Homework- Problem #5 - El Paso Medical Center

A.

- Propose an adequate allocation model for El Paso Medical Centers situation. Explain in detail.

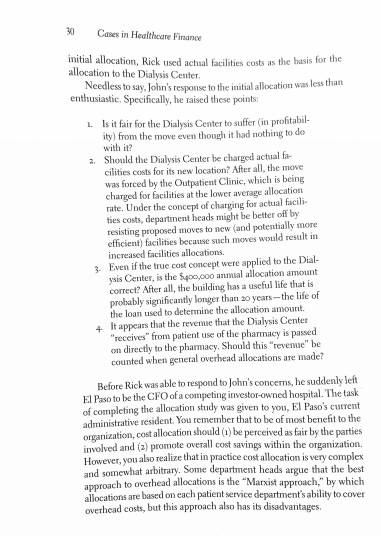

- Is it fair for the Dialysis Center to suffer (in profitability), from the move even though it had nothing to do with it?

- Should the Dialysis Center be charged actual facilities costs for its new location? After all, the move was forced by the Outpatient Clinic, which is being charged for facilities at the lower average allocation rate. Under the concept of charging for actual facilities costs, department heads might be better off by resisting proposed moves to new (and potentially more efficient) facilities because such moves would result in increased facilities allocations.

- Even if the true cost concept were applied to the Dialysis Center, is the $400,000 annual allocation amount correct? After all, the building has a useful life that is probably significantly longer than 20 years the life of the loan used to determine the allocation amount.

- It appears that the revenue that the Dialysis Center receives from patient use of the pharmacy is passed on directly to the pharmacy. Should this revenue be counted when general overhead allocations are made?

- iii. How do these answers help in the development of a solution for proposed main cost management problem? Explain in detail.

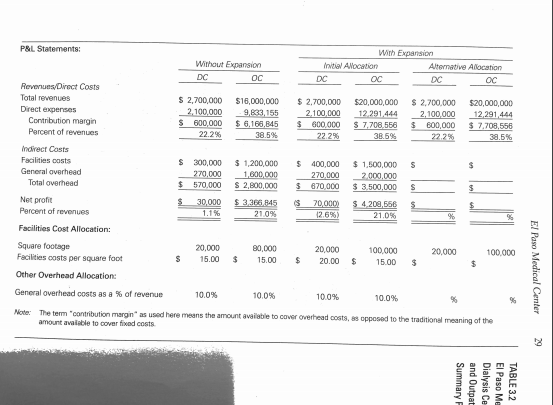

- Considering all the relevant issues, you must develop and justify a new indirect cost allocation scheme for outpatient services. Summarize your results in the Alternative Allocation in table 2.

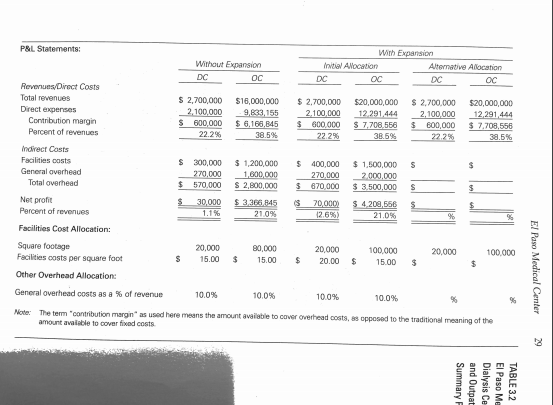

| Table 2 | | | | | | | | |

| El Paso Medical Center |

| | Without Expansion | | With Expansion | | With Expansion |

| | | | Initial Allocation | | Alternative Allocation |

| Revenues/Direct costs | DC | OC | | DC | OC | | DC | OC |

| Total revenues | $2,700,000 | $16,000,000 | | $2,700,000 | $20,000,000 | | $2,700,000 | $20,000,000 |

| Direct expenses | $2,100,000 | $9,833,155 | | $2,100,000 | $12,291,444 | | $2,100,000 | $12,291,444 |

| Contribution margin | $600,000 | $6,166,845 | | $600,000 | $7,708,556 | | $600,000 | $7,708,556 |

| Percent of revenues | 22.20% | 38.50% | | 22.20% | 38.50% | | 22.20% | 38.50% |

| Indirect Costs | | | | | | | | |

| Facilities costs | $300,000 | $1,200,000 | | $400,000 | $1,500,000 | | ? | ? |

| General overhead | $270,000 | $1,600,000 | | $270,000 | $2,000,000 | | ? | ? |

| Total overhead | $570,000 | $2,800,000 | | $670,000 | $3,500,000 | | ? | ? |

| Net profit | $30,000 | $3,366,845 | | $70,000 | $4,208,556 | | ? | ? |

| | | | | | | | | |

| Percent of revenues | 1.10% | 21.00% | | 2.60% | 21.00% | | ? | ? |

| Facilities cost allocation: | | | | | | | | |

| Square footage | $20,000 | $80,000 | | $20,000 | $100,000 | | $20,000 | $100,000 |

| Facilities costs per square foot | $15.00 | $15.00 | | $20.00 | $15.00 | | ? | ? |

| Other Overhead Allocation: | | | | | | | | |

| General overhead costs as a % | 10.00% | 10.00% | | 10.00% | 10.00% | | ? | ? |

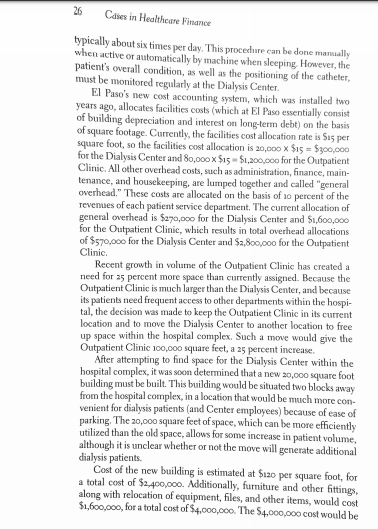

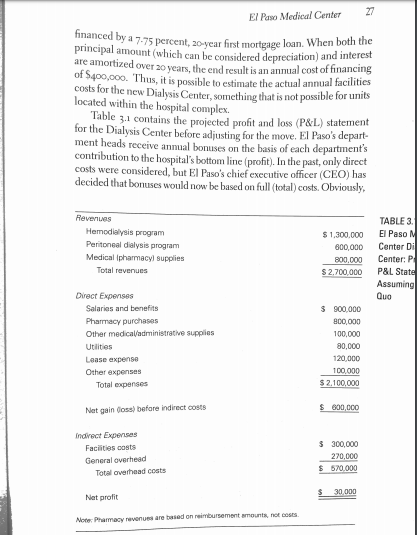

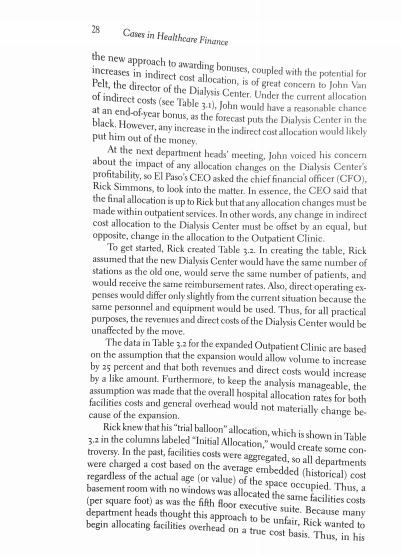

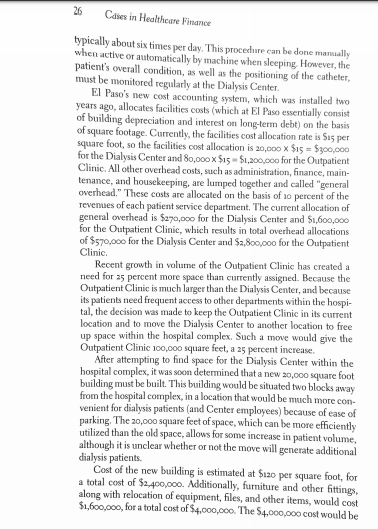

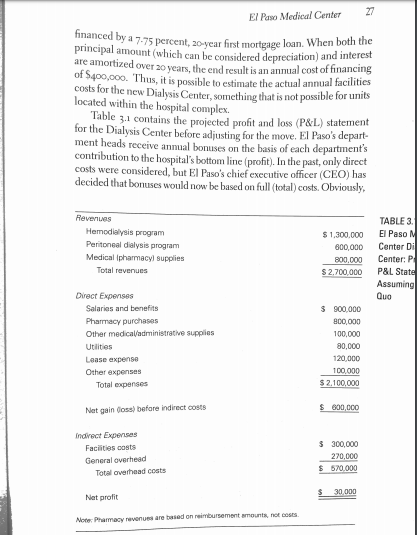

UN EL PASO MEDICAL CENTER COST ALLOCATION CONCEPTS EL PASO MEDICAL CENTER is a full-service not-for-profit acute care hospital with 325 beds located in El Paso, Texas. It is part of the three-hospital Rio Grande Healthcare System. The bulk of the hospital's facilities are devoted to inpatient care and emergency services. However, a 100,000 square-foot section of the hospital complex is devoted to out- patient services. Currently, this space has two primary uses. About 80 percent of the space is used by the Outpatient Clinic, which handles all routine outpatient services offered by the hospital. The remaining 20 percent is used by the Dialysis Center The Dialysis Center performs hemodialysis and peritoneal dialysis, which are alternative processes that remove wastes and excess water from the blood for patients with end-stage renal (kidney) disease. In hemodialysis, blood is pumped from the patient's arm through a shunt into a dialysis machine, which uses a cleansing solution and an arti- ficial membrane to perform the functions of a healthy kidney. Then, the cleansed blood is pumped back into the patient through a second shunt. In peritoneal dialysis, the cleansing solution is inserted directly into the abdominal cavity through a catheter. The body naturally cleanses the blood through the peritoneum-a thin membrane that lines the abdominal cavity. In general, hemodialysis patients require three dialy- ses a week, with each treatment lasting about four hours. Patients who use peritoneal dialysis change their own cleansing solutions at home, 26 Cases in Healthcare Finance typically about six times per day. This procedure can be done manually when active or automatically by machine when sleeping However, the patient's overall condition, as well as the positioning of the catheter, must be monitored regularly at the Dialysis Center El Paso's new cost accounting system, which was installed two years ago, allocates facilities costs (which at El Paso essentially consist of building depreciation and interest on long-term debt) on the basis of square footage. Currently, the facilities cost allocation rate is Sus per square foot, so the facilities cost allocation is 20,000 X S15 = 5300,000 for the Dialysis Center and 80,000 x $15 $1,200,000 for the Outpatient Clinic. All other overhead costs, such as administration, finance, main- tenance, and housekeeping, are lumped together and called "general overhead." These costs are allocated on the basis of 10 percent of the revenues of each patient service department. The current allocation of general overhead is $270,000 for the Dialysis Center and $1,600,000 for the Outpatient Clinic, which results in total overhead allocations of $570,000 for the Dialysis Center and $2,800,000 for the Outpatient Clinic. Recent growth in volume of the Outpatient Clinic has created a need for 25 percent more space than currently assigned. Because the Outpatient Clinic is much larger than the Dialysis Center, and because its patients need frequent access to other departments within the hospi- tal, the decision was made to keep the Outpatient Clinic in its current location and to move the Dialysis Center to another location to free up space within the hospital complex. Such a move would give the Outpatient Clinic 100,000 square feet, a 25 percent increase. After attempting to find space for the Dialysis Center within the hospital complex, it was soon determined that a new 20,000 square foot building must be built. This building would be situated two blocks away from the hospital complex, in a location that would be much more con- venient for dialysis patients and Center employees) because of ease of parking. The 20,000 square feet of space, which can be more efficiently utilized than the old space, allows for some increase in patient volume, although it is unclear whether or not the move will generate additional dialysis patients. Cost of the new building is estimated at $120 per square foot, for a total cost of $2,400,000. Additionally, furniture and other fittings along with relocation of equipment, files, and other items, would cost $1,600,000, for a total cost of $4,000,000. The $4,000,000 cost would be El Paso Medical Center 27 financed by a 7-75 percent, 20-year first mortgage 17.75 percent, 20-year first mortgage loan. When both the principal amount which can be considered depreciation) and interest are amortized over 20 years the end result is an annual cost of financing of $400,000. Thus, it is possible to estimate the actual annual facilities costs for the new Dialysis Center, something that is not possible for units located within the hospital complex Table 3.1 contains the projected profit and loss (P&L) statement for the Dialysis Center before adjusting for the move. El Paso's depart- ment heads receive annual bonuses on the basis of each department's contribution to the hospital's bottom line (profit). In the past, only direct costs were considered, but El Paso's chief executive officer (CEO) has decided that bonuses would now be based on full (total) costs. Obviously, Revenues Hemodialysis program Peritoneal dialysis program Medical pharmacy Supplies Total revenues $ 1.300.000 600,000 800.000 $ 2.700,000 TABLE 3. El Paso M Center Di Center:P P&L State Assuming Quo Direct Expenses Salaries and benefits Pharmacy purchases Other medical administrative supplies Utilities Lease expense Other expenses Total expenses $ 900.000 800,000 100,000 80.000 120,000 100.000 $ 2,100,000 Not gain doss) before indirect cours $ 600,000 Indirect Expenses Facilities costs General overhead Total overhead costs $ 300,000 270,000 $ 570.000 $ 30.000 Net profit Note Pharmacy revenues are based on reimbursement amounts, not costs 28 Cases in Healthcare Finance the new approach to awarding bonuses, coupled with the potential for increases in indirect cost allocation, is of great concern to John Van Pelt, the director of the Dialysis Center. Under the current allocation of indirect costs (see Table 3.1). John would have a reasonable chance at an end-of-year bonus, as the forecast puts the Dialysis Center in the black. However, any increase in the indirectos allocation would likely put him out of the money. At the next department heads' meeting, John voiced his concem about the impact of any allocation changes on the Dialysis Center's profitability, so El Paso's CEO asked the chief financial officer (CFO). Rick Simmons, to look into the matter. In essence, the CEO said that the final allocation is up to Rick but that any allocation changes must be made within outpatient services. In other words, any change in indirect cost allocation to the Dialysis Center must be offset by an equal, but opposite, change in the allocation to the Outpatient Clinic To get started, Rick created Table 3.a. In creating the table, Rick assumed that the new Dialysis Center would have the same number of stations as the old one, would serve the same number of patients, and would receive the same reimbursement rates. Also, direct operating ex- penses would differ only slightly from the current situation because the same personnel and equipment would be used. Thus, for all practical purposes, the revenues and direct costs of the Dialysis Center would be unaffected by the move. The data in Table 3.2 for the expanded Outpatient Clinic are based on the assumption that the expansion would allow volume to increase by 25 percent and that both revenues and direct costs would increase by a like amount. Furthermore, to keep the analysis manageable, the assumption was made that the overall hospital allocation rates for both facilities costs and general overhead would not materially change be- cause of the expansion. Rick knew that his "trial balloon" allocation, which is shown in Table za in the columns labeled "Initial Allocation," would create some con- troversy. In the past, facilities costs were aggregated, so all departments were charged a cost based on the average embedded (historical) cost regardless of the actual age (or value) of the space occupied. Thus, a basement room with no windows was allocated the same facilities costs (per square foot) as was the fifth floor executive suite. Because many department heads thought this approach to be unfair, Rick wanted to begin allocating facilities overhead on a true cost basis. Thus, in his PAL Statements Intial A Without Expansion ction OC Alternative Allocation DC DC DC Revenues/Direct Costs Total revenues Direct expenses Contribution margin Percent of revenues $ 2,700,000 2.100,000 $ 600.000 22.2% $16.000.000 R33 155 $ 165,845 38.5% $ 2.700.000 2.100.000 $ 600.000 22.2% $20,000,000 $2,700,000 1 2291 444 2.100.000 $7708,556 5 600,000 38.5% 22.2% $20.000.000 12.291 444 $7.708,556 38.5% $ $ 5 Indirect Costs Facilities costs General Overhead Total overhead 300.000 270.000 570.000 $ 1.200.000 1.800.000 S 2.800.000 400.000 270.000 670 000 1.500.000 2.000.000 $ 3.500.000 $ $ 30,000 $ 3 20,000 $4208,556 Net profit Percent of revenues 36.845 210% 210% Facilities Cost Allocation 20,000 15.00 Square footage Facilities costs per square foot 30,000 15.00 20,000 20.00 100,000 15.00 20,000 100.000 $ $ $ $ $ $ El Paso Medical Center Other Overhead Allocation: General overhead costs as a % of revenue 100% 10.0% 10.0% 10.0% Note: The term contribution margin" as used here means the amount available to cover overhead costs, as opposed to the traditional meaning of the amount available to cover fixed costs 29 Summary and Outpat Dialysis Ce El Paso Me TABLE 3.2 30 Cases in Healthcare Finance initial allocation. Rick daca facilities costs as the basis for the allocation to the Dialysis Center Needless to say, John's response to the initial allocation was less than enthusiastic. Specifically, he raised these points: 1. Is it fair for the Dialysis Center to suffer (in profitabil- ity) from the move even though it had nothing to do with it? Should the Dialysis Center be charged actual fa- cilities costs for its new location? After all, the move was forced by the Outpatient Clinic, which is being charged for facilities at the lower average allocation rate. Under the concept of charging for actual facili- ties costs, department heads might be better off by resisting proposed moves to new and potentially more efficient facilities because such moves would result in increased facilities allocations 3. Even if the true cost concept were applied to the Dial- ysis Center, is the $400,000 annual allocation amount correct? After all, the building has a useful life that is probably significantly longer than 20 years the life of the loan used to determine the allocation amount. 4. It appears that the revenue that the Dialysis Center "receives from patient use of the pharmacy is passed on directly to the pharmacy. Should this "revenue" be counted when general overhead allocations are made? Before Rick was able to respond to John's concerns, he suddenly left El Paso to be the CFO of a competing investor-owned hospital. The task of completing the allocation study was given to you, El Paso's current administrative resident. You remember that to be of most benefit to the organization, cost allocation should (1) be perceived as fair by the parties involved and (2) promote overall cost savings within the organization. However, you also realize that in practice cost allocation is very complex and somewhat arbitrary. Some department heads argue that the best approach to overhead allocations is the "Marxist approach," by which allocations are based on each patient service department's ability to cover overhead costs, but this approach also has its disadvantages. UN EL PASO MEDICAL CENTER COST ALLOCATION CONCEPTS EL PASO MEDICAL CENTER is a full-service not-for-profit acute care hospital with 325 beds located in El Paso, Texas. It is part of the three-hospital Rio Grande Healthcare System. The bulk of the hospital's facilities are devoted to inpatient care and emergency services. However, a 100,000 square-foot section of the hospital complex is devoted to out- patient services. Currently, this space has two primary uses. About 80 percent of the space is used by the Outpatient Clinic, which handles all routine outpatient services offered by the hospital. The remaining 20 percent is used by the Dialysis Center The Dialysis Center performs hemodialysis and peritoneal dialysis, which are alternative processes that remove wastes and excess water from the blood for patients with end-stage renal (kidney) disease. In hemodialysis, blood is pumped from the patient's arm through a shunt into a dialysis machine, which uses a cleansing solution and an arti- ficial membrane to perform the functions of a healthy kidney. Then, the cleansed blood is pumped back into the patient through a second shunt. In peritoneal dialysis, the cleansing solution is inserted directly into the abdominal cavity through a catheter. The body naturally cleanses the blood through the peritoneum-a thin membrane that lines the abdominal cavity. In general, hemodialysis patients require three dialy- ses a week, with each treatment lasting about four hours. Patients who use peritoneal dialysis change their own cleansing solutions at home, 26 Cases in Healthcare Finance typically about six times per day. This procedure can be done manually when active or automatically by machine when sleeping However, the patient's overall condition, as well as the positioning of the catheter, must be monitored regularly at the Dialysis Center El Paso's new cost accounting system, which was installed two years ago, allocates facilities costs (which at El Paso essentially consist of building depreciation and interest on long-term debt) on the basis of square footage. Currently, the facilities cost allocation rate is Sus per square foot, so the facilities cost allocation is 20,000 X S15 = 5300,000 for the Dialysis Center and 80,000 x $15 $1,200,000 for the Outpatient Clinic. All other overhead costs, such as administration, finance, main- tenance, and housekeeping, are lumped together and called "general overhead." These costs are allocated on the basis of 10 percent of the revenues of each patient service department. The current allocation of general overhead is $270,000 for the Dialysis Center and $1,600,000 for the Outpatient Clinic, which results in total overhead allocations of $570,000 for the Dialysis Center and $2,800,000 for the Outpatient Clinic. Recent growth in volume of the Outpatient Clinic has created a need for 25 percent more space than currently assigned. Because the Outpatient Clinic is much larger than the Dialysis Center, and because its patients need frequent access to other departments within the hospi- tal, the decision was made to keep the Outpatient Clinic in its current location and to move the Dialysis Center to another location to free up space within the hospital complex. Such a move would give the Outpatient Clinic 100,000 square feet, a 25 percent increase. After attempting to find space for the Dialysis Center within the hospital complex, it was soon determined that a new 20,000 square foot building must be built. This building would be situated two blocks away from the hospital complex, in a location that would be much more con- venient for dialysis patients and Center employees) because of ease of parking. The 20,000 square feet of space, which can be more efficiently utilized than the old space, allows for some increase in patient volume, although it is unclear whether or not the move will generate additional dialysis patients. Cost of the new building is estimated at $120 per square foot, for a total cost of $2,400,000. Additionally, furniture and other fittings along with relocation of equipment, files, and other items, would cost $1,600,000, for a total cost of $4,000,000. The $4,000,000 cost would be El Paso Medical Center 27 financed by a 7-75 percent, 20-year first mortgage 17.75 percent, 20-year first mortgage loan. When both the principal amount which can be considered depreciation) and interest are amortized over 20 years the end result is an annual cost of financing of $400,000. Thus, it is possible to estimate the actual annual facilities costs for the new Dialysis Center, something that is not possible for units located within the hospital complex Table 3.1 contains the projected profit and loss (P&L) statement for the Dialysis Center before adjusting for the move. El Paso's depart- ment heads receive annual bonuses on the basis of each department's contribution to the hospital's bottom line (profit). In the past, only direct costs were considered, but El Paso's chief executive officer (CEO) has decided that bonuses would now be based on full (total) costs. Obviously, Revenues Hemodialysis program Peritoneal dialysis program Medical pharmacy Supplies Total revenues $ 1.300.000 600,000 800.000 $ 2.700,000 TABLE 3. El Paso M Center Di Center:P P&L State Assuming Quo Direct Expenses Salaries and benefits Pharmacy purchases Other medical administrative supplies Utilities Lease expense Other expenses Total expenses $ 900.000 800,000 100,000 80.000 120,000 100.000 $ 2,100,000 Not gain doss) before indirect cours $ 600,000 Indirect Expenses Facilities costs General overhead Total overhead costs $ 300,000 270,000 $ 570.000 $ 30.000 Net profit Note Pharmacy revenues are based on reimbursement amounts, not costs 28 Cases in Healthcare Finance the new approach to awarding bonuses, coupled with the potential for increases in indirect cost allocation, is of great concern to John Van Pelt, the director of the Dialysis Center. Under the current allocation of indirect costs (see Table 3.1). John would have a reasonable chance at an end-of-year bonus, as the forecast puts the Dialysis Center in the black. However, any increase in the indirectos allocation would likely put him out of the money. At the next department heads' meeting, John voiced his concem about the impact of any allocation changes on the Dialysis Center's profitability, so El Paso's CEO asked the chief financial officer (CFO). Rick Simmons, to look into the matter. In essence, the CEO said that the final allocation is up to Rick but that any allocation changes must be made within outpatient services. In other words, any change in indirect cost allocation to the Dialysis Center must be offset by an equal, but opposite, change in the allocation to the Outpatient Clinic To get started, Rick created Table 3.a. In creating the table, Rick assumed that the new Dialysis Center would have the same number of stations as the old one, would serve the same number of patients, and would receive the same reimbursement rates. Also, direct operating ex- penses would differ only slightly from the current situation because the same personnel and equipment would be used. Thus, for all practical purposes, the revenues and direct costs of the Dialysis Center would be unaffected by the move. The data in Table 3.2 for the expanded Outpatient Clinic are based on the assumption that the expansion would allow volume to increase by 25 percent and that both revenues and direct costs would increase by a like amount. Furthermore, to keep the analysis manageable, the assumption was made that the overall hospital allocation rates for both facilities costs and general overhead would not materially change be- cause of the expansion. Rick knew that his "trial balloon" allocation, which is shown in Table za in the columns labeled "Initial Allocation," would create some con- troversy. In the past, facilities costs were aggregated, so all departments were charged a cost based on the average embedded (historical) cost regardless of the actual age (or value) of the space occupied. Thus, a basement room with no windows was allocated the same facilities costs (per square foot) as was the fifth floor executive suite. Because many department heads thought this approach to be unfair, Rick wanted to begin allocating facilities overhead on a true cost basis. Thus, in his PAL Statements Intial A Without Expansion ction OC Alternative Allocation DC DC DC Revenues/Direct Costs Total revenues Direct expenses Contribution margin Percent of revenues $ 2,700,000 2.100,000 $ 600.000 22.2% $16.000.000 R33 155 $ 165,845 38.5% $ 2.700.000 2.100.000 $ 600.000 22.2% $20,000,000 $2,700,000 1 2291 444 2.100.000 $7708,556 5 600,000 38.5% 22.2% $20.000.000 12.291 444 $7.708,556 38.5% $ $ 5 Indirect Costs Facilities costs General Overhead Total overhead 300.000 270.000 570.000 $ 1.200.000 1.800.000 S 2.800.000 400.000 270.000 670 000 1.500.000 2.000.000 $ 3.500.000 $ $ 30,000 $ 3 20,000 $4208,556 Net profit Percent of revenues 36.845 210% 210% Facilities Cost Allocation 20,000 15.00 Square footage Facilities costs per square foot 30,000 15.00 20,000 20.00 100,000 15.00 20,000 100.000 $ $ $ $ $ $ El Paso Medical Center Other Overhead Allocation: General overhead costs as a % of revenue 100% 10.0% 10.0% 10.0% Note: The term contribution margin" as used here means the amount available to cover overhead costs, as opposed to the traditional meaning of the amount available to cover fixed costs 29 Summary and Outpat Dialysis Ce El Paso Me TABLE 3.2 30 Cases in Healthcare Finance initial allocation. Rick daca facilities costs as the basis for the allocation to the Dialysis Center Needless to say, John's response to the initial allocation was less than enthusiastic. Specifically, he raised these points: 1. Is it fair for the Dialysis Center to suffer (in profitabil- ity) from the move even though it had nothing to do with it? Should the Dialysis Center be charged actual fa- cilities costs for its new location? After all, the move was forced by the Outpatient Clinic, which is being charged for facilities at the lower average allocation rate. Under the concept of charging for actual facili- ties costs, department heads might be better off by resisting proposed moves to new and potentially more efficient facilities because such moves would result in increased facilities allocations 3. Even if the true cost concept were applied to the Dial- ysis Center, is the $400,000 annual allocation amount correct? After all, the building has a useful life that is probably significantly longer than 20 years the life of the loan used to determine the allocation amount. 4. It appears that the revenue that the Dialysis Center "receives from patient use of the pharmacy is passed on directly to the pharmacy. Should this "revenue" be counted when general overhead allocations are made? Before Rick was able to respond to John's concerns, he suddenly left El Paso to be the CFO of a competing investor-owned hospital. The task of completing the allocation study was given to you, El Paso's current administrative resident. You remember that to be of most benefit to the organization, cost allocation should (1) be perceived as fair by the parties involved and (2) promote overall cost savings within the organization. However, you also realize that in practice cost allocation is very complex and somewhat arbitrary. Some department heads argue that the best approach to overhead allocations is the "Marxist approach," by which allocations are based on each patient service department's ability to cover overhead costs, but this approach also has its disadvantages