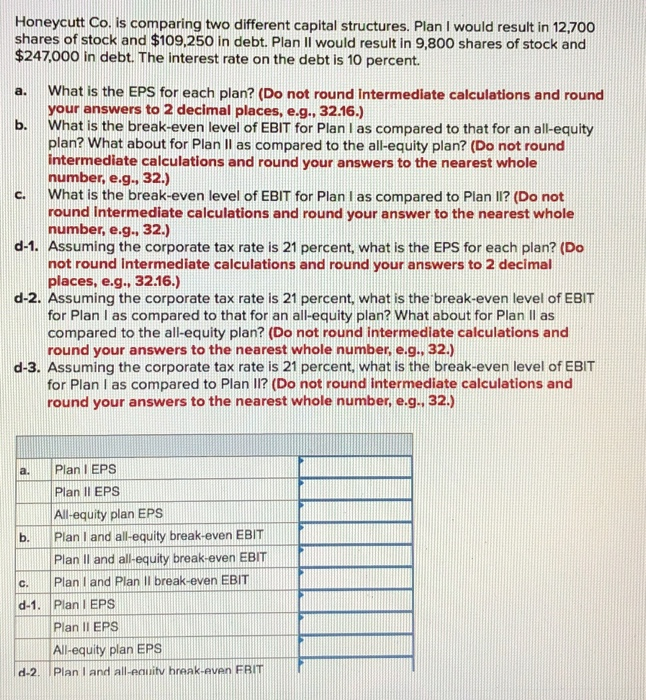

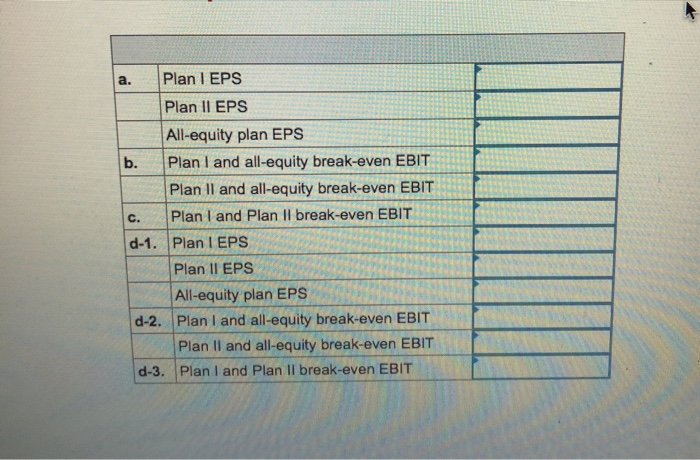

Honeycutt Co. is comparing two different capital structures. Plan I would result in 12,700 shares of stock and $109,250 in debt. Plan Il would result in 9,800 shares of stock and $247,000 in debt. The interest rate on the debt is 10 percent. What is the EPS for each plan? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) . a. What is the break-even level of EBIT for Plan I as compared to that for an all-equity plan? What about for Plan II as compared to the all-equity plan? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) What is the break-even level of EBIT for Plan I as compared to Plan II? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d-1. Assuming the corporate tax rate is 21 percent, what is the EPS for each plan? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d-2. Assuming the corporate tax rate is 21 percent, what is the break-even level of EBIT for Plan I as compared to that for an all-equity plan? What about for Plan Il as compared to the all-equity plan? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) d-3. Assuming the corporate tax rate is 21 percent, what is the break-even level of EBIT for Plan I as compared to Plan II? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) C. Plan I EPS a. Plan II EPS All-equity plan EPS Plan I and all-equity break-even EBIT . Plan Il and all-equity break-even EBIT Plan I and Plan II break-even EBIT C. Plan I EPS d-1. Plan II EPS All-equity plan EPS Plan I and all-eauitv hreak-even FRIT d-2. Honeycutt Co. is comparing two different capital structures. Plan I would result in 12,700 shares of stock and $109,250 in debt. Plan Il would result in 9,800 shares of stock and $247,000 in debt. The interest rate on the debt is 10 percent. What is the EPS for each plan? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) . a. What is the break-even level of EBIT for Plan I as compared to that for an all-equity plan? What about for Plan II as compared to the all-equity plan? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) What is the break-even level of EBIT for Plan I as compared to Plan II? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d-1. Assuming the corporate tax rate is 21 percent, what is the EPS for each plan? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d-2. Assuming the corporate tax rate is 21 percent, what is the break-even level of EBIT for Plan I as compared to that for an all-equity plan? What about for Plan Il as compared to the all-equity plan? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) d-3. Assuming the corporate tax rate is 21 percent, what is the break-even level of EBIT for Plan I as compared to Plan II? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) C. Plan I EPS a. Plan II EPS All-equity plan EPS Plan I and all-equity break-even EBIT . Plan Il and all-equity break-even EBIT Plan I and Plan II break-even EBIT C. Plan I EPS d-1. Plan II EPS All-equity plan EPS Plan I and all-eauitv hreak-even FRIT d-2