How are the above answers calculated?

How are the above answers calculated?

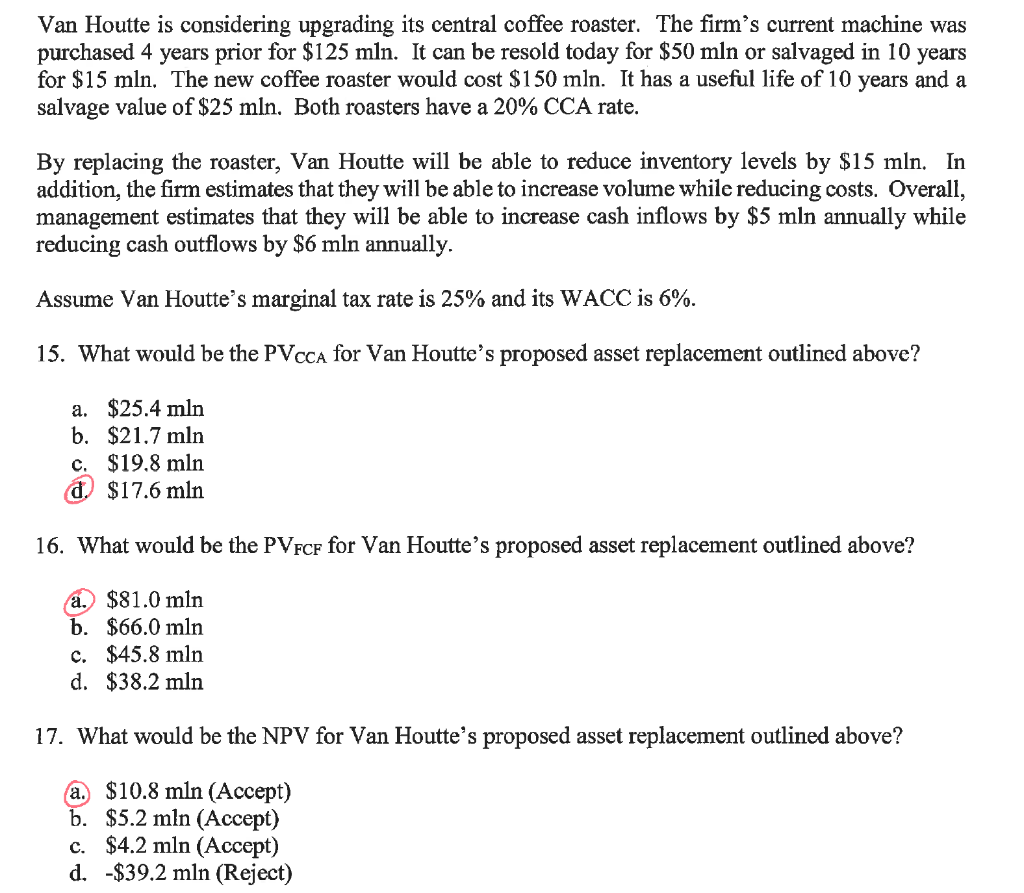

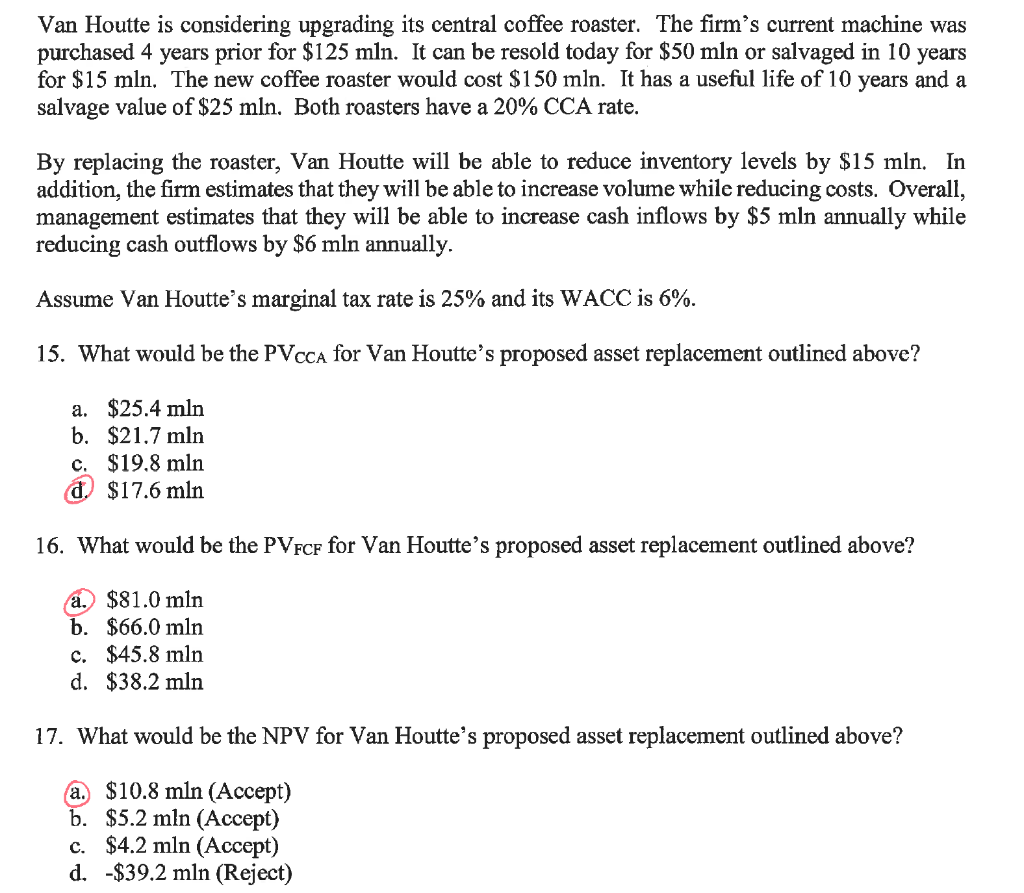

Van Houtte is considering upgrading its central coffee roaster. The firm's current machine was purchased 4 years prior for $125 mln. It can be resold today for $50 mln or salvaged in 10 years for $15 mln. The new coffee roaster would cost $150 mln. It has a useful life of 10 years and a salvage value of $25 mln. Both roasters have a 20% CCA rate. By replacing the roaster, Van Houtte will be able to reduce inventory levels by $15 mln. In addition, the firm estimates that they will be able to increase volume while reducing costs. Overall, management estimates that they will be able to increase cash inflows by $5 mln annually while reducing cash outflows by $6 mln annually. Assume Van Houtte's marginal tax rate is 25% and its WACC is 6%. 15. What would be the PVcca for Van Houtte's proposed asset replacement outlined above? a. $25.4 mln b. $21.7 mln c. $19.8 mln d) $17.6 mln 16. What would be the PVFCF for Van Houtte's proposed asset replacement outlined above? a. $81.0 mln b. $66.0 mln c. $45.8 mln d. $38.2 mln 17. What would be the NPV for Van Houtte's proposed asset replacement outlined above? a. $10.8 mln (Accept) b. $5.2 mln (Accept) c. $4.2 mln (Accept) d. -$39.2 mln (Reject) Van Houtte is considering upgrading its central coffee roaster. The firm's current machine was purchased 4 years prior for $125 mln. It can be resold today for $50 mln or salvaged in 10 years for $15 mln. The new coffee roaster would cost $150 mln. It has a useful life of 10 years and a salvage value of $25 mln. Both roasters have a 20% CCA rate. By replacing the roaster, Van Houtte will be able to reduce inventory levels by $15 mln. In addition, the firm estimates that they will be able to increase volume while reducing costs. Overall, management estimates that they will be able to increase cash inflows by $5 mln annually while reducing cash outflows by $6 mln annually. Assume Van Houtte's marginal tax rate is 25% and its WACC is 6%. 15. What would be the PVcca for Van Houtte's proposed asset replacement outlined above? a. $25.4 mln b. $21.7 mln c. $19.8 mln d) $17.6 mln 16. What would be the PVFCF for Van Houtte's proposed asset replacement outlined above? a. $81.0 mln b. $66.0 mln c. $45.8 mln d. $38.2 mln 17. What would be the NPV for Van Houtte's proposed asset replacement outlined above? a. $10.8 mln (Accept) b. $5.2 mln (Accept) c. $4.2 mln (Accept) d. -$39.2 mln (Reject)

How are the above answers calculated?

How are the above answers calculated?