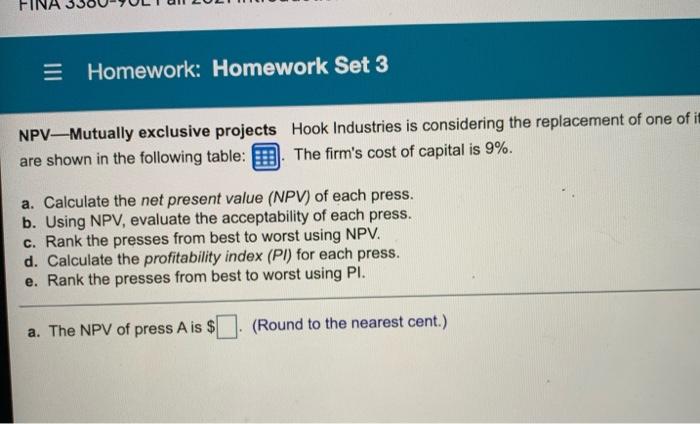

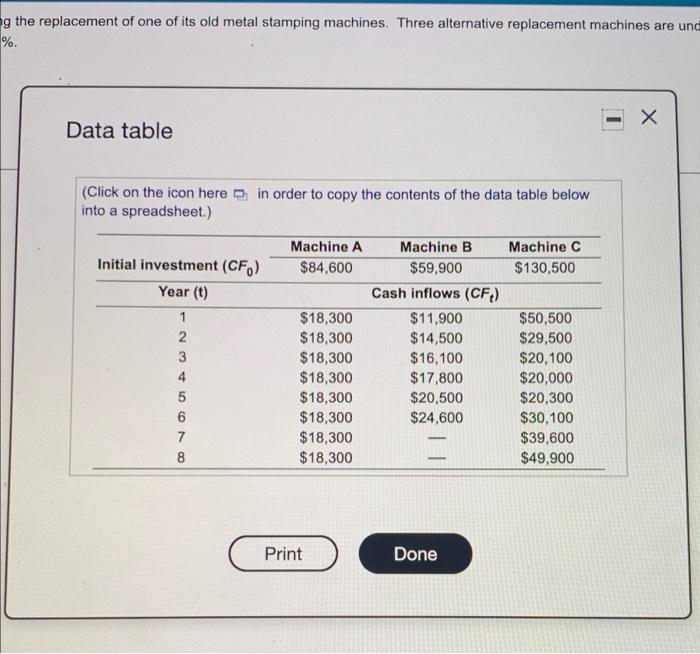

Homework: Homework Set 3 Question 17, P10-10 (al.. Part 15 HW Bore: 53.17, 2656 of 50 points O Points of 2 Save NPV Mutually exclusive projects Hook Industries is considering the replacement of one of its old me stamping machines. The verplacement machine wunder consideration. The reach out the shown in the following table The cost of capital Calowe MPVof each press b. Using what the comptability of each pross Rank proses to best to worstaing NPU Calue the profitability inde for each Data table . presses om bost to worst sing PL The NPV of press Ais Round the restent) (Click on the near to copy the the title below into al Machine A Machine Machine C Initial investment (CF) 60 358.900 3130.500 Year (0 Cashflow (CF) $18,300 311.300 500.000 $18,300 $14.500 529 500 518300 316.100 520.100 4 $18.00 3170 $20.000 5 $18,300 $20.000 320, 300 $18.300 330,100 $18.30 130.000 318,300 SAD 14.500 Print Dono = Homework: Homework Set 3 NPVMutually exclusive projects Hook Industries is considering the replacement of one of it are shown in the following table: The firm's cost of capital is 9%. a. Calculate the net present value (NPV) of each press. b. Using NPV, evaluate the acceptability of each press. c. Rank the presses from best to worst using NPV. d. Calculate the profitability index (PI) for each press. e. Rank the presses from best to worst using PI. a. The NPV of press A is $ (Round to the nearest cent.) ng the replacement of one of its old metal stamping machines. Three alternative replacement machines are und %. X Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Machine C $130,500 Initial investment (CF) Year (t) 1 OOO OMAN 2 3 4 5 6 7 8 Machine A Machine B $84,600 $59,900 Cash inflows (CF) $18,300 $11,900 $18,300 $14,500 $18,300 $16,100 $18,300 $17,800 $18,300 $20,500 $18,300 $24,600 $18,300 $18,300 $50,500 $29,500 $20,100 $20,000 $20,300 $30,100 $39,600 $49,900 Print Done Homework: Homework Set 3 Question 17, P10-10 (al.. Part 15 HW Bore: 53.17, 2656 of 50 points O Points of 2 Save NPV Mutually exclusive projects Hook Industries is considering the replacement of one of its old me stamping machines. The verplacement machine wunder consideration. The reach out the shown in the following table The cost of capital Calowe MPVof each press b. Using what the comptability of each pross Rank proses to best to worstaing NPU Calue the profitability inde for each Data table . presses om bost to worst sing PL The NPV of press Ais Round the restent) (Click on the near to copy the the title below into al Machine A Machine Machine C Initial investment (CF) 60 358.900 3130.500 Year (0 Cashflow (CF) $18,300 311.300 500.000 $18,300 $14.500 529 500 518300 316.100 520.100 4 $18.00 3170 $20.000 5 $18,300 $20.000 320, 300 $18.300 330,100 $18.30 130.000 318,300 SAD 14.500 Print Dono = Homework: Homework Set 3 NPVMutually exclusive projects Hook Industries is considering the replacement of one of it are shown in the following table: The firm's cost of capital is 9%. a. Calculate the net present value (NPV) of each press. b. Using NPV, evaluate the acceptability of each press. c. Rank the presses from best to worst using NPV. d. Calculate the profitability index (PI) for each press. e. Rank the presses from best to worst using PI. a. The NPV of press A is $ (Round to the nearest cent.) ng the replacement of one of its old metal stamping machines. Three alternative replacement machines are und %. X Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Machine C $130,500 Initial investment (CF) Year (t) 1 OOO OMAN 2 3 4 5 6 7 8 Machine A Machine B $84,600 $59,900 Cash inflows (CF) $18,300 $11,900 $18,300 $14,500 $18,300 $16,100 $18,300 $17,800 $18,300 $20,500 $18,300 $24,600 $18,300 $18,300 $50,500 $29,500 $20,100 $20,000 $20,300 $30,100 $39,600 $49,900 Print Done