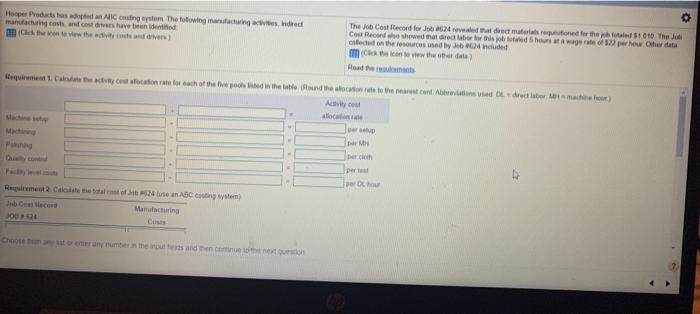

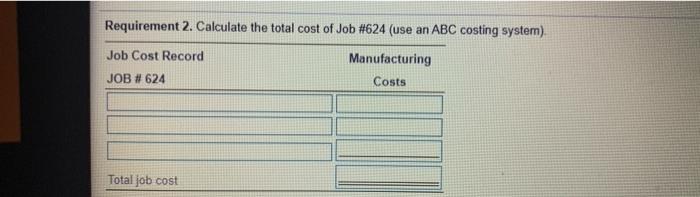

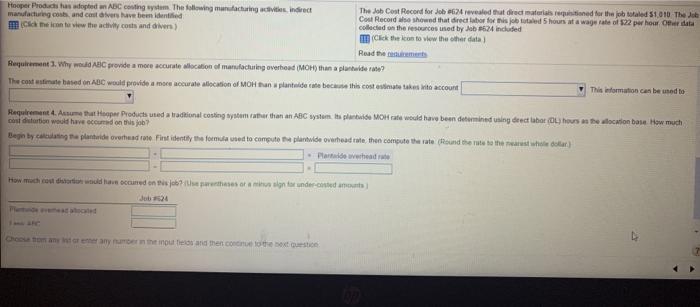

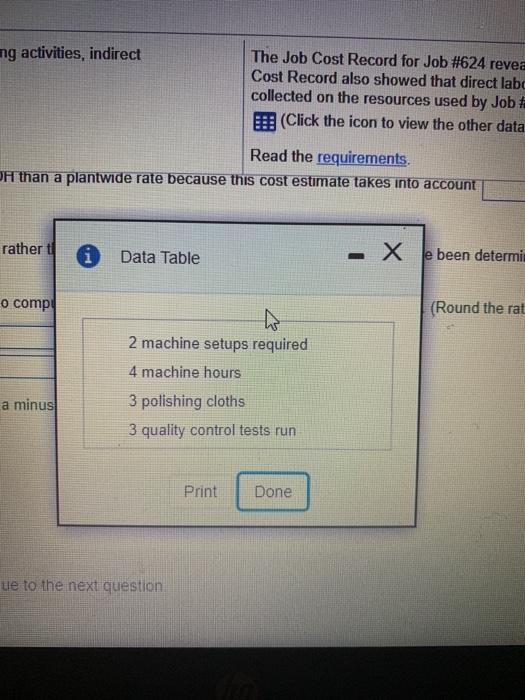

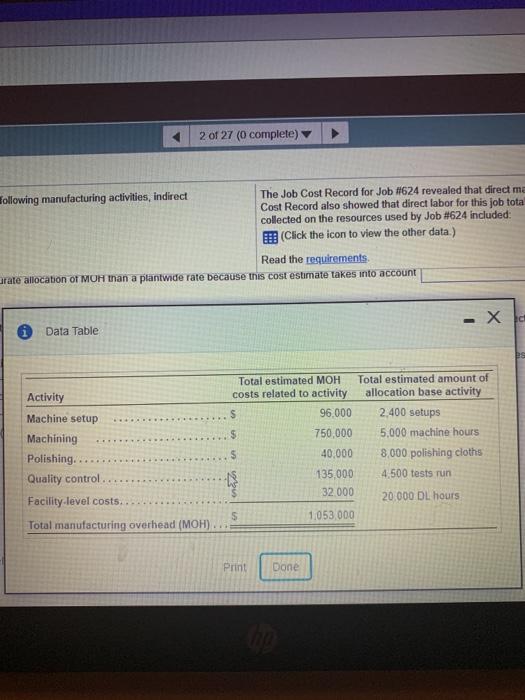

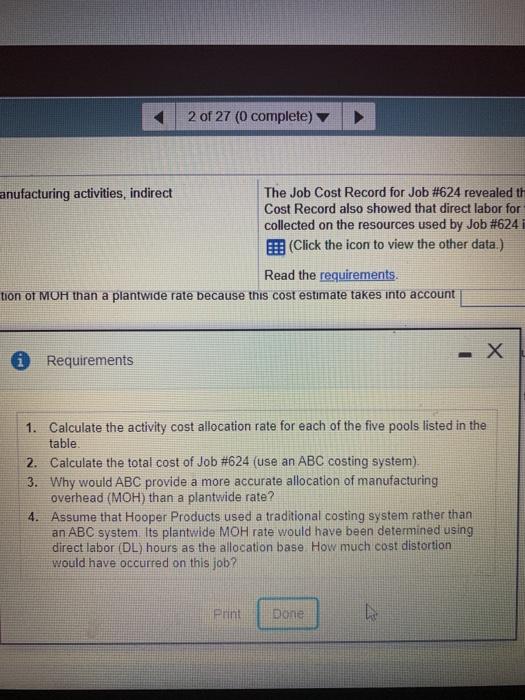

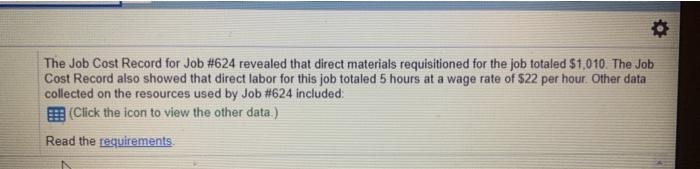

Hope Products has a singlem The following acting as det manufacturing costs and costs have been identitled The Job Cost Record for Job 24 rated the demand for the 1010 The Cost Red showed that director for this show how hardt checked on the sources med by Job 26.24 included Chew the data) Request Catechiscation for each of the theated the contes Dedema) how Rpment 2. Calcatel 2 AGC Congo Job Ced Manufacturing JOB Custe T Requirement 2. Calculate the total cost of Job #624 (use an ABC costing system) Job Cost Record Manufacturing Costs JOB # 624 Total job cost Hooper Products has adopted ABC to wydum. The following manufacturing its indirect The Job Cost Record for Job 624 revealed that direct naturli ustioned for the job totaled 51010 The Jo manufacturing costs and cover been identified Cost Record he showed that director for this job led 5 hours at a wage rate of 22 per hour or data micide con ta view the activity costs and divers) collected on the resources used by Job 624 included (Click the icon to view the other data) Read the Requirement 3. Why do ABC provide a more accurate location of manufacturing overhoed (MH) than a plurtulder? The cost estimate based on ABC would provide a more accurate allocation of MOH transplantaide cate because the cost estimate takes to account This information can be used to Requirement. Asume that Hopper Products used a traditional conting som rather than an ABC system tha plantile MOH rate would have been determined using direct that OL house location base How much Begin by entering plantelde overheadrone fint idently the fornita used to compute the plant de overhoed tote, then compute the rate round the nine to the nearest wher) cost stortion would have scored on this job? How much do dort will have occured on the wees om in ter under med at Ju 26 Chooman in any number ones and then concreto bottic ng activities, indirect The Job Cost Record for Job #624 revea Cost Record also showed that direct labc collected on the resources used by Job + Click the icon to view the other data Read the requirements, OH than a plantwide rate because this cost estimate takes into account rather ti i Data Table - X je been determin o comp (Round the rat 2 machine setups required 4 machine hours 3 polishing cloths 3 quality control tests run a minus Print Done ue to the next question 2 of 27 (0 complete) Following manufacturing activities, indirect The Job Cost Record for Job #1624 revealed that direct me Cost Record also showed that direct labor for this job tota collected on the resources used by Job #624 included: (Click the icon to view the other data) Read the requirements arate allocation of MOH than a plantwide rate because this cost estimate takes into account - X Data Table Activity Machine setup Machining Polishing.. Quality control Facility level costs.. Total manufacturing overhead (MOH) Total estimated MOH Total estimated amount of costs related to activity allocation base activity $ 96.000 2.400 setups $ 750,000 5,000 machine hours 40.000 8 000 polishing cloths 135,000 4.500 tests run 32.000 20.000 DL hours 1.053 000 Print Done 2 of 27 (0 complete) anufacturing activities, indirect The Job Cost Record for Job #624 revealed th Cost Record also showed that direct labor for collected on the resources used by Job #624 E (Click the icon to view the other data.) Read the requirements. tion of MOH than a plantwide rate because this cost estimate takes into account -X 0 Requirements 1. Calculate the activity cost allocation rate for each of the five pools listed in the table 2. Calculate the total cost of Job #624 (use an ABC costing system). 3. Why would ABC provide a more accurate allocation of manufacturing overhead (MOH) than a plantwide rate? 4. Assume that Hooper Products used a traditional costing system rather than an ABC system Its plantwide MOH rate would have been determined using direct labor (DL) hours as the allocation base How much cost distortion would have occurred on this job? Print Done Hooper Products has adopted an ABC costing system. The following manufacturing activities, indirect manufacturing costs, and cost drivers have been identified: (Click the icon to view the activity costs and drivers.) The Job Cost Record for Job #624 revealed that direct materials requisitioned for the job totaled $1,010. The Job Cost Record also showed that direct labor for this job totaled 5 hours at a wage rate of S22 per hour. Other data collected on the resources used by Job #624 included: (Click the icon to view the other data.) Read the requirements