Answered step by step

Verified Expert Solution

Question

1 Approved Answer

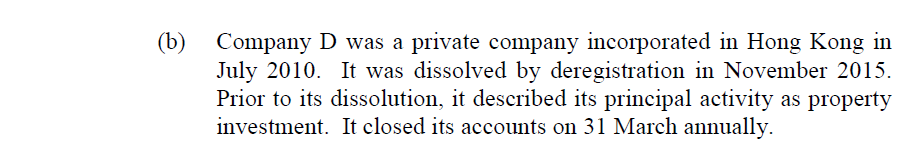

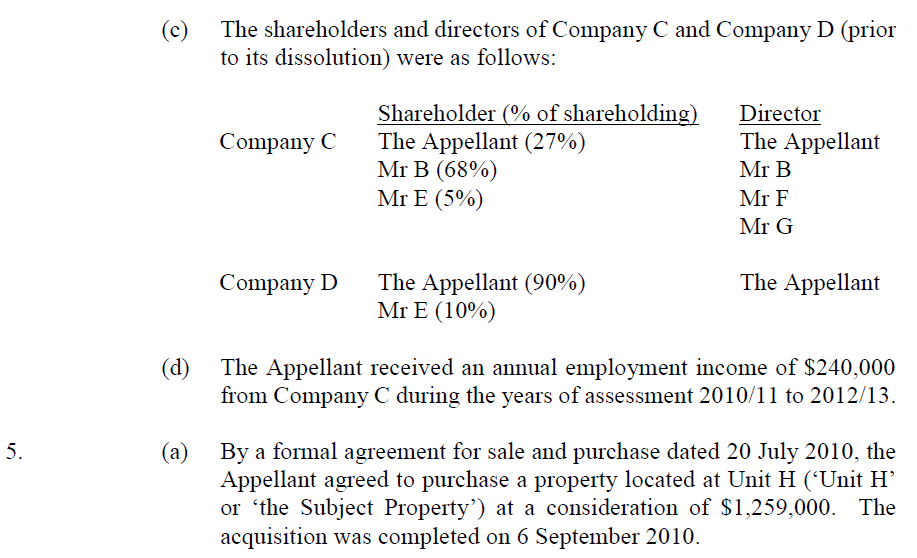

Hong Kong Taxation In a Board of Review (BoR) case for D15/19 (available at https://www.info.gov.hk/bor/en/decisions/docs/D1519.pdf) which is a decision on Profits Tax. What

Hong Kong Taxation

In a Board of Review (BoR) case for D15/19 (available at https://www.info.gov.hk/bor/en/decisions/docs/D1519.pdf) which is a decision on Profits Tax.

− What is the Tax issue in dispute?

− What is the Grounds of appeal?

− What did BoR decide to do and what are its reasons?

− If you were the taxpayer, would you agree to the BoR decision? Why?

− Lessons you have learnt from the BoR decision.

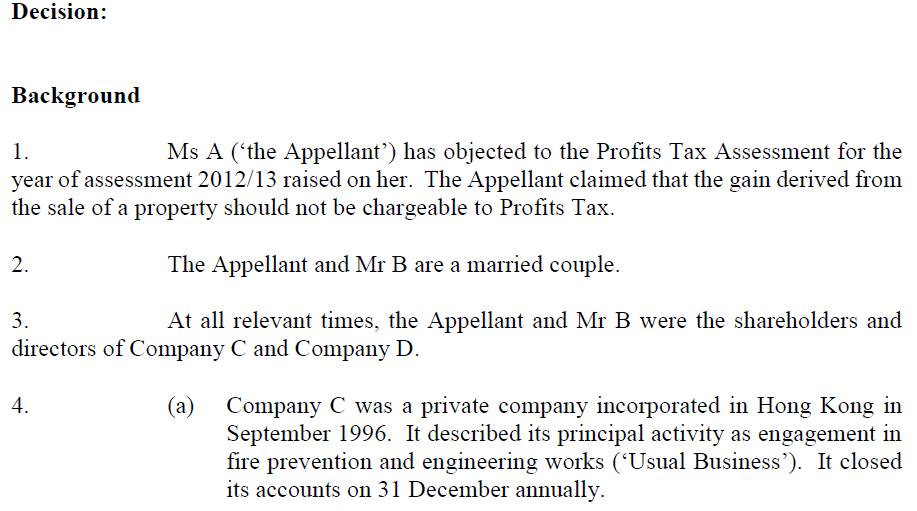

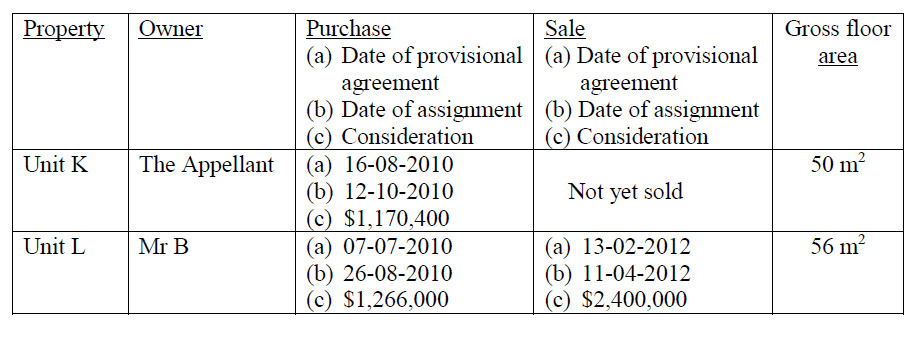

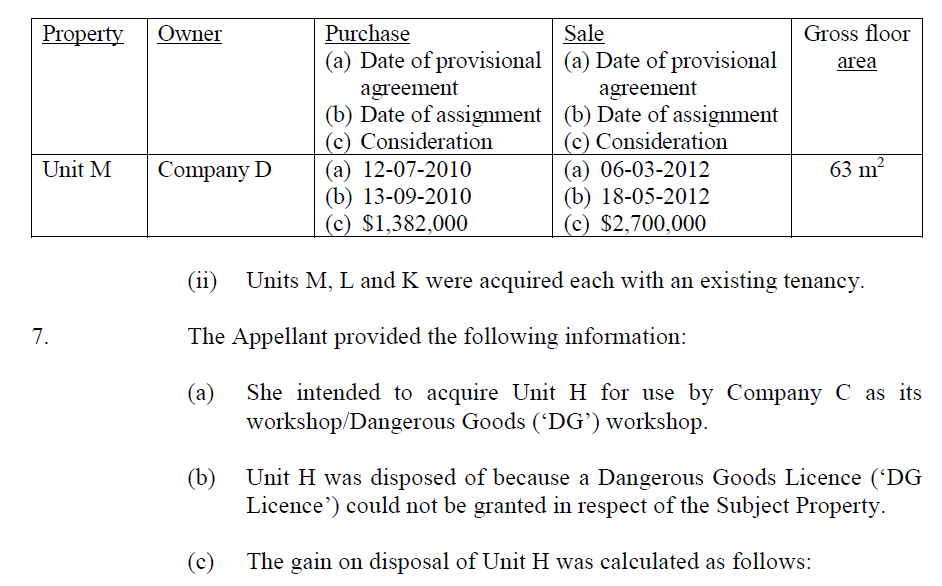

(2020-21) VOLUME 35 INLAND REVENUE BOARD OF REVIEW DECISIONS Case No. D15/19 Profits tax sale of property intention at time of acquisition sections 2(1), 14(1) and 68(4) of the Inland Revenue Ordinance Panel: Wong Kwai Huen Albert (chairman), Lee Wong Wai Ling Winnie and Patricia Joy Shih. Date of hearing: 3 July 2019. Date of decision: 14 October 2019.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

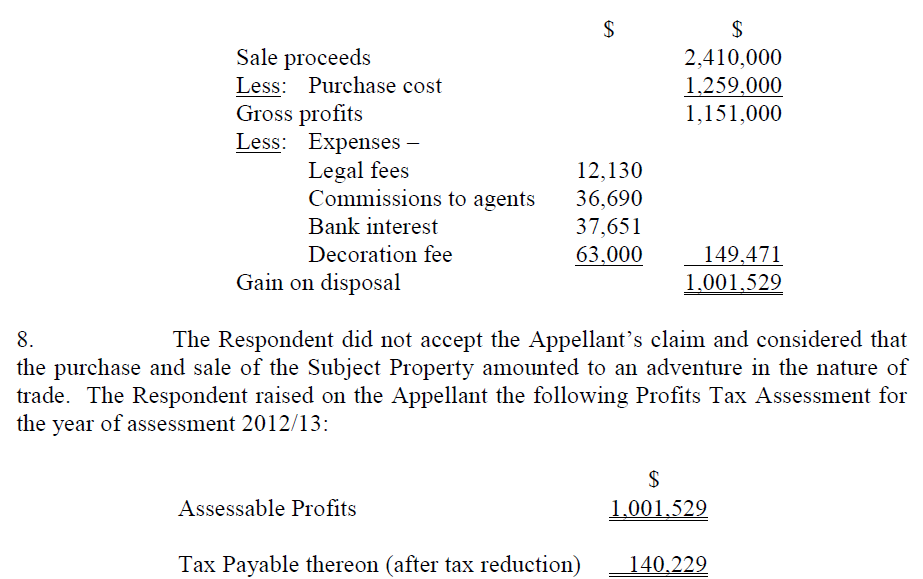

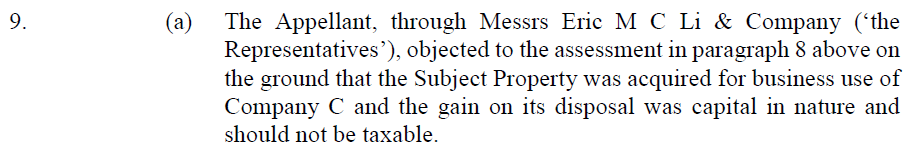

Here are the key details from the case with deep calculations 1 The Appellant and Mr B are married T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started