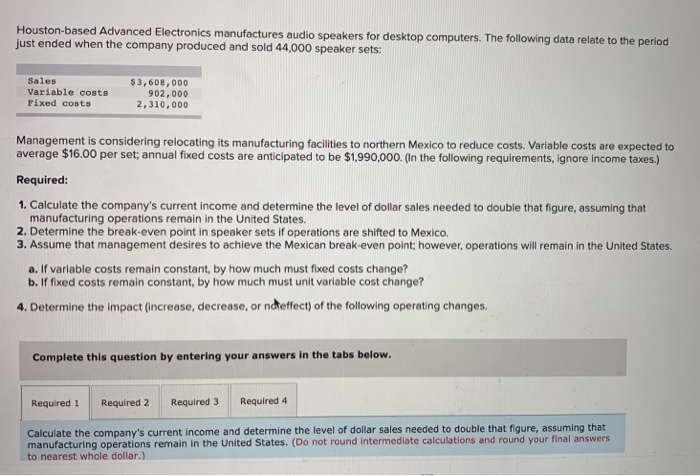

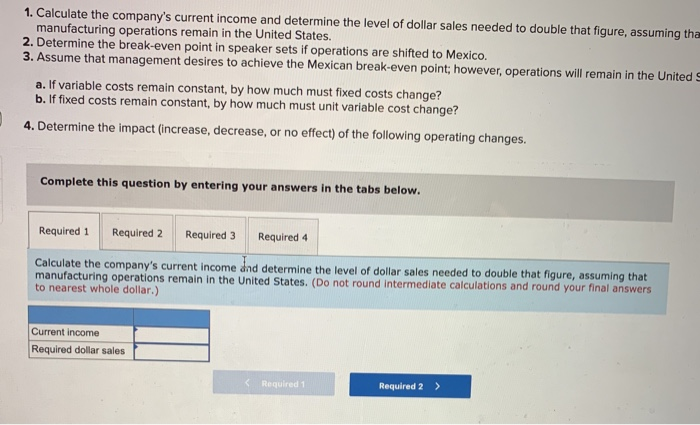

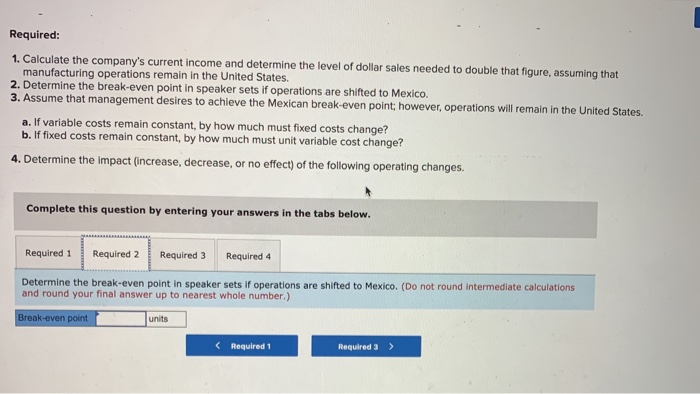

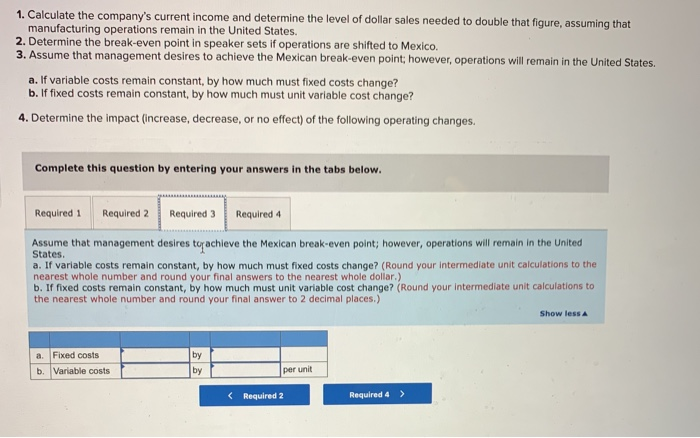

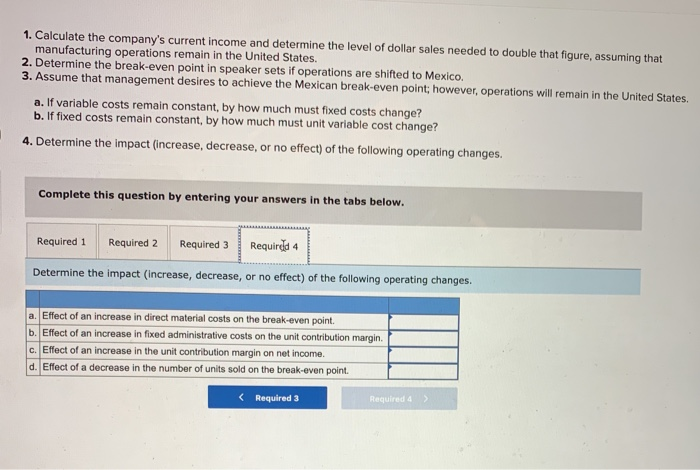

Houston-based Advanced Electronics manufactures audio speakers for desktop computers. The following data relate to the period just ended when the company produced and sold 44,000 speaker sets: Sales Variable costs Fixed costs $3,608,000 902,000 2,310,000 Management is considering relocating its manufacturing facilities to northern Mexico to reduce costs. Variable costs are expected to average $16.00 per set; annual fixed costs are anticipated to be $1,990,000. (In the following requirements, ignore income taxes.) Required: 1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. 2. Determine the break-even point in speaker sets if operations are shifted to Mexico. 3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. a. If variable costs remain constant, by how much must fixed costs change? b. If fixed costs remain constant, by how much must unit variable cost change? 4. Determine the impact (increase, decrease, or ndeffect) of the following operating changes. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. (Do not round Intermediate calculations and round your final answers to nearest whole dollar.) 1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. 2. Determine the break-even point in speaker sets if operations are shifted to Mexico 3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. a. If variable costs remain constant, by how much must fixed costs change? b. If fixed costs remain constant, by how much must unit variable cost change? 4. Determine the impact (increase, decrease, or no effect) of the following operating changes. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States a. If variable costs remain constant, by how much must fixed costs change? (Round your intermediate unit calculations to the nearest whole number and round your final answers to the nearest whole dollar.) b. If fixed costs remain constant, by how much must unit variable cost change? (Round your intermediate unit calculations to the nearest whole number and round your final answer to 2 decimal places.) Show less a. Fixed costs b. Variable costs I per unit 1. Calculate the company's current income and determine the level of dollar sales needed to double that figure, assuming that manufacturing operations remain in the United States. 2. Determine the break-even point in speaker sets if operations are shifted to Mexico. 3. Assume that management desires to achieve the Mexican break-even point; however, operations will remain in the United States. a. If variable costs remain constant, by how much must fixed costs change? b. If fixed costs remain constant, by how much must unit variable cost change? 4. Determine the impact (increase, decrease, or no effect) of the following operating changes. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Determine the impact (increase, decrease, or no effect) of the following operating changes. a. Effect of an increase in direct material costs on the break-even point. b. Effect of an increase in fixed administrative costs on the unit contribution margin. c. Effect of an increase in the unit contribution margin on net income d. Effect of a decrease in the number of units sold on the break-even point.