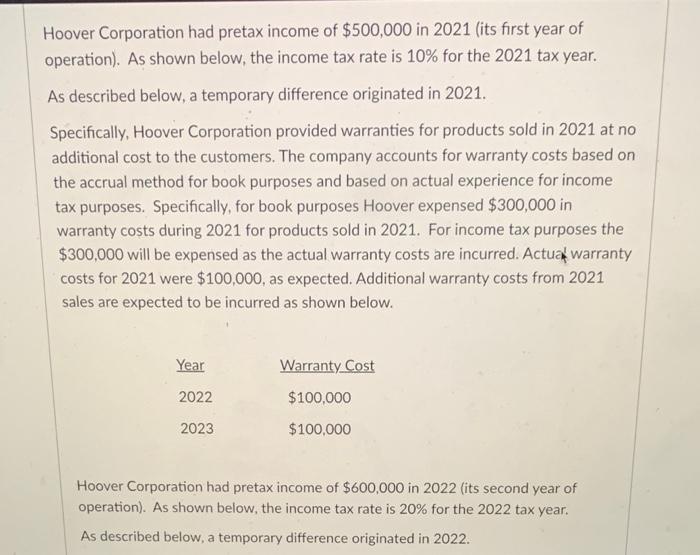

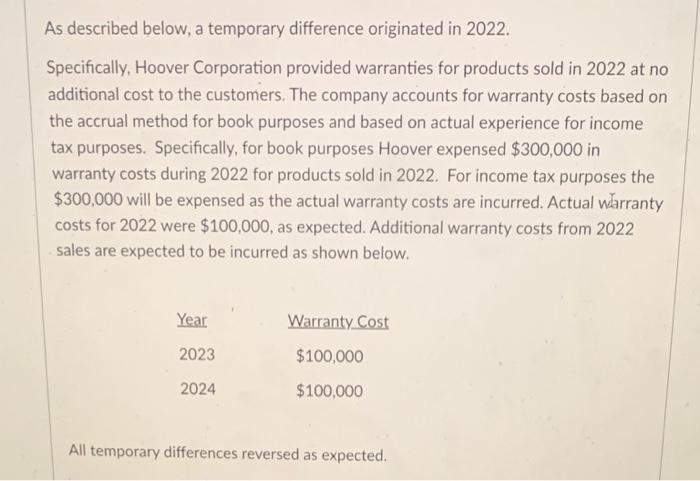

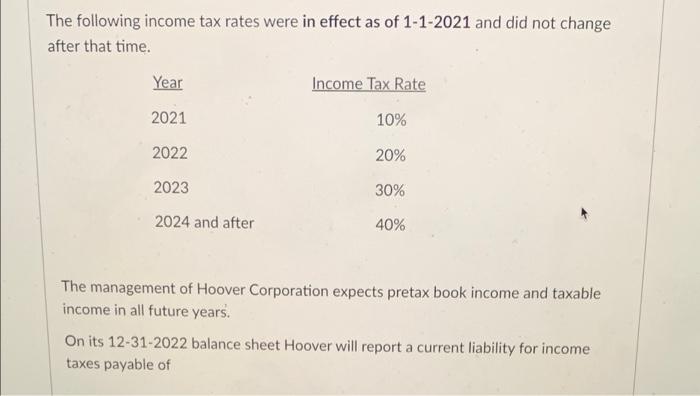

Hoover Corporation had pretax income of $500,000 in 2021 (its first year of operation). As shown below, the income tax rate is 10% for the 2021 tax year. As described below, a temporary difference originated in 2021. Specifically, Hoover Corporation provided warranties for products sold in 2021 at no additional cost to the customers. The company accounts for warranty costs based on the accrual method for book purposes and based on actual experience for income tax purposes. Specifically, for book purposes Hoover expensed $300,000 in warranty costs during 2021 for products sold in 2021. For income tax purposes the $300,000 will be expensed as the actual warranty costs are incurred. Actual warranty costs for 2021 were $100,000, as expected. Additional warranty costs from 2021 sales are expected to be incurred as shown below. Year Warranty Cost $100,000 2022 2023 $100,000 Hoover Corporation had pretax income of $600,000 in 2022 (its second year of operation). As shown below, the income tax rate is 20% for the 2022 tax year. As described below, a temporary difference originated in 2022 As described below, a temporary difference originated in 2022. Specifically, Hoover Corporation provided warranties for products sold in 2022 at no additional cost to the customers. The company accounts for warranty costs based on the accrual method for book purposes and based on actual experience for income tax purposes. Specifically, for book purposes Hoover expensed $300,000 in warranty costs during 2022 for products sold in 2022. For income tax purposes the $300,000 will be expensed as the actual warranty costs are incurred. Actual warranty costs for 2022 were $100,000, as expected. Additional warranty costs from 2022 sales are expected to be incurred as shown below. Year Warranty Cost 2023 $100,000 2024 $100,000 All temporary differences reversed as expected. The following income tax rates were in effect as of 1-1-2021 and did not change after that time. Year Income Tax Rate 2021 10% 2022 20% 2023 30% 2024 and after 40% The management of Hoover Corporation expects pretax book income and taxable income in all future years. On its 12-31-2022 balance sheet Hoover will report a current liability for income taxes payable of Hoover Corporation had pretax income of $500,000 in 2021 (its first year of operation). As shown below, the income tax rate is 10% for the 2021 tax year. As described below, a temporary difference originated in 2021. Specifically, Hoover Corporation provided warranties for products sold in 2021 at no additional cost to the customers. The company accounts for warranty costs based on the accrual method for book purposes and based on actual experience for income tax purposes. Specifically, for book purposes Hoover expensed $300,000 in warranty costs during 2021 for products sold in 2021. For income tax purposes the $300,000 will be expensed as the actual warranty costs are incurred. Actual warranty costs for 2021 were $100,000, as expected. Additional warranty costs from 2021 sales are expected to be incurred as shown below. Year Warranty Cost $100,000 2022 2023 $100,000 Hoover Corporation had pretax income of $600,000 in 2022 (its second year of operation). As shown below, the income tax rate is 20% for the 2022 tax year. As described below, a temporary difference originated in 2022 As described below, a temporary difference originated in 2022. Specifically, Hoover Corporation provided warranties for products sold in 2022 at no additional cost to the customers. The company accounts for warranty costs based on the accrual method for book purposes and based on actual experience for income tax purposes. Specifically, for book purposes Hoover expensed $300,000 in warranty costs during 2022 for products sold in 2022. For income tax purposes the $300,000 will be expensed as the actual warranty costs are incurred. Actual warranty costs for 2022 were $100,000, as expected. Additional warranty costs from 2022 sales are expected to be incurred as shown below. Year Warranty Cost 2023 $100,000 2024 $100,000 All temporary differences reversed as expected. The following income tax rates were in effect as of 1-1-2021 and did not change after that time. Year Income Tax Rate 2021 10% 2022 20% 2023 30% 2024 and after 40% The management of Hoover Corporation expects pretax book income and taxable income in all future years. On its 12-31-2022 balance sheet Hoover will report a current liability for income taxes payable of