line and has estimated the following cash flows associated with such an expansion. The initial outlay would be $10,200,000, and the project would generate cash flows of $1,160,000 per year for 20 years. The appropriate discount rate is 8.4 percent. a. Calculate the NPV. b. Calculate the Pl. c. Calculate the IRR. d. Should this project be accepted? Why or why not? (Discounted payback period) Gio's Restaurants is considering a project with the following expected cash flows: Year Project Cash Flow (millions) $(160) 01234 92 72 92 110 (Click on the icon in order to copy its contents into a spreadsheet.) If the project's appropriate discount rate is 9percent, what is the project's discounted payback period? Homework: Homework 8 Question 12, P11-21 (similar to) > HW Score: 53.17%, 85.08 of 160 points O Points: 0 of 10 Save (Discounted payback period) The Callaway Cattle Company is considering the construction of a new feed handling system for its feed lot in Abilene, Kansas. The new system will provide annual labor savings and reduced waste totaling $180,000 while the initial investment is only $475,000. Callaway's management has used a simple payback method for evaluating new investments in the past but plans to calculate the discounted payback to analyze the investment. Where the appropriate discount rate for this type of project is 11 percent, what is the project's discounted payback period? The project's discounted payback period is years. (Round to two decimal places.) (Payback and discounted payback period calculations) The Bar-None Manufacturing Co. manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's management is considering three investment projects for next year but doesn't want to make any investment that requires more than three years to recover the firm's initial investment. The cash flows for the three projects (Project A, Project B, and Project C) are as follows: a. Given Bar-None's three-year payback period, which of the projects will qualify for acceptance? b. Rank the three projects using their payback period. Which project looks the best using this criterion? Do you agree with this ranking? Why or why not? c. If Bar-None uses a discount rate of 10.1 percent to analyze projects, what is the discounted payback period for each of the three projects? If the firm still maintains its three-year payback policy for the discounted payback, which projects should the firm undertake? Data table Year Project A 0 $(980) Project B $(9,500) Project C $(6,500) 1 550 4,500 800 2 250 4,000 800 3 170 4,000 2,500 4 90 4,000 2,500 5 450 4,000 2,500 (Click on the icon in order to copy its contents into a spreadsheet.) Print Done - to two decimal places.) (Payback period and NPV calculations) Plato Energy is an oil and gas exploration and development company located in Farmington, New Mexico. The company drills shallow wells in hopes of finding significant oil and gas deposits. The firm is considering two different drilling opportunities that have very different production potentials. The first is in the Barnett Shale region of central Texas and the other is in the Gulf Coast. The Barnett Shale project requires a much larger initial investment but provides cash flows (if successful) over a much longer period of time than the Gulf Coast opportunity. In addition, the longer life of the Barnett Shale project also results in additional expenditures in year 3 of the project to enhance production throughout the project's 10-year expected life. This expenditure involves pumping either water or CO2 down into the wells in order to increase the flow of oil and gas from the structure. The expected cash flows for the two projects are as follows: a. What is the payback period for each of the two projects? b. Based on the payback periods, which of the two projects appears to be the best alternative? What are the limitations of the payback period ranking? That is, what does the payback period not consider that is important in determining the value creation potential of these two projects? c. If Plato's management uses a discount rate of 18.7percent to evaluate the present values of its energy investment projects, what is the NPV of the two proposed investments? d. What is your estimate of the value that will be created for Plato by the acceptance of each of these two investments? a Data table Year Barnett Shale Gulf Coast 012345 $(4,600,000) $(1,300,000) 1,840,000 750,000 1,840,000 750,000 (920,000) 425,000 1,840,000 130,000 1,540,000 6 1,540,000 7 1,540,000 8 800,000 9 400,000 10 80,000 (Click on the icon in order to copy its contents into a spreadsheet.) - rs. (Round to two decimal places.) Homework: Homework 8 Question 15, P11-24 (similar to) Part 1 of 5 HW Score: 53.17%, 85.08 of 160 points Points: 2 of 10 Save (Payback period, net present value, profitability index, and internal rate of return calculations) You are considering a project with an initial cash outlay of $70,000 and expected cash flows of $18,900 at the end of each year for six years. The discount rate for this project is 9.9 percent. a. What are the project's payback and discounted payback periods? b. What is the project's NPV? c. What is the project's PI? d. What is the project's IRR?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started