Answered step by step

Verified Expert Solution

Question

1 Approved Answer

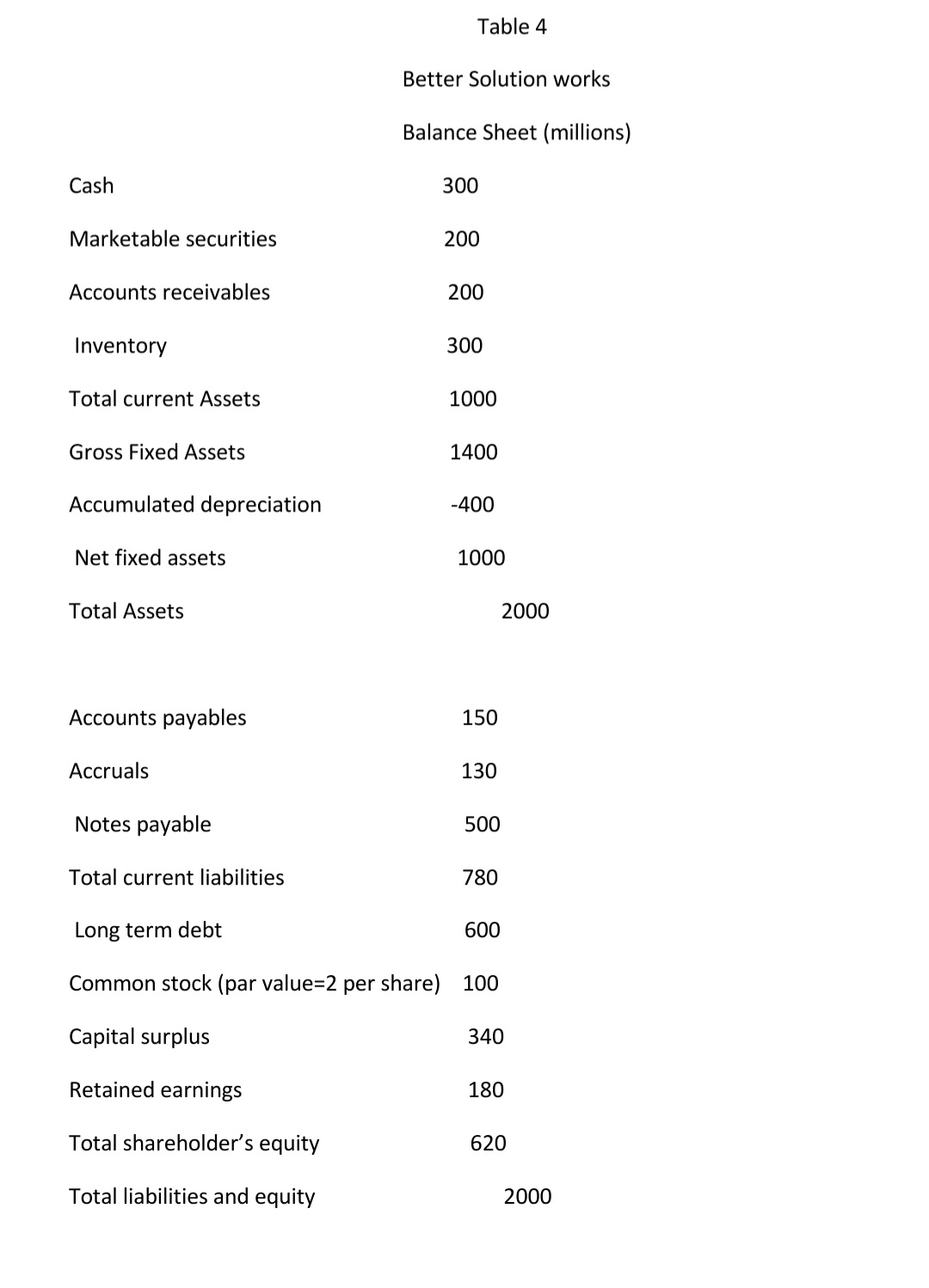

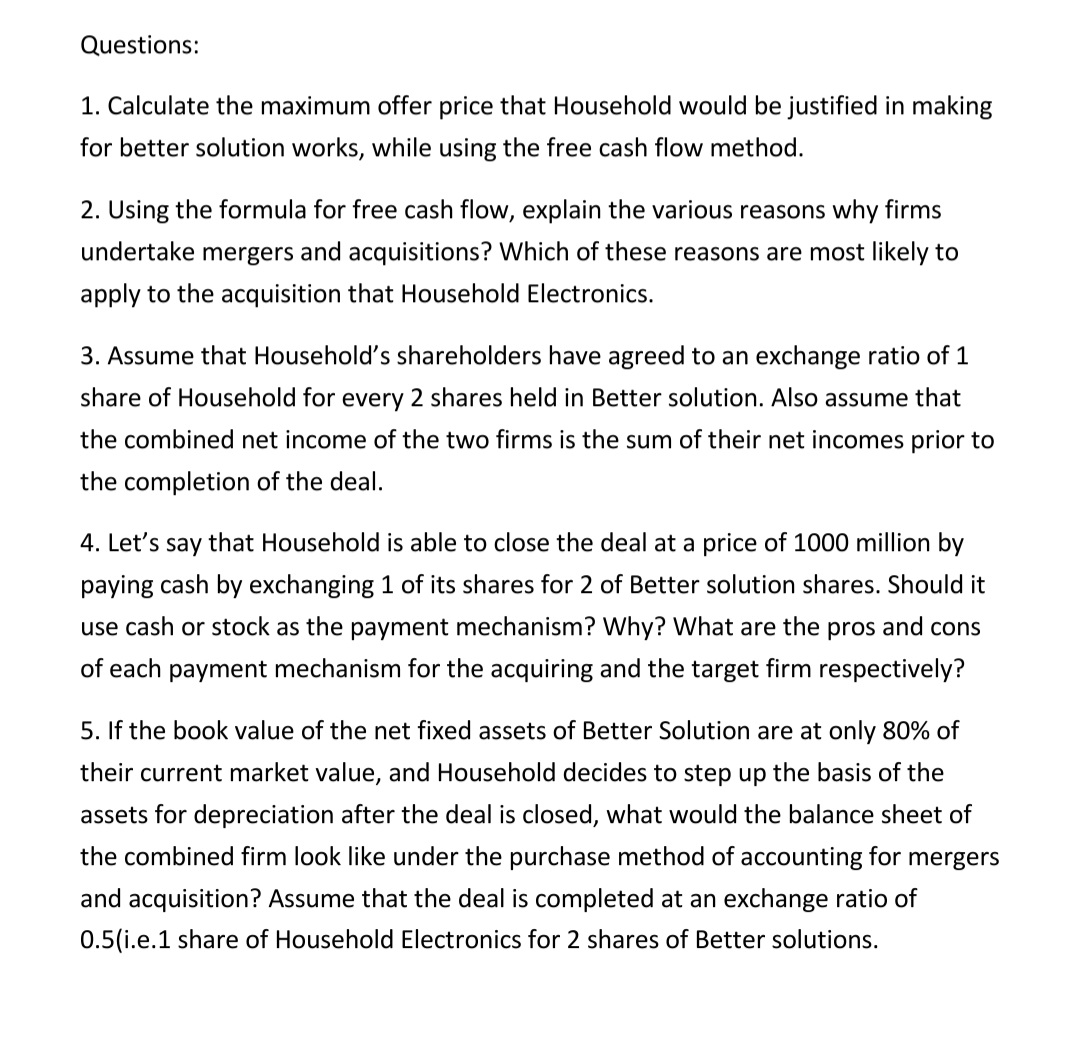

Household and electronic appliances company was formed in 2001. The time of its inception there was no strong competition in this industry, as a

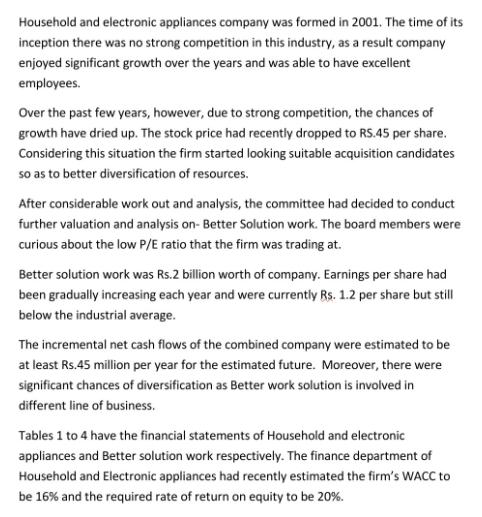

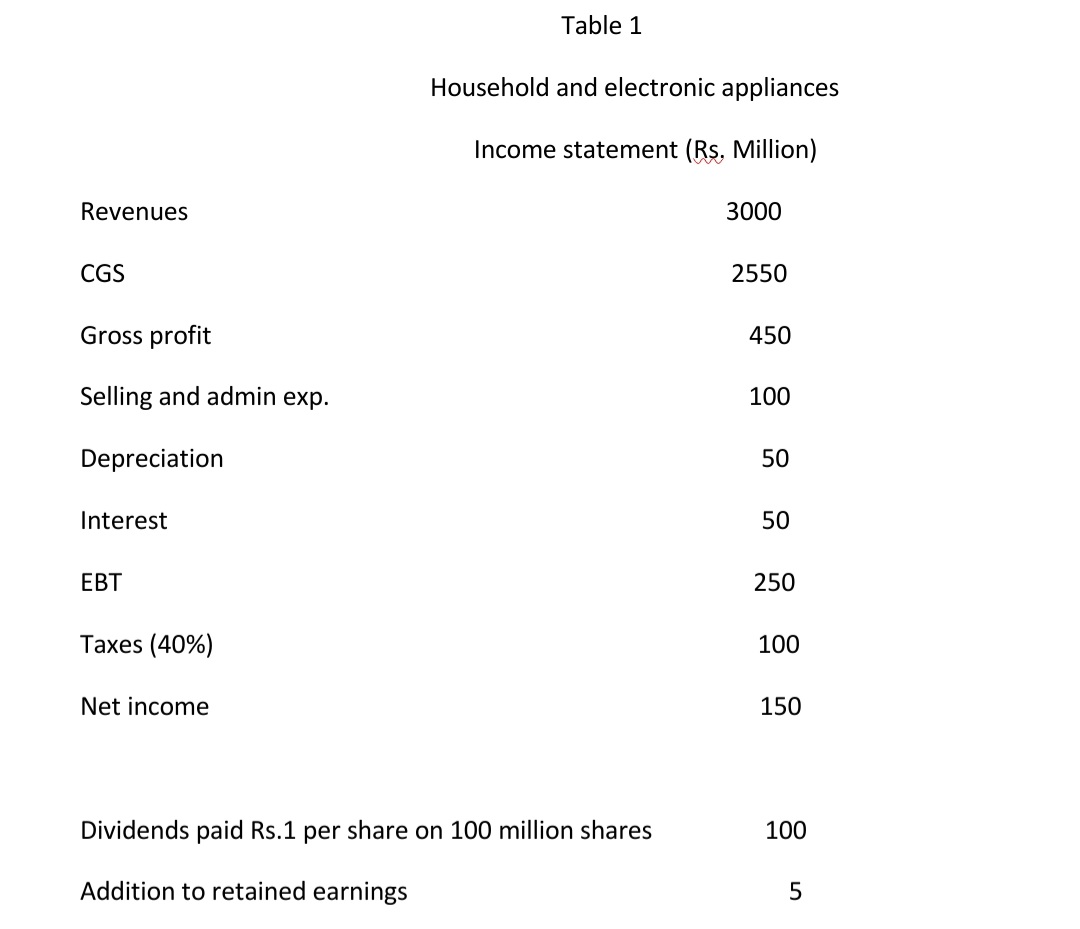

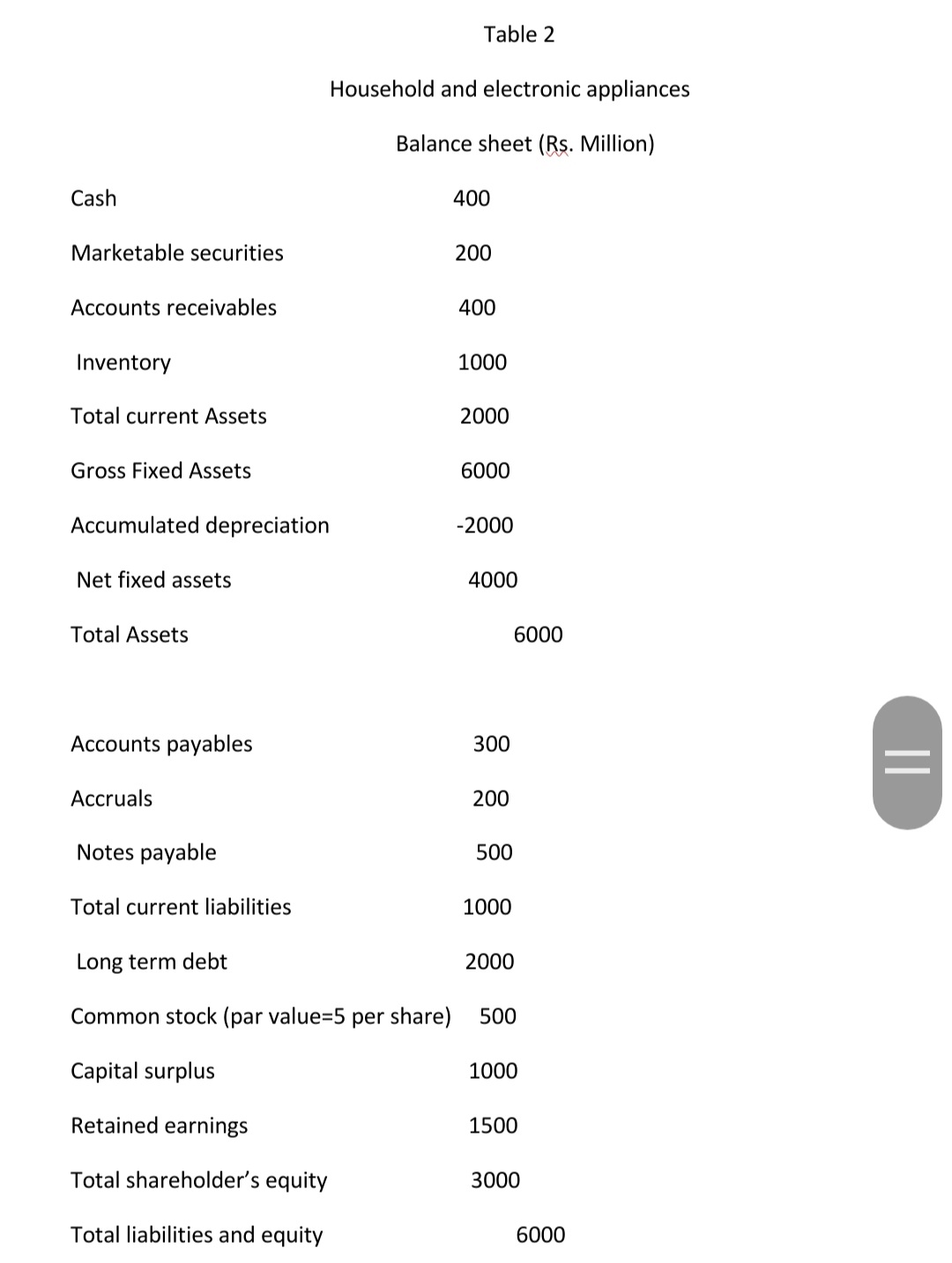

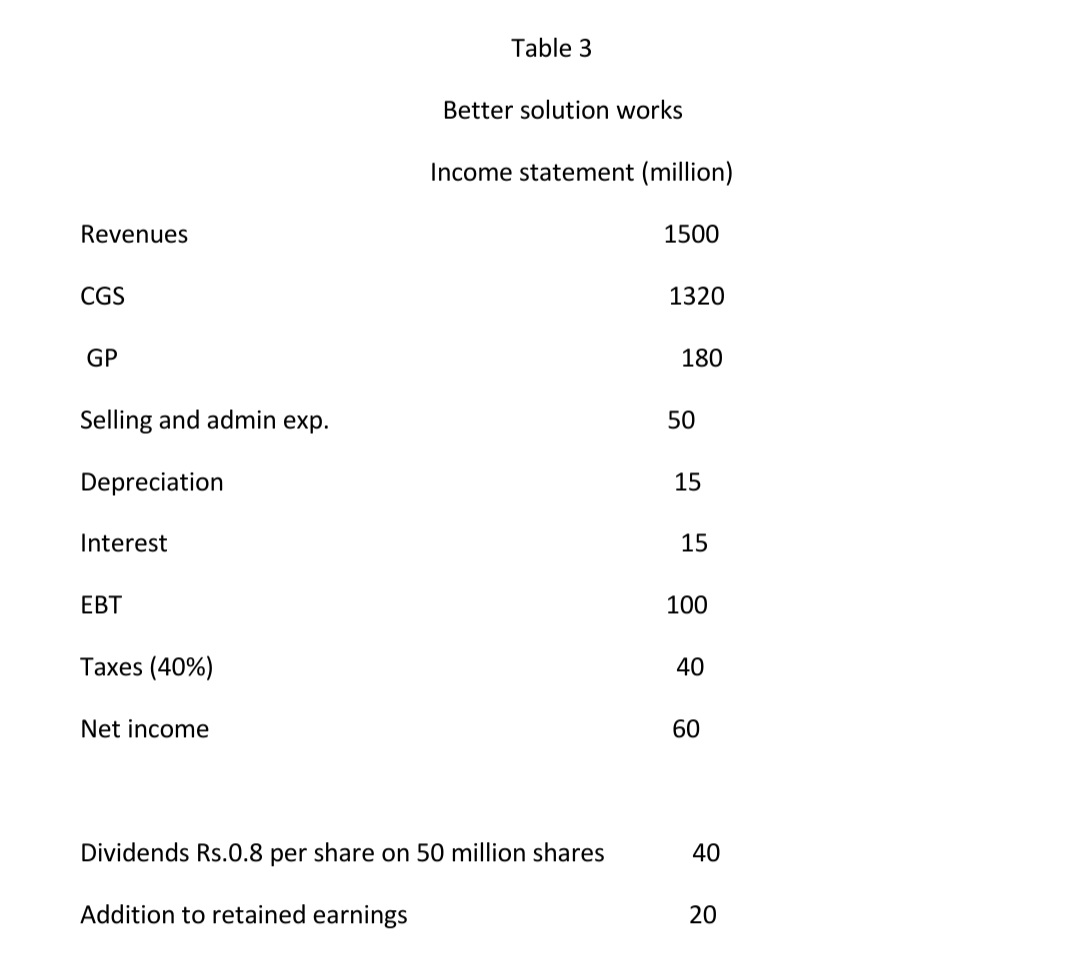

Household and electronic appliances company was formed in 2001. The time of its inception there was no strong competition in this industry, as a result company enjoyed significant growth over the years and was able to have excellent employees. Over the past few years, however, due to strong competition, the chances of growth have dried up. The stock price had recently dropped to RS.45 per share. Considering this situation the firm started looking suitable acquisition candidates so as to better diversification of resources. After considerable work out and analysis, the committee had decided to conduct further valuation and analysis on-Better Solution work. The board members were curious about the low P/E ratio that the firm was trading at. Better solution work was Rs.2 billion worth of company. Earnings per share had been gradually increasing each year and were currently Rs. 1.2 per share but still below the industrial average. The incremental net cash flows of the combined company were estimated to be at least Rs.45 million per year for the estimated future. Moreover, there were significant chances of diversification as Better work solution is involved in different line of business. Tables 1 to 4 have the financial statements of Household and electronic appliances and Better solution work respectively. The finance department of Household and Electronic appliances had recently estimated the firm's WACC to be 16% and the required rate of return on equity to be 20%. Revenues CGS Gross profit Selling and admin exp. Depreciation Interest EBT Taxes (40%) Net income Table 1 Household and electronic appliances Income statement (Rs, Million) Dividends paid Rs.1 per share on 100 million shares Addition to retained earnings 3000 2550 450 100 50 50 250 100 150 100 5 Cash Marketable securities Accounts receivables Inventory Total current Assets Gross Fixed Assets Accumulated depreciation Net fixed assets Total Assets Accounts payables Accruals Notes payable Total current liabilities Table 2 Household and electronic appliances Balance sheet (Rs. Million) Long term debt Common stock (par value=5 per share) Capital surplus Retained earnings Total shareholder's equity Total liabilities and equity 400 200 400 1000 2000 6000 -2000 4000 300 200 6000 500 1000 2000 500 1000 1500 3000 6000 || Revenues CGS GP Selling and admin exp. Depreciation Interest EBT Taxes (40%) Net income Table 3 Better solution works Income statement (million) Dividends Rs.0.8 per share on 50 million shares Addition to retained earnings 1500 1320 180 50 15 15 100 40 60 40 20 Cash Marketable securities Accounts receivables Inventory Total current Assets Gross Fixed Assets Accumulated depreciation Net fixed assets Total Assets Accounts payables Accruals Notes payable Total current liabilities Table 4 Better Solution works Balance Sheet (millions) 300 200 200 300 1000 1400 -400 1000 150 130 500 780 Long term debt Common stock (par value=2 per share) 100 Capital surplus Retained earnings Total shareholder's equity Total liabilities and equity 600 2000 340 180 620 2000 Questions: 1. Calculate the maximum offer price that Household would be justified in making for better solution works, while using the free cash flow method. 2. Using the formula for free cash flow, explain the various reasons why firms undertake mergers and acquisitions? Which of these reasons are most likely to apply to the acquisition that Household Electronics. 3. Assume that Household's shareholders have agreed to an exchange ratio of 1 share of Household for every 2 shares held in Better solution. Also assume that the combined net income of the two firms is the sum of their net incomes prior to the completion of the deal. 4. Let's say that Household is able to close the deal at a price of 1000 million by paying cash by exchanging 1 of its shares for 2 of Better solution shares. Should it use cash or stock as the payment mechanism? Why? What are the pros and cons of each payment mechanism for the acquiring and the target firm respectively? 5. If the book value of the net fixed assets of Better Solution are at only 80% of their current market value, and Household decides to step up the basis of the assets for depreciation after the deal is closed, what would the balance sheet of the combined firm look like under the purchase method of accounting for mergers and acquisition? Assume that the deal is completed at an exchange ratio of 0.5(i.e.1 share of Household Electronics for 2 shares of Better solutions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions with calculations 1 To calculate the maximum offer price using the free cash flow method Project the incremental free cash flows from the acquisition over the nex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started