Question

Houda Motors has just announced results that show that the FCF for the past year is $35 million. An experienced analyst believes that the growth

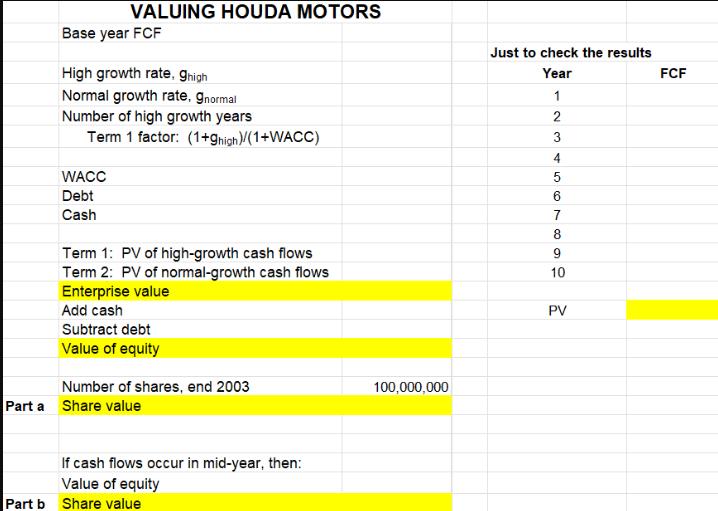

Houda Motors has just announced results that show that the FCF for the past year is $35 million. An experienced analyst believes that the growth rate of the FCF for the next year 10 years will be 25% per year and that after 10 years the growth rate will be 7% annually. Houda's WACC is 18%, and the company has 100 million shares outstanding.

a. Value the shares assuming that the FCFs occur at year-end. Houda has no debt and no excess cash reserves.

b. Suppose that the FCFs occur in mid-year. What would your answer be now?

VALUING HOUDA MOTORS Base year FCF High growth rate, ghigh Normal growth rate, gnormal Number of high growth years Term 1 factor: (1+ghigh)/(1+WACC) WACC Debt Cash Term 1: PV of high-growth cash flows Term 2: PV of normal-growth cash flows Enterprise value Add cash Subtract debt Value of equity Number of shares, end 2003 Part a Share value If cash flows occur in mid-year, then: Value of equity Part b Share value 100,000,000 Just to check the results Year 1 2 3 4 5 6 7 8 9 10 PV FCF

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Value the shares assuming that the FCFs occur at yearend Houda has no debt and no excess cash rese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started