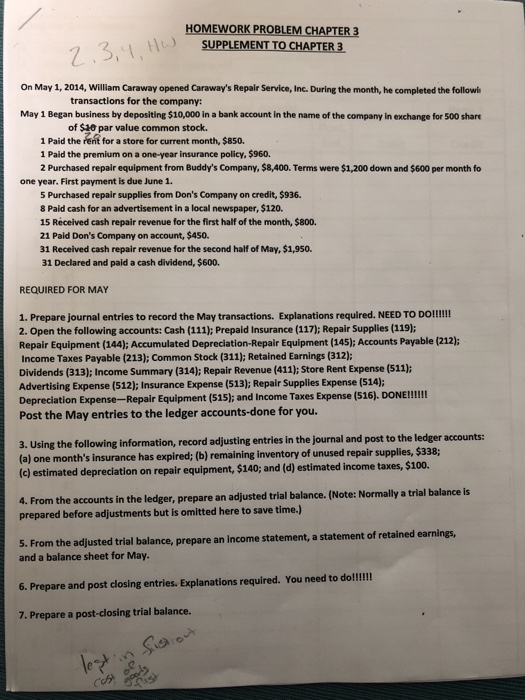

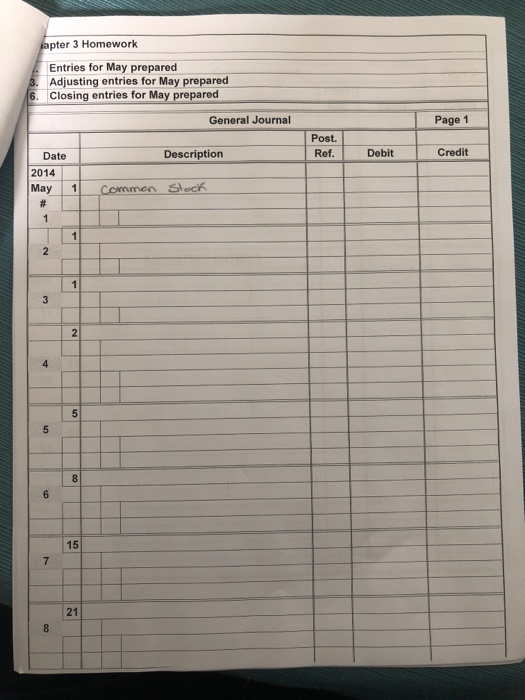

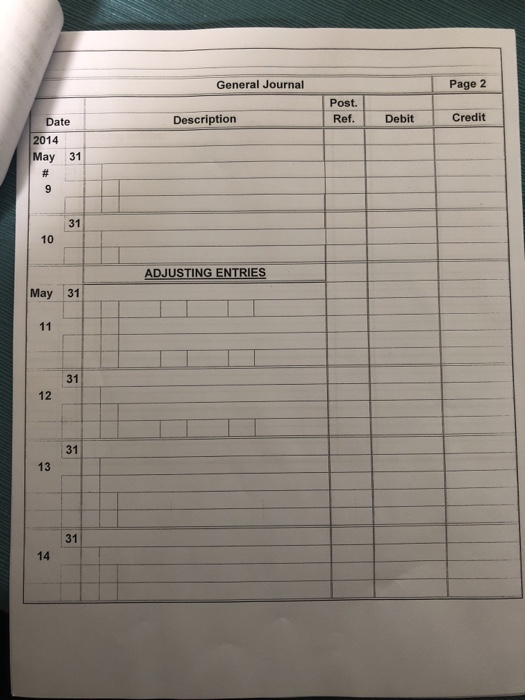

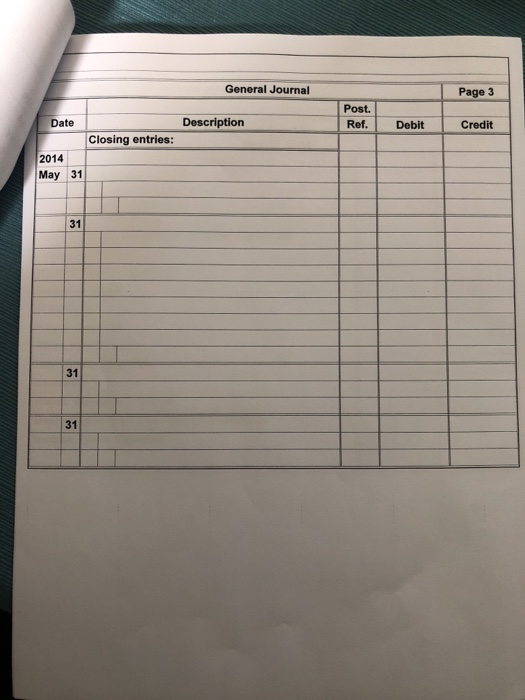

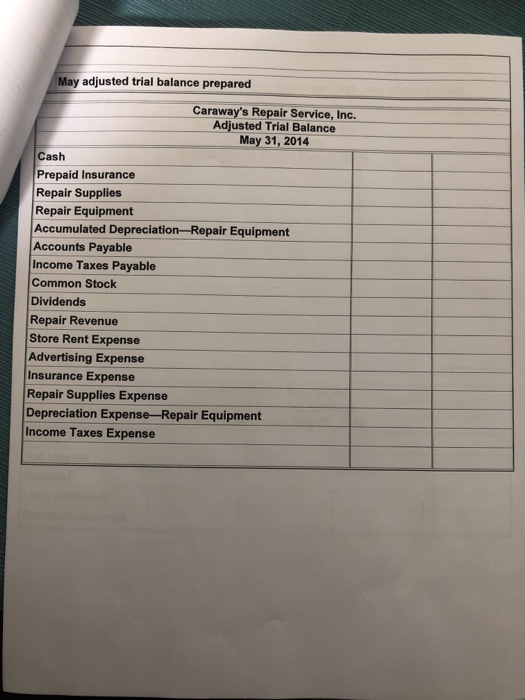

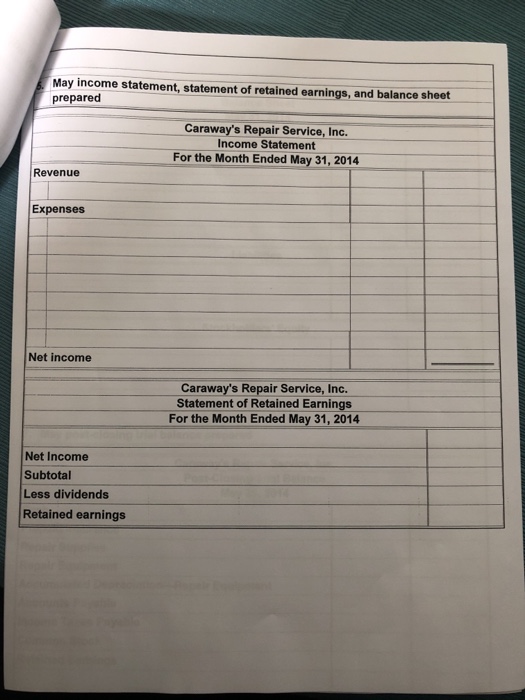

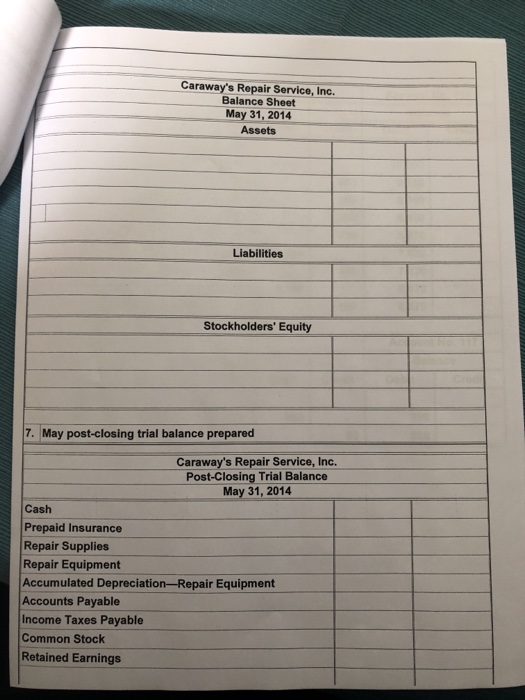

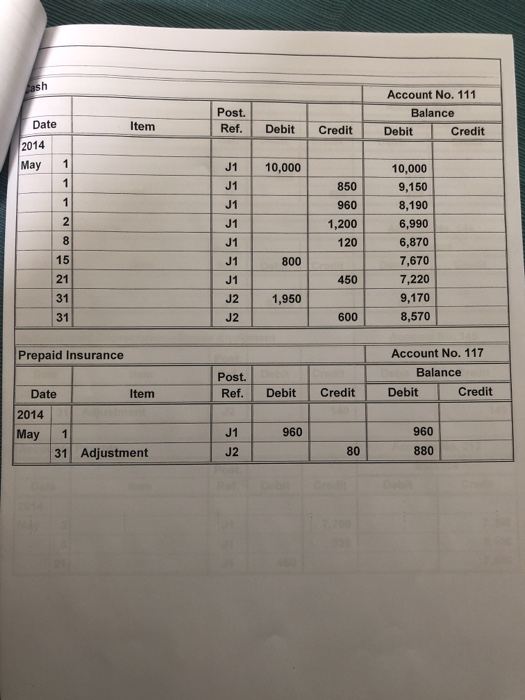

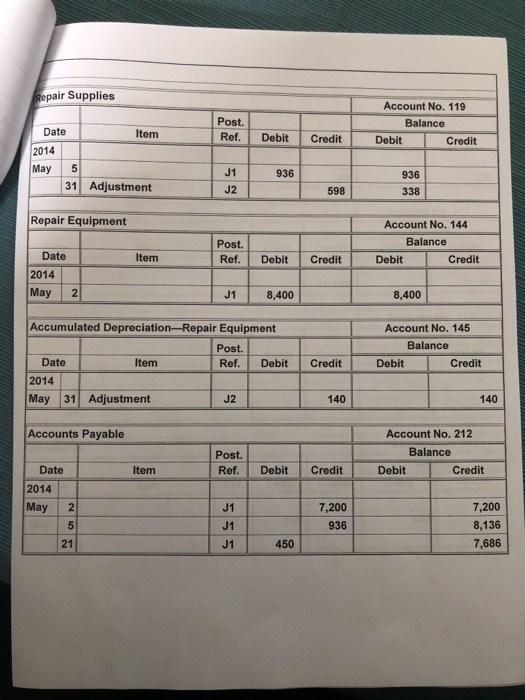

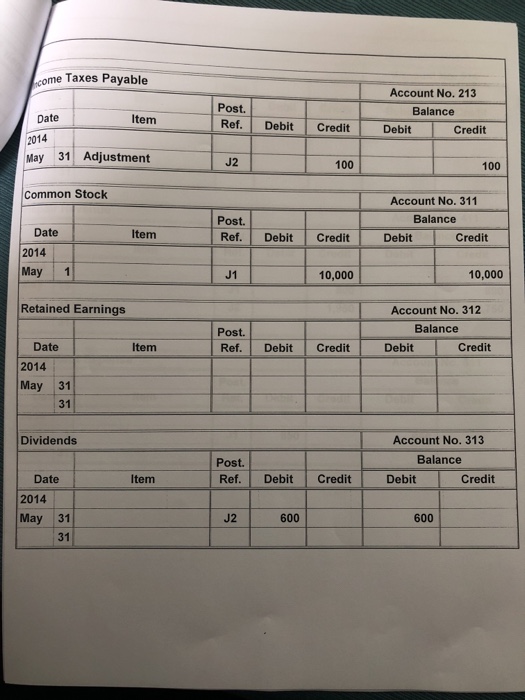

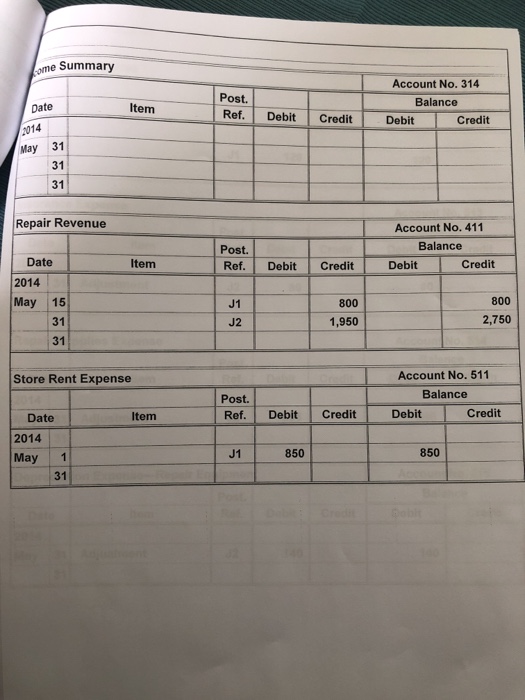

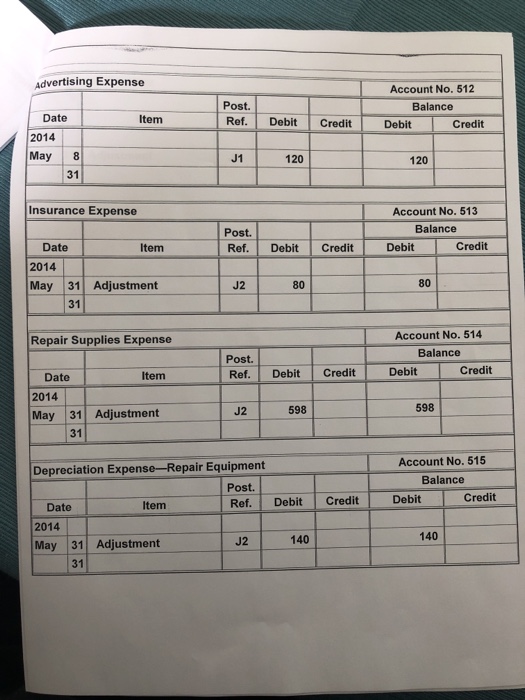

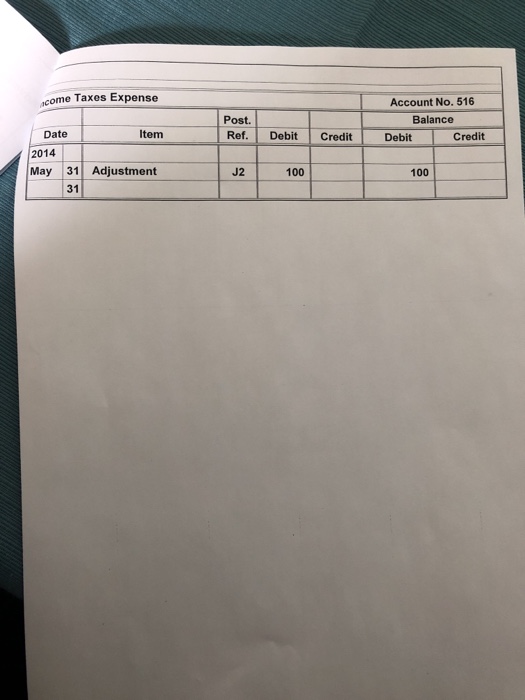

HOMEWORK PROBLEM CHAPTER 3 SUPPLEMENT TO CHAPTER 3 On May 1, 2014, William Caraway opened Caraway's Repair Service, Inc. During the month, he completed the followi transactions for the company: May 1 Began business by depositing $10,000 in a bank account in the name of the company in exchange for 500 share of $30 par value common stock. 1 Paid the ent for a store for current month, $850. 1 Paid the premium on a one-year insurance policy, $960. 2 Purchased repair equipment from Buddy's Company, $8,400. Terms were $1,200 down and $600 per month fo one year. First payment is due June 1. 5 Purchased repair supplies from Don's Company on credit, $936. 8 Paid cash for an advertisement in a local newspaper, $120. 15 Received cash repair revenue for the first half of the month, $800 21 Paid Don's Company on account, $450. 31 Received cash repair revenue for the second half of May, $1,950. 31 Declared and paid a cash dividend, $600. REQUIRED FOR MAY 1. Prepare journal entries to record the May transactions. Explanations required. NEED TO DO!!!! 2. Open the following accounts: Cash (111); Prepaid Insurance (117); Repair Supplies (119); Repair Equipment (144); Accumulated Depreciation-Repair Equipment (145); Accounts Payable (212); Income Taxes Payable (213); Common Stock (311); Retained Earnings (312): Dividends (313); Income Summary (314); Repair Revenue (411); Store Rent Expense (511) Advertising Expense (512); Insurance Expense (513); Repair Supplies Expense (514): Depreciation Expense-Repair Equipment (515); and Income Taxes Expense (516). DONE!!!! Post the May entries to the ledger accounts-done for you. 3. Using the following information, record adjusting entries in the journal and post to the ledger accounts: a) one month's insurance has expired;(b) remaining inventory of unused repair supplies, $338; (c) estimated depreciation on repair equipment, $140; and (d) estimated income taxes, $100. ( 4. From the accounts in the ledger, prepare an adjusted trial balance. (Note: Normally a trial balance is prepared before adjustments but is omitted here to save time.) 5. From the adjusted trial balance, prepare an income statement, a statement of retained earnings and a balance sheet for May. 6. Prepare and post closing entries. Explanations required. You need to do!!!!! 7. Prepare a post-closing trial balance