Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How can I solve the following Difficult Problem 3-5 Several years ago, Nora and Pip formed N&P Records, a partnership. The partnership agreement states that

How can I solve the following

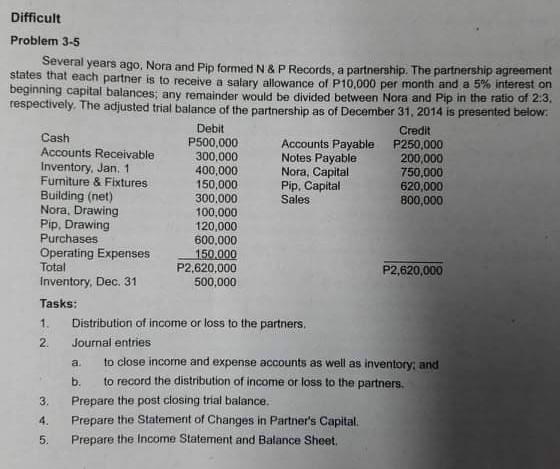

Difficult Problem 3-5 Several years ago, Nora and Pip formed N&P Records, a partnership. The partnership agreement states that each partner is to receive a salary allowance of P10,000 per month and a 5% interest on beginning capital balances; any remainder would be divided between Nora and Pip in the ratio of 2.3. respectively. The adjusted trial balance of the partnership as of December 31, 2014 is presented below. Debit Credit Cash P500,000 Accounts Payable P250,000 Accounts Receivable 300,000 Notes Payable 200,000 Inventory, Jan, 1 400,000 Nora, Capital 750,000 Furniture & Fixtures 150,000 Pip. Capital 620,000 Building (net) 300,000 Sales 800,000 Nora, Drawing 100,000 Pip, Drawing 120,000 Purchases 600,000 Operating Expenses 150.000 Total P2,620,000 P2,620,000 Inventory, Dec. 31 500,000 Tasks: 1. Distribution of income or loss to the partners, 2. Journal entries to close income and expense accounts as well as inventory and b. to record the distribution of income or loss to the partners. 3. Prepare the post closing trial balance. 4. Prepare the Statement of Changes in Partner's Capital 5. Prepare the Income Statement and Balance Sheet aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started