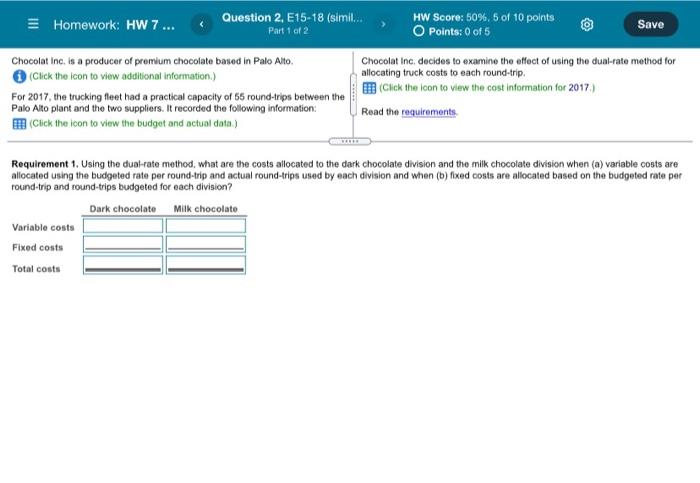

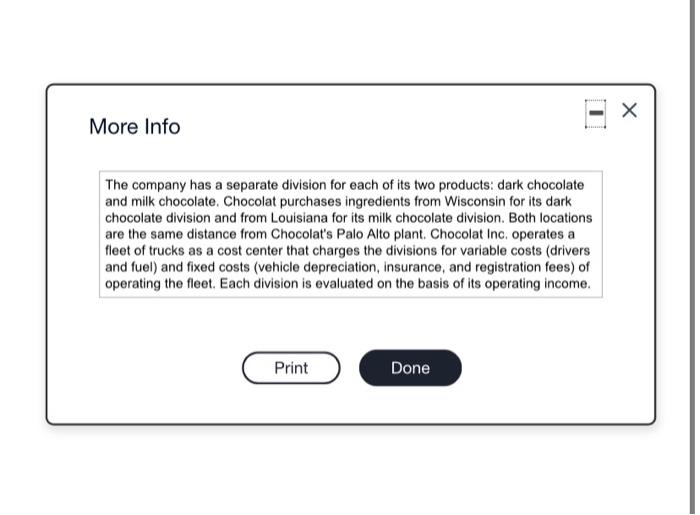

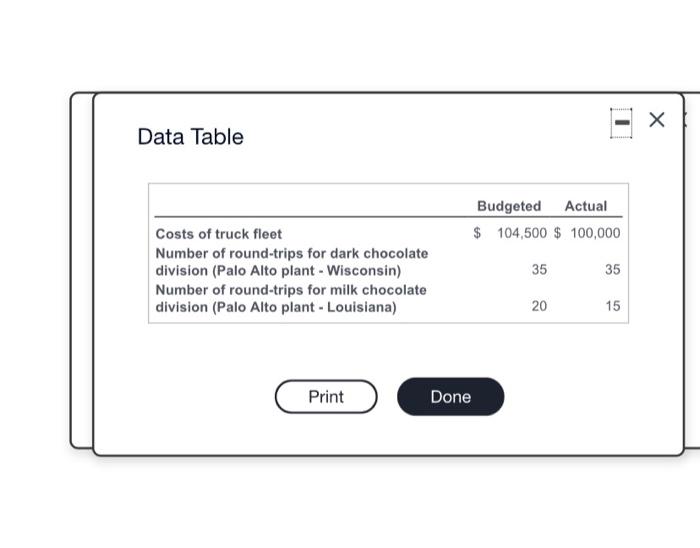

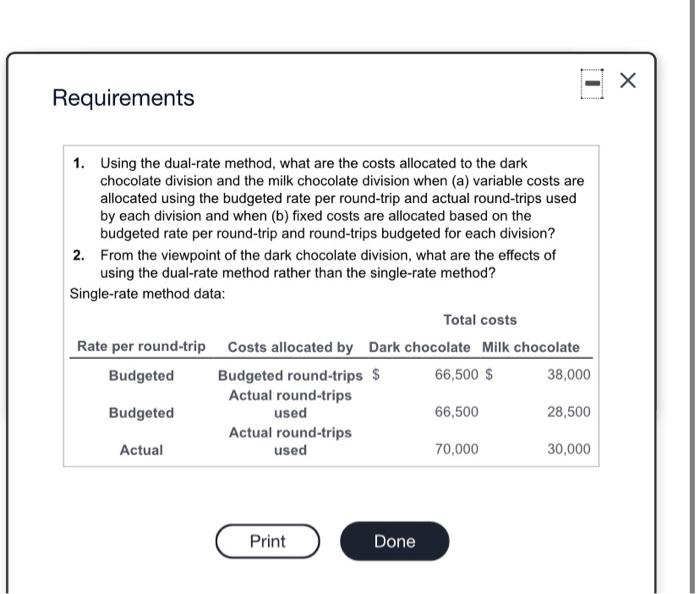

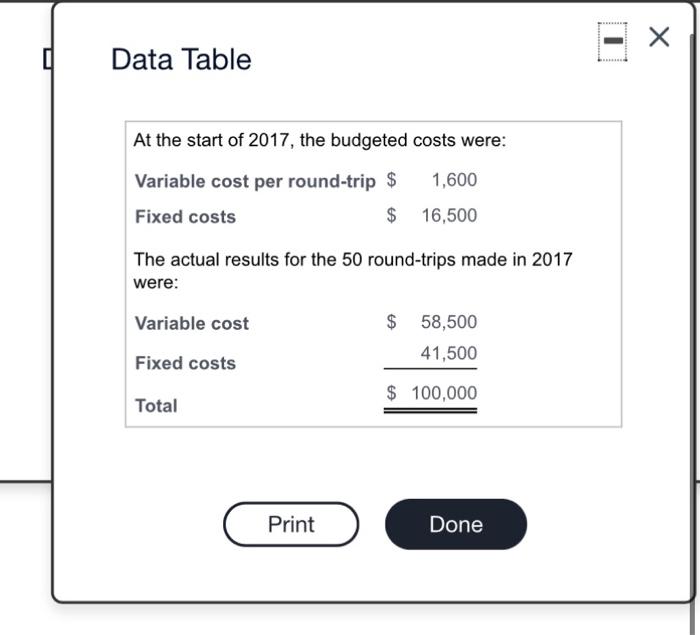

Homework: HW 7... Question 2, E15-18 (simil... HW Score: 50%, 5 of 10 points Part 1 of 2 O Points: 0 of 5 Save Chocolat Inc. is a producer of premium chocolate based in Palo Alto Chocolat Inc, decides to examine the effect of using the dual-rate method for Click the icon to view additional information) allocating truck costs to each round-trip. Click the icon to view the cost information for 2017) For 2017, the trucking fleet had a practical capacity of 55 round-trips between the Palo Alto plant and the two suppliers. It recorded the following information: Read the requirements Click the icon to view the budget and actual data) Requirement 1. Using the dual-rate method, what are the costs allocated to the dark chocolate division and the milk chocolate division when (a) variable costs are allocated using the budgeted rate per round-trip and actual round-trips used by each division and when (b) fixed costs are allocated based on the budgeted rate per round-trip and round-trips budgeted for each division? Dark chocolate Milk chocolate Variable costs Fixed costs Total costs More Info The company has a separate division for each of its two products: dark chocolate and milk chocolate Chocolat purchases ingredients from Wisconsin for its dark chocolate division and from Louisiana for its milk chocolate division. Both locations are the same distance from Chocolat's Palo Alto plant. Chocolat Inc. operates a fleet of trucks as a cost center that charges the divisions for variable costs (drivers and fuel) and fixed costs (vehicle depreciation, insurance, and registration fees) of operating the fleet. Each division is evaluated on the basis of its operating income. Print Done Data Table Budgeted Actual $ 104,500 $ 100,000 Costs of truck fleet Number of round-trips for dark chocolate division (Palo Alto plant - Wisconsin) Number of round-trips for milk chocolate division (Palo Alto plant. Louisiana) 35 35 20 15 Print Done Ex Requirements 1. Using the dual-rate method, what are the costs allocated to the dark chocolate division and the milk chocolate division when (a) variable costs are allocated using the budgeted rate per round-trip and actual round-trips used by each division and when (b) fixed costs are allocated based on the budgeted rate per round-trip and round-trips budgeted for each division? 2. From the viewpoint of the dark chocolate division, what are the effects of using the dual-rate method rather than the single-rate method? Single-rate method data: Total costs Rate per round-trip Costs allocated by Dark chocolate Milk chocolate Budgeted Budgeted round-trips $ 66,500 $ 38,000 Actual round-trips Budgeted used 66,500 28,500 Actual round-trips Actual used 70,000 30,000 Print Done Data Table At the start of 2017, the budgeted costs were: Variable cost per round-trip $ 1,600 Fixed costs $ 16,500 The actual results for the 50 round-trips made in 2017 were: Variable cost $ 58,500 41,500 Fixed costs $ 100,000 Total Print Done Homework: HW 7... Question 2, E15-18 (simil... HW Score: 50%, 5 of 10 points Part 1 of 2 O Points: 0 of 5 Save Chocolat Inc. is a producer of premium chocolate based in Palo Alto Chocolat Inc, decides to examine the effect of using the dual-rate method for Click the icon to view additional information) allocating truck costs to each round-trip. Click the icon to view the cost information for 2017) For 2017, the trucking fleet had a practical capacity of 55 round-trips between the Palo Alto plant and the two suppliers. It recorded the following information: Read the requirements Click the icon to view the budget and actual data) Requirement 1. Using the dual-rate method, what are the costs allocated to the dark chocolate division and the milk chocolate division when (a) variable costs are allocated using the budgeted rate per round-trip and actual round-trips used by each division and when (b) fixed costs are allocated based on the budgeted rate per round-trip and round-trips budgeted for each division? Dark chocolate Milk chocolate Variable costs Fixed costs Total costs More Info The company has a separate division for each of its two products: dark chocolate and milk chocolate Chocolat purchases ingredients from Wisconsin for its dark chocolate division and from Louisiana for its milk chocolate division. Both locations are the same distance from Chocolat's Palo Alto plant. Chocolat Inc. operates a fleet of trucks as a cost center that charges the divisions for variable costs (drivers and fuel) and fixed costs (vehicle depreciation, insurance, and registration fees) of operating the fleet. Each division is evaluated on the basis of its operating income. Print Done Data Table Budgeted Actual $ 104,500 $ 100,000 Costs of truck fleet Number of round-trips for dark chocolate division (Palo Alto plant - Wisconsin) Number of round-trips for milk chocolate division (Palo Alto plant. Louisiana) 35 35 20 15 Print Done Ex Requirements 1. Using the dual-rate method, what are the costs allocated to the dark chocolate division and the milk chocolate division when (a) variable costs are allocated using the budgeted rate per round-trip and actual round-trips used by each division and when (b) fixed costs are allocated based on the budgeted rate per round-trip and round-trips budgeted for each division? 2. From the viewpoint of the dark chocolate division, what are the effects of using the dual-rate method rather than the single-rate method? Single-rate method data: Total costs Rate per round-trip Costs allocated by Dark chocolate Milk chocolate Budgeted Budgeted round-trips $ 66,500 $ 38,000 Actual round-trips Budgeted used 66,500 28,500 Actual round-trips Actual used 70,000 30,000 Print Done Data Table At the start of 2017, the budgeted costs were: Variable cost per round-trip $ 1,600 Fixed costs $ 16,500 The actual results for the 50 round-trips made in 2017 were: Variable cost $ 58,500 41,500 Fixed costs $ 100,000 Total Print Done