Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hopefully this is vkear enough Please txt 484-626-3013 for additonal work and compensation It will show up! dont need to calvulate amt but It's 600,000

hopefully this is vkear enough Please txt 484-626-3013 for additonal work and compensation

It will show up! dont need to calvulate amt but It's 600,000 and 1200000. thanks

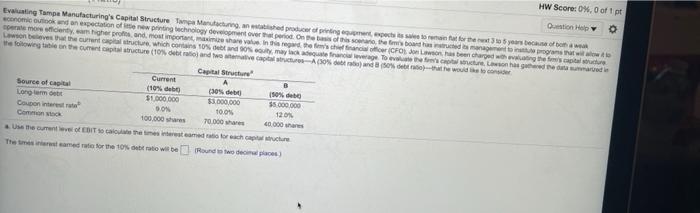

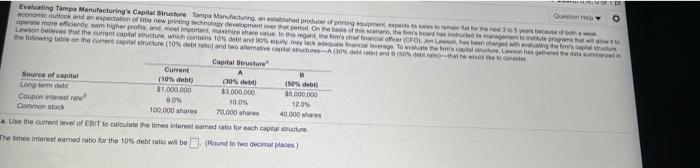

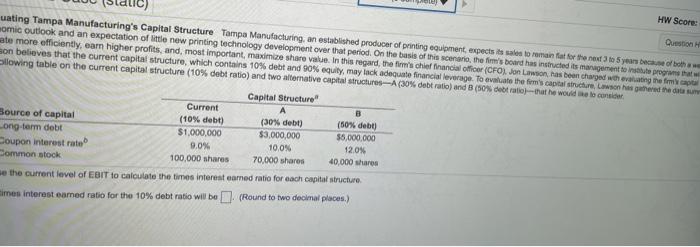

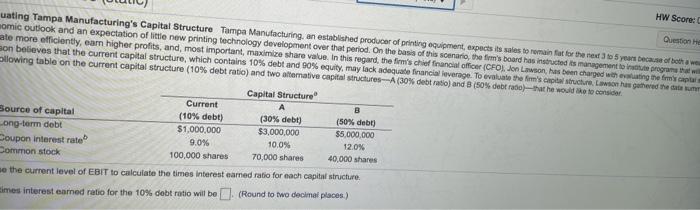

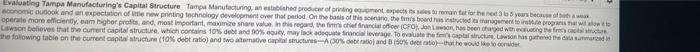

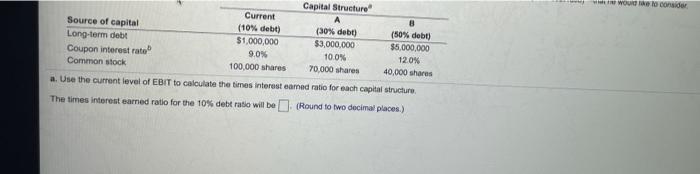

HW Score: 0%, 0 of tpt Question Help Evening Tampa Manufacturing Capital Structure Maturgashed producer of printing expects at for the con economic decation of new pinchogy development over the period one of this son, the board mentor or more detaigher promotora, mahore in the these tractor CFO oso has been charged with water wobec which can 10% may cause fra wage. To evaluated folowing table on the 10% and we live AION) She would like to con Capital Structure Current Source of capital (10% debito 150 Long termet S1 000 000 $5.000.000 $5.000.000 Coupon interest rate 9.00 10.01 12 Common 70.000 Use the current of Touchure There are somedate for the 10 rate wil bedre De Evaluating Tampa Manufacturing Capital Souture Tompa Mangalore economic took and an expectation of wrong technology demented on a farm operate more clear profitand moet portalu www.drow Cost cargt weg te www Lawson Belves that the current capital which contains to and comes to how tabe on the current cure (10% new Capital Structure Current Source of capital (10% debe (30% debit (o debe Long-term debit $1.000.000 $3.000.000 $5.000.000 Coupon ferestre 10.0 1204 Commons 100.000 shares 70.000 h 40.000 Use the current level of EBIT calculate the times interest med rate for each cacture The times internet earned ratio for the 10% debt rate will be Round to the decimal place) A HW Score: uating Tampa Manufacturing's Capital Structure Tampa Manufacturing, an established producer of printing equipment expects is to remain fat for the next 3 to 5 years because of bome Question momic outlook and an expectation of little new printing technology development over that period. On the basis of this scenario, the firm's board has instructed its management toute programs that ate more efficiently, earn higher profits, and most important, maximize share value. In this regard, the firm's chief financial Officer (CFO, Jonson has been charged when the mapa Bon believes that the current capital structure, which contains 10% debt and 90% equity, may lackadequate financial leverage. To evaluate the firm's capital structure, where the llowing table on the current capital structure (10% debt ratio) and two alternative capital structures (30% debt ratio) and B (50% debt rehat he would be consi Capital Structure Current B Source of capital (10% debt) (30% debt) (50% debt) ong-term debt $1,000,000 $3,000,000 $5,000,000 Coupon interest rate 9.0% 10,0% 12.0% ommon stock 100,000 shares 70,000 shares 40,000 shares e the current level of EBIT to calculate the times interest eamed ratio for each capital structure times interest eamed ratio for the 10% debt ratio will be (Round to two decimal places) HW Score: uating Tampa Manufacturing's Capital Structure Tampa Manufacturing an established producer of printing equipment expects its sales to remain for for the next to your decade of both Questione nomic outlook and an expectation of the new printing technology development over that period. On the basis of this scenario, the firm's board has instructed is management programa ate more efficiently, eam higher profits, and most important, maximize share value. In this regard, the firm's chief francial officer (CFOL Jon Lawson, has been charged wing the firm's captar son believes that the current capital structure, which contains 10% debt and 90% equity, may lack adequate financial leverage. To evaluate the firm's castructure. Lowo hothered the date allowing table on the current capital structure (10% debt ratio) and two alternative capital structures--A (30% debt ratio) and (50% debt rado)--that he would not consider Capital Structure Current A B Source of capital (10% debt) (30% debt) (50% debt) ong-term debt $1,000,000 $3,000,000 $5,000,000 oupon interest rate 9.0% 100% 12.0% Common stock 100,000 shares 70,000 shares 40.000 shares o the current level of EBIT to calculate the times interesteamed ratio for each capital structure times interest earned ratio for the 10% debt ratio will be ). (Round to two decimal places.) (0 complete Case (static) HW Score: 0 uating Tampa Manufacturing's Capital Structure Tampa Manufacturing, an established producer of printing equipment, expects sales to main fat for the next to you become Question nomic outlook and an expectation of little new printing technology development over that period. On the basis of this scenario, the firm's board has instructed to management to the program that will ate more efficiently, eam higher profits, and most important, maximize share value. In this regard, the firm's chief francial officer (CFOL Jonson has been charged with a son believes that the current capital structure, which contains 10% debt and 90% equity, may lack adequate financial leverage. To evaluate the firm's capital structure, Lion has put them llowing table on the current capital structure (10% debt ratio) and two alternative capital structures (30% debt ratio and B (50% deberehat he would be con Capital Structure Current A 3 Source of capital (10% debt) (30% debt) (50% debit) ong-term debt $1,000,000 $3,000,000 $5,000,000 Coupon interest rate 9.0% 10.0% 12.0% Sommon stock 100,000 shares 70,000 shares 40,000 shares o the current level of EBIT to calculate the times interest eamed ratio for each capital structure times interest earned ratio for the 10% debt ratio will be (Round to two decimal places) Evaluating Tampa Manufacturing's Capital Structure Tampa Manufacturing, mashed producer of internationer 35 yours because come outook and an expectation of the printing technology development over that period on the basis of this son, the boards inced management to the programs will operate more efficiently, cam Pigher profits, and most important maize shore value in this regard the financial officer (CFOs been arged with the most Lawson believe that the current capital structure, which contains 10% debt and 90% y may lockadequate francia leverage. To evaluate the policum Lawas gathered the words the following table on the current capital structure (10debt ratio) and two native capital structures (30% debitato and 50% debati-that he would be conside We would lo consider Capital Structure Current 8 Source of capital (10% debt) (30% debt) (50% debt) Long-term debit $1,000,000 $3.000.000 $5.000.000 Coupon interest rate 9.0% 100% 120% Common stock 100,000 shares 70,000 shares 40,000 shares a. Use the current level of EBIT to calculate the times interest earned ratio for each capital structure The times interest earned ratio for the 10% debt radio will be (Round to two decimal places) HW Score: 0%, 0 of tpt Question Help Evening Tampa Manufacturing Capital Structure Maturgashed producer of printing expects at for the con economic decation of new pinchogy development over the period one of this son, the board mentor or more detaigher promotora, mahore in the these tractor CFO oso has been charged with water wobec which can 10% may cause fra wage. To evaluated folowing table on the 10% and we live AION) She would like to con Capital Structure Current Source of capital (10% debito 150 Long termet S1 000 000 $5.000.000 $5.000.000 Coupon interest rate 9.00 10.01 12 Common 70.000 Use the current of Touchure There are somedate for the 10 rate wil bedre De Evaluating Tampa Manufacturing Capital Souture Tompa Mangalore economic took and an expectation of wrong technology demented on a farm operate more clear profitand moet portalu www.drow Cost cargt weg te www Lawson Belves that the current capital which contains to and comes to how tabe on the current cure (10% new Capital Structure Current Source of capital (10% debe (30% debit (o debe Long-term debit $1.000.000 $3.000.000 $5.000.000 Coupon ferestre 10.0 1204 Commons 100.000 shares 70.000 h 40.000 Use the current level of EBIT calculate the times interest med rate for each cacture The times internet earned ratio for the 10% debt rate will be Round to the decimal place) A HW Score: uating Tampa Manufacturing's Capital Structure Tampa Manufacturing, an established producer of printing equipment expects is to remain fat for the next 3 to 5 years because of bome Question momic outlook and an expectation of little new printing technology development over that period. On the basis of this scenario, the firm's board has instructed its management toute programs that ate more efficiently, earn higher profits, and most important, maximize share value. In this regard, the firm's chief financial Officer (CFO, Jonson has been charged when the mapa Bon believes that the current capital structure, which contains 10% debt and 90% equity, may lackadequate financial leverage. To evaluate the firm's capital structure, where the llowing table on the current capital structure (10% debt ratio) and two alternative capital structures (30% debt ratio) and B (50% debt rehat he would be consi Capital Structure Current B Source of capital (10% debt) (30% debt) (50% debt) ong-term debt $1,000,000 $3,000,000 $5,000,000 Coupon interest rate 9.0% 10,0% 12.0% ommon stock 100,000 shares 70,000 shares 40,000 shares e the current level of EBIT to calculate the times interest eamed ratio for each capital structure times interest eamed ratio for the 10% debt ratio will be (Round to two decimal places) HW Score: uating Tampa Manufacturing's Capital Structure Tampa Manufacturing an established producer of printing equipment expects its sales to remain for for the next to your decade of both Questione nomic outlook and an expectation of the new printing technology development over that period. On the basis of this scenario, the firm's board has instructed is management programa ate more efficiently, eam higher profits, and most important, maximize share value. In this regard, the firm's chief francial officer (CFOL Jon Lawson, has been charged wing the firm's captar son believes that the current capital structure, which contains 10% debt and 90% equity, may lack adequate financial leverage. To evaluate the firm's castructure. Lowo hothered the date allowing table on the current capital structure (10% debt ratio) and two alternative capital structures--A (30% debt ratio) and (50% debt rado)--that he would not consider Capital Structure Current A B Source of capital (10% debt) (30% debt) (50% debt) ong-term debt $1,000,000 $3,000,000 $5,000,000 oupon interest rate 9.0% 100% 12.0% Common stock 100,000 shares 70,000 shares 40.000 shares o the current level of EBIT to calculate the times interesteamed ratio for each capital structure times interest earned ratio for the 10% debt ratio will be ). (Round to two decimal places.) (0 complete Case (static) HW Score: 0 uating Tampa Manufacturing's Capital Structure Tampa Manufacturing, an established producer of printing equipment, expects sales to main fat for the next to you become Question nomic outlook and an expectation of little new printing technology development over that period. On the basis of this scenario, the firm's board has instructed to management to the program that will ate more efficiently, eam higher profits, and most important, maximize share value. In this regard, the firm's chief francial officer (CFOL Jonson has been charged with a son believes that the current capital structure, which contains 10% debt and 90% equity, may lack adequate financial leverage. To evaluate the firm's capital structure, Lion has put them llowing table on the current capital structure (10% debt ratio) and two alternative capital structures (30% debt ratio and B (50% deberehat he would be con Capital Structure Current A 3 Source of capital (10% debt) (30% debt) (50% debit) ong-term debt $1,000,000 $3,000,000 $5,000,000 Coupon interest rate 9.0% 10.0% 12.0% Sommon stock 100,000 shares 70,000 shares 40,000 shares o the current level of EBIT to calculate the times interest eamed ratio for each capital structure times interest earned ratio for the 10% debt ratio will be (Round to two decimal places) Evaluating Tampa Manufacturing's Capital Structure Tampa Manufacturing, mashed producer of internationer 35 yours because come outook and an expectation of the printing technology development over that period on the basis of this son, the boards inced management to the programs will operate more efficiently, cam Pigher profits, and most important maize shore value in this regard the financial officer (CFOs been arged with the most Lawson believe that the current capital structure, which contains 10% debt and 90% y may lockadequate francia leverage. To evaluate the policum Lawas gathered the words the following table on the current capital structure (10debt ratio) and two native capital structures (30% debitato and 50% debati-that he would be conside We would lo consider Capital Structure Current 8 Source of capital (10% debt) (30% debt) (50% debt) Long-term debit $1,000,000 $3.000.000 $5.000.000 Coupon interest rate 9.0% 100% 120% Common stock 100,000 shares 70,000 shares 40,000 shares a. Use the current level of EBIT to calculate the times interest earned ratio for each capital structure The times interest earned ratio for the 10% debt radio will be (Round to two decimal places) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started