Answered step by step

Verified Expert Solution

Question

1 Approved Answer

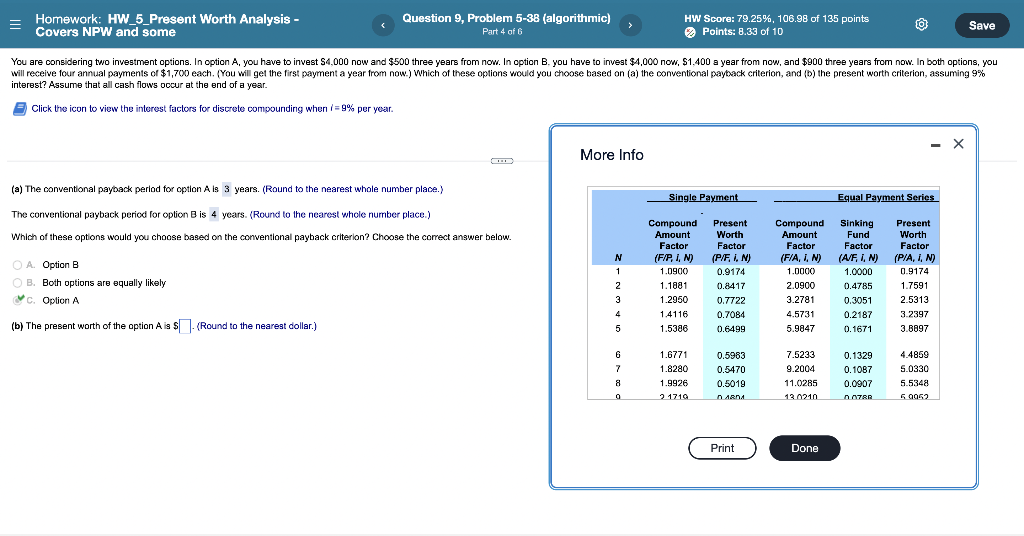

Homework: HW_5_Present Worth Analysis - Covers NPW and some Question 9, Problem 5-38 (algorithmic) Part 4 of 6 HW Score: 79.25%, 106.98 of 135

Homework: HW_5_Present Worth Analysis - Covers NPW and some Question 9, Problem 5-38 (algorithmic) Part 4 of 6 HW Score: 79.25%, 106.98 of 135 points Points: 8.33 of 10 Save You are considering two investment options. In option A, you have to invest $4,000 now and $500 three years from now. In option B. you have to invest $4,000 now, $1,400 a year from now, and $900 three years from now. In both options, you will receive four annual payments of $1,700 each. (You will get the first payment a year from now.) Which of these options would you choose based on (a) the conventional payback criterion, and (b) the present worth criterion, assuming 9% interest? Assume that all cash flows occur at the end of a year. Click the icon to view the interest factors for discrete compounding when /=9% per year. (a) The conventional payback period for option A is 3 years. (Round to the nearest whole number place.) The conventional payback period for option B is 4 years. (Round to the nearest whole number place.) Which of these options would you choose based on the conventional payback criterion? Choose the correct answer below. A. Option B B. Both options are equally likely C. Option A (b) The present worth of the option A is $. (Round to the nearest dollar.) More Info Single Payment Equal Payment Series Compound Present Amount Worth Compound Amount Factor Factor Factor Sinking Fund Factor Present Worth Factor N (F/P, I, N) (P/F, I, N) (F/A, I, N) (A/F, i, N) (P/A, i, N) 1 1.0900 0.9174 1.0000 1.0000 0.9174 2 1.1881 0.8417 2.0900 0.4785 1.7591 3 1.2950 0.7722 3.2781 0.3051 2.5313 4 1.4116 0.7084 4.5731 0.2187 3.2397 5 1.5386 0.6499 5.9847 0.1671 3.8897 6 1.6771 0.5983 7.5233 0.1329 4.4859 7 1.8280 0.5470 9.2004 0.1087 5.0330 8 1.9926 0.5019 11.0285 0.0907 5.5348 0 21719 01801 13.0210 0.0788 60062 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started