Answered step by step

Verified Expert Solution

Question

1 Approved Answer

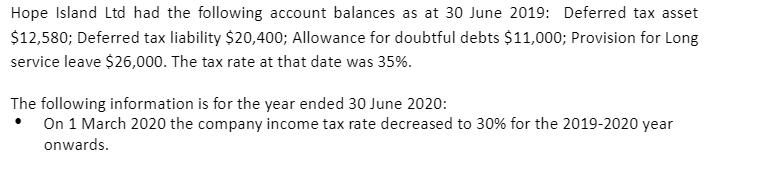

Hope Island Ltd had the following account balances as at 30 June 2019: Deferred tax asset $12,580; Deferred tax liability $20,400; Allowance for doubtful

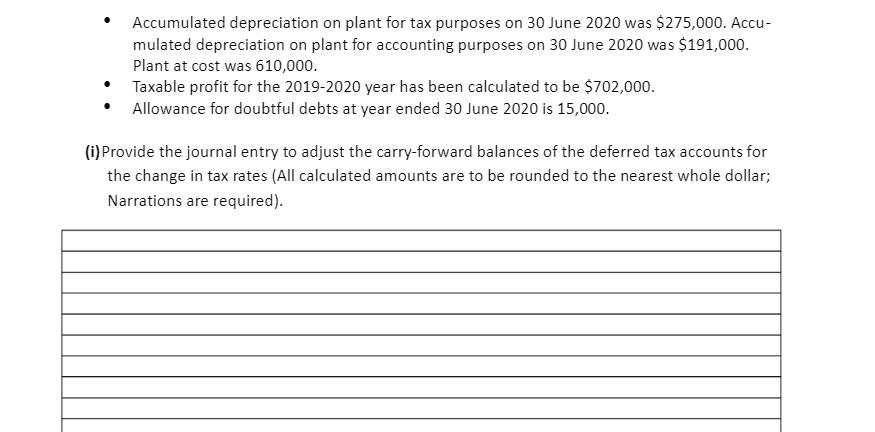

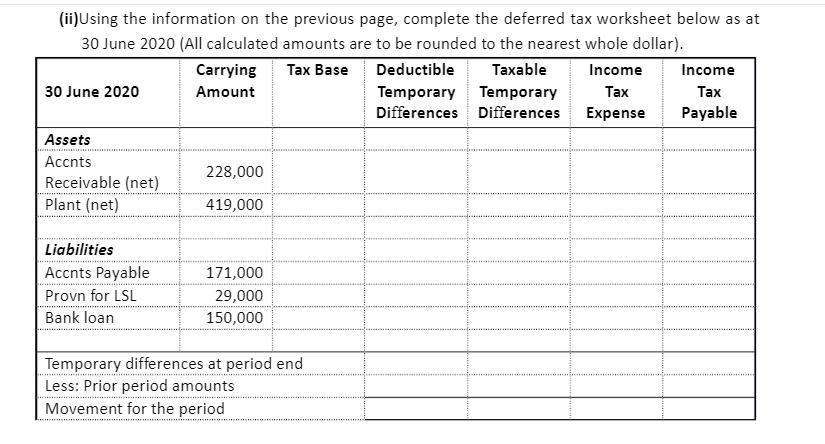

Hope Island Ltd had the following account balances as at 30 June 2019: Deferred tax asset $12,580; Deferred tax liability $20,400; Allowance for doubtful debts $11,000; Provision for Long service leave $26,000. The tax rate at that date was 35%. The following information is for the year ended 30 June 2020: On 1 March 2020 the company income tax rate decreased to 30% for the 2019-2020 year onwards. . Accumulated depreciation on plant for tax purposes on 30 June 2020 was $275,000. Accu- mulated depreciation on plant for accounting purposes on 30 June 2020 was $191,000. Plant at cost was 610,000. Taxable profit for the 2019-2020 year has been calculated to be $702,000. Allowance for doubtful debts at year ended 30 June 2020 is 15,000. (i) Provide the journal entry to adjust the carry-forward balances of the deferred tax accounts for the change in tax rates (All calculated amounts are to be rounded to the nearest whole dollar; Narrations are required). (ii)Using the information on the previous page, complete the deferred tax worksheet below as at 30 June 2020 (All calculated amounts are to be rounded to the nearest whole dollar). Tax Base 30 June 2020 Assets Accnts Receivable (net) Plant (net) Liabilities Accnts Payable Provn for LSL Bank loan Carrying Amount 228,000 419,000 171,000 29,000 150,000 Temporary differences at period end Less: Prior period amounts Movement for the period Deductible Taxable Temporary Temporary Income Income Tax Tax Differences Differences Expense Payable Tax affected Tax on taxable income. Income tax adjustments required (111) Prepare journal entries for both the current and deferred tax consequences and for disclosure of deferred tax in the Balance Sheet (Narrations are required):

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started