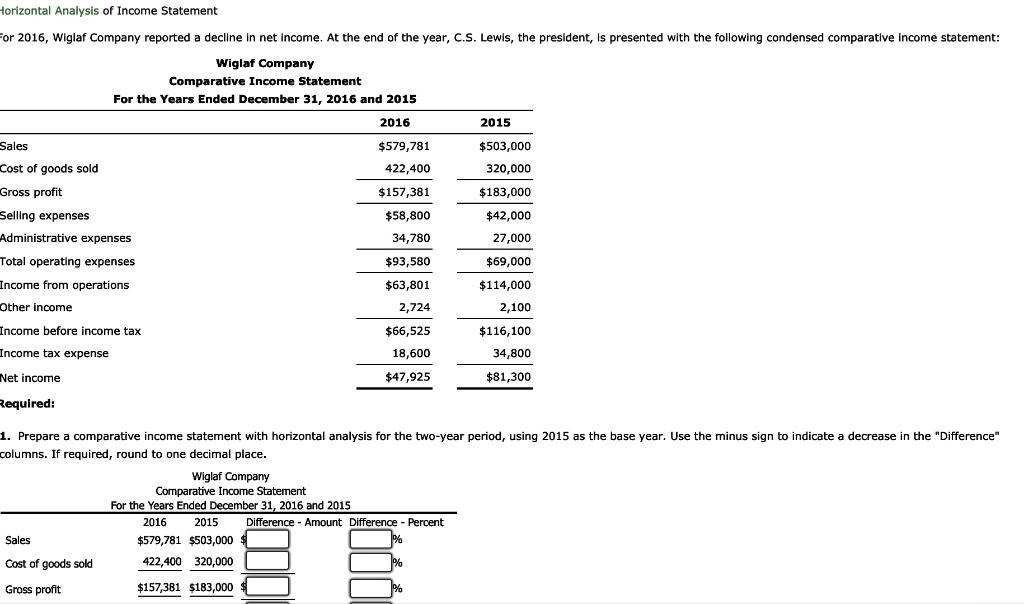

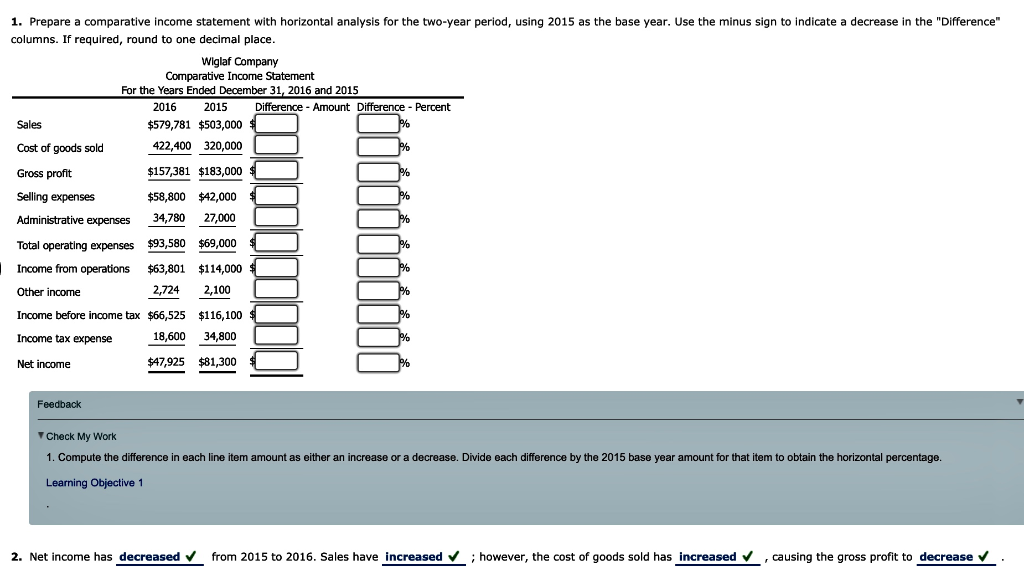

Horizontal Analysis of Income Statement For 2016, Wiglaf Company reported a decline in net income. At the end of the year, C.S. Lewis, the president, is presented with the following condensed comparative income statement: 2015 Wiglaf Company Comparative Income Statement For the Years Ended December 31, 2016 and 2015 2016 Sales $579,781 Cost of goods sold 422,400 Gross profit $157,381 Selling expenses $58,800 Administrative expenses 34,780 Total operating expenses $93,580 Income from operations $63,801 Other income 2,724 Income before income tax $66,525 Income tax expense 18,600 $503,000 320,000 $183,000 $42,000 27,000 $69,000 $114,000 2,100 $116,100 34,800 $81,300 Net income $47,925 Required: 1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 2015 as the base year. Use the minus sign to indicate a decrease in the "Difference" columns. If required, round to one decimal place. Wiglaf Company Comparative Income Statement For the Years Ended December 31, 2016 and 2015 2016 2015 Difference - Amount Difference - Percent Sales $579,781 $503,000 $ Cost of goods sold 422,400 320,000 Gross profit $157,381 $183,000 1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 2015 as the base year. Use the minus sign to indicate a decrease in the "Difference" columns. If required, round to one decimal place. Wiglaf Company Comparative Income Statement For the Years Ended December 31, 2016 and 2015 2016 2015 Difference - Amount Difference - Percent Sales $579,781 $503,000 L Cost of goods sold 422,400 320,000 Gross profit $157,381 $183,000 Selling expenses $58,800 $42,000 Administrative expenses 34,780 27,000 Total operating expenses $93,580 $69,000 Income from operations $63,801 $114,000 Other income 2,724 2,100 Income before income tax $66,525 $116,100 Income tax expense 18,600 34,800 Net income $47,925 $81,300 $ Feedback Check My Work 1. Compute the difference in each line item amount as either an increase or a decrease. Divide each difference by the 2015 base year amount for that item to obtain the horizontal percentage. Learning Objective 1 2. Net income has decreased from 2015 to 2016. Sales have increased ; however, the cost of goods sold has increased , causing the gross profit to decrease