Answered step by step

Verified Expert Solution

Question

1 Approved Answer

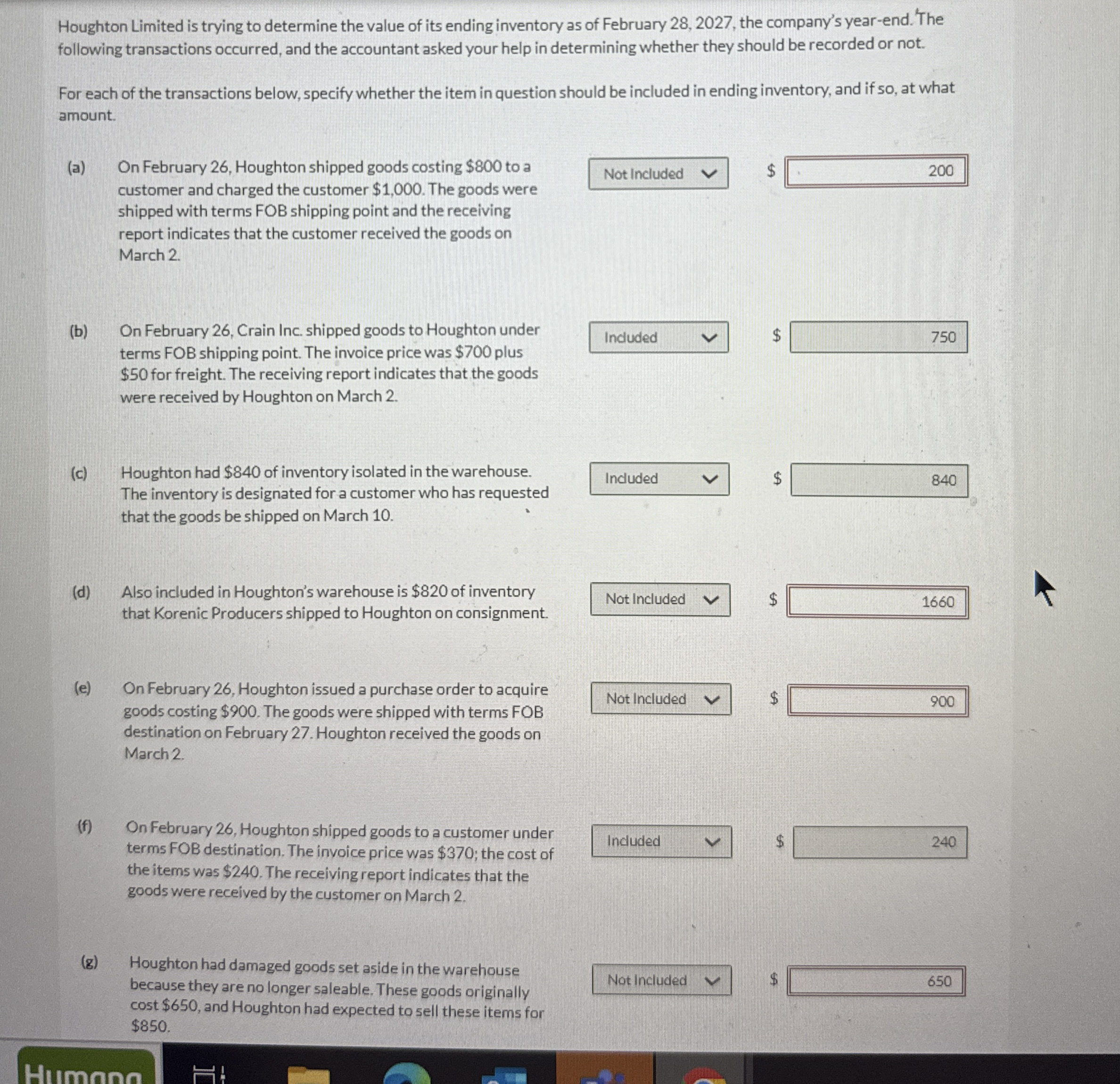

Houghton Limited is trying to determine the value of its ending inventory as of February 2 8 , 2 0 2 7 , the company's

Houghton Limited is trying to determine the value of its ending inventory as of February the company's yearend. 'The

following transactions occurred, and the accountant asked your help in determining whether they should be recorded or not.

For each of the transactions below, specify whether the item in question should be included in ending inventory, and if so at what

amount.

a On February Houghton shipped goods costing $ to a

customer and charged the customer $ The goods were

shipped with terms FOB shipping point and the receiving

report indicates that the customer received the goods on

March

b On February Crain Inc. shipped goods to Houghton under

terms FOB shipping point. The invoice price was $ plus

$ for freight. The receiving report indicates that the goods

were received by Houghton on March

c Houghton had $ of inventory isolated in the warehouse.

The inventory is designated for a customer who has requested

that the goods be shipped on March

d Also included in Houghton's warehouse is $ of inventory

that Korenic Producers shipped to Houghton on consignment.

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started