Answered step by step

Verified Expert Solution

Question

1 Approved Answer

House and lot sales commissions are the sources of Caramel's income. Taxes were withheld from Gorgeous Land, Inc. Mr. Caramel's total quarterly tax is

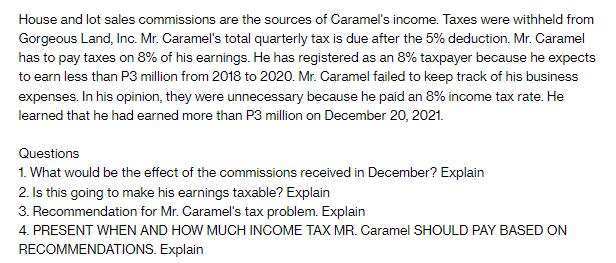

House and lot sales commissions are the sources of Caramel's income. Taxes were withheld from Gorgeous Land, Inc. Mr. Caramel's total quarterly tax is due after the 5% deduction. Mr. Caramel has to pay taxes on 8% of his earnings. He has registered as an 8% taxpayer because he expects to earn less than P3 million from 2018 to 2020. Mr. Caramel failed to keep track of his business expenses. In his opinion, they were unnecessary because he paid an 8% income tax rate. He learned that he had earned more than P3 million on December 20, 2021. Questions 1. What would be the effect of the commissions received in December? Explain 2. Is this going to make his earnings taxable? Explain 3. Recommendation for Mr. Caramel's tax problem. Explain 4. PRESENT WHEN AND HOW MUCH INCOME TAX MR. Caramel SHOULD PAY BASED ON RECOMMENDATIONS. Explain

Step by Step Solution

★★★★★

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 The commissions received in December would be subject to income tax Since Mr Caramel registered as an 8 taxpayer and expected to earn less than P3 m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started