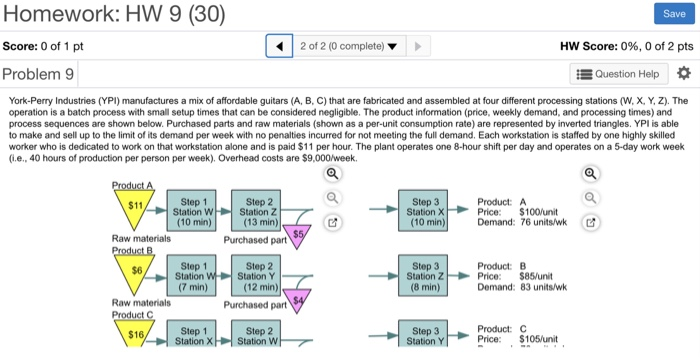

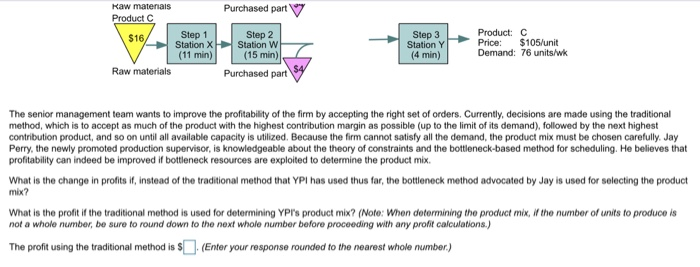

Homework: HW 9 (30) Score: 0 of 1 pt Problem 9 Save 2 of 2 (0 complete) HW Score: 0%, 0 of 2 pts Question Help York-Perry Industries (YPI) manufactures a mix of affordable guitars (A, B, C) that are fabricated and assembled at four different processing stations (W, X, Y, Z). The operation is a batch process with small setup times that can be considered negligible. The product information (price, weekly demand, and processing times) and process sequences are shown below. Purchased parts and raw materials (shown as a per-unit consumption rate) are represented by inverted triangles. YPl is able to make and sell up to the limit of its demand per week with no penalties incurred for not meeting the full demand. Each workstation is staffed by one highly skilled worker who is dedicated to work on that workstation alone and is paid $11 per hour. The plant operates one 8-hour shift per day and operates on a 5-day work weelk L.e., 40 hours of production per person per week). Overhead costs are $9,000/week. Step 1 Station WW (10 min) Step 2 Station Z (13 min) Step 3 Station X Product: A Price: $100/unit Demand: 76 units/wk Raw materials Purchased part Step 1 (7 min) Step 2 Station Y (12 min) Step 3 Station Z Product: B Price: $85Vunit Demand: 83 units/wk $6 (8 min) Raw materials Purchased part Step 2 Station X HStation W Product C Price: $105/unit Step 1 Step 3 Station Y $16 Kaw matenais Purchased part Product C Step 1 Station X Step 2 Station Ww (15 min) Step 3 Station Y Product: C Price: $105/unit Demand: 76 units/wk $16 (11 min) Raw materials Purchased part The senior management team wants to improve the profitability of the firm by accepting the right set of orders. Currently, decisions are made using the traditional method, which is to accept as much of the product with the highest contribution margin as possible (up to the limit of its demand), followed by the next highest contribution product, and so on until all available capacity is utilized. Because the firm cannot satisfy all the demand, the product mix must be chosen carefully. Jay Perry, the newly promoted production supervisor, is knowledgeable about the theory of constraints and the bottleneck-based method for scheduling. He believes that profitability can indeed be improved if bottleneck resources are exploited to determine the product mix. What is the change in profits if, instead of the traditional method that YPI has used thus far, the bottleneck method advocated by Jay is used for selecting the product mix? What is the profit if the traditional method is used for determining YPI's product mix? (Note: When determining the product mix, if the number of units to produce is not a whole number, be sure to round down to the next whole number before proceeding with any profit calculations.) The proft using the traditional method is S(Enter your response rounded to the nearest whole number) Homework: HW 9 (30) Score: 0 of 1 pt Problem 9 Save 2 of 2 (0 complete) HW Score: 0%, 0 of 2 pts Question Help York-Perry Industries (YPI) manufactures a mix of affordable guitars (A, B, C) that are fabricated and assembled at four different processing stations (W, X, Y, Z). The operation is a batch process with small setup times that can be considered negligible. The product information (price, weekly demand, and processing times) and process sequences are shown below. Purchased parts and raw materials (shown as a per-unit consumption rate) are represented by inverted triangles. YPl is able to make and sell up to the limit of its demand per week with no penalties incurred for not meeting the full demand. Each workstation is staffed by one highly skilled worker who is dedicated to work on that workstation alone and is paid $11 per hour. The plant operates one 8-hour shift per day and operates on a 5-day work weelk L.e., 40 hours of production per person per week). Overhead costs are $9,000/week. Step 1 Station WW (10 min) Step 2 Station Z (13 min) Step 3 Station X Product: A Price: $100/unit Demand: 76 units/wk Raw materials Purchased part Step 1 (7 min) Step 2 Station Y (12 min) Step 3 Station Z Product: B Price: $85Vunit Demand: 83 units/wk $6 (8 min) Raw materials Purchased part Step 2 Station X HStation W Product C Price: $105/unit Step 1 Step 3 Station Y $16 Kaw matenais Purchased part Product C Step 1 Station X Step 2 Station Ww (15 min) Step 3 Station Y Product: C Price: $105/unit Demand: 76 units/wk $16 (11 min) Raw materials Purchased part The senior management team wants to improve the profitability of the firm by accepting the right set of orders. Currently, decisions are made using the traditional method, which is to accept as much of the product with the highest contribution margin as possible (up to the limit of its demand), followed by the next highest contribution product, and so on until all available capacity is utilized. Because the firm cannot satisfy all the demand, the product mix must be chosen carefully. Jay Perry, the newly promoted production supervisor, is knowledgeable about the theory of constraints and the bottleneck-based method for scheduling. He believes that profitability can indeed be improved if bottleneck resources are exploited to determine the product mix. What is the change in profits if, instead of the traditional method that YPI has used thus far, the bottleneck method advocated by Jay is used for selecting the product mix? What is the profit if the traditional method is used for determining YPI's product mix? (Note: When determining the product mix, if the number of units to produce is not a whole number, be sure to round down to the next whole number before proceeding with any profit calculations.) The proft using the traditional method is S(Enter your response rounded to the nearest whole number)