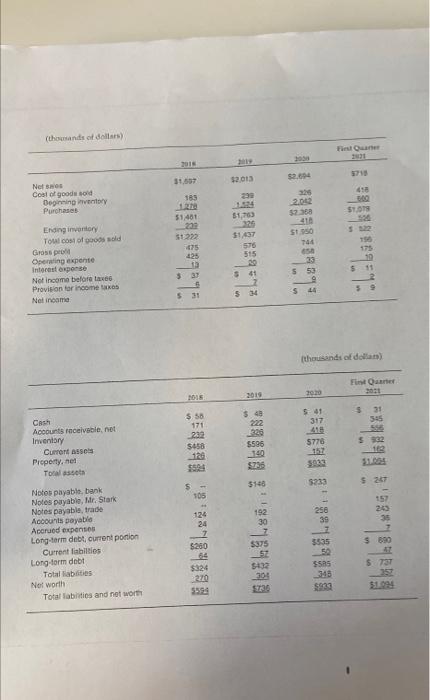

Homework (Real-world-of-business Learning Outcome exercise) The balance sheet and income statement are from an actual company (non-public) with the identity etc. hidden and other revealing info modified. Questions: 1) Look at the financial info carefully and get a pulse for what is going on with this firm. 2) Compute for each year: i) receivable period; ii) inventory period; iii) payable period. 3) Both A/R and A/P - credit term = net 30. What is going on? 4) Using the 3-year average figures, computer the sustainable growth rate. Make reasonable assumptions, if necessary. Different from exam/quiz questions, you are not necessarily solving for a solution. Rather, you are analyzing an actual company. Be prepared to participate in class. I will ask questions to students (random cold-call). NOT the other way around. (thousands of dollars) File 11.557 $2.013 $2.04 Nel nos Cool of goods sold Deginning Purchases 230 2012 52360 51401 $1,700 329 5122 439899921 Ending inventory Tomos o sold Grosso Opening experte Interest expose Not income before taxe Provision for income Not income $1437 576 515 St. T4 290094959 5 41 2 34 33 5 53 9 5 44 5 thousands of dollars) Fintarer 2019 20.10 Cash $ 58 171 222 5458 $40 222 320 $596 140 5786 S41 317 418 5776 Accounts receivable, not Inventory Current Ass Property Det Toaleta 120 5146 5233 $- 105 -29055*189813 124 24 192 30 Nolos payable bank Noles payable, Mr. Stark Notes payabis, trade Accounts payable Accrued expense Long-term debt current ponion Current labios Longform dobt Totalities Net worth Total Balities and not worth 256 39 $200 3535 $375 57 5432 304 $324 270 5595 5505 343 $939 Homework (Real-world-of-business Learning Outcome exercise) The balance sheet and income statement are from an actual company (non-public) with the identity etc. hidden and other revealing info modified. Questions: 1) Look at the financial info carefully and get a pulse for what is going on with this firm. 2) Compute for each year: i) receivable period; ii) inventory period; iii) payable period. 3) Both A/R and A/P - credit term = net 30. What is going on? 4) Using the 3-year average figures, computer the sustainable growth rate. Make reasonable assumptions, if necessary. Different from exam/quiz questions, you are not necessarily solving for a solution. Rather, you are analyzing an actual company. Be prepared to participate in class. I will ask questions to students (random cold-call). NOT the other way around. (thousands of dollars) File 11.557 $2.013 $2.04 Nel nos Cool of goods sold Deginning Purchases 230 2012 52360 51401 $1,700 329 5122 439899921 Ending inventory Tomos o sold Grosso Opening experte Interest expose Not income before taxe Provision for income Not income $1437 576 515 St. T4 290094959 5 41 2 34 33 5 53 9 5 44 5 thousands of dollars) Fintarer 2019 20.10 Cash $ 58 171 222 5458 $40 222 320 $596 140 5786 S41 317 418 5776 Accounts receivable, not Inventory Current Ass Property Det Toaleta 120 5146 5233 $- 105 -29055*189813 124 24 192 30 Nolos payable bank Noles payable, Mr. Stark Notes payabis, trade Accounts payable Accrued expense Long-term debt current ponion Current labios Longform dobt Totalities Net worth Total Balities and not worth 256 39 $200 3535 $375 57 5432 304 $324 270 5595 5505 343 $939