Answered step by step

Verified Expert Solution

Question

1 Approved Answer

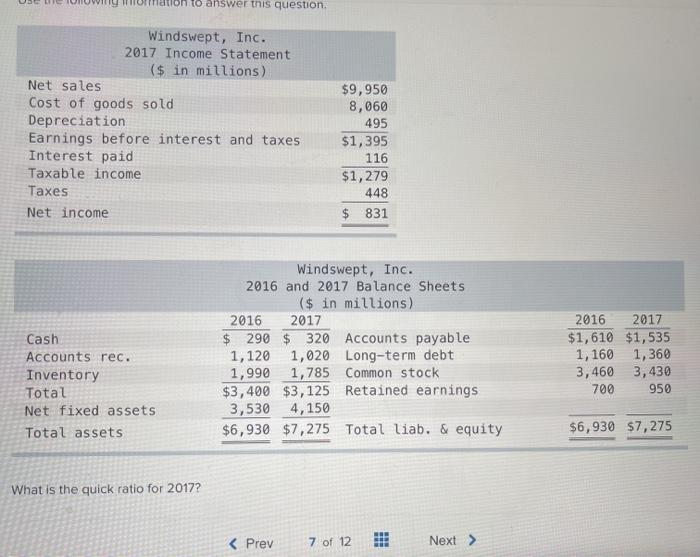

Homework Sarea Help Save & Exit Submit Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest

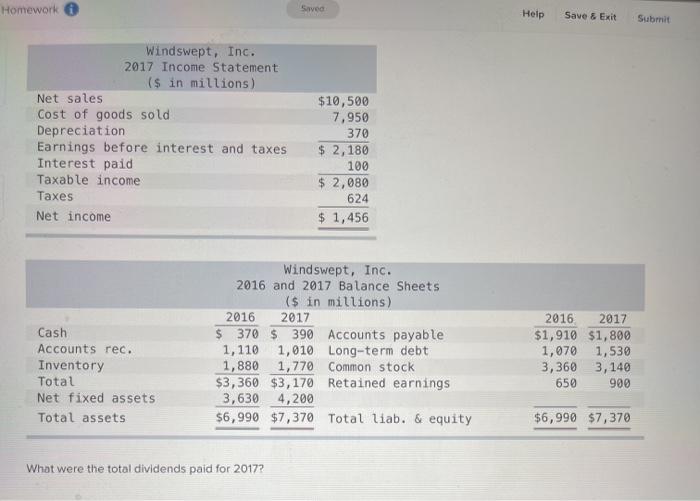

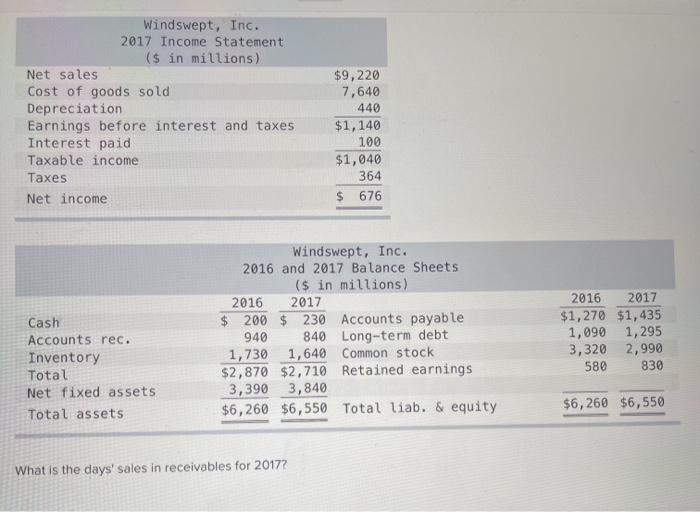

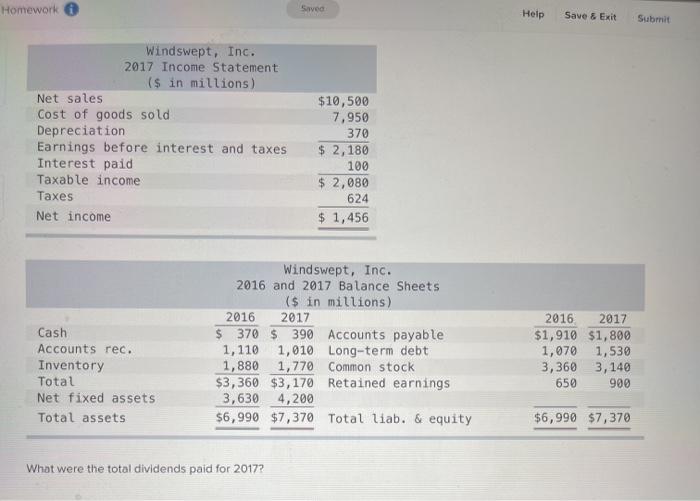

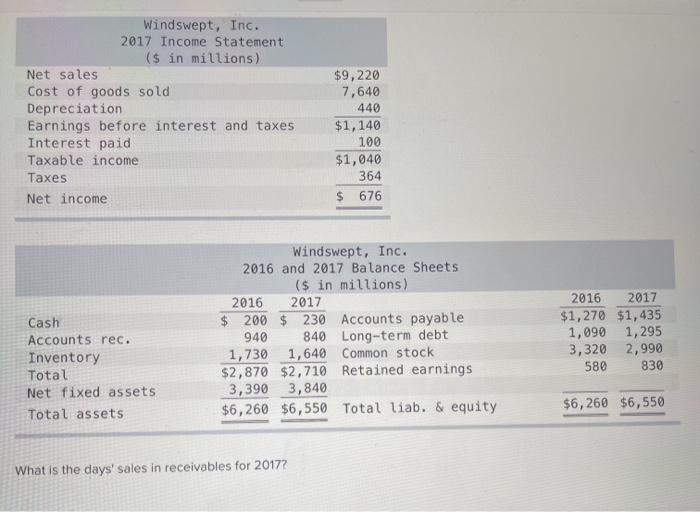

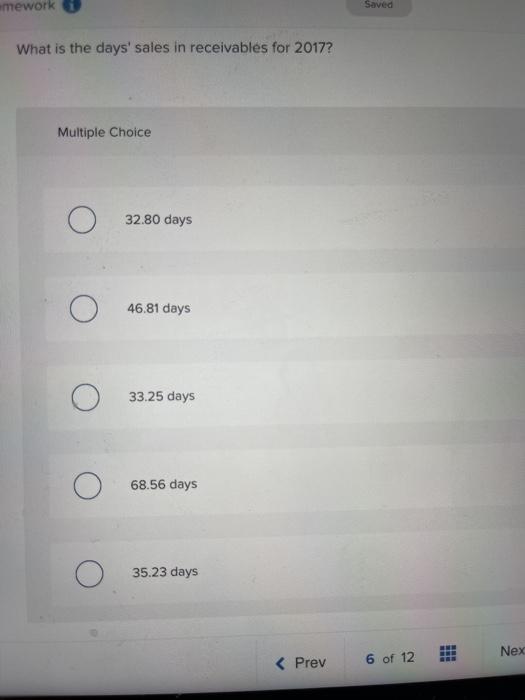

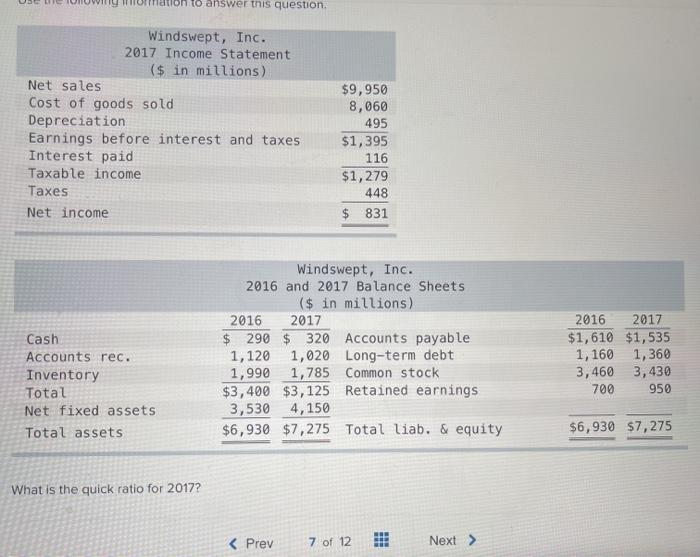

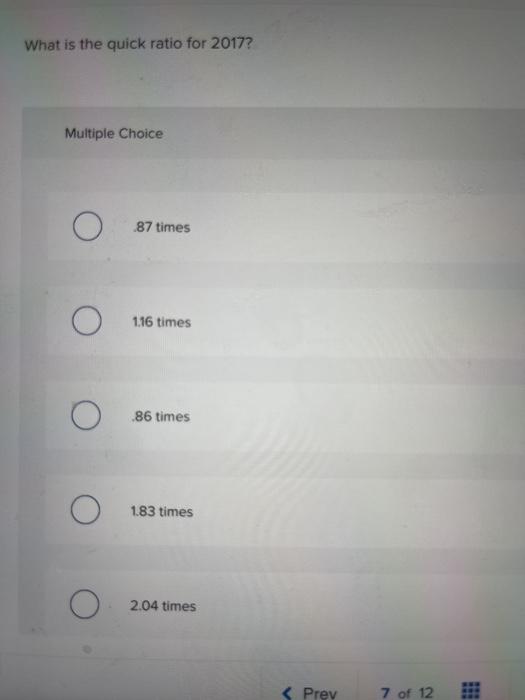

Homework Sarea Help Save & Exit Submit Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income $10,500 7,950 370 $ 2,180 100 $ 2,080 624 $ 1,456 Cash Accounts rec. Inventory Total Net fixed assets Total assets Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions) 2016 2017 $ 370 $ 390 Accounts payable 1,110 1,010 Long-term debt 1,880 1,770 Common stock $3,360 $3,170 Retained earnings 3,630 4,200 $6,990 $7,370 Total liab. & equity 2016 2017 $1,910 $1,800 1,070 1,539 3,360 3,140 650 900 $6,990 $7,370 What were the total dividends paid for 2017? What were the total dividends paid for 2017? Multiple Choice O $250 million $1,066 million $510 million O $775 million O $1.206 million Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income $9,220 7,640 440 $1,140 100 $1,040 364 $ 676 Cash Accounts rec. Inventory Total Net fixed assets Total assets Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions) 2016 2017 200 $ 230 Accounts payable 940 840 Long-term debt 1,730 1,640 Common stock $2,870 $2,710 Retained earnings 3,390 3,840 $6,260 $6,550 Total liab. & equity 2016 2017 $1,270 $1,435 1,090 1,295 3,320 2,990 580 830 $6,260 $6,550 What is the days' sales in receivables for 2017? mework Saved What is the days' sales in receivables for 2017? Multiple Choice O 32.80 days 46.81 days 33.25 days 68.56 days 35.23 days Nex What is the quick ratio for 2017? Multiple Choice 87 times O 1.16 times .86 times 1.83 times 2.04 times

Homework Sarea Help Save & Exit Submit Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income $10,500 7,950 370 $ 2,180 100 $ 2,080 624 $ 1,456 Cash Accounts rec. Inventory Total Net fixed assets Total assets Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions) 2016 2017 $ 370 $ 390 Accounts payable 1,110 1,010 Long-term debt 1,880 1,770 Common stock $3,360 $3,170 Retained earnings 3,630 4,200 $6,990 $7,370 Total liab. & equity 2016 2017 $1,910 $1,800 1,070 1,539 3,360 3,140 650 900 $6,990 $7,370 What were the total dividends paid for 2017? What were the total dividends paid for 2017? Multiple Choice O $250 million $1,066 million $510 million O $775 million O $1.206 million Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income $9,220 7,640 440 $1,140 100 $1,040 364 $ 676 Cash Accounts rec. Inventory Total Net fixed assets Total assets Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions) 2016 2017 200 $ 230 Accounts payable 940 840 Long-term debt 1,730 1,640 Common stock $2,870 $2,710 Retained earnings 3,390 3,840 $6,260 $6,550 Total liab. & equity 2016 2017 $1,270 $1,435 1,090 1,295 3,320 2,990 580 830 $6,260 $6,550 What is the days' sales in receivables for 2017? mework Saved What is the days' sales in receivables for 2017? Multiple Choice O 32.80 days 46.81 days 33.25 days 68.56 days 35.23 days Nex What is the quick ratio for 2017? Multiple Choice 87 times O 1.16 times .86 times 1.83 times 2.04 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started