Question

Hope you can help me with this case :) However, question number 1 have already answered :) Here are the answers for question number 1

Hope you can help me with this case :)

However, question number 1 have already answered :) Here are the answers for question number 1

a) Key financial ratios:

current ratio = 12536/7147 = 1.8

quick ratio = 5217/7147 = 0.7

debt ratio = 9014*100/15074 =59.8%

times interest earned = 697/469 = 1.5

inventory turnover (cost) =26140/7319 = 3.6

inventory turnover (sales) =30703/7319= 4.2

fixed assets turnover = 30703/2538 = 12.1

total assets turnover =30703/15074 = 2.0

average collection period = 4605*365/30703 = 55 days

profit margin = 118*100/30703 = 0.4%

gross margin = 4563*100/30703 = 14.9%

return on total assets = 118*100/15074 = 0.8%

return on equity = 118*100/6060 = 1.9%

dividend payout ratio =30*100/118 = 25.4%

Altman Z factor = 1.2*0.36+1.4*0.16+3.3*.05+0.6*0.06+1*2 = 2.9

(Z-Factor = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E, where: A = Working Capital/Total Assets; B = Retained Earnings/Total Assets; C = Earnings Before Interest & Tax/Total Assets; D = Market Value of Equity/Total Liabilities; E = Sales/Total Assets)

b) Funds flow statement:

Sources:

Net income 118

Add depreciation 320

funds from operation 438

Decrease in net working capital 68

total sources 506

Uses of funds:

repayment of long term loan 41

common stock dividend 30

increase in fixed assets 435

Total uses 506

Analysis of changes in WCL

Current assets:

decrease in cash -16

increase in AR 1709

increase in inventory 2138

total increase in current assets 3831

Current liabilities:

increase in ST bank borrowing 2060

increase in AP 1489

increase in accruals 350

increase in current liabilities 3899

Net decrease in NWC 68

Hope you can answer question number 2 in full explanation. Thank you so much :)

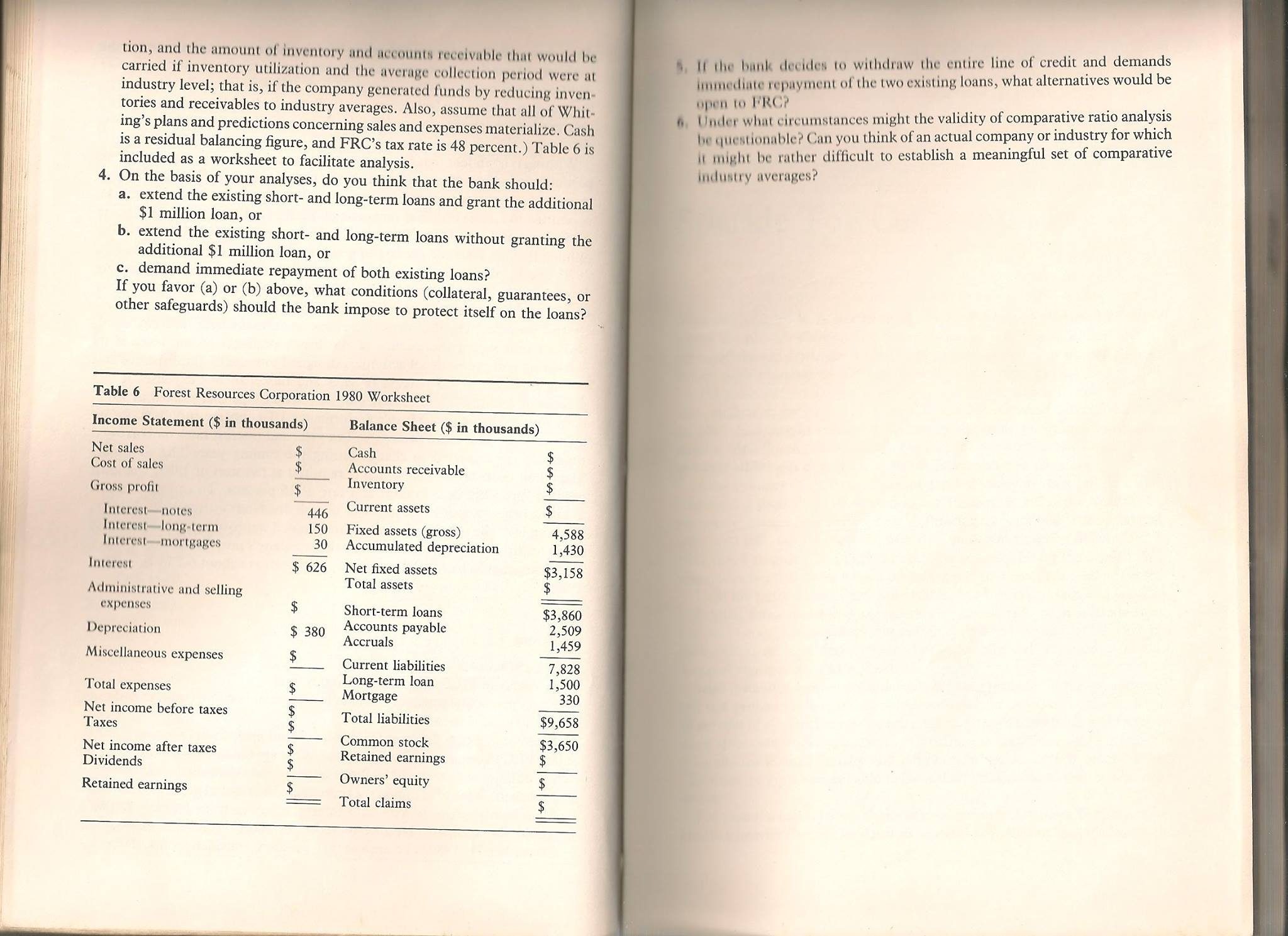

Case 1: Financial Analysis Forest Resources Corporation Laurie Phillips, vice-president and senior loan officer of the First Florida National Bank of Jacksonville, was recently alerted to the deteriorating finan- cial position of one of the bank's long-standing clients, Forest Resources Corporation (FRC), via the bank's computer analysis program. The bank requires Information from such statements is fed into the computer, which then calculates key ratios for each customer, charts trends in these ratios, and compares the statistics for each company with the average ratios of other firms in the same industry and against any protective requirements in the loan quarterly financial statements from each of its major loan customers reements. If any ratio is significantly worse than the industry average, ag reflects a marked adverse trend, or fails to meet contractual requirements, the computer highlights the deficiency An analysis of FRC's financial statements revealed a number of significant trends (see Tables 1-5 for the financial statements and partial analyses thereof). Particularly disturbing were the 1979 current and debt ratios, which failed to meet the contractual limits of 2.0 and 55 percent, respectively Because the current and debt ratios do not meet contractual requirements, the bank legally could call for immediate repayment of both the long- and short term loans and, if they were not repaid within ten days, could force the company into bankruptcy. However, Phillips was reluctant to take such drastic to initiate immediate, decisive action to improve the company's financial position. Accordingly, she sent a copy of the computer output, together with her comments on the company's financial position, to George Whiting, founder and president of FRC, with a request that he review this material and submit to the bank proposals for immediate corrective action. action, preferring to approach FRC's management and persuade them Forest Resources Corporation's common stock is traded over-the-counter The company manufactures and distributes a wide range of forest products including building lumber, pulp and paper, plywood, and wood specialtiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started