Answered step by step

Verified Expert Solution

Question

1 Approved Answer

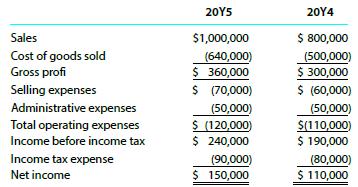

Income statement data for Yellowstone Images Inc. for the years ended December 31, 20Y5 and 20Y4, are as follows: a. Prepare a comparative income statement

Income statement data for Yellowstone Images Inc. for the years ended December 31, 20Y5 and 20Y4, are as follows:

a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for 20Y5 when compared with 20Y4. Round to one decimal place.

b. What conclusions can be drawn from the horizontal analysis?

20Y5 204 Sales $1,000,000 $ 800,000 Cost of goods sold Gross profi (640,000) $ 360,000 $ (70,000) (500,000) $ 300,000 $ (60,000) Selling expenses Administrative expenses Total operating expenses Income before income tax (50,000) $ (120,000) $ 240,000 (50,000) $(110,000) $ 190,000 Income tax expense (90,000) $ 150,000 (80,000) Net income $ 110,000

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Required solution Ans a Comparative Income Stateme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dbc79bf72d_178439.pdf

180 KBs PDF File

635dbc79bf72d_178439.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started