Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Homogeneous Bertrand Duopoly with Asymmetric Costs) Consider firm 1, located in country 1, which faces competition from a foreign firm (firm 2) in its

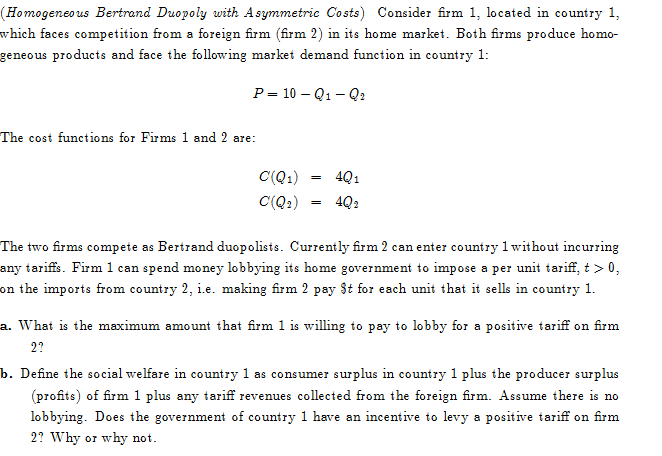

(Homogeneous Bertrand Duopoly with Asymmetric Costs) Consider firm 1, located in country 1, which faces competition from a foreign firm (firm 2) in its home market. Both firms produce homo- geneous products and face the following market demand function in country 1: The cost functions for Firms 1 and 2 are: P 10 Q1 Q2 C(Q1) C(Q2) = 4Q1 = 4Q2 The two firms compete as Bertrand duopolists. Currently firm 2 can enter country 1 without incurring any tariffs. Firm 1 can spend money lobbying its home government to impose a per unit tariff, t> 0, on the imports from country 2, i.e. making firm 2 pay $t for each unit that it sells in country 1. a. What is the maximum amount that firm 1 is willing to pay to lobby for a positive tariff on firm 27 b. Define the social welfare in country 1 as consumer surplus in country 1 plus the producer surplus (profits) of firm 1 plus any tariff revenues collected from the foreign firm. Assume there is no lobbying. Does the government of country 1 have an incentive to levy a positive tariff on firm 2? Why or why not.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a In a Bertrand duopoly the best response function for each firm is P MC Therefore Firm 1s opti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started