Hope to have a detailed explanation, thank you

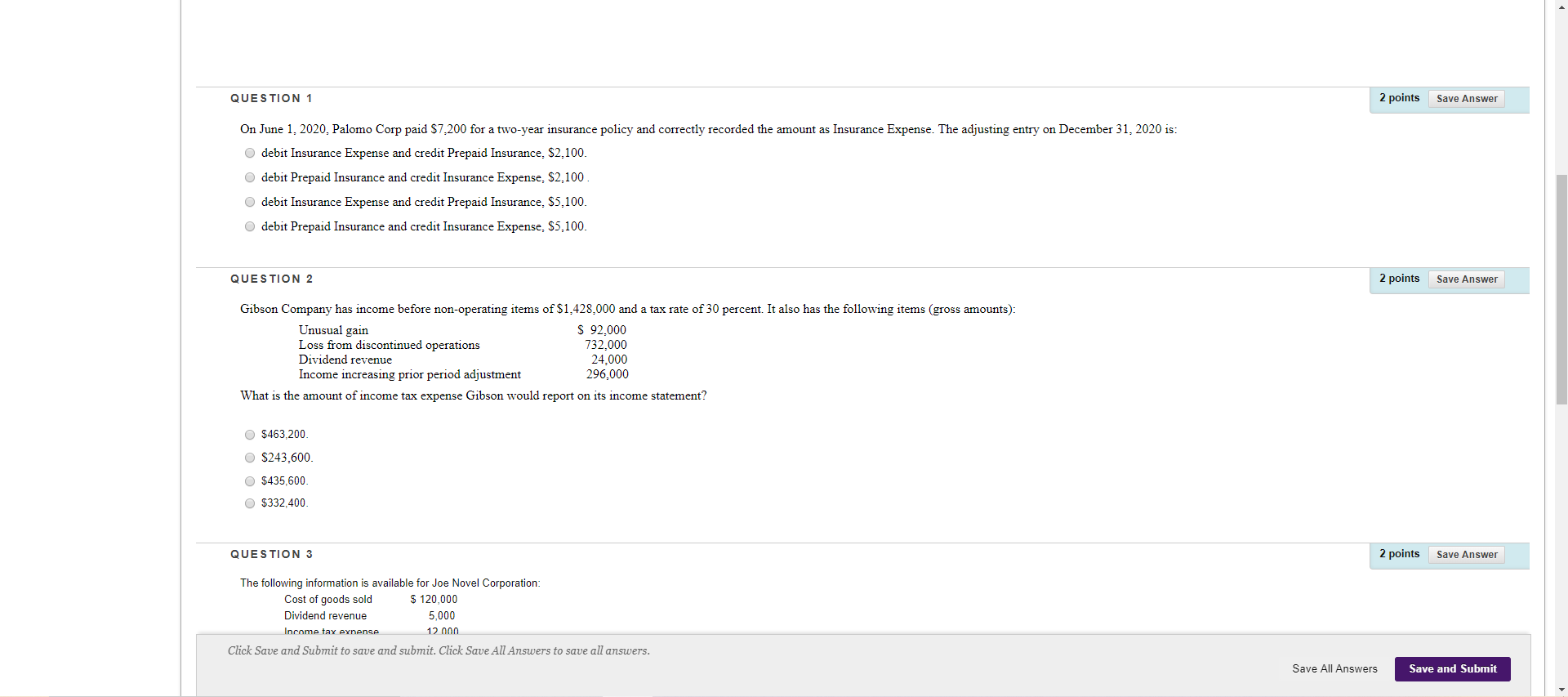

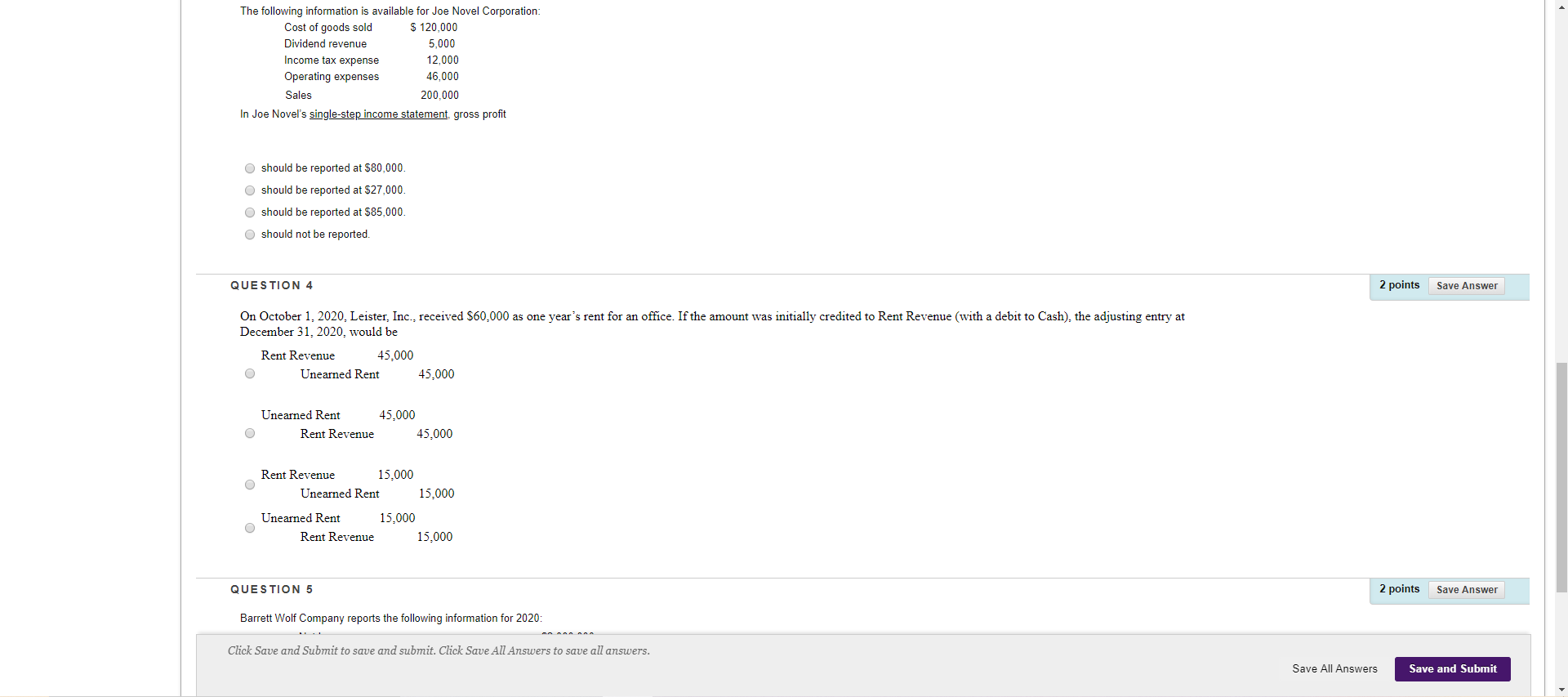

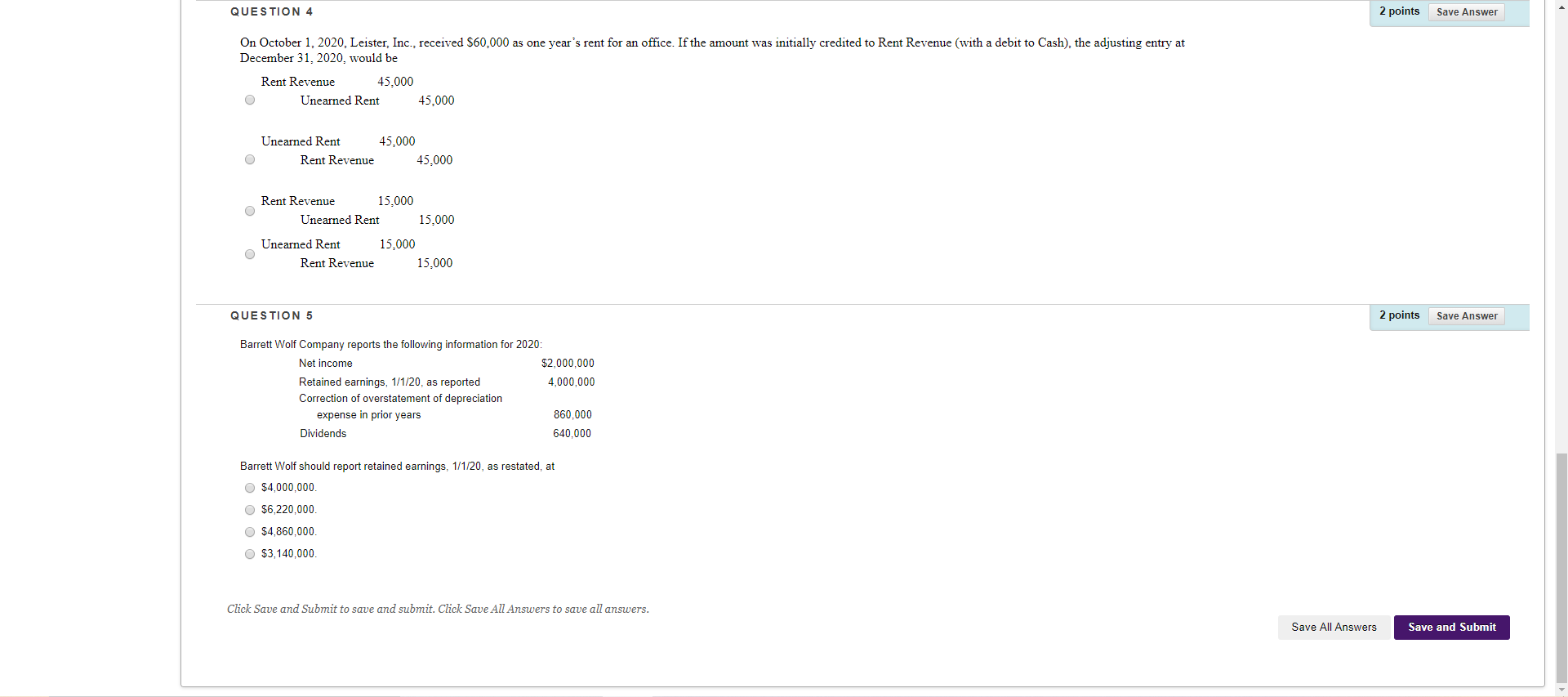

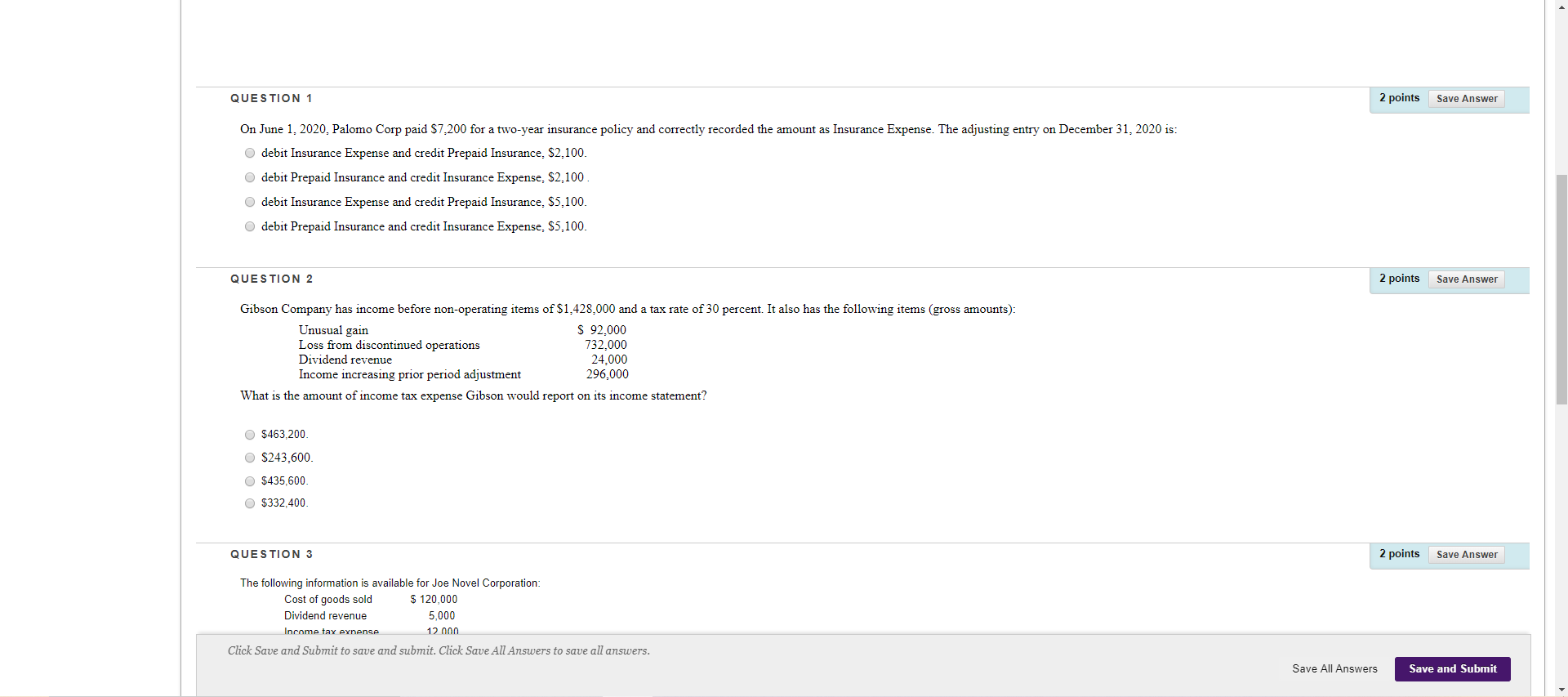

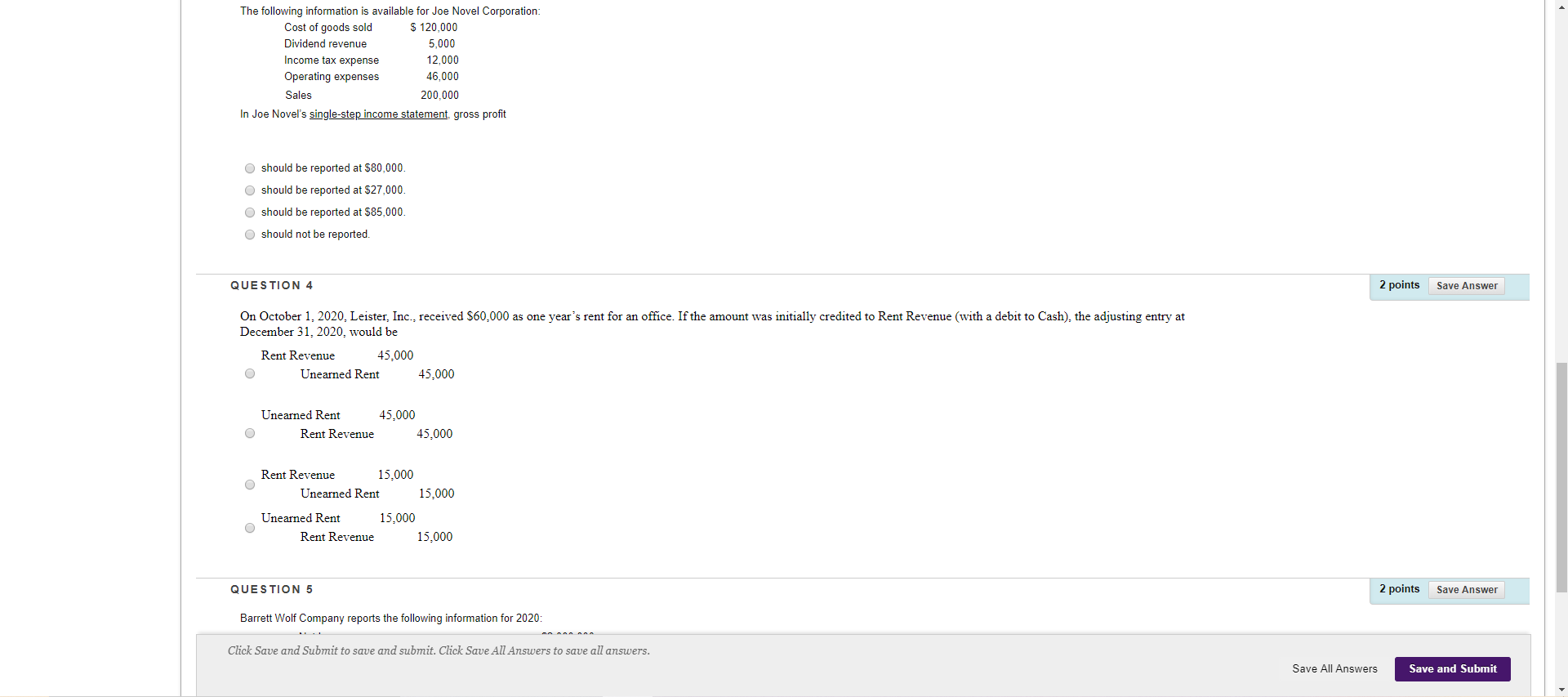

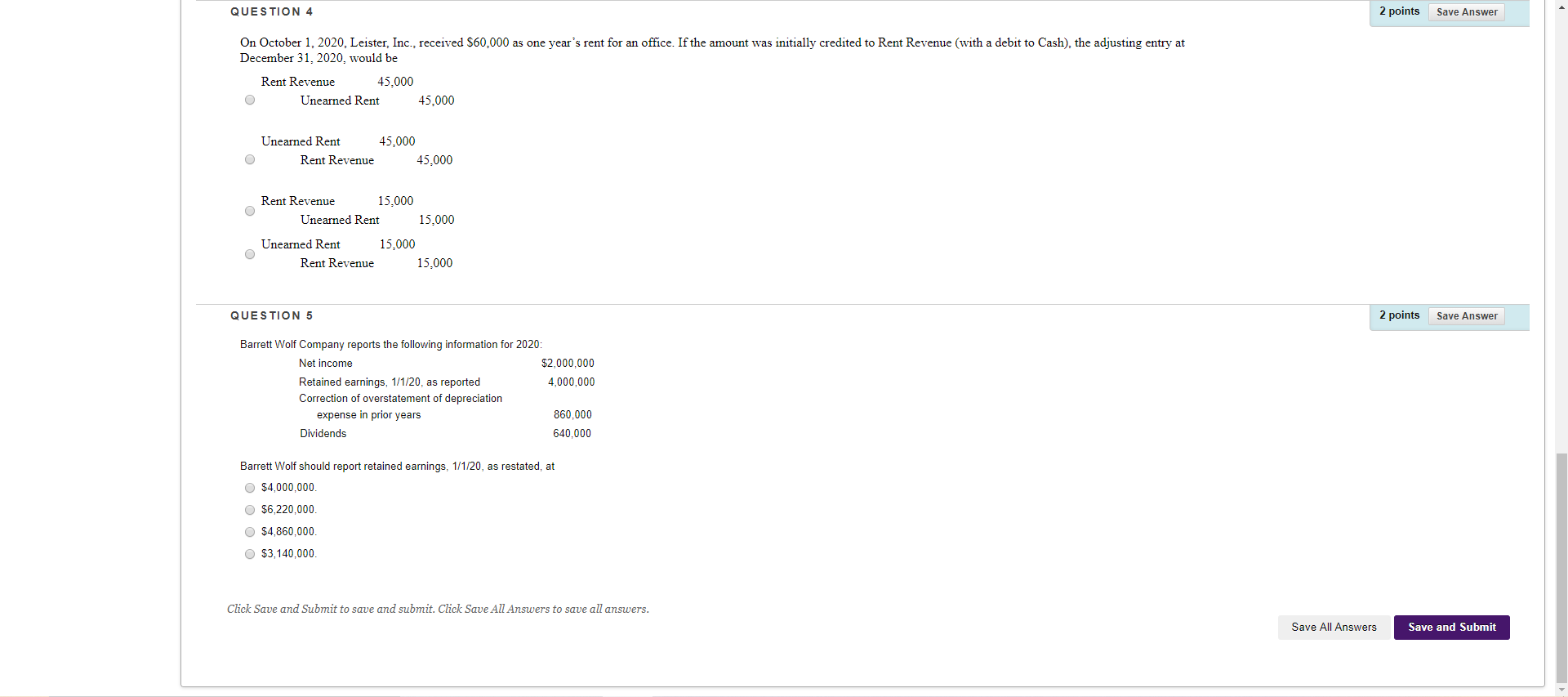

QUESTION 1 2 points Save Answer On June 1, 2020. Palomo Corp paid $7,200 for a two-year insurance policy and correctly recorded the amount as Insurance Expense. The adjusting entry on December 31, 2020 is: debit Insurance Expense and credit Prepaid Insurance. $2.100. debit Prepaid Insurance and credit Insurance Expense. $2.100 debit Insurance Expense and credit Prepaid Insurance. $5.100. debit Prepaid Insurance and credit Insurance Expense. $5.100. QUESTION 2 2 points Save Answer Gibson Company has income before non-operating items of $1,428,000 and a tax rate of 30 percent. It also has the following items (gross amounts): Unusual gain S 92.000 Loss from discontinued operations 732.000 Dividend revenue 24,000 Income increasing prior period adjustment 296,000 What is the amount of income tax expense Gibson would report on its income statement? $463,200 OS243,600 $435,600 $332,400 QUESTION 3 2 points Save Answer The following information is available for Joe Novel Corporation: Cost of goods sold $ 120,000 Dividend revenue 5,000 Income tax eynense 12 000 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit The following information is available for Joe Novel Corporation: Cost of goods sold $ 120,000 Dividend revenue 5,000 Income tax expense 12,000 Operating expenses 46,000 Sales 200,000 In Joe Novel's single-step income statement, gross profit should be reported at $80,000. should be reported at $27,000. should be reported at $85,000. should not be reported QUESTION 4 2 points Save Answer On October 1, 2020. Leister, Inc., received $60,000 as one year's rent for an office. If the amount was initially credited to Rent Revenue (with a debit to Cash), the adjusting entry at December 31, 2020, would be Rent Revenue 45,000 o Unearned Rent 45,000 Unearned Rent 45,000 O Rent Revenue 45,000 Rent Revenue 15,000 O Unearned Rent 15,000 Unearned Rent Rent Revenue 15,000 15,000 QUESTION 5 2 points Save Answer Barrett Wolf Company reports the following information for 2020: Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit QUESTION 4 2 points Save Answer On October 1, 2020. Leister, Inc., received $60,000 as one year's rent for an office. If the amount was initially credited to Rent Revenue (with a debit to Cash), the adjusting entry at December 31, 2020, would be Rent Revenue 45,000 Unearned Rent 45,000 o Unearned Rent 45,000 Rent Revenue 45,000 Rent Revenue 15,000 Unearned Rent 15,000 Unearned Rent O Rent Revenue 15,000 15,000 QUESTION 5 2 points Save Answer Barrett Wolf Company reports the following information for 2020: Net income $2,000,000 Retained earnings, 1/1/20, as reported 4,000,000 Correction of overstatement of depreciation expense in prior years 860,000 Dividends 640.000 Barrett Wolf should report retained earnings, 1/1/20, as restated, at $4,000,000 $6,220,000. $4,860,000 $3,140,000 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit