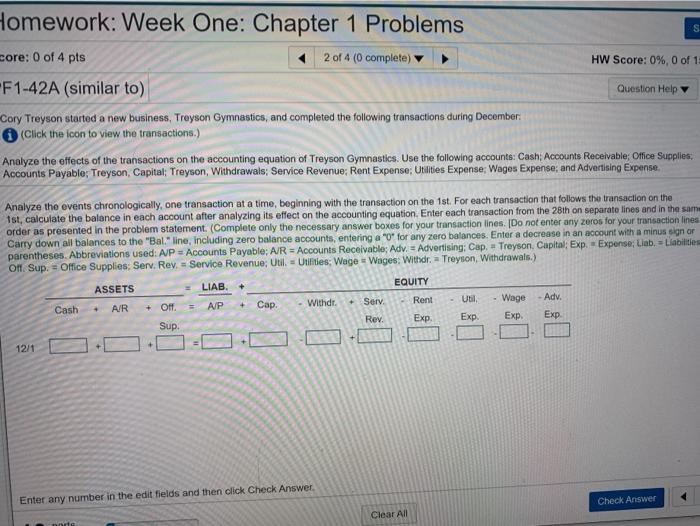

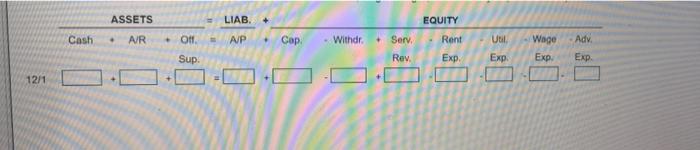

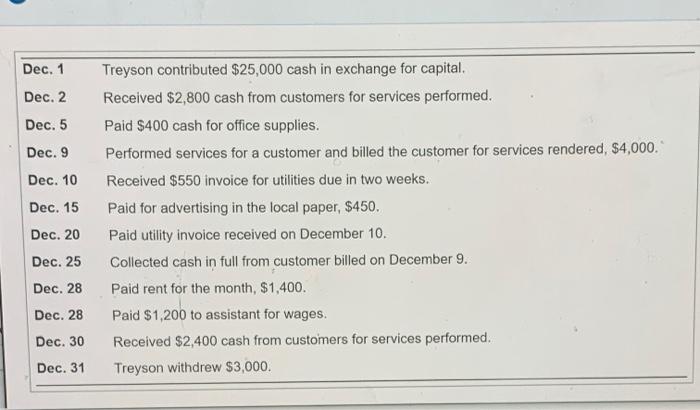

Homework: Week One: Chapter 1 Problems S core: 0 of 4 pts 2 of 4 (0 complete) HW Score: 0%, 0 of 1 F1-42A (similar to) Question Help Cory Treyson started a new business, Treyson Gymnastics, and completed the following transactions during Decomber (Click the icon to view the transactions.) Analyze the effects of the transactions on the accounting equation of Treyson Gymnastics. Use the following accounts: Cash; Accounts Receivable: Office Supplies Accounts Payable; Treyson, Capital; Treyson, Withdrawals; Service Revenue; Rent Expense: Utilities Expense; Wages Expense; and Advertising Expense. Analyze the events chronologically, one transaction at a time, beginning with the transaction on the 1st. For each transaction that follows the transaction on the 1st, calculate the balance in each account after analyzing its effect on the accounting equation. Enter each transaction from the 28th on separate lines and in the same order as presented in the problem statement. (Complete only the necessary answer boxes for your transaction lines. Do not enter any zeros for your transaction lines Carry down all balances to the "Bal" line, including zero balance accounts, entering a "0" for any zero balances. Enter a decrease in an account with a minus sign or parentheses. Abbreviations used: AJP Accounts Payable: A/R = Accounts Receivable: Adv. - Advertising; Cap. + Treyson Capital: Exp. - Expense: Liab, Liabilities Of Sup. = Office Supplies: Serv. Rey, = Service Revenue: Util. = Utilities: Wage - Wages: Withdr. Treyson, Withdrawals.) ASSETS LIAB EQUITY Cap. Withdr. Serv Util Wage - Adv. Exp Exp. Exp. Exp Sup. Rent A/R Cash + Off . A/P Rev. + 12/1 Enter any number in the edit fields and then click Check Answer Check Answer Clear All norte ASSETS LIAB EQUITY Cash AR - Off AP , Cop Withdr. Serv Rent Util Wage Adv. Sup. Rev. Exp Exp Exp. Exp 12/1 Dec. 1 Treyson contributed $25,000 cash in exchange for capital. Dec. 2 Received $2,800 cash from customers for services performed. Dec. 5 Paid $400 cash for office supplies. Dec. 9 Performed services for a customer and billed the customer for services rendered, $4,000. Dec. 10 Received $550 invoice for utilities due in two weeks. Dec. 15 Paid for advertising in the local paper, $450. Dec. 20 Paid utility invoice received on December 10. Dec. 25 Collected cash in full from customer billed on December 9. Dec. 28 Paid rent for the month, $1,400. Dec. 28 Paid $1,200 to assistant for wages. Dec. 30 Received $2,400 cash from customers for services performed. Dec. 31 Treyson withdrew $3,000