How can I get it ?

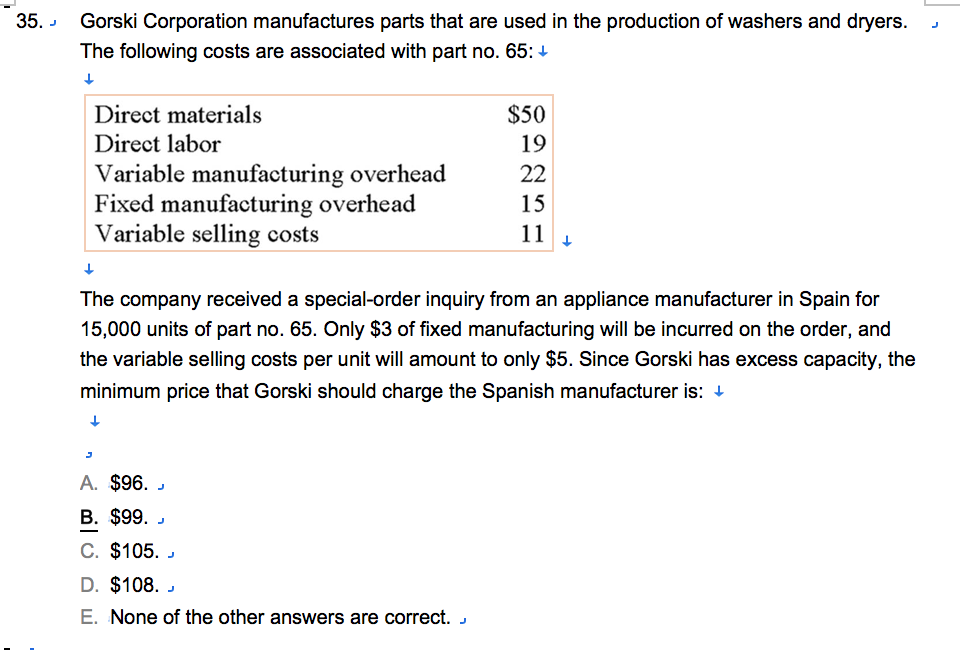

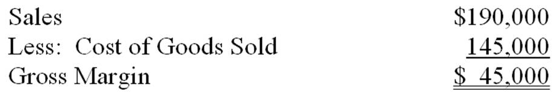

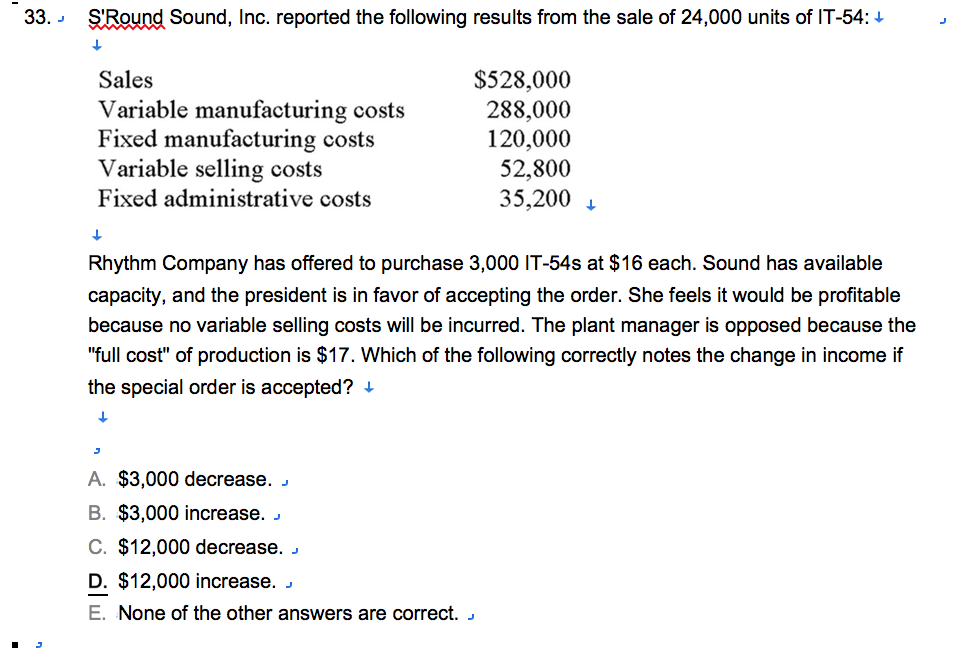

Snyder, Inc., which has excess capacity, received a special order for 4,000 units at a price of $15 per unit. Currently, production and sales are anticipated to be 10,000 units without considering the special order. Budget information for the current year follows.

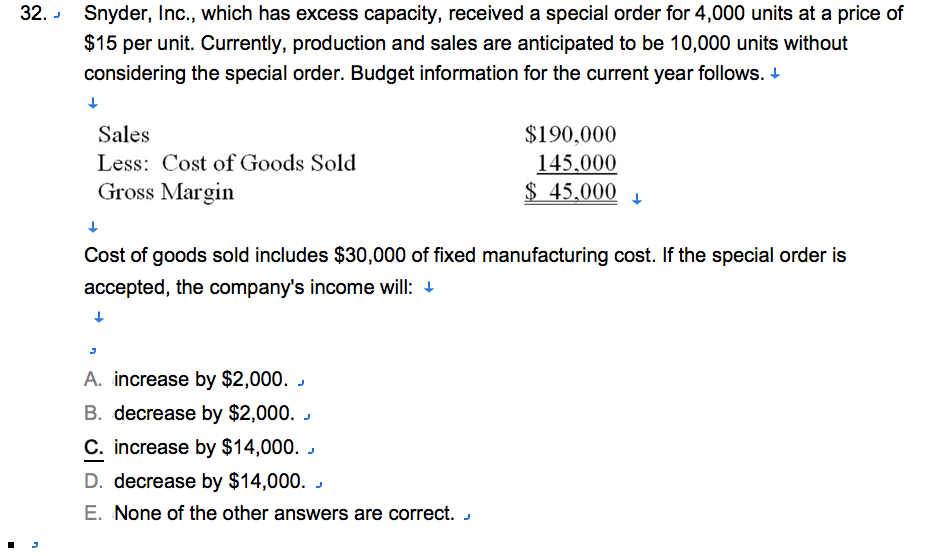

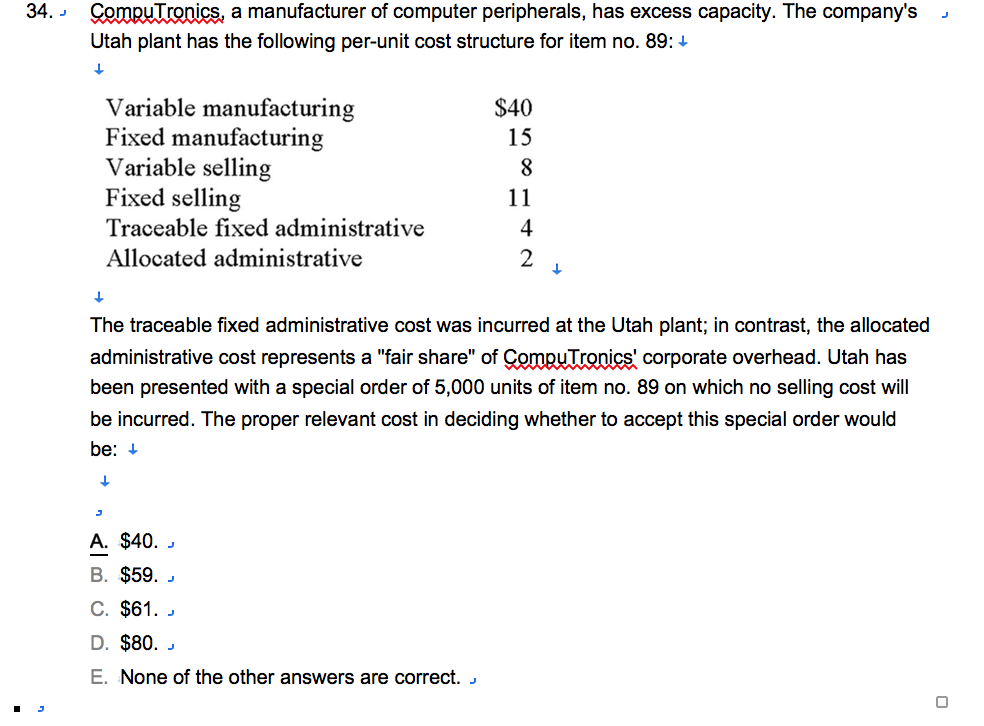

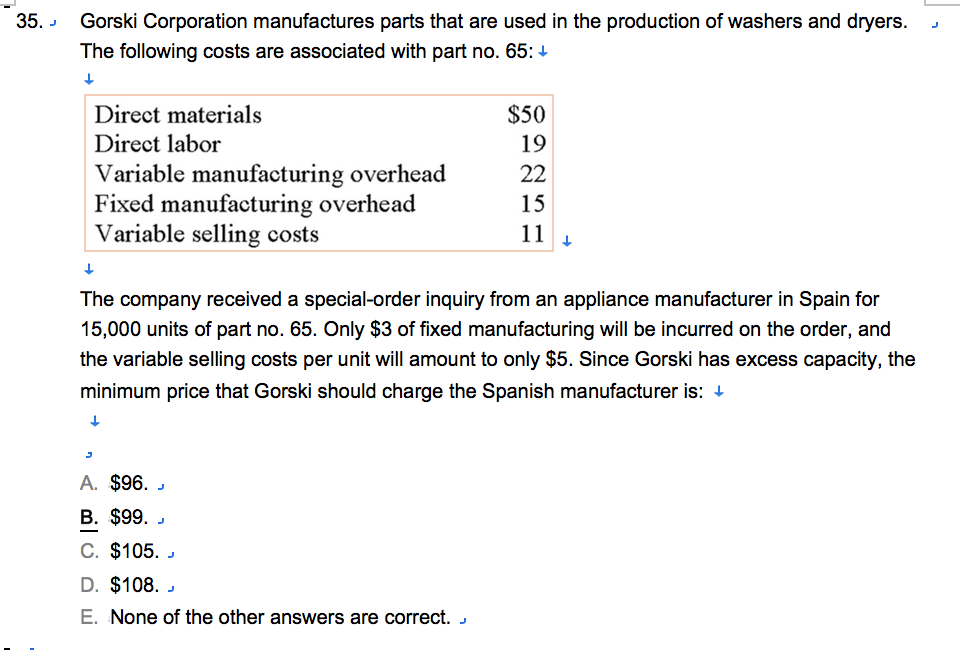

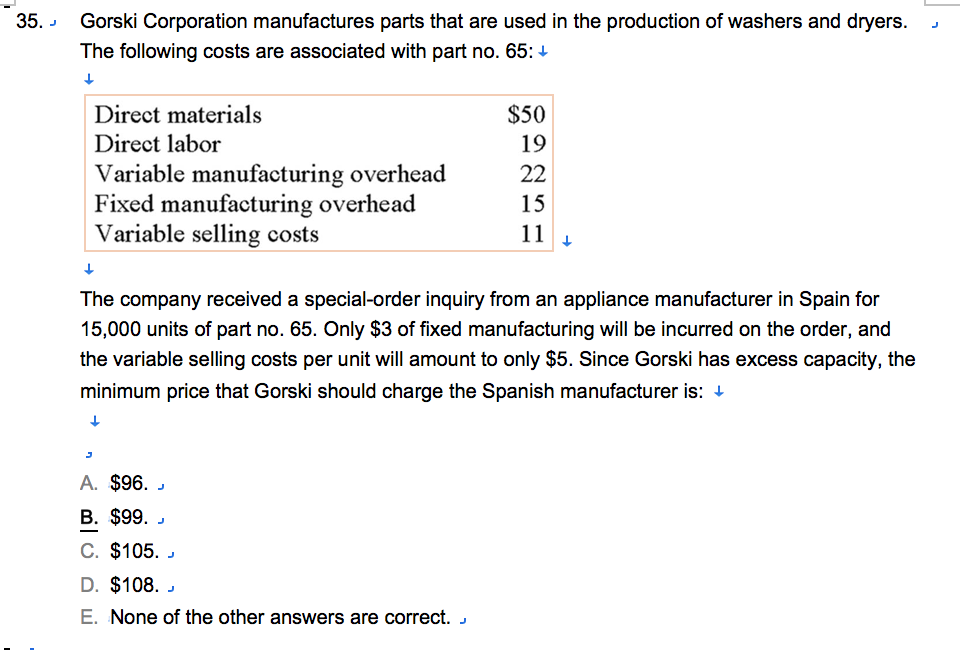

\f32. .n Snyder. Inc., which has excess capacity. received a special order for 4,000 units at a price of $15 per unit. Currently, production and sales are anticipated to be 10,000 units without considering the special order. Budget information for the current year follows. J. 4. Sales $190,000 Less: Cest of Goods Sold 145,000 Gross Margin M11100 4, 4. Cost of goods sold includes $30,000 of xed manufacturing cost. If the special order is accepted. the compaan income will: 4, J. .1 A. increase by $2,000. J B. decrease by $2,000. 4 9 increase by $14,000. J D. decrease by $14,000. 4 E. None of the other answers are correct. 4 33. a gag'ImQSoundI Inc. reported the following results from the sale of 24,000 units of lT-54: J. 4. Sales $528,000 Variable manufacturing costs 288,000 Fixed manufacturing costs 120,000 Variable selling costs 52,800 Fixed administrative costs 35,200 4, J. Rhythm Company has offered to purchase 3,000 lT-54s at $16 each. Sound has available capacity, and the president is in favor of accepting the order. She feels it would be protable because no variable selling costs will be incurred. The plant manager is opposed because the "full cost" of production is $17. Which of the following correctly notes the change in income if the special order is accepted? J. 4. J A. $3,000 decrease. J B. $3.000 increase. 4 C. $12,000 decrease. 4 E $12,000 increase. 4 E. None of the other answers are correct. 4 J 34. 4 W a manufacturer of computer peripherals. has excess capacity. The company's .. Utah plant has the following per-unit cost structure for item no. 89: J. 4. Variable manufacturing $40 Fixed manufactm'ing 15 Variable selling 8 Fixed selling 11 Traceable xed administrative 4 Allocated administrative 2 J, J. The traceable xed administrative cost was incurred at the Utah plant; in contrast, the allocated administrative cost represents a "fair share" of W corporate overhead. Utah has been presented with a special order of 5,000 units of item no. 89 on which no selling cost will be incurred. The proper relevant cost in deciding whether to accept this special order would be: J. 4. J 5 $40. . B. $59. 4 C. $61. J D. $80. J E. None of the other answers are correct. 4 1-! 35. 4 Gorski Corporation manufactures parts that are used in the production of washers and dryers. The following costs are associated with part no. 65: J. 4. Direct materials $50 Direct labor 19 Variable manufacturing overhead 22 Fixed manufacturing overhead 15 Variable selling costs 11 J, 4. The company received a special-order inquiry from an appliance manufacturer in Spain for 15,000 units of part no. 65. Only $3 of xed manufacturing will be incurred on the order, and the variable selling costs per unit will amount to only $5. Since Gorski has excess capacity. the minimum price that Gorski should charge the Spanish manufacturer is: J. J. J A. $96. J 3 $99. . C. $105. .. D. $108. .. E. None of the other answers are correct. J I J